Understanding Your Options for a Successful Exit

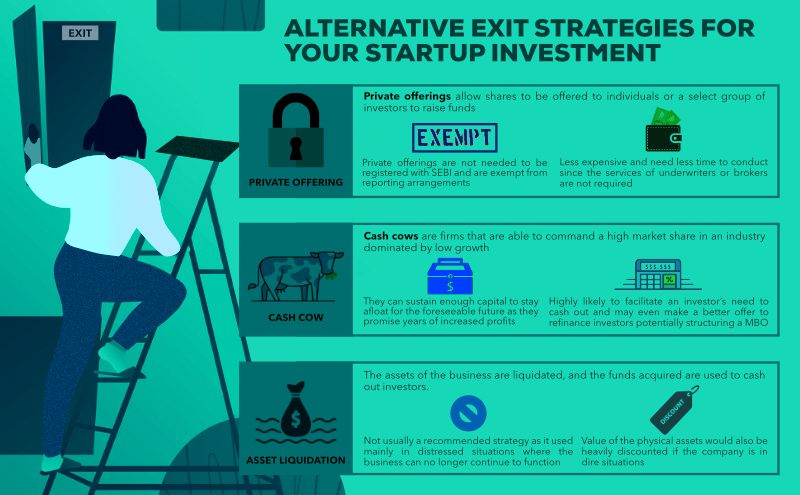

When it comes to startup exit options, entrepreneurs often find themselves at a crossroads, unsure of which path to take. With various exit strategies available, it’s essential to understand the different options and their implications. Startup exit options are not a one-size-fits-all solution; each exit strategy has its unique benefits and drawbacks. Acquisition, IPO, merger, and liquidation are some of the most common exit options startups consider.

Acquisition, for instance, can be a lucrative exit option for startups with a strong product or service offering. This exit strategy involves another company acquiring a majority stake in the startup, often providing a significant return on investment for founders and investors. However, acquisition can also result in loss of control and cultural changes within the organization.

IPOs, on the other hand, offer startups the opportunity to go public and raise capital from a wide range of investors. This exit option can increase visibility and credibility for the startup, but it also comes with increased regulatory requirements and shareholder expectations. Mergers and consolidation are other exit options startups may consider, allowing them to combine resources and expertise with another company to achieve greater success.

Understanding the different startup exit options and their implications is crucial for entrepreneurs to make informed decisions about their business. By considering factors such as growth potential, market demand, and competitive landscape, startups can determine the best exit strategy for their unique situation. With the right exit strategy in place, startups can maximize their value and achieve a successful exit.

Startup exit options are not just limited to acquisition, IPO, and merger. Liquidation, although often considered a last resort, can be a viable exit option for startups that are no longer viable or have exhausted all other options. This exit strategy involves the sale of assets and distribution of proceeds to creditors and shareholders.

In conclusion, startup exit options are diverse and complex, requiring careful consideration and planning. By understanding the different exit strategies and their implications, entrepreneurs can make informed decisions about their business and achieve a successful exit. Whether through acquisition, IPO, merger, or liquidation, the right exit strategy can help startups maximize their value and achieve their goals.

How to Prepare Your Startup for a Lucrative Exit

Preparing a startup for a lucrative exit requires careful planning, strategic decision-making, and a deep understanding of the startup exit options available. One of the key factors that can make or break a startup’s exit is its team. A strong, experienced, and dedicated team can significantly increase a startup’s value and attractiveness to potential acquirers or investors.

Developing a unique value proposition is another crucial aspect of preparing a startup for exit. This involves identifying the startup’s competitive advantage, differentiating it from others in the market, and communicating its value to potential buyers or investors. A well-crafted value proposition can help a startup stand out in a crowded market and increase its chances of a successful exit.

Maintaining a clean financial record is also essential for startups looking to exit. This includes keeping accurate and transparent financial statements, managing cash flow effectively, and minimizing debt. A clean financial record can help build trust with potential acquirers or investors and increase the startup’s value.

In addition to these factors, startups should also focus on building a strong network of relationships with potential acquirers, investors, and partners. This can involve attending industry events, networking with key players, and building relationships with potential buyers or investors. A strong network can help a startup stay informed about market trends and opportunities, and increase its chances of a successful exit.

