The Art of Building Wealth: A Progressive Journey

Embarking on the path to financial prosperity requires a strategic and well-planned approach. This comprehensive guide outlines the “Steps to Help You Build Wealth,” emphasizing patience, discipline, and informed decision-making. By following these steps, you can establish a solid foundation for your financial future and secure long-term success.

Establishing a Solid Financial Foundation: Budgeting and Debt Management

A strong financial foundation is essential for building wealth. This stage involves two critical components: budgeting and debt management. By mastering these skills, you can effectively manage your income and expenses, laying the groundwork for a prosperous financial future.

Budgeting: The Cornerstone of Financial Success

A well-crafted budget is the foundation of financial stability. It allows you to allocate resources to various needs and goals, ensuring that you live within your means. To create a workable budget, follow these steps:

- Track your expenses: Categorize and record every expense for at least one month. This will help you understand your spending habits and identify areas for improvement.

- Set financial goals: Determine your short-term, mid-term, and long-term financial objectives. These may include reducing debt, saving for a vacation, or buying a house.

- Create a budget: Allocate your income to cover your needs, wants, and financial goals. Ensure that you set aside funds for savings and debt repayment.

- Monitor and adjust: Regularly review your budget and make adjustments as needed. This will help you stay on track and maintain financial discipline.

Debt Management: Regaining Control

Excessive debt can hinder your wealth-building journey. To regain control of your financial situation, consider the following:

- Prioritize high-interest debt: Pay off debts with the highest interest rates first, such as credit cards, to minimize the overall cost of borrowing.

- Create a debt repayment plan: Establish a systematic approach to paying off your debts, allocating a specific amount towards debt repayment each month.

- Avoid accruing new debt: Refrain from taking on additional debt while you work towards becoming debt-free. This may involve adjusting your spending habits or finding ways to increase your income.

By mastering budgeting and debt management, you can establish a solid financial foundation and take the first steps towards building wealth. Remember, this process requires patience, discipline, and a commitment to making smart financial decisions.

Building an Emergency Fund: Ensuring Financial Resilience

An essential component of a robust financial foundation is an emergency fund. This safety net provides a financial cushion for unexpected expenses, such as medical emergencies, car repairs, or job loss. By setting aside funds specifically for these unforeseen events, you can maintain financial stability and avoid derailing your wealth-building journey.

Determining the Ideal Emergency Fund Size

The size of your emergency fund depends on your personal circumstances, including your income, expenses, and risk tolerance. A common recommendation is to save three to six months’ worth of living expenses. However, you may want to consider saving more if you have a variable income, are self-employed, or have dependents.

Selecting the Right Location for Your Emergency Fund

When choosing where to keep your emergency funds, consider the following factors:

- Liquidity: Ensure that the funds are easily accessible when needed. High-yield savings accounts, money market accounts, or online savings accounts are suitable options.

- Safety: Opt for low-risk accounts to protect your savings from market volatility. Insured accounts, such as those offered by Federal Deposit Insurance Corporation (FDIC)-insured banks, provide additional security.

- Return: Although the primary goal of an emergency fund is to preserve capital, it’s still beneficial to earn some interest. High-yield savings accounts typically offer higher interest rates than traditional savings accounts.

Steps to Help You Build Wealth: Accumulating Your Emergency Fund

Building an emergency fund requires patience and discipline. To get started, follow these steps:

- Set a savings goal: Determine the amount you need to save and divide it by the number of months you have to reach your target.

- Create a budget: Allocate a portion of your income towards emergency fund savings. Consider setting up automatic transfers to ensure consistency.

- Trim expenses: Identify areas where you can reduce spending and redirect the savings towards your emergency fund.

- Monitor progress: Regularly review your progress and make adjustments as needed. Celebrate milestones to stay motivated and committed to your savings goal.

By prioritizing the creation of an emergency fund, you can enhance your financial resilience and take a significant step towards building wealth. Remember, this process requires persistence, discipline, and a commitment to smart financial decisions.

Investing in Retirement Accounts: Planning for a Secure Future

Retirement accounts, such as 401(k)s and Individual Retirement Accounts (IRAs), offer a valuable opportunity to build wealth for the long term. These accounts provide tax advantages and enable individuals to accumulate funds for retirement systematically. Understanding the differences between these accounts and implementing strategies to maximize contributions and investment returns can significantly enhance your financial security in later years.

Understanding Retirement Accounts: 401(k)s and IRAs

Both 401(k)s and IRAs are employer-sponsored and individual retirement savings plans, respectively. They share similarities, such as tax advantages and long-term investment horizons, but also have distinct differences:

- 401(k)s: These are employer-sponsored retirement plans that allow employees to contribute a portion of their pre-tax salary to a range of investment options. Employers may also match employee contributions up to a certain percentage. There are two primary types of 401(k)s: traditional and Roth.

