The Mindset of a High Earner: What Sets Them Apart

Having a growth mindset is essential for achieving financial success and learning how to make hella money. Individuals with a growth mindset believe that their abilities and intelligence can be developed through hard work, dedication, and persistence. They are open to learning, embracing challenges, and viewing failures as opportunities for growth. This mindset allows them to stay adaptable and resilient in the face of uncertainty, which is critical for navigating the complexities of wealth creation.

High earners also think differently about money and wealth creation. They understand that wealth is not just about accumulating riches, but about creating value and making a positive impact on society. They are focused on building multiple income streams, investing in assets that generate passive income, and minimizing debt. They also prioritize financial education, staying up-to-date with the latest trends and strategies for wealth creation.

Calculated risk-taking is another key characteristic of high earners. They are not afraid to take risks, but they also carefully assess the potential risks and rewards before making a decision. This allows them to stay ahead of the curve and capitalize on opportunities that others may miss. By embracing calculated risk-taking, high earners can accelerate their wealth creation and achieve financial freedom faster.

In addition, high earners have a strong sense of self-discipline and responsibility. They understand that wealth creation requires hard work, patience, and perseverance. They are willing to make sacrifices in the short-term in order to achieve their long-term financial goals. By staying focused and motivated, high earners can overcome obstacles and stay on track to achieving financial success.

Furthermore, high earners have a strong network of supportive relationships. They surround themselves with like-minded individuals who share their values and goals. They also seek out mentors and coaches who can provide guidance and support. By building a strong network, high earners can access new opportunities, gain valuable insights, and stay motivated on their journey to financial success.

In conclusion, having a growth mindset, thinking differently about money and wealth creation, embracing calculated risk-taking, having self-discipline and responsibility, and building a strong network are all essential characteristics of high earners. By adopting these traits, individuals can set themselves up for success and achieve financial freedom. Whether you’re looking to learn how to make hella money or simply want to improve your financial situation, cultivating these characteristics is a great place to start.

Identifying Lucrative Opportunities: Where to Focus Your Efforts

When it comes to learning how to make hella money, it’s essential to focus on high-potential areas that can generate significant revenue. Entrepreneurship, investing, real estate, and online businesses are just a few examples of lucrative opportunities that can help you achieve financial success.

Entrepreneurship, for instance, can be a highly rewarding venture for those who are willing to take calculated risks. Successful entrepreneurs like Steve Jobs, Bill Gates, and Mark Zuckerberg have made fortunes by creating innovative products and services that solve real-world problems. By identifying a genuine need in the market and developing a unique solution, entrepreneurs can create a successful business that generates substantial revenue.

Investing is another high-potential area for making money. Investing in stocks, bonds, and other securities can provide a steady stream of income and help you build wealth over time. Successful investors like Warren Buffett and Peter Lynch have made fortunes by identifying undervalued companies and investing in them for the long-term. By doing your research and making informed investment decisions, you can also generate significant returns on your investments.

Real estate is another lucrative opportunity for making money. Investing in rental properties, fix-and-flip projects, or real estate investment trusts (REITs) can provide a steady stream of income and help you build wealth over time. Successful real estate investors like Robert Kiyosaki and Donald Trump have made fortunes by identifying undervalued properties and investing in them for the long-term. By doing your research and making informed investment decisions, you can also generate significant returns on your real estate investments.

Online businesses are also a high-potential area for making money. With the rise of e-commerce and digital marketing, it’s easier than ever to start an online business and reach a global audience. Successful online entrepreneurs like Jeff Bezos and Elon Musk have made fortunes by creating innovative products and services that solve real-world problems. By identifying a genuine need in the market and developing a unique solution, online entrepreneurs can create a successful business that generates substantial revenue.

Other lucrative opportunities for making money include affiliate marketing, freelancing, and creating and selling online courses. By identifying your strengths and passions, and developing a unique solution that solves a real-world problem, you can create a successful business that generates significant revenue and helps you achieve financial success.

Ultimately, the key to making hella money is to focus on high-potential areas that align with your strengths and passions. By doing your research, making informed decisions, and taking calculated risks, you can identify lucrative opportunities that can help you achieve financial success and build wealth over time.