Furthermore, startups should prioritize scalability and flexibility when building their business model. This involves developing a business model that can adapt to changing market conditions, and scaling quickly and efficiently in response to growing demand. A scalable business model can help a startup increase its value and attractiveness to potential acquirers or investors.

By focusing on these key areas, startups can increase their chances of a successful exit and maximize their value. Whether through acquisition, IPO, or merger, a well-prepared startup can achieve a lucrative exit and realize its full potential.

It’s also important to note that startup exit options are not a one-time event, but rather a process that requires ongoing planning and preparation. Startups should regularly review and update their exit strategy to ensure they are on track to achieve their goals.

By following these tips and strategies, startups can position themselves for a successful exit and achieve their goals. Whether you’re a startup founder, investor, or advisor, understanding the importance of preparation and planning is crucial for achieving a lucrative exit.

The Pros and Cons of Different Exit Options

When considering startup exit options, entrepreneurs must weigh the pros and cons of each option carefully. Acquisition, for example, can be a lucrative exit option, but it also involves loss of control and potential cultural changes within the organization. On the other hand, IPOs offer increased visibility and access to capital, but also come with increased regulatory requirements and shareholder expectations.

Merger and consolidation are other exit options that startups may consider. These options involve combining resources and expertise with another company to achieve greater success. However, mergers and consolidation can also be complex and time-consuming, requiring significant resources and effort to integrate the two companies.

Liquidation, although often considered a last resort, can be a viable exit option for startups that are no longer viable or have exhausted all other options. This exit strategy involves the sale of assets and distribution of proceeds to creditors and shareholders. However, liquidation can also result in significant losses for investors and founders.

Real-life examples can help illustrate the benefits and drawbacks of each exit option. For instance, Facebook’s acquisition of Instagram in 2012 is a prime example of a successful acquisition. Instagram’s founders were able to retain control and autonomy, while also gaining access to Facebook’s resources and expertise.

On the other hand, the IPO of Snapchat in 2017 is an example of the challenges that come with going public. The company faced significant scrutiny and criticism from investors and analysts, and its stock price has been volatile since the IPO.

When evaluating startup exit options, entrepreneurs must consider their company’s unique circumstances and goals. They must also weigh the pros and cons of each option carefully, considering factors such as control, autonomy, and access to resources and capital.

Ultimately, the right exit option for a startup will depend on its specific needs and goals. By understanding the pros and cons of each option, entrepreneurs can make informed decisions about their company’s future and achieve a successful exit.

It’s also important to note that startup exit options are not mutually exclusive. Many startups may consider multiple exit options simultaneously, or pursue a combination of exit strategies. For example, a startup may pursue an acquisition while also exploring the possibility of an IPO.

By considering multiple exit options and weighing the pros and cons of each, entrepreneurs can increase their chances of a successful exit and achieve their goals.

Acquisition Strategies for Startups

Acquisition is a popular exit option for startups, offering a lucrative way to exit the business while also providing a strategic partner to help drive growth. However, navigating the acquisition process can be complex, and startups must be prepared to position themselves for acquisition and negotiate a favorable deal.

There are several types of acquisitions that startups may consider, including strategic, financial, and private equity acquisitions. Strategic acquisitions involve a company acquiring a startup to gain access to its technology, talent, or market share. Financial acquisitions, on the other hand, involve a company acquiring a startup for its financial performance and potential for growth. Private equity acquisitions involve a private equity firm acquiring a startup with the intention of eventually selling it for a profit.

To position themselves for acquisition, startups must demonstrate a strong value proposition, a scalable business model, and a talented team. They must also be prepared to provide detailed financial information, including revenue projections and cash flow statements. Additionally, startups must be prepared to negotiate a favorable deal, including a fair valuation and terms that align with their goals.

One key strategy for startups looking to be acquired is to build relationships with potential acquirers. This can involve attending industry events, networking with key players, and building relationships with potential buyers. Startups must also be prepared to demonstrate their value proposition and showcase their technology, talent, and market share.

Another key strategy is to focus on building a strong financial profile. This includes maintaining a clean financial record, demonstrating revenue growth, and showcasing a scalable business model. Startups must also be prepared to provide detailed financial information, including revenue projections and cash flow statements.

