Breaking Free from High Interest Rates

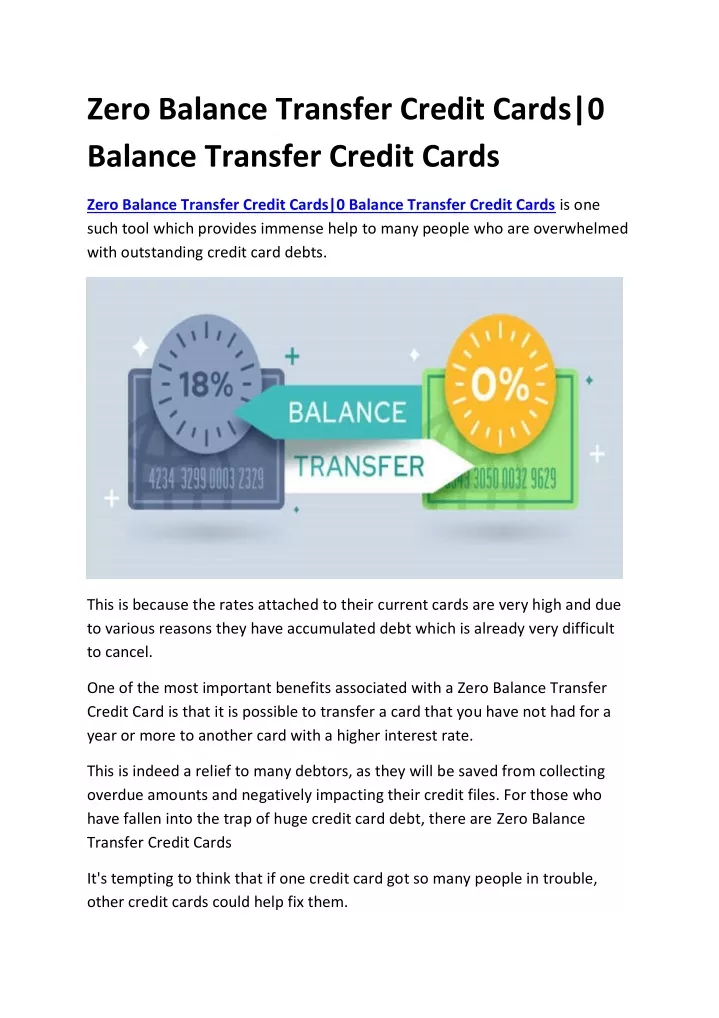

For individuals struggling with high-interest debt, a 0% balance transfer credit card can be a game-changer. By transferring existing balances to a credit card with a 0% introductory APR, cardholders can save hundreds or even thousands of dollars in interest payments over 24 months. This can be a significant relief for those feeling overwhelmed by debt. However, it’s essential to understand the terms and conditions of these credit cards to maximize their benefits.

A 0% balance transfer credit card can provide a much-needed break from high-interest rates, allowing cardholders to focus on paying off the principal amount. With a 0% introductory APR, cardholders can avoid accumulating additional interest charges, making it easier to pay off debt. For example, if an individual has a $2,000 balance on a credit card with an 18% APR, they can save up to $360 in interest charges over 24 months by transferring the balance to a 0% balance transfer credit card.

It’s crucial to note that the 0% introductory APR is only available for a limited time, typically 24 months. After this period, the regular APR will apply, which may be higher than the original interest rate. Therefore, it’s essential to create a plan to pay off the debt during the introductory period to avoid accumulating additional interest charges.

When using a 0% balance transfer credit card, it’s also important to avoid new purchases and cash advances, as these may incur interest charges or fees. By focusing on paying off the transferred balance and avoiding new debt, cardholders can make the most of the 0% introductory APR and achieve their debt repayment goals.

In summary, a 0% balance transfer credit card can be a valuable tool for individuals struggling with high-interest debt. By understanding the terms and conditions and creating a plan to pay off the debt during the introductory period, cardholders can save money on interest charges and achieve financial freedom.

How to Choose the Best 0% Balance Transfer Credit Card for Your Needs

With numerous 0% balance transfer credit cards available in the market, selecting the best one can be overwhelming. To make an informed decision, it’s essential to consider several key factors, including the length of the introductory period, balance transfer fee, and ongoing interest rate.

