What is Upstart and How Does it Work?

Upstart is a financial technology company that provides personal loans and credit products to individuals. Founded in 2012 by a group of ex-Google employees, Upstart aims to revolutionize the lending industry by using artificial intelligence (AI) to evaluate creditworthiness. Unlike traditional lenders, Upstart’s AI-powered platform considers a broader range of factors beyond credit scores, including education, employment history, and income. This approach enables the company to offer more personalized and flexible loan options to borrowers.

Upstart’s services include personal loans, credit cards, and lines of credit. The company’s loan products are designed to be more accessible and affordable than those offered by traditional lenders. With Upstart, borrowers can apply for loans online and receive a decision in minutes. The company’s AI-powered platform also enables it to offer more competitive interest rates and fees compared to traditional lenders.

As a company, Upstart is committed to transparency and fairness in its lending practices. The company’s website provides clear and detailed information about its loan products, including interest rates, fees, and repayment terms. Upstart also offers a range of tools and resources to help borrowers manage their debt and improve their financial health.

So, is Upstart a good company? Based on its innovative approach to lending and commitment to transparency and fairness, Upstart appears to be a reputable and trustworthy company. However, as with any lender, it’s essential to carefully evaluate the terms and conditions of any loan product before making a decision.

Assessing Upstart’s Loan Options: Are They Right for You?

Upstart offers a range of loan options to cater to different financial needs. The company’s personal loans, credit cards, and lines of credit are designed to be more accessible and affordable than those offered by traditional lenders. In this section, we’ll evaluate the interest rates, fees, and repayment terms associated with each loan option to help you determine if Upstart’s services are right for you.

Upstart’s personal loans range from $1,000 to $50,000, with interest rates starting at 6.95% APR. The company’s credit cards have no annual fee, and the interest rates range from 10.99% to 35.99% APR. Upstart’s lines of credit offer flexible repayment terms, with interest rates starting at 6.95% APR.

One of the key benefits of Upstart’s loan options is their flexibility. The company offers repayment terms ranging from 3 to 5 years, allowing borrowers to choose a repayment schedule that suits their financial situation. Additionally, Upstart’s loans have no prepayment penalties, enabling borrowers to pay off their loans early without incurring additional fees.

However, it’s essential to carefully evaluate the fees associated with Upstart’s loan options. The company charges an origination fee ranging from 0% to 8% of the loan amount, depending on the borrower’s creditworthiness. Additionally, late payment fees and returned payment fees may apply.

So, is Upstart a good company for your financial needs? When evaluating Upstart’s loan options, consider your individual financial situation and goals. If you’re looking for a flexible and affordable loan option with competitive interest rates, Upstart may be a good choice. However, it’s crucial to carefully review the terms and conditions of any loan product before making a decision.

How to Get Approved for an Upstart Loan: Tips and Strategies

Getting approved for an Upstart loan requires a combination of good credit, a stable income, and a low debt-to-income ratio. While Upstart’s AI-powered platform considers a broader range of factors beyond credit scores, there are still steps you can take to increase your chances of approval. In this section, we’ll provide tips and strategies to help you get approved for an Upstart loan.

One of the most important factors in getting approved for an Upstart loan is your credit score. Upstart considers credit scores from all three major credit bureaus, so it’s essential to have a good credit history. Aim for a credit score of 620 or higher, and work on improving your credit score if it’s lower.

Another crucial factor is your debt-to-income ratio. Upstart considers your income and expenses to determine whether you can afford the loan payments. To improve your chances of approval, reduce your debt-to-income ratio by paying off high-interest debts and avoiding new credit inquiries.

Providing accurate financial information is also essential for getting approved for an Upstart loan. Make sure to provide complete and accurate information about your income, expenses, and employment history. Upstart’s AI-powered platform will use this information to evaluate your creditworthiness and determine whether you’re eligible for a loan.

In addition to these tips, consider the following strategies to increase your chances of approval:

- Check your credit report for errors and dispute any inaccuracies.

- Pay off high-interest debts and avoid new credit inquiries.

- Provide complete and accurate financial information.

- Consider applying for a smaller loan amount to increase your chances of approval.

