What is a Good Hourly Wage and Why Does it Matter

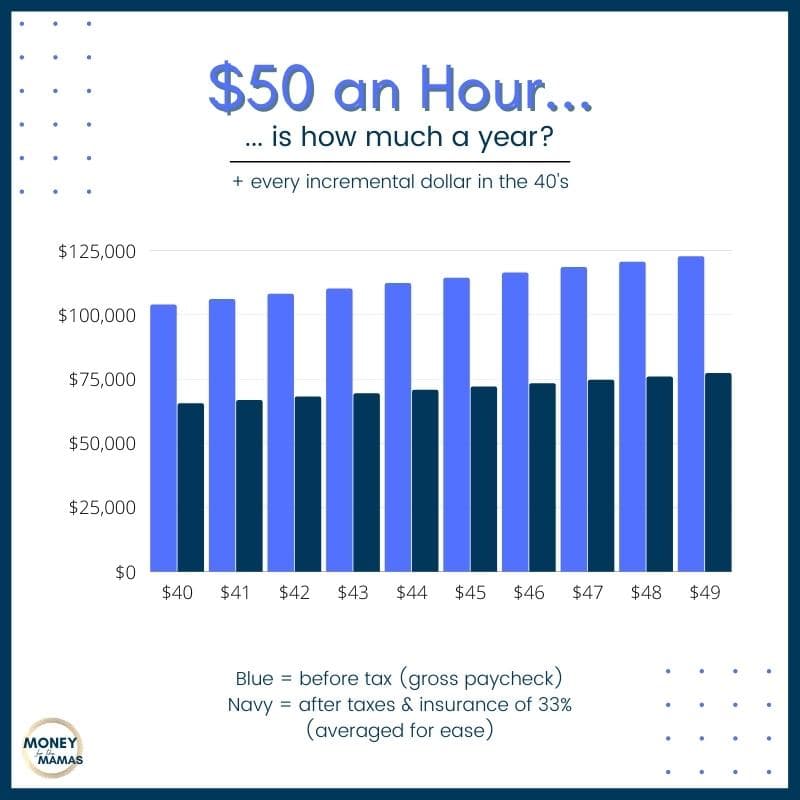

Earning a good hourly wage is essential for achieving financial stability, reducing stress, and increasing job satisfaction. A $50 per hour salary, in particular, can provide a comfortable lifestyle and opportunities for savings and investment. This hourly wage can cover the costs of living in many parts of the country, allowing individuals to enjoy a decent standard of living without excessive financial strain.

In today’s economy, a $50 per hour salary is considered a good hourly wage, as it exceeds the median hourly wage in many industries. According to the Bureau of Labor Statistics, the median hourly wage for all occupations was $25.72 in May 2020. Therefore, earning $50 per hour can provide a significant advantage in terms of financial security and flexibility.

A good hourly wage can also have a positive impact on mental and physical health. When individuals earn a decent income, they are more likely to feel secure and less stressed, which can lead to better overall health and well-being. Furthermore, a good hourly wage can provide the means to pursue hobbies and interests, leading to a more fulfilling and enjoyable life.

In addition to the personal benefits, a $50 per hour salary can also have a positive impact on the economy. When individuals earn a good income, they are more likely to spend money, invest in their communities, and contribute to economic growth. This, in turn, can lead to increased economic activity, job creation, and a higher standard of living for everyone.

Overall, earning a good hourly wage, such as $50 per hour, is crucial for achieving financial stability, reducing stress, and increasing job satisfaction. It can provide a comfortable lifestyle, opportunities for savings and investment, and a positive impact on mental and physical health. As the economy continues to evolve, it is essential to prioritize fair compensation and good hourly wages to ensure a prosperous future for individuals and society as a whole.

Jobs That Pay $50 an Hour: Exploring High-Paying Career Options

Several careers offer salaries around $50 per hour, providing individuals with a comfortable lifestyle and opportunities for savings and investment. Some of the highest-paying jobs can be found in the tech, healthcare, finance, and consulting industries.

In the tech industry, careers such as software engineering, data science, and product management can command high hourly wages. For example, a software engineer with expertise in cloud computing and artificial intelligence can earn an average hourly wage of $55-$65 per hour. Similarly, a data scientist with experience in machine learning and data visualization can earn an average hourly wage of $50-$60 per hour.

In the healthcare industry, careers such as physician assistant, nurse practitioner, and pharmacist can also offer high hourly wages. For instance, a physician assistant with expertise in surgery and emergency medicine can earn an average hourly wage of $50-$60 per hour. A nurse practitioner with experience in pediatrics and gerontology can earn an average hourly wage of $45-$55 per hour.

The finance industry also offers several high-paying career options, including investment banking, financial analysis, and portfolio management. An investment banker with expertise in mergers and acquisitions can earn an average hourly wage of $60-$70 per hour. A financial analyst with experience in financial modeling and data analysis can earn an average hourly wage of $50-$60 per hour.