- IRAs: These are individual retirement accounts that can be opened by anyone with earned income. There are two primary types of IRAs: traditional and Roth. Traditional IRAs offer tax deductions on contributions, while Roth IRAs provide tax-free withdrawals in retirement.

Maximizing Contributions: Steps to Help You Build Wealth

To make the most of your retirement accounts, consider the following strategies:

- Contribute consistently: Aim to contribute the maximum allowable amount each year. This approach can help you build wealth over time and take full advantage of tax benefits.

- Take advantage of employer matches: If your employer matches your contributions, ensure you contribute at least enough to receive the full match. This is essentially free money that can boost your retirement savings.

- Consider catch-up contributions: If you’re age 50 or older, you can make catch-up contributions to both 401(k)s and IRAs. These additional contributions can help you save more for retirement and reduce your taxable income.

Selecting Appropriate Investment Options

When investing in retirement accounts, consider the following factors:

- Risk tolerance: Assess your risk tolerance and select investments that align with your comfort level. Generally, younger investors can afford to take on more risk, while older investors may prefer more conservative options.

- Diversification: Diversify your investments across various asset classes to minimize risk and optimize returns. This strategy can help you weather market volatility and achieve long-term growth.

- Fees: Be aware of the fees associated with your investment options. High fees can eat into your returns and hinder your wealth-building efforts. Opt for low-cost index funds or exchange-traded funds (ETFs) when possible.

By investing in retirement accounts and implementing strategies to maximize contributions and investment returns, you can build wealth for a secure financial future. Remember, the key to success lies in consistent contributions, smart investment choices, and a long-term perspective.

