Understanding the Math Behind Hourly and Annual Salaries

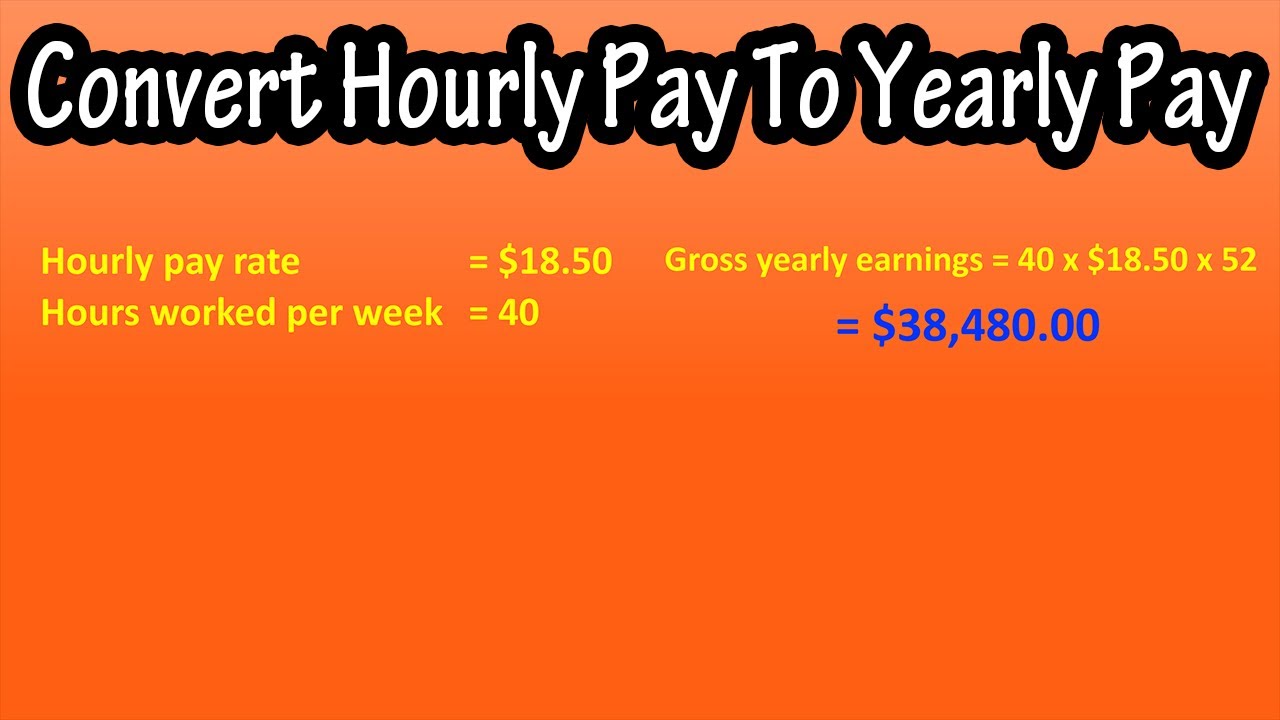

Converting hourly wages to annual salaries is a straightforward process that requires a basic understanding of math. To calculate an annual salary from an hourly wage, you need to know the number of hours worked per week and the number of weeks worked per year. Assuming a standard 40-hour workweek and 52 weeks per year, the calculation is as follows:

Hourly wage x Number of hours worked per week x Number of weeks worked per year = Annual salary

For example, if you earn $50 an hour and work 40 hours a week, your weekly earnings would be:

$50/hour x 40 hours/week = $2,000/week

To calculate your annual salary, multiply your weekly earnings by the number of weeks worked per year:

$2,000/week x 52 weeks/year = $104,000/year

This means that $50 an hour is equivalent to an annual salary of $104,000, assuming a 40-hour workweek and 52 weeks per year. However, this is just a rough estimate and does not take into account factors like taxes, benefits, and overtime pay.

It’s also worth noting that the number of hours worked per week and the number of weeks worked per year can vary significantly depending on the job, industry, and employer. Some jobs may require longer hours or more weeks worked per year, which can impact the annual salary.

