Mastering the Art of Money Management

Effective money management is the cornerstone of financial stability and security. By using money wisely, individuals can reduce stress, increase savings, and achieve their long-term financial goals. In today’s fast-paced and often unpredictable economic landscape, it’s more important than ever to develop a solid understanding of personal finance and make informed decisions about money. This article will provide actionable tips and strategies for mastering the art of money management, helping readers to make the most of their hard-earned cash and set themselves up for long-term financial success. Whether you’re looking to pay off debt, build wealth, or simply make ends meet, the following 10 ways to use money wisely will provide a valuable foundation for achieving your financial objectives.

Understanding Your Financial Goals: Setting the Stage for Success

Establishing clear financial goals is a crucial step in achieving financial security. Whether you’re saving for a down payment on a house, retirement, or a big purchase, having a well-defined objective helps guide your financial decisions and ensures you’re making progress towards your target. To create a personalized financial roadmap, start by identifying your short-term and long-term goals. Consider what you want to achieve in the next 6-12 months, as well as your aspirations for the next 5-10 years. Be specific and make sure your goals are measurable, achievable, relevant, and time-bound (SMART). For example, instead of saying “I want to save money,” set a goal like “I want to save $10,000 for a down payment on a house within the next 12 months.” By setting clear financial goals, you’ll be able to create a tailored plan that helps you stay focused and motivated on your path to financial success.

How to Create a Budget That Actually Works

Creating a realistic budget is a crucial step in managing your finances effectively. A well-crafted budget helps you track your income and expenses, identify areas for cost-cutting, and make informed decisions about how to allocate your resources. To create a budget that actually works, start by gathering information about your income and expenses. Make a list of all your income sources, including your salary, investments, and any side hustles. Next, track your expenses for a month to get a clear picture of where your money is going. Categorize your expenses into needs (housing, food, utilities) and wants (entertainment, hobbies, travel). Be sure to include a category for savings and debt repayment. Once you have a clear understanding of your income and expenses, you can start making adjustments to optimize your budget. Consider using the 50/30/20 rule as a guideline: 50% of your income should go towards needs, 30% towards wants, and 20% towards savings and debt repayment. By following these steps and regularly reviewing your budget, you can create a financial plan that helps you achieve your goals and use your money wisely.