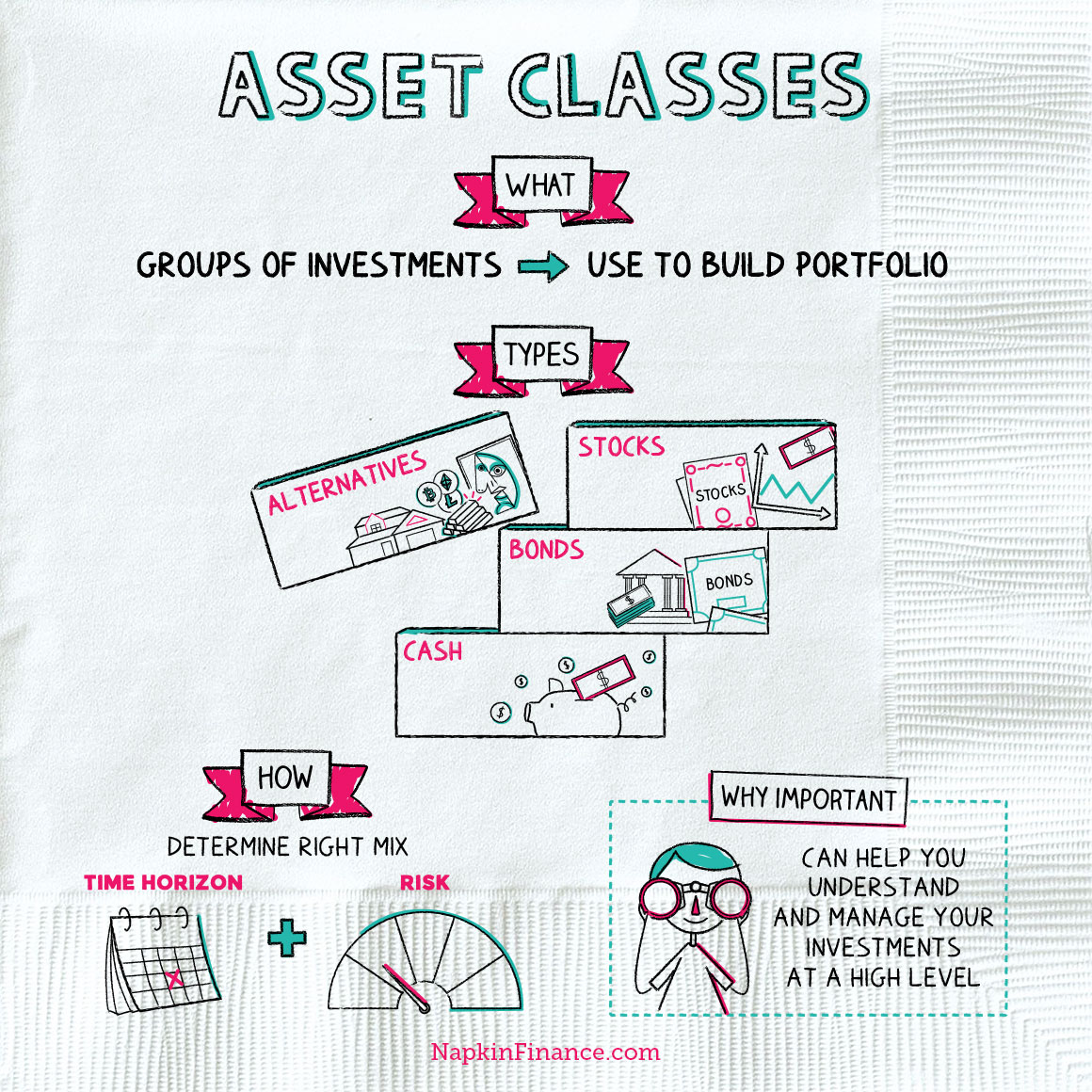

Diversifying Your Investment Portfolio: Exploring Asset Classes

Diversification is a crucial strategy for minimizing investment risk and optimizing returns. By allocating your investments across various asset classes, you can mitigate the impact of market volatility and achieve long-term growth. This section will discuss different asset classes, such as stocks, bonds, real estate, and alternative investments, and their respective advantages and disadvantages.

Stocks: High Potential Returns and Volatility

Stocks, or equities, represent ownership in a company. They offer high potential returns but are also subject to significant volatility. Investors can choose from various sectors, such as technology, healthcare, and finance, and can invest in individual companies or through exchange-traded funds (ETFs) that track a specific index or sector.

Bonds: Fixed Income and Lower Risk

Bonds are debt instruments that offer fixed income and lower risk compared to stocks. When you purchase a bond, you’re essentially lending money to an entity (such as a government or corporation) in exchange for periodic interest payments and the return of your principal at maturity. Bonds can provide stability and income to a diversified portfolio, but their returns are generally lower than those of stocks.

Real Estate: Tangible Assets and Income Potential

Real estate investments can include residential or commercial properties, real estate investment trusts (REITs), or real estate ETFs. Real estate offers tangible assets, income potential through rental income, and the potential for appreciation. However, real estate investments can be illiquid, requiring significant upfront capital and ongoing management.

Alternative Investments: Diversification and Niche Opportunities

Alternative investments, such as private equity, hedge funds, commodities, and cryptocurrencies, can provide diversification and niche opportunities. These investments often have higher fees, minimum investment requirements, and illiquidity compared to traditional asset classes. However, they can offer unique returns and diversification benefits.

To build wealth, consider diversifying your investment portfolio by allocating assets across various classes. This approach can help you weather market volatility, minimize risk, and achieve long-term growth. Remember, each asset class has its advantages and disadvantages, so it’s essential to understand the risks and potential returns before investing.