Understanding the math behind hourly and annual salaries is essential for anyone who wants to make informed decisions about their career and finances. By knowing how to calculate your annual salary from an hourly wage, you can better evaluate job offers, negotiate salaries, and plan for your financial future.

How to Calculate Your Annual Salary from an Hourly Wage

Calculating your annual salary from an hourly wage is a straightforward process that requires a few simple steps. Here’s a step-by-step guide to help you calculate your annual salary:

Step 1: Determine your hourly wage

Start by determining your hourly wage. This is the amount of money you earn per hour of work. For example, if you earn $50 an hour, this is your hourly wage.

Step 2: Determine the number of hours worked per week

Next, determine the number of hours you work per week. This can vary depending on your job, industry, and employer. For example, if you work a standard 40-hour workweek, this is the number of hours you work per week.

Step 3: Determine the number of weeks worked per year

Then, determine the number of weeks you work per year. This can also vary depending on your job, industry, and employer. For example, if you work 52 weeks per year, this is the number of weeks you work per year.

Step 4: Calculate your weekly earnings

Now, calculate your weekly earnings by multiplying your hourly wage by the number of hours worked per week. For example:

$50/hour x 40 hours/week = $2,000/week

Step 5: Calculate your annual salary

Finally, calculate your annual salary by multiplying your weekly earnings by the number of weeks worked per year. For example:

$2,000/week x 52 weeks/year = $104,000/year

This means that if you earn $50 an hour and work 40 hours a week for 52 weeks a year, your annual salary would be $104,000.

Accounting for Overtime, Bonuses, and Other Forms of Compensation

In addition to your regular hourly wage, you may also earn overtime pay, bonuses, or other forms of compensation. To calculate your annual salary, you’ll need to factor these into your calculation. For example:

If you earn $50 an hour and work 10 hours of overtime per week at a rate of $75 per hour, your weekly earnings would be:

$50/hour x 40 hours/week = $2,000/week

+$75/hour x 10 hours/week = $750/week

Total weekly earnings: $2,000/week + $750/week = $2,750/week

Then, calculate your annual salary by multiplying your total weekly earnings by the number of weeks worked per year:

$2,750/week x 52 weeks/year = $143,000/year

This means that if you earn $50 an hour, work 40 hours a week, and earn 10 hours of overtime per week at a rate of $75 per hour, your annual salary would be $143,000.

The Impact of Taxes and Benefits on Your Take-Home Pay

When evaluating the value of a $50 an hour wage, it’s essential to consider the impact of taxes and benefits on your take-home pay. Taxes, benefits, and other deductions can significantly reduce the actual amount of money you earn from your hourly wage.

Taxes: A Significant Deduction

Taxes are a significant deduction from your hourly wage. The amount of taxes you pay depends on your tax bracket, filing status, and other factors. For example, if you earn $50 an hour and work 40 hours a week, your weekly earnings would be $2,000. However, after taxes, your take-home pay might be around $1,500 per week, depending on your tax bracket.

Benefits: A Valuable Addition

Benefits, such as health insurance, retirement plans, and paid time off, can add significant value to your hourly wage. However, these benefits can also impact your take-home pay. For example, if your employer offers a health insurance plan that costs $200 per month, this amount would be deducted from your paycheck, reducing your take-home pay.

Other Deductions: A Further Reduction

In addition to taxes and benefits, other deductions can further reduce your take-home pay. These deductions might include:

401(k) or other retirement plan contributions

Life insurance premiums

Disability insurance premiums

Other benefits or deductions

For example, if you contribute 10% of your income to a 401(k) plan, this amount would be deducted from your paycheck, reducing your take-home pay.

Calculating Your Take-Home Pay

To calculate your take-home pay, you’ll need to consider all the deductions mentioned above. Here’s an example:

Gross income: $2,000 per week (based on $50 an hour and 40 hours per week)

Taxes: 25% of gross income (depending on tax bracket) = $500 per week

Benefits: $200 per month (health insurance) = $46 per week

401(k) contribution: 10% of gross income = $200 per week

Other deductions: $50 per week (life insurance, disability insurance, etc.)