Consulting careers, such as management consulting and IT consulting, can also provide high hourly wages. A management consultant with expertise in strategy and operations can earn an average hourly wage of $55-$65 per hour. An IT consultant with experience in cloud computing and cybersecurity can earn an average hourly wage of $50-$60 per hour.

To succeed in these high-paying careers, individuals typically need to possess advanced skills and qualifications, such as a bachelor’s or master’s degree, certifications, and relevant work experience. Additionally, staying up-to-date with industry trends and developments is crucial for maintaining a competitive edge in the job market.

Overall, several careers offer salaries around $50 per hour, providing individuals with a comfortable lifestyle and opportunities for savings and investment. By acquiring the necessary skills and qualifications, individuals can increase their earning potential and achieve financial stability.

How to Negotiate a Higher Hourly Wage: Tips and Strategies

Negotiating a higher hourly wage can be a challenging but crucial step in achieving a $50 per hour salary. To successfully negotiate a higher wage, it’s essential to research industry standards, highlight your skills and experience, and make a strong case for increased compensation.

Researching industry standards is a critical step in determining a fair hourly wage. Utilize online resources such as the Bureau of Labor Statistics, Glassdoor, or Payscale to determine the average hourly wage for your profession and location. This information will provide a solid foundation for your negotiation.

Highlighting your skills and experience is also vital in negotiating a higher hourly wage. Make a list of your relevant skills, certifications, and experience, and be prepared to discuss how they align with the job requirements. Emphasize your achievements and the value you can bring to the organization.

When making a strong case for increased compensation, it’s essential to be confident and assertive. Avoid apologetic or hesitant language, and instead, focus on the value you can bring to the organization. Use phrases such as “Based on my research, I believe my skills and experience warrant a higher hourly wage” or “I’m excited about the opportunity to contribute to the organization, and I believe my compensation should reflect my value.”

Here’s an example of a successful negotiation script:

“Hi [Manager’s Name], I wanted to discuss my hourly wage for this position. Based on my research, I believe the average hourly wage for this profession in our location is around $50 per hour. Considering my [number of years] of experience and [relevant skills], I believe I can bring significant value to the organization. I’m excited about the opportunity to contribute, and I believe my compensation should reflect my value. Would it be possible to discuss a higher hourly wage?”

Additionally, be prepared to negotiate and find a mutually beneficial agreement. Think creatively about other benefits, such as additional vacation time, flexible work arrangements, or professional development opportunities, that could offset a lower hourly wage.

By researching industry standards, highlighting your skills and experience, and making a strong case for increased compensation, you can successfully negotiate a higher hourly wage and achieve a $50 per hour salary.

Freelancing and Consulting: Alternative Paths to a $50 per Hour Salary

Freelancing and consulting can be attractive alternatives to traditional employment for those seeking a $50 per hour salary. These options offer flexibility, autonomy, and the potential for high earnings, but also come with unique challenges and responsibilities.

Freelancing involves offering services on a project-by-project basis, often through online platforms or personal networks. This can be a great way to monetize skills and expertise, but requires strong self-marketing and time management skills. Freelancers must also be prepared to handle variable income and lack of benefits.

Consulting, on the other hand, involves providing expert advice and guidance to clients on a specific topic or industry. This can be a lucrative option for those with specialized knowledge and experience, but requires strong communication and interpersonal skills. Consultants must also be able to build and maintain a strong professional network.

To get started with freelancing or consulting, it’s essential to identify your strengths and areas of expertise. Consider what services you can offer, and what kind of clients you want to work with. Develop a strong online presence, including a professional website and social media profiles, to showcase your skills and attract potential clients.

Setting rates is also a crucial aspect of freelancing and consulting. Research industry standards and consider factors such as your experience, skills, and the level of expertise required for each project. Be prepared to negotiate rates with clients, and consider offering tiered pricing or package deals to attract more business.

Some popular freelance and consulting platforms include Upwork, Freelancer, and LinkedIn. These platforms can provide access to a large pool of potential clients, but also come with fees and competition. Consider building your own professional network and marketing yourself directly to clients to avoid these fees and increase your earning potential.

Ultimately, freelancing and consulting can be a great way to earn a $50 per hour salary, but require careful planning, strong self-marketing, and a willingness to take on new challenges. By identifying your strengths, developing a strong online presence, and setting competitive rates, you can build a successful freelance or consulting business and achieve your financial goals.

Education and Training: Investing in Your Future

Investing in ongoing education and training is essential for increasing earning potential and achieving a $50 per hour salary. By acquiring new skills and knowledge, individuals can enhance their career prospects, boost their earning potential, and stay competitive in the job market.

There are various types of courses, certifications, and degrees that can lead to high-paying jobs. For example, in the tech industry, courses in programming languages such as Python, Java, and JavaScript can be highly valuable. In the healthcare industry, certifications in nursing, medical assisting, and healthcare management can lead to high-paying jobs.

In the finance industry, degrees in accounting, finance, and business administration can lead to high-paying jobs. Additionally, certifications such as the Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA) can also be highly valuable.

Online courses and certifications are also becoming increasingly popular, as they offer flexibility and convenience. Platforms such as Coursera, Udemy, and LinkedIn Learning offer a wide range of courses and certifications in various fields.

