Understanding the Importance of a Well-Planned Exit Strategy

A well-planned exit strategy is crucial for startups to achieve success and maximize returns on investment. A clear exit strategy provides a roadmap for growth, helps to increase valuation, and enhances competitiveness in the market. It also improves investor confidence, as a well-defined exit plan demonstrates a startup’s potential for long-term success. By incorporating a well-planned exit strategy into their business model, startups can better navigate the challenges of growth and ultimately achieve a successful exit.

Startup growth exit strategies are not a one-size-fits-all solution. Each startup requires a unique approach, taking into account its specific industry, market conditions, and goals. A well-planned exit strategy should be tailored to the startup’s needs, with a focus on driving growth, increasing revenue, and building a strong management team.

According to a study by CB Insights, the top reasons why startups fail include lack of market need, running out of cash, and not having the right team in place. A well-planned exit strategy can help mitigate these risks by providing a clear direction for growth and ensuring that the startup is well-positioned for success.

By prioritizing a well-planned exit strategy, startups can set themselves up for long-term success and create a strong foundation for growth. This, in turn, can lead to increased valuation, improved investor confidence, and enhanced competitiveness in the market. As the startup ecosystem continues to evolve, a well-planned exit strategy will become increasingly important for startups looking to achieve success and maximize returns on investment.

In the context of startup growth exit strategies, it is essential to consider the various options available, including mergers and acquisitions, initial public offerings, and strategic partnerships. Each option has its pros and cons, and a well-planned exit strategy should take into account the startup’s specific needs and goals.

Ultimately, a well-planned exit strategy is critical for startups looking to achieve success and maximize returns on investment. By prioritizing a clear exit plan, startups can drive growth, increase revenue, and build a strong management team, ultimately leading to a successful exit.

How to Identify the Right Growth Metrics for Your Startup

When it comes to startup growth exit strategies, tracking the right growth metrics is crucial for making informed decisions. By monitoring key performance indicators (KPIs), startups can gauge their progress, identify areas for improvement, and adjust their strategy accordingly. But which metrics are most important for startups to track?

Customer acquisition costs (CAC) and retention rates are two critical metrics that can help startups evaluate their growth strategy. CAC measures the cost of acquiring a new customer, while retention rates indicate the percentage of customers retained over a specific period. By tracking these metrics, startups can optimize their marketing and sales efforts, reduce churn, and increase revenue.

Revenue growth is another essential metric for startups to track. This can be measured by tracking monthly recurring revenue (MRR), annual recurring revenue (ARR), or year-over-year (YoY) growth. By monitoring revenue growth, startups can assess their progress towards scalability and make adjustments to their pricing, sales, and marketing strategies.

Other important growth metrics for startups to track include user engagement, customer lifetime value (CLV), and return on investment (ROI). By monitoring these metrics, startups can gain a deeper understanding of their customers’ needs, preferences, and behaviors, and make data-driven decisions to drive growth and exit.

In the context of startup growth exit strategies, tracking the right growth metrics is essential for making informed decisions. By monitoring key performance indicators, startups can optimize their growth strategy, reduce costs, and increase revenue. This, in turn, can lead to increased valuation, improved investor confidence, and enhanced competitiveness in the market.

For example, a startup that tracks its CAC and retention rates may discover that its customer acquisition costs are too high, and that it needs to adjust its marketing strategy to reduce costs and improve retention. By making data-driven decisions, the startup can optimize its growth strategy and increase its chances of success.

Ultimately, tracking the right growth metrics is critical for startups looking to drive growth and exit. By monitoring key performance indicators, startups can make informed decisions, optimize their growth strategy, and increase their chances of success.

The Role of Market Research in Informing Exit Strategies

Market research plays a crucial role in informing exit strategies for startups. By conducting thorough market research, startups can gain a deeper understanding of industry trends, competitor activity, and potential acquirers. This information can help startups make informed decisions about their exit strategy, including the timing, valuation, and potential buyers.

One of the key benefits of market research is that it provides startups with a comprehensive understanding of their target market. This includes information about customer needs, preferences, and behaviors, as well as insights into the competitive landscape. By analyzing this data, startups can identify opportunities for growth and expansion, and develop a strategy for achieving their goals.

Market research can also help startups identify potential acquirers and understand their acquisition strategies. This information can be used to develop a targeted approach to exit, including building relationships with potential acquirers and positioning the startup for acquisition.

In addition to identifying potential acquirers, market research can also help startups understand the current market conditions and trends. This includes information about the overall health of the industry, as well as insights into the competitive landscape. By analyzing this data, startups can make informed decisions about their exit strategy, including the timing and valuation.

For example, a startup that conducts market research may discover that there is a growing trend towards consolidation in their industry. This information can be used to develop a strategy for exit, including positioning the startup for acquisition by a larger company.

Another example is a startup that conducts market research and discovers that there is a high demand for their product or service. This information can be used to develop a strategy for growth and expansion, including increasing production and marketing efforts.

Ultimately, market research is a critical component of any startup’s exit strategy. By conducting thorough market research, startups can gain a deeper understanding of their target market, identify potential acquirers, and make informed decisions about their exit strategy.

In the context of startup growth exit strategies, market research is essential for making informed decisions. By analyzing market trends, competitor activity, and potential acquirers, startups can develop a targeted approach to exit and achieve their goals.