The length of the introductory period is a critical factor to consider. Look for credit cards that offer a 0% introductory APR for 24 months, such as the Citi Simplicity Card or the Bank of America Cash Rewards credit card. This will give you ample time to pay off your debt without incurring interest charges.

Another important factor to consider is the balance transfer fee. This fee can range from 3% to 5% of the transferred amount, so it’s essential to choose a credit card with a low or no balance transfer fee. Some credit cards, such as the Discover it Balance Transfer, offer a 0% balance transfer fee for the first 60 days.

In addition to the introductory period and balance transfer fee, it’s also essential to consider the ongoing interest rate. This is the interest rate that will apply after the introductory period ends. Look for credit cards with a competitive ongoing interest rate, such as the Citi Double Cash Card, which offers a 14.49% – 24.49% (Variable) APR.

Other factors to consider when choosing a 0% balance transfer credit card include the credit limit, credit score requirements, and rewards program. Some credit cards, such as the Chase Freedom Unlimited, offer a rewards program that can help you earn cash back or points on your purchases.

Ultimately, the best 0% balance transfer credit card for your needs will depend on your individual circumstances and financial goals. By considering the length of the introductory period, balance transfer fee, and ongoing interest rate, you can make an informed decision and choose a credit card that will help you pay off your debt and achieve financial freedom.

Some popular 0% balance transfer credit cards that offer a 24-month introductory period include:

- Citi Simplicity Card

- Bank of America Cash Rewards credit card

- Discover it Balance Transfer

- Chase Freedom Unlimited

By choosing the right 0% balance transfer credit card, you can save hundreds or even thousands of dollars in interest payments over 24 months and achieve your debt repayment goals.

Understanding the Fine Print: Balance Transfer Fees and Interest Rates

When using a 0% balance transfer credit card, it’s essential to understand the fine print, including the balance transfer fee and ongoing interest rate. These fees and rates can significantly impact the overall cost of the credit card and your ability to pay off debt.

The balance transfer fee is a charge applied to the amount transferred to the new credit card. This fee can range from 3% to 5% of the transferred amount, with some credit cards charging a higher fee for larger balances. For example, if you transfer a $2,000 balance to a credit card with a 3% balance transfer fee, you’ll be charged $60.

However, some credit cards offer a 0% balance transfer fee for a limited time, usually 60 days. This can be a significant advantage, especially for larger balances. To avoid paying the balance transfer fee, make sure to transfer your balance within the specified time frame and pay off the debt during the introductory period.

In addition to the balance transfer fee, it’s also essential to understand the ongoing interest rate. This is the interest rate that will apply after the introductory period ends. Ongoing interest rates can vary significantly, ranging from 12.99% to 24.99% APR. To avoid accumulating interest charges, make sure to pay off the full balance during the introductory period or consider a credit card with a competitive ongoing interest rate.

Some credit cards also offer a tiered interest rate structure, where the interest rate increases as the balance increases. For example, a credit card may offer a 12.99% APR for balances up to $1,000 and a 14.99% APR for balances over $1,000. Understanding the interest rate structure can help you avoid accumulating interest charges and make the most of the 0% introductory APR.

To illustrate the impact of the balance transfer fee and ongoing interest rate, consider the following example:

- Balance: $2,000

- Balance transfer fee: 3%

- Ongoing interest rate: 14.99% APR

- Introductory period: 24 months

In this example, the balance transfer fee would be $60 (3% of $2,000). If you pay off the full balance during the introductory period, you’ll avoid accumulating interest charges. However, if you don’t pay off the full balance, you’ll be charged the ongoing interest rate of 14.99% APR, which can significantly increase the overall cost of the credit card.

By understanding the balance transfer fee and ongoing interest rate, you can make informed decisions when using a 0% balance transfer credit card and avoid accumulating unnecessary charges.

Strategies for Paying Off Debt During the 0% Introductory Period

Paying off debt during the 0% introductory period is crucial to maximizing the benefits of a 0% balance transfer credit card. To achieve this, it’s essential to create a solid plan and stick to it. Here are some strategies to help you pay off debt during the 0% introductory period:

1. Create a budget: Start by creating a budget that accounts for all your income and expenses. This will help you understand how much you can afford to pay each month. Make sure to prioritize your debt payments and allocate as much as possible towards your debt.

2. Set up automatic payments: Set up automatic payments to ensure you never miss a payment. You can set up automatic payments through your credit card issuer’s website or mobile app. This way, you’ll ensure that you make timely payments and avoid late fees.

