Understanding Hourly Wages and Weekly Income

Calculating weekly income from hourly wages is a crucial step in understanding take-home pay. Many individuals, especially those in hourly wage jobs, often wonder how their hourly rate translates to a weekly income. For instance, if someone earns $30 an hour, they may ask themselves, “$30 an hour is how much a week?” To answer this question, it’s essential to understand the relationship between hourly wages and weekly income.

In the United States, the Fair Labor Standards Act (FLSA) requires employers to pay employees for all hours worked, including overtime. Hourly wages are calculated by multiplying the number of hours worked by the hourly rate. However, this calculation does not take into account factors like taxes, benefits, and overtime pay, which can significantly impact weekly income.

To accurately calculate weekly income, individuals need to consider their hourly wage, the number of hours worked per week, and any additional forms of compensation. For example, if someone earns $30 an hour and works 40 hours a week, their weekly income would be $1,200. However, this amount may not reflect their actual take-home pay, as taxes, benefits, and other deductions can reduce their weekly earnings.

Understanding the relationship between hourly wages and weekly income is vital for creating a realistic budget, making informed financial decisions, and negotiating fair compensation. By calculating weekly income accurately, individuals can better manage their finances, plan for the future, and achieve their long-term financial goals.

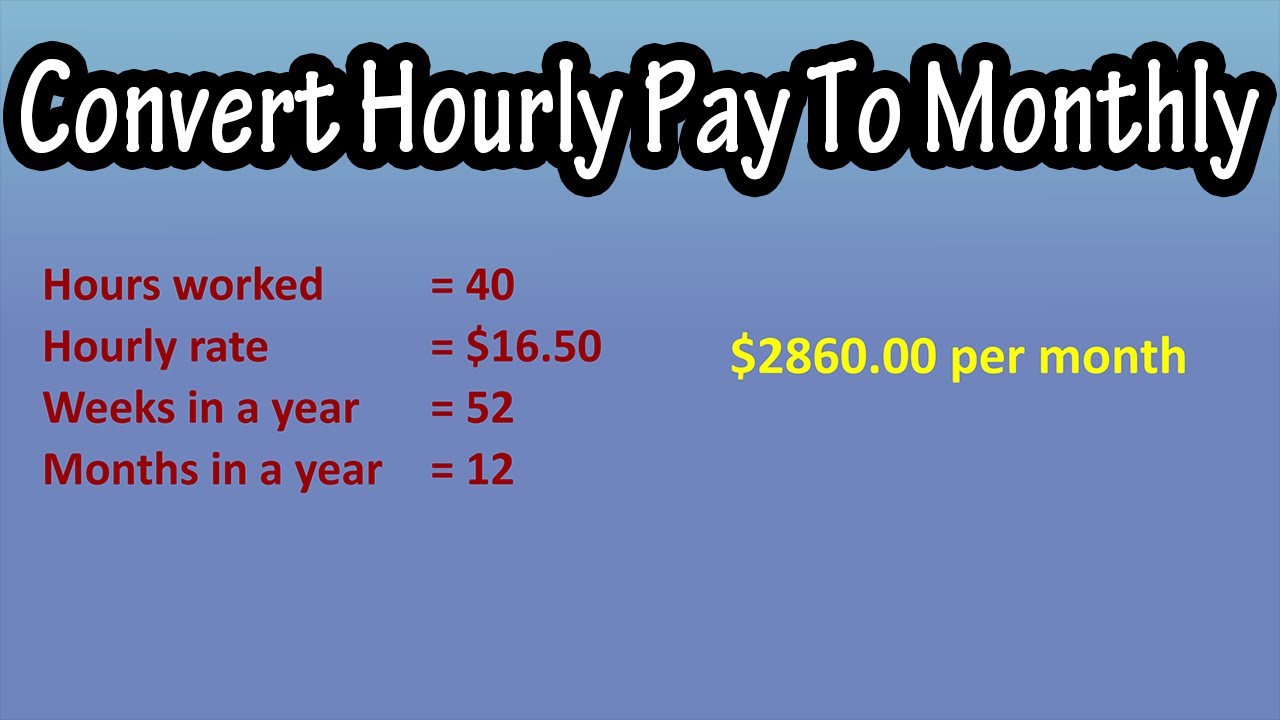

Converting Hourly Wages to Weekly Income: A Simple Formula

To calculate weekly income from hourly wages, you can use a simple formula: Weekly Income = Hourly Wage x Number of Hours Worked. For example, if you earn $30 an hour and work 40 hours a week, your weekly income would be $30 x 40 = $1,200. This calculation assumes a standard full-time schedule, but you can adjust the number of hours worked to reflect your individual circumstances.

