Unlocking the Secrets of Venture Capital Investment

Venture capital (VC) firms play a vital role in the startup ecosystem, providing funding to promising entrepreneurs in exchange for equity. This investment model has been instrumental in the growth and success of numerous startups, enabling them to scale and innovate. Venture capital and funding have become synonymous with startup success, with many entrepreneurs seeking VC investment to take their businesses to the next level.

So, what exactly is venture capital? In essence, VC firms invest money in startups that demonstrate high growth potential, innovative ideas, and a strong management team. In return, the VC firm receives equity in the startup, typically in the form of shares. This investment model allows startups to access the funding they need to grow and expand, while also providing VC firms with the potential for significant returns on investment.

The benefits of VC funding for entrepreneurs are numerous. For one, VC firms bring a wealth of expertise and experience to the table, providing valuable guidance and mentorship to startup founders. Additionally, VC funding can provide the necessary capital to scale a business, hire new talent, and invest in research and development. Perhaps most importantly, VC funding can provide a level of credibility and validation, helping to attract new customers, partners, and investors.

However, securing VC funding is no easy feat. Startups must demonstrate a clear and compelling vision, a strong management team, and a unique value proposition. They must also be prepared to navigate a complex and often daunting fundraising process, which can be time-consuming and challenging. Nevertheless, for those startups that are successful in securing VC funding, the rewards can be significant, providing the necessary fuel to drive growth, innovation, and success.

How to Attract Venture Capitalists to Your Startup

To increase their chances of securing venture capital and funding, startups must demonstrate a clear and compelling vision, a strong management team, and a unique value proposition. A solid business plan is essential, outlining the startup’s mission, goals, and strategies for growth and success. This plan should include a detailed financial projection, a market analysis, and a competitive landscape assessment.

A strong management team is also crucial, as venture capitalists invest in people as much as they invest in ideas. Startups should have a clear organizational structure, with experienced and skilled team members who can execute the business plan. A unique value proposition is also essential, as it sets the startup apart from its competitors and provides a compelling reason for customers to choose its product or service.

In addition to these key elements, startups should also be prepared to articulate their vision and strategy clearly and concisely. This means developing a strong pitch, which should include a brief overview of the startup, its products or services, and its growth potential. The pitch should also highlight the startup’s competitive advantage, its target market, and its financial projections.

Networking is also critical, as venture capitalists often rely on referrals and recommendations from trusted sources. Startups should attend industry events, conferences, and networking sessions to connect with potential investors and partners. Building relationships with venture capitalists and other industry professionals can help startups stay top of mind and increase their chances of securing funding.

Finally, startups should be prepared to demonstrate traction and progress, whether through revenue growth, user acquisition, or product development. This shows venture capitalists that the startup is executing on its plan and has the potential for long-term success.

The Different Stages of Venture Capital Funding

Venture capital funding is typically divided into several stages, each with its own unique characteristics and requirements. Understanding these stages is crucial for startups seeking to secure VC funding and navigate the investment process.

The first stage of VC funding is seed funding, which typically involves investments of $500,000 to $2 million. At this stage, startups are usually in the early stages of development, and the funding is used to support product development, market research, and team building. To secure seed funding, startups must demonstrate a clear and compelling vision, a strong management team, and a unique value proposition.

The next stage of VC funding is Series A, which typically involves investments of $2 million to $15 million. At this stage, startups have typically demonstrated some level of traction, such as revenue growth or user acquisition. The funding is used to scale the business, expand the team, and further develop the product or service. To secure Series A funding, startups must demonstrate a clear path to profitability, a strong competitive advantage, and a scalable business model.

Series B funding typically involves investments of $15 million to $30 million and is used to further scale the business, expand into new markets, and develop new products or services. At this stage, startups must demonstrate significant revenue growth, a strong management team, and a clear plan for expansion.

Series C funding typically involves investments of $30 million to $100 million and is used to support large-scale expansion, acquisitions, and further development of the business. At this stage, startups must demonstrate significant revenue growth, a strong competitive advantage, and a clear plan for long-term success.