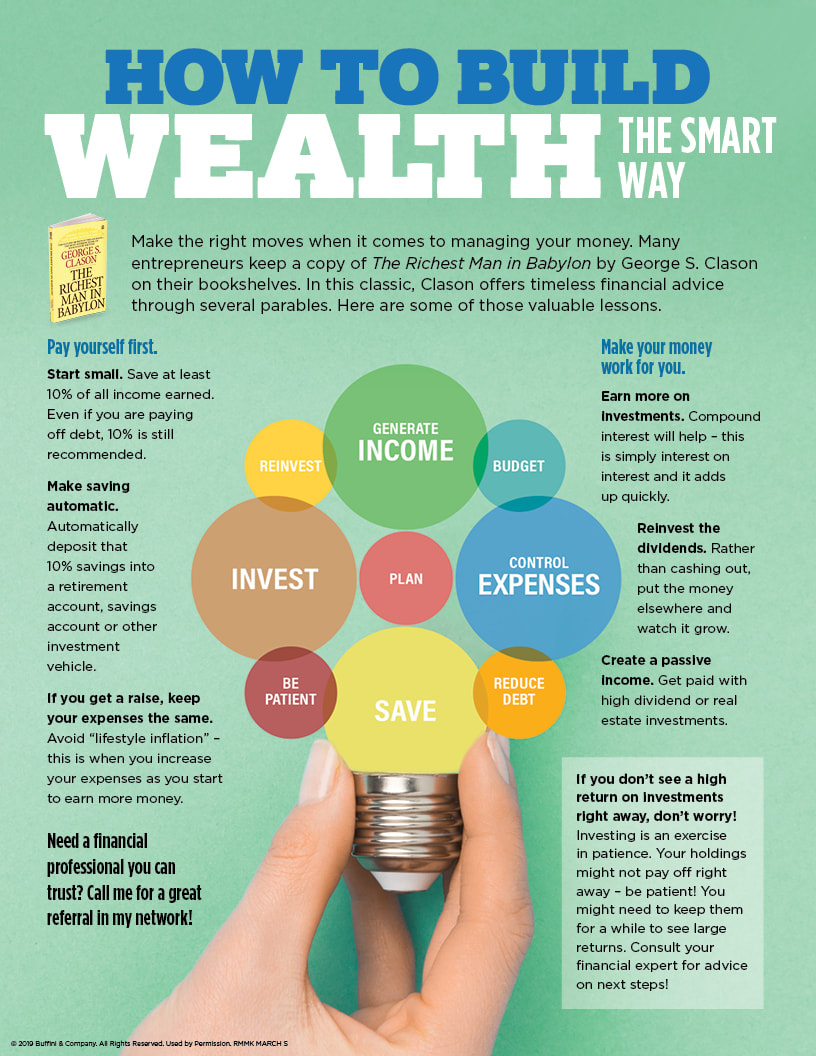

Steps to Help You Build Wealth: Long-Term Investment Strategies and the Buy-and-Hold Approach

Building wealth is a gradual and rewarding process that requires patience, discipline, and smart financial decisions. Implementing long-term investment strategies, such as the buy-and-hold approach, can help you achieve your financial goals and secure your future. This section will discuss the benefits of long-term investing, share insights on selecting quality investments, and provide guidance on setting realistic expectations and avoiding common pitfalls.

The Power of Long-Term Investing

Long-term investment strategies, like the buy-and-hold approach, offer several benefits. They allow your investments to grow over time, taking advantage of compound interest and market fluctuations. By focusing on the long term, you can avoid the stress and potential losses associated with short-term market timing and day trading. Additionally, long-term investing can help you ride out market downturns and capitalize on the eventual recovery.

Selecting Quality Investments

When building a long-term investment portfolio, focus on quality investments that align with your financial goals and risk tolerance. Consider factors such as the company’s financial health, management team, competitive position, and growth potential. Diversify your portfolio by investing in various asset classes, such as stocks, bonds, real estate, and alternative investments, to minimize risk and optimize returns.

Setting Realistic Expectations

While long-term investing offers the potential for significant returns, it’s essential to set realistic expectations. Understand that market volatility is normal, and your investments may experience ups and downs. Stay informed about market trends and economic indicators, but avoid making impulsive decisions based on short-term fluctuations. Instead, focus on your long-term financial goals and the progress you’re making towards achieving them.

Avoiding Common Pitfalls

To maximize the benefits of long-term investment strategies, be aware of common pitfalls. These include attempting to time the market, chasing high-risk investments, neglecting to diversify, and failing to regularly review and adjust your portfolio. By staying disciplined and committed to your long-term plan, you can avoid these pitfalls and build wealth over time.

Implementing long-term investment strategies, such as the buy-and-hold approach, can help you build wealth and secure your financial future. By focusing on quality investments, setting realistic expectations, and avoiding common pitfalls, you can create a solid investment portfolio that aligns with your financial goals and risk tolerance.

Steps to Help You Build Wealth: Monitoring and Adjusting Your Portfolio

As you progress on your wealth-building journey, it’s crucial to regularly monitor and adjust your investment portfolio to ensure alignment with your financial goals and risk tolerance. This section will discuss the importance of portfolio reviews, offer guidance on how often to rebalance, and provide tips on staying informed about market trends.

The Importance of Regular Portfolio Reviews

Regularly reviewing your investment portfolio helps you assess its performance, identify potential issues, and make adjustments as needed. By staying proactive and informed, you can maintain a well-diversified portfolio that supports your long-term financial objectives.

When to Rebalance Your Portfolio</h

Steps to Help You Build Wealth: Cultivating a Wealth Mindset

Throughout this comprehensive guide, we have explored various practical steps to help you build wealth. However, it’s essential to recognize that a crucial component of wealth building is cultivating a wealth mindset. This section will emphasize the significance of continuous learning, personal growth, and a commitment to financial literacy as you progress on your wealth-building journey.

The Power of a Wealth Mindset

A wealth mindset is a set of beliefs and attitudes that prioritize financial well-being and long-term success. By embracing a wealth mindset, you become more proactive, informed, and resilient in your financial decisions, ultimately increasing your chances of achieving your financial goals.

Continuous Learning and Personal Growth

To maintain a wealth mindset, it’s vital to commit to continuous learning and personal growth. Stay informed about financial news, trends, and best practices. Regularly read books, attend seminars, and engage in discussions with financial professionals to expand your knowledge and skills.

Embracing Financial Literacy

Financial literacy is the foundation of a wealth mindset. By understanding financial concepts, such as budgeting, debt management, investing, and taxes, you can make better decisions and build wealth more effectively. Make an effort to learn about these topics and apply your knowledge to your personal finances.

Staying Curious, Informed, and Proactive

Lastly, cultivate a wealth mindset by staying curious, informed, and proactive. Ask questions, seek answers, and take action to improve your financial situation. By maintaining a growth mindset and a strong commitment to financial literacy, you’ll be better equipped to navigate the complex world of personal finance and build wealth for the long term.