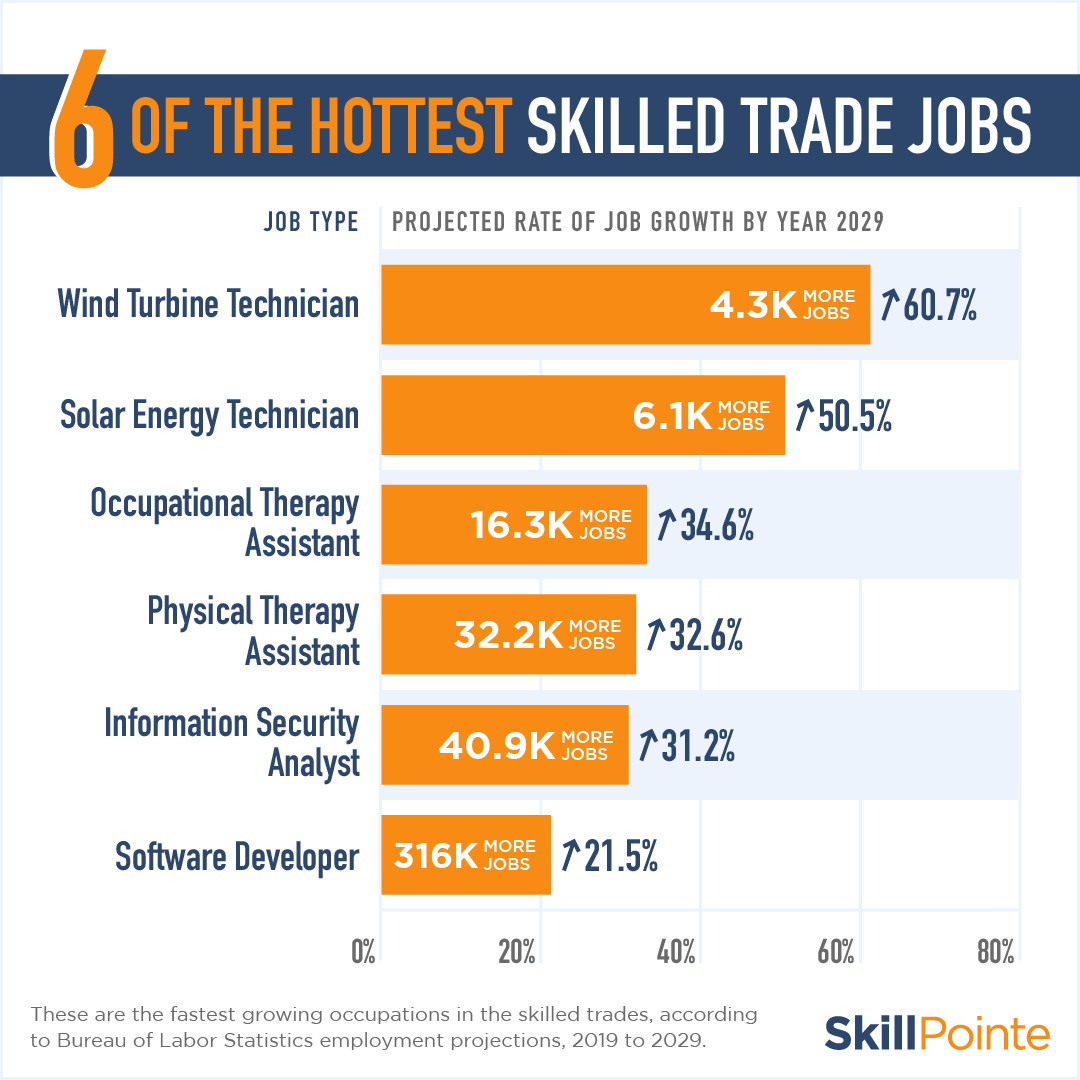

Developing In-Demand Skills: Investing in Your Human Capital

Acquiring skills that are in high demand in the job market is crucial for increasing earning potential and learning how to make hella money. In today’s fast-paced, technology-driven world, skills such as coding, digital marketing, and data science are highly valued by employers and can command high salaries.