Each stage of VC funding has its own unique requirements and milestones, and startups must be prepared to demonstrate significant progress and growth to secure funding. By understanding these stages, startups can better navigate the VC funding process and increase their chances of securing the funding they need to grow and succeed.

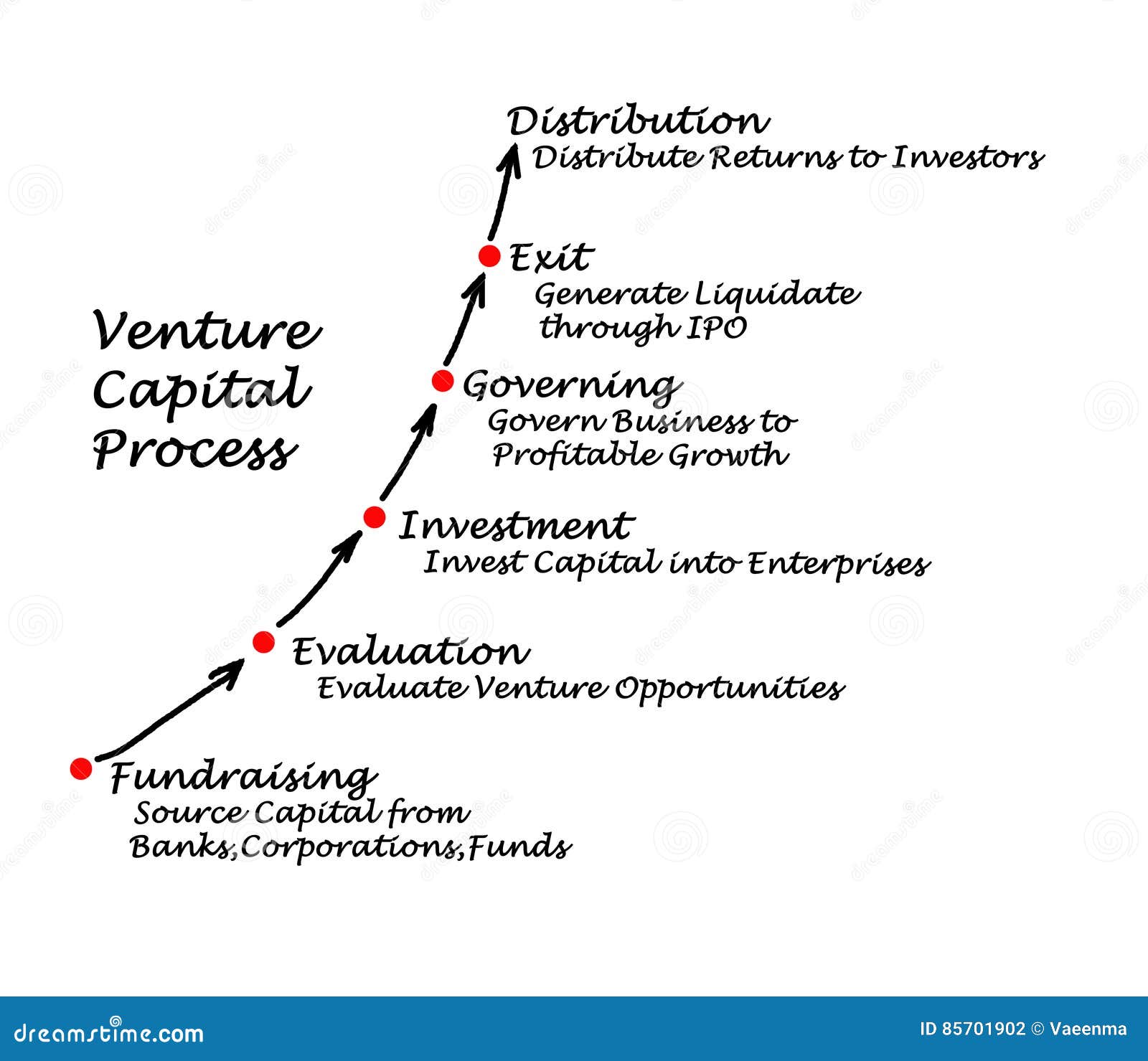

Understanding the Venture Capital Investment Process

The venture capital investment process can be complex and time-consuming, but understanding the key stages and factors that influence VC decision-making can help startups navigate the process more effectively. The process typically begins with an initial pitch, where the startup presents its business plan, product or service, and growth potential to the VC firm.