3. Consider a debt repayment plan: If you have multiple debts with different interest rates and balances, consider creating a debt repayment plan. You can use the snowball method, where you pay off the debt with the smallest balance first, or the avalanche method, where you pay off the debt with the highest interest rate first.

4. Make more than the minimum payment: To pay off debt quickly, make more than the minimum payment each month. This will help you pay off the principal balance faster and reduce the amount of interest you owe.

5. Use the 50/30/20 rule: Allocate 50% of your income towards necessary expenses like rent, utilities, and groceries. Use 30% for discretionary spending, and 20% for saving and debt repayment. This will help you prioritize your debt payments and ensure you’re making progress towards becoming debt-free.

6. Avoid new debt: While you’re paying off debt, avoid accumulating new debt. This means avoiding new credit card purchases, personal loans, or other forms of debt. Instead, focus on paying off your existing debt and building a safety net.

By following these strategies, you can pay off debt during the 0% introductory period and make the most of your 0% balance transfer credit card. Remember to stay disciplined, and you’ll be on your way to becoming debt-free.

For example, let’s say you have a $2,000 balance on a credit card with a 0% introductory APR for 24 months. If you make monthly payments of $83, you’ll pay off the debt in 24 months and avoid paying any interest. However, if you make only the minimum payment of $25, you’ll take 60 months to pay off the debt and pay $1,141 in interest.

As you can see, making more than the minimum payment and creating a solid plan can help you pay off debt quickly and avoid paying unnecessary interest.

Common Mistakes to Avoid When Using a 0% Balance Transfer Credit Card

While a 0% balance transfer credit card can be a powerful tool for paying off debt, it’s essential to use it responsibly to avoid common mistakes that can undermine its benefits. Here are some mistakes to avoid when using a 0% balance transfer credit card:

Missing payments is a significant mistake that can lead to the loss of the 0% introductory APR and trigger the regular interest rate. Late payments can also result in late fees and negatively impact credit scores. To avoid this, set up automatic payments or reminders to ensure timely payments.

Accumulating new debt during the introductory period is another mistake to avoid. Adding new debt can make it challenging to pay off the existing balance during the 0% introductory period, leading to interest charges when the regular APR kicks in. Avoid using the credit card for new purchases during the introductory period, and focus on paying off the transferred balance.

Not paying off the full balance during the introductory period is a common mistake that can result in interest charges. Make a plan to pay off the entire balance within the 24-month introductory period to avoid interest charges. Consider creating a budget and setting up automatic payments to ensure timely payments.

Not considering the balance transfer fee is another mistake to avoid. While a 0% balance transfer credit card can save hundreds or thousands of dollars in interest payments, the balance transfer fee can add up quickly. Look for credit cards with low or no balance transfer fees, and factor in the fee when calculating the total cost of the credit card.

Not checking the regular APR is a mistake that can lead to surprise interest charges when the introductory period ends. Make sure to check the regular APR and understand how it will apply to any remaining balance after the introductory period ends.

By avoiding these common mistakes, individuals can maximize the benefits of a 0% balance transfer credit card and pay off debt efficiently. Remember to always read the fine print, create a budget, and make timely payments to get the most out of a 0% balance transfer credit card.

Using a 0% Balance Transfer Credit Card for Credit Score Improvement

Using a 0% balance transfer credit card responsibly can be a powerful tool for improving credit scores. By making on-time payments and keeping credit utilization low, individuals can demonstrate good credit habits and potentially see an improvement in their credit scores.

One of the key factors in determining credit scores is payment history, which accounts for 35% of the total credit score. Making on-time payments on a 0% balance transfer credit card can help individuals establish a positive payment history, which can lead to an improvement in their credit scores. It’s essential to set up automatic payments or reminders to ensure timely payments.

Another important factor in determining credit scores is credit utilization, which accounts for 30% of the total credit score. Keeping credit utilization low on a 0% balance transfer credit card can help individuals demonstrate responsible credit habits and potentially see an improvement in their credit scores. It’s recommended to keep credit utilization below 30% and ideally below 10% for the best credit scores.

In addition to making on-time payments and keeping credit utilization low, using a 0% balance transfer credit card can also help individuals improve their credit scores by reducing debt. By paying off high-interest debt during the 0% introductory period, individuals can reduce their overall debt burden and potentially see an improvement in their credit scores.

