Why Choosing the Right Career is Crucial for Wealth Creation

When it comes to achieving financial success, selecting the right career can be a crucial factor. The career path you choose can have a significant impact on your long-term financial stability and wealth accumulation. In fact, research has shown that certain careers can lead to higher earning potential and greater financial rewards. So, what career can make you rich? While there is no one-size-fits-all answer, there are certain fields and industries that tend to offer higher salaries and greater opportunities for advancement.

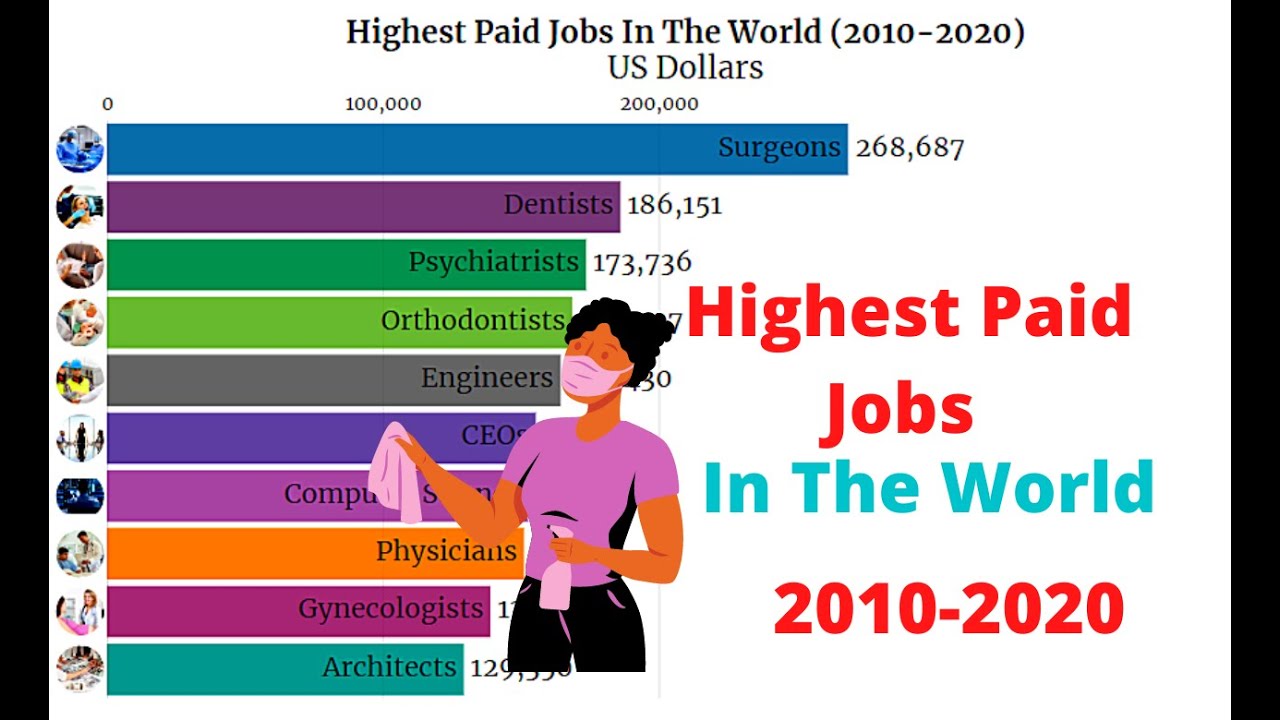

For example, careers in finance, technology, and healthcare tend to be among the highest-paying fields. According to the Bureau of Labor Statistics, the median annual salary for physicians and surgeons is over $208,000, while software developers and data scientists can earn upwards of $124,000 per year. Similarly, careers in law and business can also be lucrative, with top executives and lawyers earning hundreds of thousands of dollars per year.

However, it’s not just about the salary. Choosing the right career can also provide a sense of purpose and fulfillment, which can be just as valuable as financial rewards. When you’re passionate about your work, you’re more likely to be motivated and driven to succeed, which can lead to greater financial success in the long run.

Ultimately, the key to achieving financial success is to choose a career that aligns with your skills, interests, and values. By doing so, you’ll be more likely to excel in your field and earn a higher income, which can lead to greater financial stability and wealth creation. So, if you’re looking to make a career change or just starting out, it’s essential to consider the potential earning potential of your chosen career and make informed decisions that will set you up for long-term financial success.

High-Paying Careers that Can Make You Rich: An Overview

When it comes to high-paying careers that can lead to wealth creation, there are several fields that stand out. These careers often require specialized skills, education, and experience, but can offer significant financial rewards. So, what career can make you rich? Here are some examples of high-paying careers across various industries:

In the finance sector, careers such as investment banking, hedge fund management, and private equity can be extremely lucrative. For example, investment bankers can earn average salaries ranging from $100,000 to over $200,000 per year, depending on experience and performance. Similarly, hedge fund managers and private equity professionals can earn millions of dollars in bonuses and profits.