Using this formula, you can easily calculate your weekly income based on your hourly wage. For instance, if you earn $30 an hour and work 30 hours a week, your weekly income would be $30 x 30 = $900. Similarly, if you earn $30 an hour and work 50 hours a week, your weekly income would be $30 x 50 = $1,500.

It’s essential to note that this formula only provides an estimate of your weekly income, as it does not take into account factors like taxes, benefits, and overtime pay. However, it can give you a rough idea of your weekly earnings and help you plan your finances accordingly.

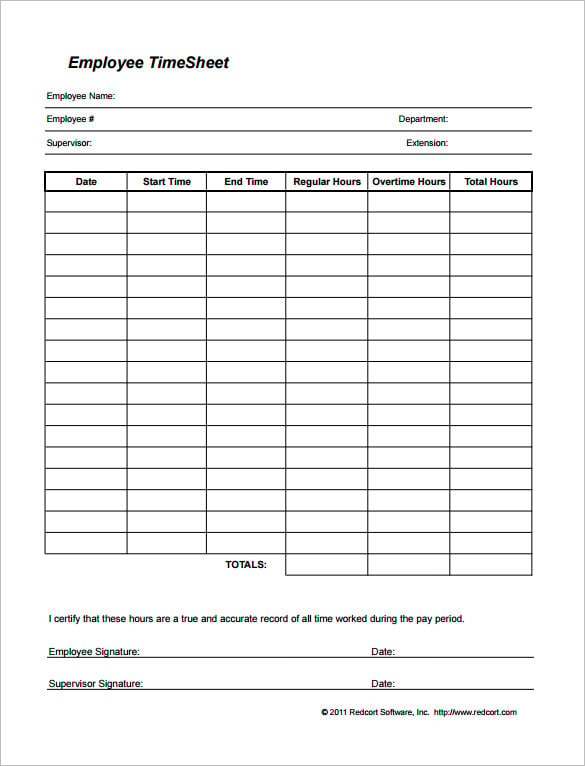

To make the most of this formula, you can use an online calculator or create a spreadsheet to calculate your weekly income based on your hourly wage and number of hours worked. This can help you stay organized and ensure that you’re accurately tracking your earnings.

Now, let’s go back to the question: “$30 an hour is how much a week?” Based on the formula above, we can see that $30 an hour can translate to a weekly income of $1,200, assuming a standard full-time schedule of 40 hours a week. However, this amount can vary depending on your individual circumstances, and it’s essential to consider all the factors that affect your weekly income.

How to Calculate Weekly Income from Hourly Wages: A Real-Life Example

Let’s consider a real-life scenario to demonstrate how to calculate weekly income from hourly wages. Meet Emily, a marketing specialist who earns $30 an hour and works 40 hours a week. To calculate her weekly income, we can use the formula: Weekly Income = Hourly Wage x Number of Hours Worked.

In Emily’s case, her weekly income would be $30 x 40 = $1,200. This is a straightforward calculation, but it’s essential to consider other factors that may affect her weekly income. For instance, if Emily works overtime, her hourly wage may increase, and her weekly income would be higher. On the other hand, if she takes time off or works fewer hours, her weekly income would be lower.