Total deductions: $796 per week

Take-home pay: $2,000 per week – $796 per week = $1,204 per week

This example illustrates how taxes, benefits, and other deductions can significantly reduce your take-home pay. When evaluating the value of a $50 an hour wage, it’s essential to consider these factors to get an accurate picture of your take-home pay.

Comparing $50 an Hour to Other Common Salaries

To put the value of $50 an hour into perspective, it’s helpful to compare it to other common salaries. Here are a few examples:

Minimum Wage: $7.25 an Hour

The federal minimum wage is $7.25 an hour, which translates to an annual salary of around $15,000 per year, assuming a 40-hour workweek and 52 weeks per year. This is significantly lower than the annual salary equivalent of $50 an hour, which is around $104,000 per year.

Average Salary: $56,310 per Year

According to the Bureau of Labor Statistics, the average annual salary for all occupations in the United States is around $56,310 per year. This is lower than the annual salary equivalent of $50 an hour, which is around $104,000 per year.

Industry-Specific Salaries

Salaries can vary significantly depending on the industry and profession. Here are a few examples of average salaries in different industries:

Software Engineers: $124,000 per Year

Physicians: $208,000 per Year

Lawyers: $144,530 per Year

Teachers: $60,480 per Year

These salaries are based on national averages and can vary depending on factors such as location, experience, and industry.

Profession-Specific Salaries

Salaries can also vary significantly depending on the profession. Here are a few examples of average salaries in different professions:

Dentists: $156,240 per Year

Pharmacists: $126,120 per Year

Engineers: $115,000 per Year

Accountants: $74,170 per Year

These salaries are based on national averages and can vary depending on factors such as location, experience, and industry.

In conclusion, $50 an hour is a relatively high hourly wage, especially when compared to the federal minimum wage and average salary. However, salaries can vary significantly depending on the industry, profession, and location.

Is $50 an Hour a Good Salary? Factors to Consider

Whether $50 an hour is a good salary depends on various factors, including cost of living, industry standards, and personal financial goals. Here are some factors to consider:

Cost of Living

The cost of living in your area can significantly impact the value of $50 an hour. For example, if you live in a city with a high cost of living, such as New York or San Francisco, $50 an hour may not go as far as it would in a city with a lower cost of living, such as Des Moines or Omaha.

Industry Standards

Industry standards can also impact the value of $50 an hour. For example, if you work in a industry where the average hourly wage is $30, $50 an hour may be considered a good salary. However, if you work in an industry where the average hourly wage is $75, $50 an hour may be considered below average.

Personal Financial Goals

Your personal financial goals can also impact the value of $50 an hour. For example, if you are trying to pay off debt or save for a specific goal, $50 an hour may be a good salary. However, if you are trying to save for retirement or achieve a certain level of financial independence, $50 an hour may not be enough.

Other Factors to Consider

Other factors to consider when evaluating the value of $50 an hour include:

Benefits: Does the job offer benefits, such as health insurance or a 401(k) plan?

Job Security: Is the job secure, or is there a risk of layoffs or downsizing?

Opportunities for Advancement: Are there opportunities for advancement or professional development?

Work-Life Balance: Does the job offer a good work-life balance, or are the hours long and demanding?

Overall, whether $50 an hour is a good salary depends on a variety of factors, including cost of living, industry standards, and personal financial goals. It’s essential to consider these factors when evaluating the value of $50 an hour.

Real-Life Examples of Jobs that Pay $50 an Hour

While $50 an hour may seem like a high hourly wage, there are many jobs that pay around this amount. Here are some real-life examples of jobs that pay around $50 an hour:

Software Engineer

Software engineers design, develop, and test software programs. According to the Bureau of Labor Statistics, the median hourly wage for software engineers is around $53 an hour. However, experienced software engineers can earn upwards of $100 an hour.

Dentist

Dentists diagnose and treat problems with teeth and mouths. According to the Bureau of Labor Statistics, the median hourly wage for dentists is around $76 an hour. However, experienced dentists can earn upwards of $150 an hour.