When negotiating a deal, startups must be prepared to advocate for themselves and their shareholders. This includes negotiating a fair valuation, ensuring that the terms of the deal align with their goals, and protecting their intellectual property and talent.

Real-life examples of successful acquisitions include Facebook’s acquisition of Instagram and Google’s acquisition of Waze. In both cases, the acquired companies were able to maintain their autonomy and continue to drive growth, while also gaining access to the resources and expertise of the acquiring company.

By understanding the different types of acquisitions and how to position themselves for acquisition, startups can increase their chances of a successful exit and achieve their goals.

IPOs and the Startup Exit Process

Going public through an initial public offering (IPO) is a significant milestone for startups, offering a way to raise capital, increase visibility, and provide liquidity to shareholders. However, the IPO process can be complex and challenging, requiring careful planning and preparation.

One of the primary benefits of an IPO is the ability to raise capital from a wide range of investors. This can provide startups with the funding they need to drive growth, expand their operations, and invest in new technologies. Additionally, going public can increase a startup’s visibility and credibility, making it more attractive to customers, partners, and top talent.

However, the IPO process also comes with significant challenges. Startups must navigate a complex regulatory environment, including the Securities and Exchange Commission (SEC) and other regulatory bodies. They must also prepare detailed financial statements, including audited financials and quarterly earnings reports.

Furthermore, going public can also lead to increased scrutiny and transparency, as startups are required to disclose detailed financial information and operational metrics to the public. This can be challenging for startups that are not used to operating in a transparent environment.

Despite these challenges, many startups have successfully navigated the IPO process and gone on to achieve significant success. For example, companies like Facebook, Twitter, and LinkedIn have all gone public and used the capital raised to drive growth and expansion.

To successfully navigate the IPO process, startups must be prepared to invest significant time and resources. This includes hiring experienced professionals, such as investment bankers and lawyers, to guide them through the process. Startups must also be prepared to provide detailed financial information and operational metrics to investors and regulatory bodies.

Additionally, startups must also be prepared to adapt to the changing needs of the public market. This includes providing regular updates on their financial performance and operational metrics, as well as responding to investor inquiries and concerns.

By understanding the IPO process and its implications for startups, entrepreneurs can make informed decisions about their exit strategy and achieve their goals. Whether through an IPO or other exit options, startups can use the capital raised to drive growth, expand their operations, and achieve significant success.

Mergers and Consolidation in the Startup Ecosystem

Mergers and consolidation are common phenomena in the startup ecosystem, where companies combine their resources and expertise to achieve greater success. This exit option can be beneficial for startups, allowing them to expand their market share, improve their competitive position, and increase their revenue.

However, navigating the merger process can be complex and challenging. Startups must carefully evaluate the potential benefits and drawbacks of a merger, including the impact on their employees, customers, and shareholders. They must also ensure that the merger is structured in a way that aligns with their goals and objectives.

One of the key benefits of a merger is the ability to combine resources and expertise. By pooling their resources, startups can achieve greater efficiency and effectiveness, and improve their competitive position in the market. Additionally, a merger can provide startups with access to new markets, customers, and technologies, allowing them to expand their reach and improve their revenue.

However, a merger can also be challenging for startups, particularly if the companies involved have different cultures, values, and operating styles. Integrating the two companies can be complex and time-consuming, requiring significant resources and effort. Additionally, a merger can also lead to job losses and redundancies, particularly if the companies involved have overlapping functions and operations.

Despite these challenges, many startups have successfully navigated the merger process and achieved significant success. For example, companies like AOL and Time Warner have merged to form a new entity, allowing them to expand their reach and improve their competitive position in the market.

To successfully navigate the merger process, startups must be prepared to invest significant time and resources. This includes conducting thorough due diligence, negotiating the terms of the merger, and integrating the two companies. Startups must also be prepared to communicate effectively with their employees, customers, and shareholders, ensuring that they understand the benefits and implications of the merger.

Additionally, startups must also be prepared to adapt to the changing needs of the market. This includes responding to changes in customer demand, technological advancements, and shifts in the competitive landscape. By being agile and responsive, startups can ensure that they remain competitive and achieve their goals.