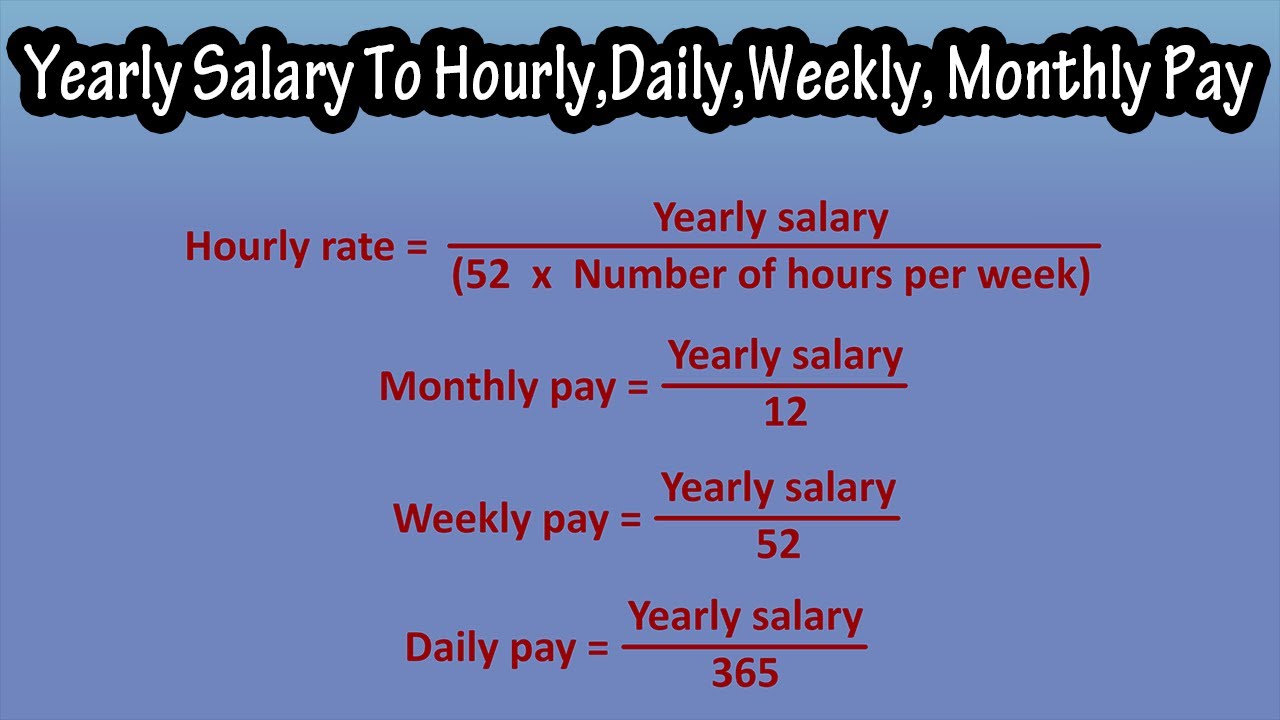

To give you a better idea, let’s break down Emily’s weekly income into a monthly and annual income. Assuming she works 40 hours a week and 52 weeks a year, her annual income would be $1,200 x 52 = $62,400. This translates to a monthly income of $62,400 / 12 = $5,200.

Now, let’s go back to the question: “$30 an hour is how much a week?” Based on Emily’s scenario, we can see that $30 an hour can translate to a weekly income of $1,200, assuming a standard full-time schedule of 40 hours a week. However, this amount can vary depending on individual circumstances, and it’s essential to consider all the factors that affect weekly income.

By using this real-life example, we can see how calculating weekly income from hourly wages can help individuals like Emily understand their take-home pay and make informed financial decisions. Whether you’re a marketing specialist or work in a different field, understanding your weekly income is crucial for creating a budget, saving for the future, and achieving your long-term financial goals.

Factors Affecting Weekly Income: Overtime, Bonuses, and Benefits

While calculating weekly income from hourly wages is a straightforward process, there are several factors that can impact the accuracy of your calculations. Overtime, bonuses, and benefits are just a few examples of variables that can affect your weekly income.

Overtime pay, for instance, can significantly increase your weekly income. If you earn $30 an hour and work 10 hours of overtime at a rate of 1.5 times your regular hourly wage, your overtime pay would be $30 x 1.5 x 10 = $450. This amount would be added to your regular weekly income, resulting in a higher total weekly income.

Bonuses can also impact your weekly income. If you receive a bonus of $1,000 per quarter, your weekly income would increase by $1,000 / 13 = $76.92 per week. This amount would be added to your regular weekly income, resulting in a higher total weekly income.

Benefits, such as health insurance, retirement plans, and paid time off, can also affect your weekly income. While these benefits may not directly impact your take-home pay, they can reduce your taxable income and increase your overall compensation package.

To accurately calculate your weekly income, it’s essential to factor in these variables. Here are some tips to help you get started:

1. Keep track of your overtime hours and pay rate to ensure accurate calculations.

2. Consider bonuses and other forms of compensation when calculating your weekly income.

3. Factor in benefits, such as health insurance and retirement plans, to get a complete picture of your compensation package.

By considering these factors, you can get a more accurate picture of your weekly income and make informed financial decisions. Remember, understanding your weekly income is crucial for creating a budget, saving for the future, and achieving your long-term financial goals.

Weekly Income and Budgeting: Making the Most of Your Earnings

Now that you understand how to calculate your weekly income, it’s time to think about how to make the most of your earnings. Budgeting is a crucial step in managing your finances effectively, and it’s essential to create a budget that’s based on your weekly income.

A budget is a plan for how you want to allocate your income towards different expenses, savings, and investments. By creating a budget, you can ensure that you’re making the most of your earnings and achieving your financial goals.

Here are some tips for creating a budget based on your weekly income:

1. Track your expenses: Start by tracking your expenses for a week or a month to get an idea of where your money is going. Make a list of all your expenses, including rent, utilities, groceries, transportation, and entertainment.