In the technology industry, careers such as software engineering, data science, and product management can be highly rewarding. Software engineers, for instance, can earn average salaries ranging from $100,000 to over $200,000 per year, depending on experience and location. Data scientists and product managers can also earn high salaries, with average ranges from $118,000 to over $170,000 per year.

In the healthcare industry, careers such as medicine, dentistry, and pharmacy can be highly lucrative. Physicians and surgeons, for example, can earn average salaries ranging from $208,000 to over $600,000 per year, depending on specialty and experience. Dentists and pharmacists can also earn high salaries, with average ranges from $156,000 to over $200,000 per year.

In the law industry, careers such as corporate law, intellectual property law, and securities law can be highly rewarding. Corporate lawyers, for instance, can earn average salaries ranging from $150,000 to over $250,000 per year, depending on experience and location. Intellectual property lawyers and securities lawyers can also earn high salaries, with average ranges from $140,000 to over $200,000 per year.

These are just a few examples of high-paying careers that can lead to wealth creation. While salary is an important consideration, it’s also essential to consider other factors such as personal fulfillment, work-life balance, and growth opportunities when choosing a career.

How to Identify Lucrative Career Opportunities in Emerging Industries

Identifying emerging industries and career paths that have the potential to generate significant income can be a crucial step in achieving financial success. So, what career can make you rich? To answer this question, it’s essential to stay ahead of the curve and be aware of the latest trends and developments in various industries.

One way to identify emerging industries is to research job market trends and analyze data on employment growth and salary ranges. This can be done by using online resources such as the Bureau of Labor Statistics, LinkedIn, and Glassdoor. Additionally, networking with professionals in various industries can provide valuable insights into emerging trends and career opportunities.

Another way to identify emerging industries is to stay up-to-date with industry news and developments. This can be done by reading industry publications, attending conferences and seminars, and following industry leaders on social media. By staying informed, you can gain a better understanding of the skills and qualifications required to succeed in emerging industries.

Some examples of emerging industries that have the potential to generate significant income include renewable energy, cybersecurity, and healthcare technology. Careers in these industries, such as solar engineer, cybersecurity consultant, and healthcare data analyst, can offer high salaries and growth opportunities.

Furthermore, emerging industries often require specialized skills and qualifications, which can be acquired through education and training programs. For instance, careers in artificial intelligence and machine learning require advanced degrees in computer science and mathematics. By acquiring these skills, you can position yourself for success in emerging industries and increase your earning potential.

In conclusion, identifying emerging industries and career paths that have the potential to generate significant income requires research, networking, and staying up-to-date with industry news and developments. By doing so, you can gain a competitive edge in the job market and increase your chances of achieving financial success.

The Role of Education and Skills in Achieving Financial Success

Acquiring relevant education and skills is crucial to succeed in high-paying careers and achieve financial success. The job market is constantly evolving, and employers are looking for candidates with specialized skills and knowledge to stay ahead of the competition. So, what career can make you rich? To answer this question, it’s essential to invest in education and skills that are in high demand.

Continuous learning is key to staying adaptable in a rapidly changing job market. Many high-paying careers require advanced degrees or certifications, such as a master’s degree in business administration or a certification in data science. Additionally, staying up-to-date with industry trends and developments is essential to remain competitive.

Professional certifications can also play a significant role in achieving financial success. Certifications such as the Chartered Financial Analyst (CFA) or the Certified Public Accountant (CPA) can demonstrate expertise and commitment to a particular field, leading to higher salaries and greater job prospects.

Furthermore, developing soft skills such as communication, teamwork, and problem-solving can also be beneficial in achieving financial success. These skills are highly valued by employers and can be applied to a wide range of careers, from finance to technology to healthcare.

In addition to formal education and certifications, online courses and training programs can also provide valuable skills and knowledge. Platforms such as Coursera, Udemy, and LinkedIn Learning offer a wide range of courses and certifications in various fields, from data science to digital marketing.

In conclusion, acquiring relevant education and skills is essential to succeed in high-paying careers and achieve financial success. By investing in education and skills, individuals can increase their earning potential and stay ahead of the competition in a rapidly changing job market.

Entrepreneurship and Wealth Creation: Turning Your Passion into a Lucrative Career

Entrepreneurship can be a powerful means to achieving financial success and wealth creation. By turning your passion into a lucrative career, you can create a business that generates significant income and provides a sense of fulfillment. So, what career can make you rich? For many entrepreneurs, the answer lies in identifying a niche or industry that aligns with their passions and skills.

Starting one’s own business can be a challenging but rewarding experience. Successful entrepreneurs must be willing to take calculated risks, adapt to changing market conditions, and continuously innovate and improve their products or services. However, the potential rewards can be substantial, with many entrepreneurs earning significant incomes and achieving financial freedom.