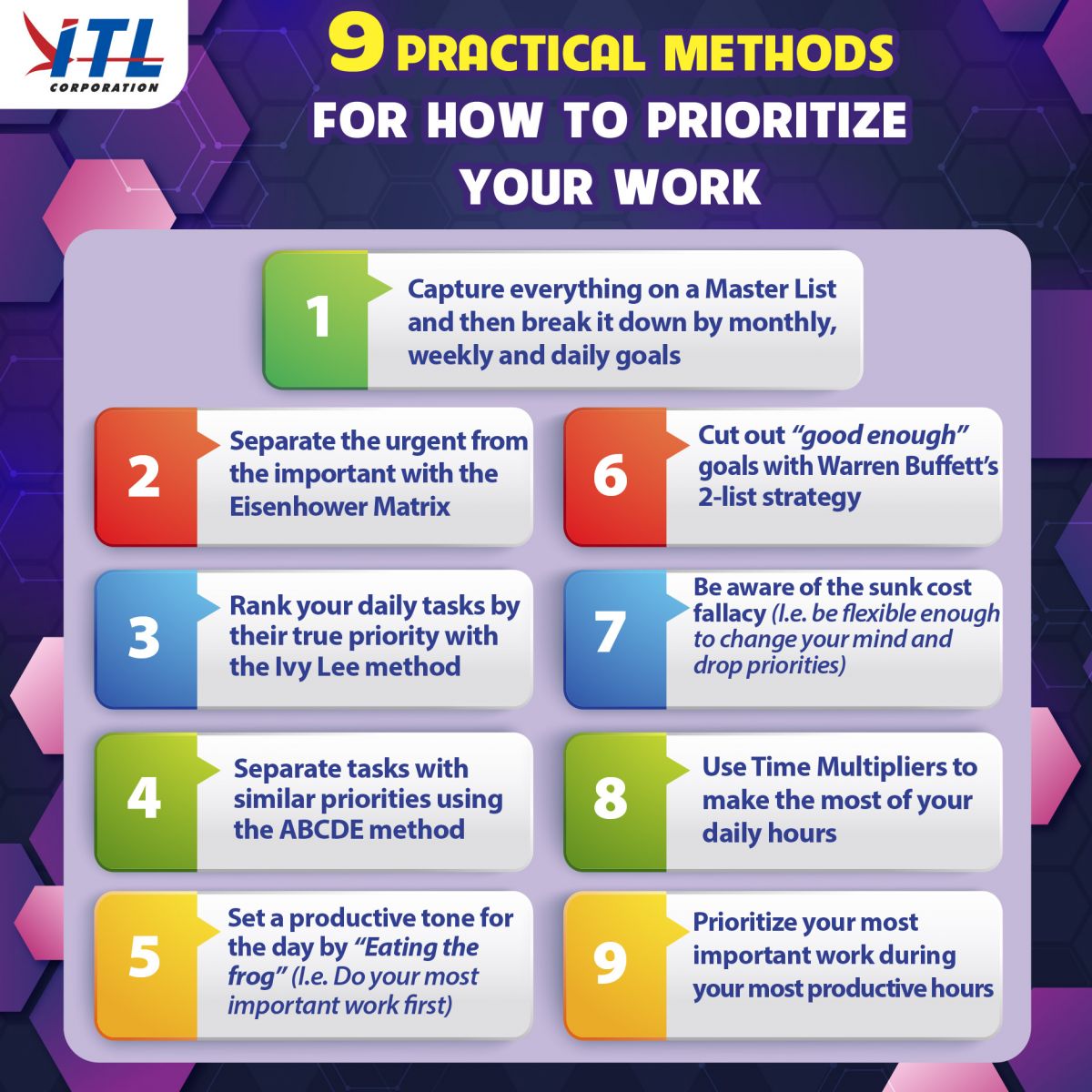

The Power of Prioritization: Focusing on Needs Over Wants

Prioritizing essential expenses over discretionary spending is a crucial aspect of using money wisely. By distinguishing between needs and wants, individuals can make conscious spending decisions that align with their financial goals. Needs include essential expenses such as housing, food, utilities, and transportation, while wants include discretionary spending such as dining out, entertainment, and hobbies. To prioritize effectively, consider the 50/30/20 rule: 50% of your income should go towards needs, 30% towards wants, and 20% towards savings and debt repayment. By allocating your resources in this way, you can ensure that you’re meeting your essential expenses while also making progress towards your long-term financial goals. Additionally, consider implementing a “wait 24 hours” rule for non-essential purchases, which can help you avoid making impulsive buying decisions and stay focused on your financial priorities.

Maximizing Your Income: Strategies for Boosting Earnings

Increasing your income is a crucial step in achieving financial security. By boosting your earnings, you can accelerate your savings, pay off debt, and invest in your future. One effective way to increase your income is to take on a side hustle. This could be anything from freelancing, dog walking, or tutoring, to selling products online or renting out a spare room on Airbnb. Another strategy is to ask for a raise at your current job. This can be a daunting task, but it’s often worth it. Make sure to prepare a solid case for why you deserve a raise, highlighting your achievements and the value you bring to the company. You can also consider pursuing additional education or training to enhance your skills and increase your earning potential. Online courses and certifications can be a great way to boost your skills and make yourself more attractive to potential employers. By implementing these strategies, you can maximize your income and set yourself up for long-term financial success.

Smart Investing for Long-Term Growth

Investing wisely is a crucial step in achieving long-term financial security. By making informed investment decisions, you can grow your wealth over time and achieve your financial goals. One key concept to understand is compound interest, which can help your investments grow exponentially over time. Diversification is also essential, as it can help you manage risk and increase potential returns. Low-risk investments, such as index funds and ETFs, can provide a stable foundation for your portfolio. Retirement accounts, such as 401(k)s and IRAs, can also offer tax benefits and help you save for the future. When investing, it’s essential to have a long-term perspective and avoid making emotional decisions based on short-term market fluctuations. By taking a smart and informed approach to investing, you can set yourself up for long-term financial success and achieve your goals.

Minimizing Debt: Strategies for Paying Off High-Interest Loans

Tackling high-interest debt is a crucial step in achieving financial security. By paying off high-interest loans, such as credit card balances, personal loans, and mortgages, you can free up more money in your budget to save and invest. One effective strategy for paying off debt is debt consolidation, which involves combining multiple debts into a single loan with a lower interest rate and a longer repayment period. Another approach is the snowball method, which involves paying off debts with the smallest balances first, while making minimum payments on larger debts. Negotiation techniques can also be effective in reducing debt, such as negotiating with creditors to lower interest rates or waive fees. Additionally, consider using the debt avalanche method, which involves paying off debts with the highest interest rates first, while making minimum payments on other debts. By using these strategies, you can pay off high-interest debt and achieve financial freedom.

Cultivating a Savings Mindset: Tips for Building Wealth

Developing a savings mindset is essential for building wealth and achieving long-term financial security. By prioritizing savings and making it a habit, you can create a safety net for unexpected expenses, build wealth over time, and achieve your financial goals. One effective way to cultivate a savings mindset is to automate your savings by setting up automatic transfers from your checking account to your savings or investment accounts. This way, you’ll ensure that you’re saving regularly without having to think about it. Another tip is to avoid lifestyle inflation, which can erode your savings over time. Instead, direct excess funds towards savings and investments. Additionally, consider using the 52-week savings challenge, where you save an amount equal to the number of the week. For example, in week 1, you’ll save $1, in week 2, you’ll save $2, and so on. By following these tips and making savings a priority, you can build wealth over time and achieve financial freedom.