2. Categorize your expenses: Once you have a list of your expenses, categorize them into different groups, such as housing, food, transportation, and entertainment.

3. Set financial goals: Determine what you want to achieve with your budget. Do you want to save for a down payment on a house? Pay off debt? Build up your emergency fund?

4. Allocate your income: Based on your expenses, categories, and financial goals, allocate your weekly income towards different expenses and savings.

5. Review and adjust: Review your budget regularly and adjust as needed. Your budget should be a dynamic document that changes as your financial situation changes.

For example, if you earn $30 an hour and work 40 hours a week, your weekly income would be $1,200. You could allocate 50% of your income towards necessary expenses like rent, utilities, and groceries, 30% towards discretionary expenses like entertainment and hobbies, and 20% towards savings and debt repayment.

By following these steps, you can create a budget that’s based on your weekly income and helps you achieve your financial goals.

Maximizing Your Earning Potential: Tips for Increasing Weekly Income

If you’re looking to increase your weekly income, there are several strategies you can use to maximize your earning potential. Here are some actionable tips to help you get started:

1. Take on a side hustle: Consider starting a part-time business or taking on a freelance project to supplement your income. This can be a great way to earn extra money and diversify your income streams.

2. Negotiate a raise: If you feel that you’re underpaid, consider negotiating a raise with your employer. Make a strong case for why you deserve a higher salary, and be prepared to discuss your value to the company.

3. Pursue additional education or training: Investing in your education and skills can help you increase your earning potential. Consider taking courses or earning certifications that can help you advance in your career.

4. Ask for overtime: If you’re eligible for overtime pay, consider asking your employer if you can work extra hours. This can be a great way to earn extra money, especially during peak periods.

5. Sell products or services online: If you have a talent for creating things or providing services, consider selling them online. This can be a great way to earn extra money and reach a wider audience.

For example, if you earn $30 an hour and work 40 hours a week, your weekly income would be $1,200. However, if you take on a side hustle and earn an additional $500 per week, your total weekly income would be $1,700. This can make a big difference in your overall financial situation and help you achieve your long-term goals.

Remember, increasing your weekly income takes time and effort, but it’s worth it in the long run. By following these tips and staying committed to your goals, you can maximize your earning potential and achieve financial success.

Common Mistakes to Avoid When Calculating Weekly Income

When calculating weekly income, it’s easy to make mistakes that can lead to inaccurate results. Here are some common errors to avoid:

1. Forgetting to account for overtime: Overtime pay can significantly impact weekly income, so make sure to include it in your calculations.

2. Not considering bonuses and benefits: Bonuses and benefits can also impact weekly income, so make sure to factor them into your calculations.

3. Using the wrong hourly wage: Make sure to use the correct hourly wage when calculating weekly income. If you’re unsure, check your pay stub or consult with your employer.

4. Not accounting for taxes: Taxes can significantly reduce weekly income, so make sure to account for them in your calculations.

5. Not considering irregular schedules: If you work an irregular schedule, make sure to account for the varying number of hours worked each week.

For example, if you earn $30 an hour and work 40 hours a week, but forget to account for overtime, your weekly income calculation may be inaccurate. Similarly, if you don’t consider bonuses and benefits, you may be underestimating your weekly income.

To avoid these mistakes, make sure to carefully review your calculations and consider all the factors that impact your weekly income. By doing so, you can ensure that your calculations are accurate and reliable.

By avoiding these common mistakes, you can ensure that your weekly income calculations are accurate and reliable. This will help you make informed financial decisions and achieve your long-term financial goals.

Conclusion: Taking Control of Your Weekly Income

Understanding your weekly income is crucial for taking control of your financial life. By accurately calculating your earnings, you can make informed decisions about your budget, savings, and investments. Remember, $30 an hour is how much a week? The answer is $1,200, assuming a standard full-time schedule of 40 hours per week.

However, weekly income is not just about the number of hours worked or the hourly wage. It’s also about understanding the factors that impact your earnings, such as overtime, bonuses, and benefits. By considering these variables, you can get a more accurate picture of your weekly income and make informed decisions about your financial life.

Take control of your weekly income by following the tips and strategies outlined in this article. Calculate your weekly income accurately, create a budget that works for you, and make informed decisions about your financial life. By doing so, you can achieve your long-term financial goals and live a more secure and prosperous life.

Remember, understanding your weekly income is just the first step. It’s up to you to take control of your financial life and make informed decisions about your earnings. By doing so, you can unlock your earning potential and achieve financial success.