It’s essential to note that using a 0% balance transfer credit card for credit score improvement requires responsible credit habits. Missing payments, accumulating new debt, or not paying off the full balance during the introductory period can negatively impact credit scores. By using a 0% balance transfer credit card responsibly, individuals can potentially see an improvement in their credit scores and enjoy better financial health.

Some popular 0% balance transfer credit cards that can help with credit score improvement include the Citi Simplicity Card and the Bank of America Cash Rewards credit card. These credit cards offer 0% balance transfer for 24 months, providing individuals with ample time to pay off debt and improve their credit scores.

By using a 0% balance transfer credit card responsibly and making on-time payments, keeping credit utilization low, and reducing debt, individuals can potentially see an improvement in their credit scores and enjoy better financial health. Remember to always read the fine print and understand the terms and conditions of the credit card before applying.

Alternatives to 0% Balance Transfer Credit Cards: Other Debt Consolidation Options

While 0% balance transfer credit cards can be a powerful tool for paying off debt, they may not be the best option for everyone. Fortunately, there are alternative debt consolidation options available that can help individuals pay off debt and improve their financial health.

Personal loans are one alternative to 0% balance transfer credit cards. Personal loans offer a fixed interest rate and a set repayment term, which can provide individuals with a clear plan for paying off debt. Additionally, personal loans often have lower interest rates than credit cards, which can save individuals money on interest payments.

Debt management plans are another alternative to 0% balance transfer credit cards. Debt management plans involve working with a credit counselor to create a plan for paying off debt. Credit counselors can help individuals negotiate with creditors to reduce interest rates and fees, and can provide guidance on creating a budget and sticking to it.

Debt consolidation loans are also an option for individuals who want to pay off debt. Debt consolidation loans involve taking out a single loan to pay off multiple debts, which can simplify the repayment process and potentially save individuals money on interest payments.

It’s essential to note that these alternative debt consolidation options may have their own set of fees and interest rates, which can impact the overall cost of paying off debt. However, for individuals who are not eligible for a 0% balance transfer credit card or who prefer a different approach to debt consolidation, these options can be a viable alternative.

In comparison to 0% balance transfer credit cards, personal loans and debt management plans may offer more flexibility and customization. For example, personal loans can be used to pay off a variety of debts, including credit cards, medical bills, and personal loans. Debt management plans, on the other hand, can provide individuals with a more structured approach to paying off debt, which can be helpful for those who need guidance and support.

Ultimately, the best debt consolidation option will depend on an individual’s specific financial situation and goals. It’s essential to carefully consider the pros and cons of each option and to seek professional advice before making a decision.

Some popular alternatives to 0% balance transfer credit cards include personal loans from lenders like LendingClub and Prosper, and debt management plans from non-profit credit counseling agencies like the National Foundation for Credit Counseling.

By considering these alternative debt consolidation options, individuals can find the best solution for their financial needs and take the first step towards paying off debt and improving their financial health.

Conclusion: Making the Most of a 0% Balance Transfer Credit Card

A 0% balance transfer credit card can be a powerful tool for paying off debt and improving credit scores. By understanding the benefits and strategies for using a 0% balance transfer credit card, individuals can make the most of this financial tool and achieve their financial goals.

Remember, a 0% balance transfer credit card is not a solution for debt accumulation, but rather a tool for debt consolidation and repayment. It’s essential to use the card responsibly and make timely payments to avoid interest charges and fees.

When selecting a 0% balance transfer credit card, consider the length of the introductory period, balance transfer fee, and ongoing interest rate. Look for cards that offer 0% balance transfer for 24 months, such as the Citi Simplicity Card or Bank of America Cash Rewards credit card.

During the 0% introductory period, focus on paying off debt and avoiding new purchases. Create a budget, set up automatic payments, and consider a debt repayment plan to ensure timely payments and debt repayment.

Using a 0% balance transfer credit card responsibly can also help improve credit scores. Make on-time payments, keep credit utilization low, and monitor credit reports to ensure accurate information.

While a 0% balance transfer credit card can be a valuable tool for debt consolidation and repayment, it’s essential to consider alternative debt consolidation options, such as personal loans or debt management plans. These options may offer more flexibility and customization, and can be a better fit for individuals with specific financial needs.

Ultimately, the key to making the most of a 0% balance transfer credit card is responsible credit card use and debt management. By understanding the benefits and strategies for