By following these tips and strategies, you can increase your chances of getting approved for an Upstart loan. Remember, Upstart’s AI-powered platform considers a broader range of factors beyond credit scores, so don’t be discouraged if you have a less-than-perfect credit history.

Upstart’s Customer Service: What to Expect

Upstart’s customer service is a critical aspect of its overall user experience. The company offers a range of support channels to help customers with their queries and concerns. In this section, we’ll evaluate Upstart’s customer service, including its reputation, response time, and support channels.

Upstart’s customer service team is available to assist customers via phone, email, and online chat. The company’s website also features a comprehensive FAQ section that provides answers to common questions and concerns. Additionally, Upstart’s mobile app allows customers to manage their accounts and access support on-the-go.

According to customer reviews and ratings, Upstart’s customer service is generally well-regarded. The company has a 4.5-star rating on Trustpilot and a 4.5-star rating on Consumer Reports. Customers praise Upstart’s customer service team for being responsive, helpful, and knowledgeable.

However, some customers have reported difficulty in getting in touch with Upstart’s customer service team, particularly during peak hours. Additionally, some customers have expressed frustration with the company’s automated phone system, which can be time-consuming and frustrating to navigate.

Despite these limitations, Upstart’s customer service is generally considered to be one of the company’s strengths. The company’s commitment to providing excellent customer service is evident in its comprehensive support channels and responsive customer service team.

So, is Upstart a good company for your financial needs? When evaluating Upstart’s customer service, consider the company’s reputation, response time, and support channels. While Upstart’s customer service is not perfect, it is generally well-regarded and provides a range of support channels to help customers with their queries and concerns.

Comparing Upstart to Other Lenders: A Side-by-Side Analysis

When considering a personal loan or credit product, it’s essential to compare the services of different lenders to find the best option for your financial needs. In this section, we’ll compare Upstart’s services to those of other lenders, including traditional banks, online lenders, and credit unions.

Traditional banks, such as Wells Fargo and Bank of America, offer a range of personal loan and credit products. However, these banks often have stricter credit requirements and may charge higher interest rates and fees. Additionally, the application process can be lengthy and may require a visit to a physical branch.

Online lenders, such as LendingClub and Prosper, offer a more streamlined application process and may have more flexible credit requirements. However, these lenders may charge higher interest rates and fees, and may not offer the same level of customer service as Upstart.

Credit unions, such as Navy Federal and Alliant, offer a range of personal loan and credit products with competitive interest rates and fees. However, credit unions often have membership requirements and may not offer the same level of convenience as Upstart.

Upstart’s services stand out from those of other lenders due to its use of AI to evaluate creditworthiness. This allows Upstart to offer more personalized and flexible loan options, with competitive interest rates and fees. Additionally, Upstart’s online application process is quick and easy, and the company’s customer service team is available to assist with any questions or concerns.

So, is Upstart a good company for your financial needs? When comparing Upstart’s services to those of other lenders, consider the company’s use of AI, competitive interest rates and fees, and convenient online application process. While other lenders may offer similar services, Upstart’s unique approach to lending and commitment to customer service make it a strong option for individuals seeking a personal loan or credit product.

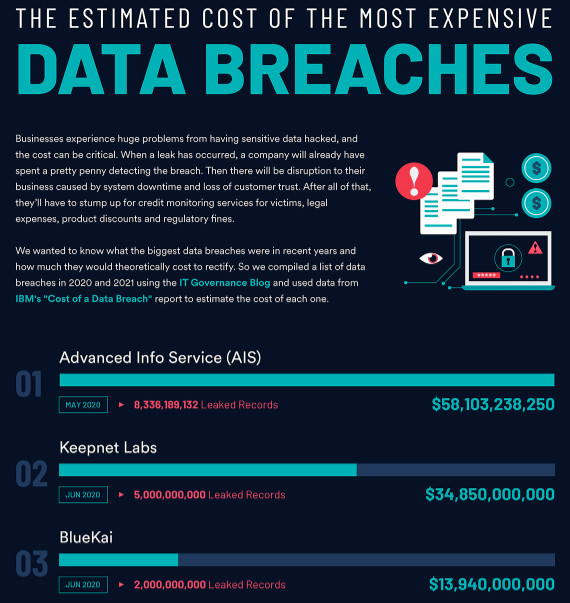

Upstart’s Security and Transparency: Is Your Data Safe?