Lawyer

Lawyers advise clients on legal matters and represent them in court. According to the Bureau of Labor Statistics, the median hourly wage for lawyers is around $69 an hour. However, experienced lawyers can earn upwards of $200 an hour.

Air Traffic Controller

Air traffic controllers coordinate the movement of aircraft to ensure safe distances between planes. According to the Bureau of Labor Statistics, the median hourly wage for air traffic controllers is around $62 an hour. However, experienced air traffic controllers can earn upwards of $100 an hour.

Pharmacist

Pharmacists dispense medication and advise patients on its use. According to the Bureau of Labor Statistics, the median hourly wage for pharmacists is around $61 an hour. However, experienced pharmacists can earn upwards of $120 an hour.

These are just a few examples of jobs that pay around $50 an hour. Keep in mind that salaries can vary widely depending on factors such as location, experience, and industry.

How to Negotiate a Higher Hourly Wage

Negotiating a higher hourly wage can be a challenging task, but it’s essential to ensure that you’re fairly compensated for your work. Here are some tips and strategies to help you negotiate a higher hourly wage:

Research Market Rates

Before negotiating a higher hourly wage, it’s essential to research market rates for your position and industry. This will give you a solid understanding of what you’re worth and help you make a strong case for a raise. You can use online resources such as Glassdoor, Payscale, or the Bureau of Labor Statistics to determine the average hourly wage for your position.

Highlight Your Skills and Experience

When negotiating a higher hourly wage, it’s essential to highlight your skills and experience. Make a list of your achievements and qualifications, and be prepared to discuss how they’ve positively impacted your employer. This will help demonstrate your value to your employer and make a strong case for a raise.

Make a Strong Case for a Raise

When asking for a raise, it’s essential to make a strong case for why you deserve one. Be prepared to discuss your research on market rates, your skills and experience, and any additional responsibilities you’ve taken on. Be confident and assertive, but also respectful and professional.

Be Flexible and Open to Negotiation

When negotiating a higher hourly wage, it’s essential to be flexible and open to negotiation. Your employer may not be able to grant you the exact hourly wage you’re asking for, so be prepared to compromise. Think about what you’re willing to accept and be prepared to negotiate.

Consider Other Benefits

When negotiating a higher hourly wage, it’s essential to consider other benefits that may be included in your compensation package. These can include things like health insurance, retirement plans, or paid time off. Make sure you understand the total value of your compensation package and negotiate accordingly.

Be Prepared to Discuss Your Future Plans

When negotiating a higher hourly wage, it’s essential to be prepared to discuss your future plans. Your employer may want to know if you’re planning to stay with the company long-term or if you’re looking to move on to other opportunities. Be honest and transparent about your plans, and be prepared to discuss how they may impact your hourly wage.

Conclusion: What $50 an Hour Really Means for Your Finances

In conclusion, $50 an hour is a significant hourly wage that can translate to a substantial annual salary. However, it’s essential to consider the various factors that can impact your take-home pay, including taxes, benefits, and other deductions.

As we’ve discussed throughout this article, $50 an hour is equivalent to an annual salary of around $104,000, assuming a 40-hour workweek and 52 weeks per year. However, this amount can vary significantly depending on your location, industry, and other factors.

When evaluating the value of $50 an hour, it’s crucial to consider the cost of living in your area, industry standards, and your personal financial goals. Additionally, it’s essential to research market rates, highlight your skills and experience, and make a strong case for a raise when negotiating a higher hourly wage.

Ultimately, $50 an hour can be a good salary for many people, but it’s essential to consider the various factors that can impact your take-home pay and overall financial situation. By understanding the math behind hourly and annual salaries, researching market rates, and negotiating a fair hourly wage, you can make informed decisions about your career and finances.

In summary, $50 an hour is a significant hourly wage that can translate to a substantial annual salary. However, it’s essential to consider the various factors that can impact your take-home pay and overall financial situation. By understanding the math behind hourly and annual salaries and negotiating a fair hourly wage, you can make informed decisions about your career and finances.