It’s also important to note that education and training are not limited to formal degrees and certifications. Soft skills such as communication, teamwork, and problem-solving are also highly valued by employers and can be developed through various training programs and workshops.

Some popular resources for further learning include:

– Coursera: Offers online courses and certifications in various fields, including business, technology, and healthcare.

– Udemy: Offers online courses and certifications in various fields, including business, technology, and creative skills.

– LinkedIn Learning: Offers online courses and certifications in various fields, including business, technology, and creative skills.

– edX: Offers online courses and certifications in various fields, including business, technology, and healthcare.

By investing in ongoing education and training, individuals can enhance their career prospects, boost their earning potential, and achieve a $50 per hour salary.

Creating Multiple Income Streams: Diversifying Your Earnings

Having multiple income streams is essential for achieving financial stability and increasing earning potential. By diversifying your earnings, you can reduce financial risk and create a safety net in case of unexpected expenses or job loss.

One way to create multiple income streams is to start a side business. This can be a part-time venture that complements your main job, such as freelancing, consulting, or selling products online. By starting a side business, you can earn extra income, pursue your passions, and build a safety net.

Another way to diversify your income is to invest in real estate. Real estate investing can provide a steady stream of passive income through rental properties, real estate investment trusts (REITs), or real estate crowdfunding platforms.

Generating passive income through online platforms is also a viable option. You can create and sell online courses, ebooks, or affiliate marketing products, which can provide a steady stream of income without requiring direct involvement.

Additionally, you can also explore alternative sources of income, such as:

– Renting out a spare room on Airbnb

– Selling products on Amazon or Etsy

– Creating a mobile app or game

– Investing in dividend-paying stocks

By creating multiple income streams, you can reduce financial risk, increase earning potential, and achieve a $50 per hour salary. Remember to always research and understand the opportunities and challenges associated with each income stream before getting started.

It’s also important to note that creating multiple income streams requires effort, patience, and persistence. However, with the right mindset and strategy, you can achieve financial stability and increase your earning potential.

Managing Your Finances: Making the Most of Your $50 per Hour Salary

Managing your finances effectively is crucial to making the most of your $50 per hour salary. By creating a budget, saving, and investing, you can ensure that your hard-earned money is working for you, rather than against you.

Creating a budget is the first step in managing your finances. Start by tracking your income and expenses to get a clear picture of where your money is going. Make a list of your essential expenses, such as rent/mortgage, utilities, and groceries, and then allocate your remaining income towards savings, investments, and discretionary spending.

Saving is also an essential part of managing your finances. Aim to save at least 20% of your income each month, and consider setting up an automatic transfer from your checking account to your savings or investment accounts. This will help you build a safety net and achieve your long-term financial goals.

Investing is another important aspect of managing your finances. Consider contributing to a 401(k) or IRA, and take advantage of any employer matching contributions. You can also explore other investment options, such as stocks, bonds, or real estate, to grow your wealth over time.

Avoiding lifestyle inflation is also crucial to managing your finances effectively. As your income increases, it can be tempting to inflate your lifestyle by spending more on luxuries and discretionary items. However, this can lead to financial stress and decreased savings rates. Instead, focus on saving and investing your money, and avoid making impulse purchases or buying things you don’t need.

Building wealth over time requires discipline, patience, and a long-term perspective. By creating a budget, saving, and investing, you can make the most of your $50 per hour salary and achieve financial stability and security.

Some popular budgeting and investment tools include:

– Mint: A personal finance app that helps you track your spending and create a budget.

– You Need a Budget (YNAB): A budgeting app that helps you manage your finances and achieve your financial goals.

– Vanguard: A investment platform that offers a range of low-cost index funds and ETFs.

– Robinhood: A brokerage app that allows you to buy and sell stocks, ETFs, and options with no commission fees.

Conclusion: Achieving a $50 per Hour Salary Requires Strategy and Hard Work

Achieving a $50 per hour salary requires a combination of strategy, hard work, and dedication. By understanding the importance of earning a good hourly wage, exploring high-paying career options, and developing the skills and qualifications required for these roles, individuals can increase their earning potential and achieve financial stability.

Additionally, negotiating a higher hourly wage, freelancing and consulting, and creating multiple income streams can also help individuals achieve a $50 per hour salary. Managing finances effectively, including budgeting, saving, and investing, is also crucial to making the most of a high hourly wage.

While achieving a $50 per hour salary may require significant effort and dedication, the benefits of financial stability, reduced stress, and increased job satisfaction make it a worthwhile goal. By taking action and working towards their financial goals, individuals can create a better future for themselves and their families.

In conclusion, achieving a $50 per hour salary requires a combination of strategy, hard work, and dedication. By following the tips and strategies outlined in this article, individuals can increase their earning potential and achieve financial stability.

Remember, achieving a high hourly wage is not just about the money; it’s about creating a better life for yourself and your family. By taking control of your finances and working towards your goals, you can create a brighter future and achieve financial freedom.