If the VC firm is interested, they will typically conduct due diligence, which involves a thorough review of the startup’s financials, market, and competitive landscape. This stage is critical, as it allows the VC firm to assess the startup’s potential for growth and returns on investment.

During due diligence, the VC firm will typically evaluate the startup’s management team, product or service, market size and growth potential, competitive landscape, and financial projections. They will also assess the startup’s unique value proposition, competitive advantage, and potential for scalability.

If the VC firm decides to move forward, they will typically present the startup with a term sheet, which outlines the terms and conditions of the investment. The term sheet will include details such as the investment amount, valuation, equity stake, and any other conditions or requirements.

Once the term sheet is agreed upon, the VC firm will conduct a final review of the startup’s financials and other documentation before closing the deal. This stage is critical, as it ensures that the startup is properly prepared for the investment and that the VC firm is confident in their decision.

Throughout the investment process, startups should be prepared to provide detailed information about their business, product or service, and growth potential. They should also be prepared to negotiate the terms and conditions of the investment, and to work collaboratively with the VC firm to ensure a successful partnership.

Alternatives to Venture Capital Funding

While venture capital funding can be a great way to secure funding for a startup, it’s not the only option. There are several alternative funding options available, each with their own pros and cons. In this section, we’ll explore some of the most popular alternatives to venture capital funding.

Angel investors are high net worth individuals who invest in startups in exchange for equity. They often provide funding in the early stages of a startup’s development and can offer valuable guidance and mentorship. Angel investors typically invest smaller amounts of money than venture capital firms, but can still provide significant funding for startups.

Crowdfunding is another alternative to venture capital funding. Platforms like Kickstarter and Indiegogo allow startups to raise funding from a large number of people, typically in exchange for rewards or equity. Crowdfunding can be a great way to validate a product or service and build a community around a startup.

Bootstrapping is a funding option that involves using personal savings or revenue from early customers to fund a startup. This approach can be challenging, but can also be beneficial for startups that want to maintain control and avoid debt.

Other alternative funding options include incubators and accelerators, which provide funding and resources to startups in exchange for equity. There are also government programs and grants that can provide funding for startups, particularly those in specific industries or regions.

When considering alternative funding options, startups should carefully evaluate the pros and cons of each option. They should also consider their own needs and goals, as well as the potential risks and rewards of each funding option.

For example, angel investors can provide valuable guidance and mentorship, but may also require a significant amount of equity. Crowdfunding can be a great way to validate a product or service, but may also require a significant amount of time and effort to manage the campaign.

Ultimately, the best funding option for a startup will depend on its specific needs and goals. By carefully evaluating the pros and cons of each option, startups can make informed decisions about how to fund their growth and success.

Building a Strong Relationship with Your Venture Capitalist

Once a startup has secured venture capital funding, it’s essential to build a strong relationship with the VC investor. This relationship can be a key factor in the startup’s success, as it can provide access to valuable guidance, mentorship, and networking opportunities.

To build a strong relationship with your VC investor, it’s essential to communicate effectively. This means being transparent about the startup’s progress, challenges, and goals. Regular updates and open communication can help to build trust and ensure that the VC investor is aligned with the startup’s vision.

Setting clear expectations is also crucial. This means defining the roles and responsibilities of both the startup and the VC investor, as well as establishing clear goals and objectives. By setting clear expectations, both parties can work together to achieve shared goals and avoid misunderstandings.

Collaboration is also key to building a strong relationship with your VC investor. This means working together to identify opportunities, address challenges, and make strategic decisions. By collaborating, the startup and VC investor can leverage each other’s expertise and resources to drive growth and success.