Examples of successful entrepreneurs who have turned their passions into lucrative careers include Steve Jobs, co-founder of Apple, and Sara Blakely, founder of Spanx. These individuals identified a need in the market and created innovative products that met that need, resulting in significant financial success.

Additionally, entrepreneurship can provide a sense of autonomy and flexibility that is not always available in traditional employment. By being one’s own boss, entrepreneurs can create a work-life balance that aligns with their values and goals.

However, entrepreneurship is not without its challenges. Starting a business requires significant investment, whether it be financial, emotional, or time-based. Additionally, entrepreneurs must be prepared to face uncertainty and adapt to changing market conditions.

Despite these challenges, many entrepreneurs find that the rewards of entrepreneurship far outweigh the risks. By turning their passion into a lucrative career, entrepreneurs can create a business that generates significant income and provides a sense of fulfillment.

Investing in Yourself: The Importance of Personal Development and Networking

Investing in personal development and networking is crucial to advancing in high-paying careers and achieving financial success. By building a strong professional network, developing a personal brand, and cultivating a growth mindset, individuals can increase their earning potential and stay ahead of the competition.

A strong professional network can provide access to valuable connections, job opportunities, and industry insights. Attend industry events, join professional organizations, and connect with colleagues and peers on LinkedIn to build a robust network.

Developing a personal brand is also essential to advancing in high-paying careers. Create a professional online presence, including a LinkedIn profile and personal website or blog, to showcase skills, experience, and achievements.

Cultivating a growth mindset is critical to staying adaptable in a rapidly changing job market. Continuously seek out new learning opportunities, including online courses, workshops, and conferences, to stay up-to-date with industry trends and developments.

Additionally, investing in personal development can help individuals identify and pursue high-paying career opportunities. By developing a strong understanding of their strengths, weaknesses, and interests, individuals can make informed decisions about their career path and increase their earning potential.

For example, individuals who are interested in pursuing a career in finance may want to consider obtaining a certification in financial analysis or accounting. Similarly, individuals who are interested in pursuing a career in technology may want to consider obtaining a certification in software development or data science.

By investing in personal development and networking, individuals can increase their earning potential, stay ahead of the competition, and achieve financial success.

Managing Wealth and Achieving Financial Freedom

Managing wealth and achieving financial freedom requires a strategic approach to saving, investing, and managing debt. By creating a long-term financial plan, individuals can ensure that their wealth continues to grow and provide for their financial needs.

Saving is an essential component of managing wealth. By setting aside a portion of their income each month, individuals can build an emergency fund, pay off debt, and invest in their future. Aim to save at least 10% to 20% of your income each month.

Investing is another critical aspect of managing wealth. By investing in a diversified portfolio of stocks, bonds, and other assets, individuals can grow their wealth over time. Consider working with a financial advisor to create a customized investment plan.

Managing debt is also crucial to achieving financial freedom. By paying off high-interest debt, such as credit card balances, individuals can free up more money in their budget to save and invest. Consider consolidating debt into a lower-interest loan or credit card.

Creating a long-term financial plan is essential to achieving financial freedom. By setting clear financial goals and developing a strategy to achieve them, individuals can ensure that their wealth continues to grow and provide for their financial needs.

For example, individuals who are saving for retirement may want to consider contributing to a 401(k) or IRA. Those who are saving for a down payment on a house may want to consider opening a high-yield savings account.

By following these strategies, individuals can manage their wealth effectively and achieve financial freedom. Remember, achieving financial freedom takes time and discipline, but the payoff is well worth the effort.

Conclusion: Unlocking Your Earning Potential and Achieving Financial Success

In conclusion, achieving financial success and wealth creation requires a strategic approach to career development, education, and personal growth. By choosing the right career, acquiring relevant education and skills, and investing in personal development and networking, individuals can unlock their earning potential and achieve financial freedom.

Remember, what career can make you rich is not just about the salary, but also about the opportunities for growth, the sense of fulfillment, and the potential for wealth creation. By following the guidance outlined in this article, individuals can make informed decisions about their career path and increase their chances of achieving financial success.

Ultimately, achieving financial success requires discipline, hard work, and a willingness to continuously learn and adapt. By staying focused, motivated, and committed to their goals, individuals can overcome obstacles and achieve their desired level of financial success.

In today’s fast-paced and rapidly changing job market, it’s more important than ever to stay ahead of the curve and continuously develop new skills and knowledge. By doing so, individuals can increase their earning potential, advance in their careers, and achieve financial freedom.

So, what career can make you rich? The answer lies in finding a career that aligns with your passions, skills, and values, and that offers opportunities for growth and wealth creation. By following the guidance outlined in this article, individuals can make informed decisions about their career path and increase their chances of achieving financial success.