Coding, for instance, is a highly sought-after skill that can open doors to lucrative career opportunities. With the rise of mobile apps, software development, and artificial intelligence, the demand for skilled coders is skyrocketing. By learning programming languages such as Python, Java, or JavaScript, individuals can increase their earning potential and stay ahead of the curve in the job market.

Digital marketing is another in-demand skill that can lead to significant increases in earning potential. As more businesses shift their focus to online marketing, the demand for skilled digital marketers is growing rapidly. By learning skills such as SEO, social media marketing, and content creation, individuals can help businesses reach their target audience and drive sales.

Data science is another highly valued skill that can lead to lucrative career opportunities. With the exponential growth of data in today’s digital age, companies are looking for skilled data scientists who can analyze and interpret complex data sets. By learning skills such as machine learning, data visualization, and statistical analysis, individuals can help businesses make informed decisions and drive growth.

Upskilling and reskilling are essential for staying relevant in the job market and increasing earning potential. By investing in your human capital, you can stay ahead of the curve and adapt to changing industry demands. Whether you’re looking to switch careers or advance in your current role, acquiring in-demand skills can help you achieve your goals and learn how to make hella money.

Fortunately, there are many resources available for individuals looking to acquire in-demand skills. Online courses, boot camps, and certification programs can provide the training and education needed to get started. Additionally, many companies offer training and development programs for their employees, which can help them stay up-to-date with the latest industry trends and technologies.

In conclusion, acquiring in-demand skills is essential for increasing earning potential and learning how to make hella money. By investing in your human capital and staying ahead of the curve, you can adapt to changing industry demands and achieve your career goals. Whether you’re looking to switch careers or advance in your current role, acquiring in-demand skills can help you succeed in today’s fast-paced, technology-driven world.

Building Multiple Income Streams: Diversifying Your Revenue

Having multiple income streams is a key strategy for achieving financial success and learning how to make hella money. By diversifying your revenue streams, you can reduce your financial risk and increase your wealth creation potential. This approach can also help you achieve financial independence and live a more fulfilling life.

One of the most effective ways to build multiple income streams is to invest in dividend-paying stocks. These stocks provide a regular stream of income and can help you build wealth over time. Companies like Coca-Cola, Johnson & Johnson, and Procter & Gamble have a long history of paying consistent dividends and can provide a relatively stable source of income.

Rental properties are another popular way to build multiple income streams. By investing in real estate, you can generate rental income and benefit from long-term appreciation in property values. This approach requires significant upfront capital, but can provide a steady stream of income and help you build wealth over time.

Peer-to-peer lending is another innovative way to build multiple income streams. Platforms like Lending Club and Prosper allow you to lend money to individuals or small businesses, earning interest on your investment. This approach can provide a relatively stable source of income and help you diversify your portfolio.

Creating and selling online products or courses is another way to build multiple income streams. By leveraging your expertise and creating digital products, you can generate passive income and help others achieve their goals. This approach requires significant upfront effort, but can provide a steady stream of income and help you build wealth over time.

Building multiple income streams requires discipline, patience, and a willingness to take calculated risks. By diversifying your revenue streams, you can reduce your financial risk and increase your wealth creation potential. Whether you’re looking to achieve financial independence or simply want to build wealth, having multiple income streams can help you achieve your goals and learn how to make hella money.

In addition to the income streams mentioned above, there are many other ways to build multiple income streams. These include investing in real estate investment trusts (REITs), creating a mobile app or game, and investing in a small business. By exploring different options and finding what works best for you, you can build multiple income streams and achieve financial success.

Ultimately, building multiple income streams is a key strategy for achieving financial success and learning how to make hella money. By diversifying your revenue streams, you can reduce your financial risk and increase your wealth creation potential. Whether you’re looking to achieve financial independence or simply want to build wealth, having multiple income streams can help you achieve your goals and live a more fulfilling life.

Networking and Building Relationships: The Power of Connections

Building relationships with successful and like-minded individuals is a crucial aspect of achieving financial success and learning how to make hella money. By networking and building connections, you can access new opportunities, gain valuable insights, and stay motivated on your journey to financial freedom.