Finally, it’s essential to be responsive to the VC investor’s needs and concerns. This means being available to answer questions, provide updates, and address any issues that may arise. By being responsive, the startup can demonstrate its commitment to the relationship and build trust with the VC investor.

By following these tips, startups can build a strong relationship with their VC investor and set themselves up for success. A strong relationship can provide access to valuable resources, guidance, and networking opportunities, and can help to drive growth and success.

For example, a startup that has secured VC funding may want to establish a regular update schedule with the VC investor. This could include monthly or quarterly updates on the startup’s progress, as well as regular meetings to discuss goals and objectives.

By building a strong relationship with the VC investor, the startup can ensure that it is aligned with the investor’s goals and objectives, and can work together to drive growth and success.

Common Mistakes to Avoid When Seeking Venture Capital Funding

When seeking venture capital funding, startups often make mistakes that can hurt their chances of securing funding. In this section, we’ll highlight some common mistakes to avoid and provide advice on how to increase your chances of securing funding.

One common mistake is inadequate preparation. Startups often underestimate the amount of time and effort required to prepare for a VC pitch. To avoid this mistake, startups should prepare a solid business plan, financial projections, and a clear pitch deck.

Another common mistake is unrealistic valuations. Startups often overvalue their company, which can be a turn-off for VCs. To avoid this mistake, startups should conduct thorough market research and determine a realistic valuation based on industry benchmarks.

Poor communication is also a common mistake. Startups often fail to communicate effectively with VCs, which can lead to misunderstandings and a lack of trust. To avoid this mistake, startups should be clear and concise in their communication, and ensure that all stakeholders are aligned.

Additionally, startups often fail to demonstrate a clear understanding of their market and competition. To avoid this mistake, startups should conduct thorough market research and demonstrate a clear understanding of their competitive landscape.

Finally, startups often fail to show a clear path to scalability. To avoid this mistake, startups should demonstrate a clear plan for growth and scalability, and show how they intend to use the VC funding to drive growth.

By avoiding these common mistakes, startups can increase their chances of securing VC funding and achieving success. Remember, VC funding is a competitive process, and startups must be prepared to demonstrate their value and potential for growth.

For example, a startup that is seeking VC funding should prepare a solid business plan that outlines their market opportunity, competitive landscape, and financial projections. They should also prepare a clear pitch deck that communicates their value proposition and growth potential.

By being prepared and avoiding common mistakes, startups can increase their chances of securing VC funding and achieving success.

Success Stories of Venture Capital-Backed Startups

There are many successful startups that have received venture capital funding and gone on to achieve great success. In this section, we’ll showcase a few examples of these startups and analyze the factors that contributed to their success.

Uber, for example, received $200,000 in seed funding from First Round Capital in 2010. This funding helped the company to scale its operations and expand its user base. Today, Uber is one of the largest and most successful startups in the world, with a valuation of over $80 billion.

Airbnb, another successful startup, received $7.2 million in series A funding from Sequoia Capital in 2010. This funding helped the company to expand its operations and improve its user experience. Today, Airbnb is one of the largest and most successful startups in the world, with a valuation of over $50 billion.

Spotify, a music streaming service, received $21.6 million in series A funding from Kleiner Perkins in 2008. This funding helped the company to expand its operations and improve its user experience. Today, Spotify is one of the largest and most successful music streaming services in the world, with a valuation of over $20 billion.

These startups, and many others like them, demonstrate the potential for venture capital funding to help startups achieve great success. By providing the necessary funding and support, venture capital firms can help startups to scale their operations, improve their products and services, and achieve their goals.

When analyzing the success of these startups, it’s clear that venture capital funding played a critical role in their growth and success. The funding provided by venture capital firms helped these startups to scale their operations, improve their products and services, and achieve their goals.

Additionally, the guidance and support provided by venture capital firms helped these startups to navigate the challenges of growing a business and to make strategic decisions that drove their success.