When considering a personal loan or credit product, it’s essential to evaluate the lender’s security measures and transparency regarding its lending practices and fees. In this section, we’ll discuss Upstart’s security measures and transparency to help you determine if the company is a good fit for your financial needs.

Upstart takes the security of its customers’ data seriously. The company uses industry-standard data encryption to protect sensitive information, such as social security numbers and bank account details. Additionally, Upstart’s website and mobile app are secured with HTTPS, ensuring that all data transmitted between the customer’s device and Upstart’s servers is encrypted.

Upstart also offers two-factor authentication, which adds an extra layer of security to the login process. This feature requires customers to enter a verification code sent to their phone or email in addition to their password, making it more difficult for unauthorized users to access their accounts.

In terms of transparency, Upstart is committed to providing clear and concise information about its lending practices and fees. The company’s website features a comprehensive FAQ section that answers common questions about its services, including interest rates, fees, and repayment terms. Additionally, Upstart’s customer service team is available to assist with any questions or concerns.

Upstart is also compliant with regulatory requirements, such as the Gramm-Leach-Bliley Act (GLBA) and the Fair Credit Reporting Act (FCRA). These regulations ensure that Upstart handles customer data in a secure and responsible manner.

So, is Upstart a good company for your financial needs? When evaluating Upstart’s security measures and transparency, consider the company’s use of data encryption, two-factor authentication, and compliance with regulatory requirements. Additionally, Upstart’s commitment to transparency regarding its lending practices and fees provides customers with the information they need to make informed decisions about their financial health.

Real-Life Examples of Upstart’s Impact: Success Stories and Reviews

To get a better understanding of Upstart’s impact on its customers, let’s take a look at some real-life examples of individuals who have used the company’s services. These success stories and reviews provide valuable insights into the effectiveness of Upstart’s loan options and customer service.

One customer, who wished to remain anonymous, reported that they were able to consolidate their debt and reduce their monthly payments by using Upstart’s personal loan option. They praised the company’s customer service team for being helpful and responsive throughout the application process.

Another customer, who used Upstart’s credit card option, reported that they were able to improve their credit score by making timely payments and keeping their credit utilization ratio low. They appreciated the flexibility of Upstart’s credit card option and the ability to earn rewards on their purchases.

On review websites such as Trustpilot and Consumer Reports, Upstart has an average rating of 4.5 out of 5 stars. Customers praise the company’s ease of use, competitive interest rates, and helpful customer service team. However, some customers have reported difficulty in getting approved for a loan or credit product, and a few have experienced issues with the company’s mobile app.

Overall, these success stories and reviews suggest that Upstart is a good company for individuals who are looking for a flexible and affordable loan or credit product. While there may be some drawbacks to using the company’s services, the benefits of working with Upstart appear to outweigh the costs for many customers.

Conclusion: Is Upstart a Good Company for Your Financial Needs?

In conclusion, Upstart is a good company for individuals who are looking for a flexible and affordable loan or credit product. The company’s use of AI to evaluate creditworthiness and provide personalized loan options is a unique and innovative approach to lending. Additionally, Upstart’s customer service team is responsive and helpful, and the company’s security measures are robust and transparent.

While there may be some drawbacks to using Upstart’s services, such as the potential for higher interest rates and fees, the benefits of working with the company appear to outweigh the costs for many customers. Upstart’s loan options are flexible and affordable, and the company’s customer service team is available to assist with any questions or concerns.

For individuals who are considering using Upstart’s services, we recommend carefully evaluating the company’s loan options and fees to ensure that they are a good fit for your financial needs. Additionally, we recommend taking advantage of Upstart’s customer service team and support channels to get the most out of the company’s services.

Overall, Upstart is a good company for individuals who are looking for a flexible and affordable loan or credit product. With its innovative approach to lending, robust security measures, and responsive customer service team, Upstart is a solid choice for anyone who is looking to improve their financial health.