Successful individuals understand the importance of building relationships and networking. They attend conferences, join professional organizations, and participate in online communities to connect with others who share their interests and goals. By building a strong network, they can access new opportunities, gain valuable insights, and stay ahead of the curve in their industry.

One of the most effective ways to build relationships is to attend networking events and conferences. These events provide a platform for meeting new people, learning about new opportunities, and gaining valuable insights from industry experts. By attending these events, you can expand your network, build relationships, and stay motivated on your journey to financial success.

Another effective way to build relationships is to join professional organizations and online communities. These organizations provide a platform for connecting with others who share your interests and goals. By participating in online forums, attending webinars, and engaging with others on social media, you can build relationships, gain valuable insights, and stay motivated on your journey to financial success.

Building relationships with successful and like-minded individuals can also provide valuable mentorship and guidance. By learning from others who have achieved financial success, you can gain valuable insights and avoid common mistakes. By building relationships with mentors, you can access new opportunities, gain valuable insights, and stay motivated on your journey to financial freedom.

In addition to building relationships with successful and like-minded individuals, it’s also important to build relationships with people who can provide valuable services and support. This includes building relationships with accountants, lawyers, and financial advisors who can provide valuable guidance and support on your journey to financial success.

Ultimately, building relationships and networking is a crucial aspect of achieving financial success and learning how to make hella money. By building a strong network, you can access new opportunities, gain valuable insights, and stay motivated on your journey to financial freedom. Whether you’re looking to start a new business, invest in real estate, or build a successful online business, building relationships and networking can help you achieve your goals and achieve financial success.

By building relationships and networking, you can also stay motivated and disciplined on your journey to financial success. By surrounding yourself with like-minded individuals who share your goals and values, you can stay focused and motivated, even in the face of challenges and setbacks. By building relationships and networking, you can achieve financial success and learn how to make hella money.

Managing Your Finances: The Importance of Budgeting and Saving

Effective financial management is crucial for achieving financial success and learning how to make hella money. By creating a budget, saving for emergencies, and investing for the future, you can take control of your finances and build wealth over time.

Creating a budget is the first step in managing your finances effectively. By tracking your income and expenses, you can identify areas where you can cut back and allocate your resources more efficiently. A budget should include categories for housing, transportation, food, entertainment, and savings. By prioritizing your spending and making conscious financial decisions, you can achieve financial stability and build wealth over time.

Saving for emergencies is another critical aspect of financial management. By setting aside a portion of your income each month, you can build an emergency fund that can help you weather financial storms. Aim to save at least three to six months’ worth of living expenses in your emergency fund. This will provide a cushion in case of unexpected expenses or financial setbacks.

Investing for the future is also essential for achieving financial success. By investing in assets such as stocks, real estate, or retirement accounts, you can build wealth over time and achieve your long-term financial goals. Consider working with a financial advisor to develop an investment strategy that aligns with your goals and risk tolerance.

Living below your means is also critical for achieving financial success. By avoiding debt and living within your means, you can build wealth over time and achieve financial stability. Avoid making impulse purchases and prioritize needs over wants. By being mindful of your spending habits, you can achieve financial freedom and learn how to make hella money.

Avoiding debt is also essential for achieving financial success. By avoiding high-interest debt such as credit card balances, you can save money on interest payments and build wealth over time. Consider consolidating debt into lower-interest loans or balance transfer credit cards. By paying off debt and avoiding new debt, you can achieve financial stability and build wealth over time.

Ultimately, effective financial management is critical for achieving financial success and learning how to make hella money. By creating a budget, saving for emergencies, investing for the future, living below your means, and avoiding debt, you can take control of your finances and build wealth over time. Whether you’re looking to start a new business, invest in real estate, or build a successful online business, effective financial management is essential for achieving your goals and achieving financial success.

By following these tips and strategies, you can manage your finances effectively and achieve financial success. Remember to stay disciplined, patient, and informed, and you’ll be on your way to learning how to make hella money and achieving financial freedom.