By understanding the role of mergers and consolidation in the startup ecosystem, entrepreneurs can make informed decisions about their exit strategy and achieve their goals. Whether through a merger or other exit options, startups can use the resources and expertise gained to drive growth, expand their operations, and achieve significant success.

Exit Options for Early-Stage Startups

Early-stage startups face unique challenges when considering exit options. With limited resources and a nascent business model, these startups must carefully evaluate their exit options to ensure they achieve their goals. In this article, we will discuss the importance of building a strong network, securing funding, and developing a scalable business model for early-stage startups.

Building a strong network is crucial for early-stage startups. This includes establishing relationships with potential investors, partners, and customers. By building a strong network, startups can gain access to valuable resources, expertise, and funding opportunities. Additionally, a strong network can provide startups with the support and guidance they need to navigate the challenges of the startup ecosystem.

Securing funding is another critical aspect of exit options for early-stage startups. With limited resources, these startups must carefully evaluate their funding options to ensure they have the necessary capital to drive growth and expansion. This includes considering venture capital, angel investors, and crowdfunding options. By securing funding, startups can invest in their business, drive growth, and increase their chances of a successful exit.

Developing a scalable business model is also essential for early-stage startups. This includes creating a business model that can adapt to changing market conditions, customer needs, and technological advancements. By developing a scalable business model, startups can increase their revenue, improve their profitability, and enhance their competitive position.

Early-stage startups must also consider the timing of their exit. With limited resources and a nascent business model, these startups must carefully evaluate their exit options to ensure they achieve their goals. This includes considering the market conditions, customer demand, and competitive landscape. By timing their exit correctly, startups can maximize their exit value and achieve their goals.

Real-life examples of successful early-stage startups include companies like Airbnb, Uber, and Instagram. These companies were able to build a strong network, secure funding, and develop a scalable business model, which enabled them to achieve a successful exit.

By understanding the unique challenges faced by early-stage startups, entrepreneurs can make informed decisions about their exit strategy and achieve their goals. Whether through acquisition, IPO, or merger, early-stage startups can use the resources and expertise gained to drive growth, expand their operations, and achieve significant success.

In conclusion, exit options for early-stage startups require careful consideration and planning. By building a strong network, securing funding, and developing a scalable business model, these startups can increase their chances of a successful exit and achieve their goals.

Maximizing Your Startup’s Exit Value

Maximizing your startup’s exit value requires careful planning and execution. Whether you’re considering acquisition, IPO, or merger, it’s essential to take steps to increase your startup’s revenue, improve its profitability, and enhance its competitive position.

One key strategy for maximizing your startup’s exit value is to focus on increasing revenue. This can be achieved by expanding your customer base, improving your sales and marketing efforts, and developing new products or services. Additionally, startups can also consider diversifying their revenue streams to reduce their dependence on a single source of income.

Improving profitability is another critical aspect of maximizing your startup’s exit value. This can be achieved by reducing costs, improving operational efficiency, and optimizing your pricing strategy. Startups can also consider outsourcing non-core functions to reduce costs and improve focus on their core business.

Enhancing your startup’s competitive position is also essential for maximizing its exit value. This can be achieved by developing a unique value proposition, building a strong brand, and establishing a strong market presence. Startups can also consider forming strategic partnerships to expand their reach and improve their competitive position.

Real-life examples of startups that have successfully maximized their exit value include companies like Facebook, Twitter, and Instagram. These companies were able to increase their revenue, improve their profitability, and enhance their competitive position, which ultimately led to successful exits.

By focusing on increasing revenue, improving profitability, and enhancing their competitive position, startups can maximize their exit value and achieve their goals. Whether through acquisition, IPO, or merger, startups can use the strategies outlined above to increase their chances of a successful exit.

It’s also important to note that maximizing your startup’s exit value requires careful planning and execution. Startups must be prepared to invest time and resources in developing a strong business strategy, building a talented team, and establishing a strong market presence.

By taking the steps outlined above, startups can maximize their exit value and achieve their goals. Whether you’re considering acquisition, IPO, or merger, it’s essential to focus on increasing revenue, improving profitability, and enhancing your competitive position to maximize your startup’s exit value.