Staying Motivated and Disciplined: Overcoming Obstacles to Success

Achieving financial success and learning how to make hella money requires more than just knowledge and skills – it also requires motivation and discipline. However, many people struggle with staying motivated and disciplined, especially when faced with obstacles and setbacks.

One of the most common obstacles to achieving financial success is procrastination. Procrastination can be a major hindrance to progress, as it can lead to missed opportunities and lost time. To overcome procrastination, it’s essential to set clear goals and deadlines, and to break down large tasks into smaller, manageable chunks.

Another common obstacle is fear. Fear can hold people back from taking risks and pursuing opportunities, which can limit their potential for financial success. To overcome fear, it’s essential to focus on the potential benefits of taking action, rather than the potential risks. It’s also important to develop a growth mindset, and to view failures and setbacks as opportunities for growth and learning.

Self-doubt is another common obstacle to achieving financial success. Self-doubt can lead to a lack of confidence, which can make it difficult to take action and pursue opportunities. To overcome self-doubt, it’s essential to focus on past successes and accomplishments, and to remind yourself of your strengths and abilities.

Staying motivated and disciplined requires a combination of strategies and techniques. One effective strategy is to set clear goals and track progress. By setting specific, measurable goals, and tracking progress towards those goals, you can stay motivated and focused. Another effective strategy is to celebrate milestones and achievements, which can help to build momentum and reinforce positive habits.

Additionally, it’s essential to create a supportive environment that fosters motivation and discipline. This can include surrounding yourself with positive and supportive people, and creating a workspace that is conducive to productivity and focus.

Ultimately, staying motivated and disciplined is crucial for achieving financial success and learning how to make hella money. By overcoming obstacles such as procrastination, fear, and self-doubt, and by using strategies and techniques such as goal-setting and tracking progress, you can stay motivated and disciplined, and achieve your financial goals.

By incorporating these strategies and techniques into your daily routine, you can develop the motivation and discipline needed to achieve financial success. Remember to stay focused, stay positive, and keep moving forward, even in the face of obstacles and setbacks.

With persistence and determination, you can overcome any obstacle and achieve financial success. So, don’t let procrastination, fear, or self-doubt hold you back – take action today, and start building the wealth and financial freedom you deserve.

Putting it All Together: Creating a Personalized Wealth Creation Plan

Creating a personalized wealth creation plan is essential for achieving financial success and learning how to make hella money. By incorporating the strategies and techniques discussed in this article, you can develop a comprehensive plan that aligns with your goals and values.

Start by identifying your financial goals and values. What do you want to achieve? What is most important to you? Once you have a clear understanding of your goals and values, you can begin to develop a plan that aligns with them.

Next, assess your current financial situation. What are your income and expenses? What are your assets and liabilities? By understanding your current financial situation, you can identify areas for improvement and develop strategies for achieving your goals.

Develop a budget and savings plan that aligns with your goals and values. This should include strategies for reducing expenses, increasing income, and building wealth. Consider using the 50/30/20 rule as a guideline for allocating your income.

Invest in your human capital by acquiring skills that are in high demand in the job market. This can include skills such as coding, digital marketing, and data science. By upskilling and reskilling, you can increase your earning potential and achieve financial success.

Build multiple income streams to reduce financial risk and increase wealth creation potential. This can include dividend-paying stocks, rental properties, and peer-to-peer lending. By diversifying your income streams, you can achieve financial stability and build wealth over time.

Network and build relationships with successful and like-minded individuals. This can include attending conferences and events, joining professional organizations, and connecting with people on social media. By building a strong network, you can access new opportunities, gain valuable insights, and stay motivated on your journey to financial success.

Finally, stay motivated and disciplined by setting clear goals, tracking progress, and celebrating milestones. By staying focused and committed to your goals, you can overcome obstacles and achieve financial success.

By following these steps and incorporating the strategies and techniques discussed in this article, you can create a personalized wealth creation plan that aligns with your goals and values. Remember to stay flexible and adapt to changing circumstances, and don’t be afraid to seek help and guidance along the way.

With a solid plan in place, you can achieve financial success and learn how to make hella money. So, take action today and start building the wealth and financial freedom you deserve.