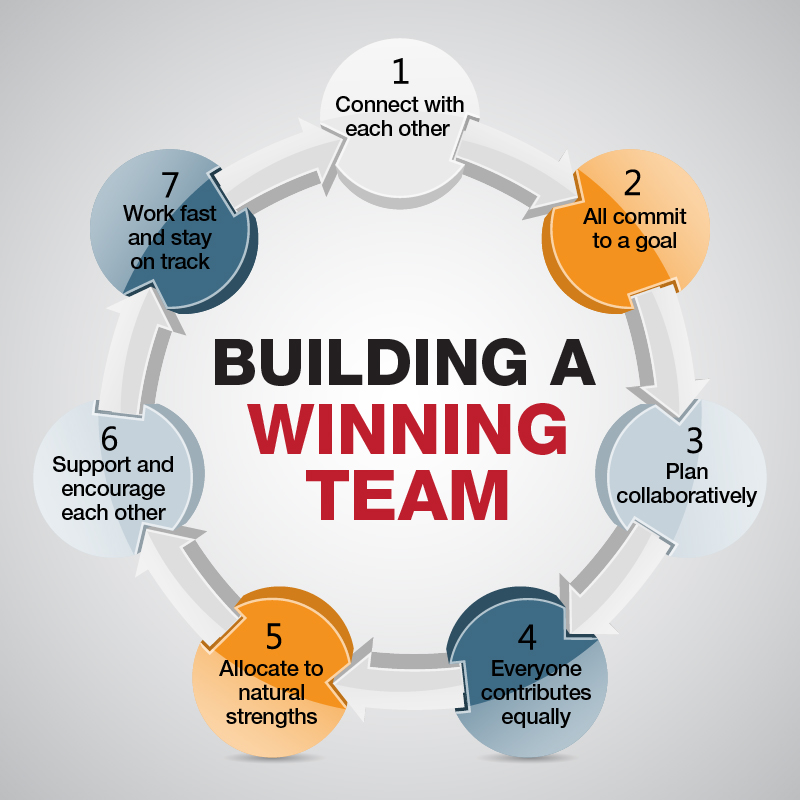

Building a Strong Management Team to Drive Growth and Exit

A skilled and experienced management team is essential for driving growth and executing a successful exit strategy. A strong management team can help startups navigate the challenges of growth, make informed decisions, and achieve their goals.

One of the key characteristics of a successful management team is a deep understanding of the startup’s industry and market. This includes knowledge of the competitive landscape, customer needs, and market trends. By having a management team with this expertise, startups can make informed decisions about their growth strategy and exit plans.

Another important characteristic of a successful management team is a proven track record of success. This includes experience in scaling businesses, managing teams, and driving growth. By having a management team with this experience, startups can increase their chances of success and achieve their goals.

In addition to industry expertise and a proven track record of success, a strong management team should also have a clear vision for the startup’s future. This includes a well-defined growth strategy, a clear understanding of the startup’s strengths and weaknesses, and a plan for achieving its goals.

For example, a startup that is looking to exit through an acquisition may need a management team with experience in mergers and acquisitions. This team can help the startup navigate the acquisition process, negotiate with potential acquirers, and achieve the best possible outcome.

On the other hand, a startup that is looking to exit through an initial public offering (IPO) may need a management team with experience in public markets. This team can help the startup navigate the IPO process, manage the startup’s public image, and achieve the best possible outcome.

Ultimately, a strong management team is critical for driving growth and executing a successful exit strategy. By having a team with industry expertise, a proven track record of success, and a clear vision for the startup’s future, startups can increase their chances of success and achieve their goals.

In the context of startup growth exit strategies, a strong management team is essential for making informed decisions and achieving success. By having a team with the right expertise and experience, startups can navigate the challenges of growth and exit, and achieve their goals.

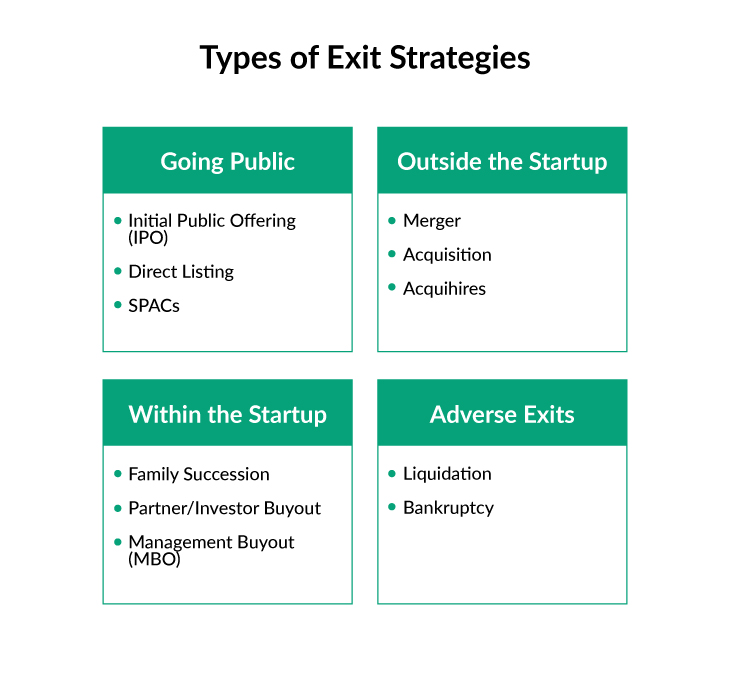

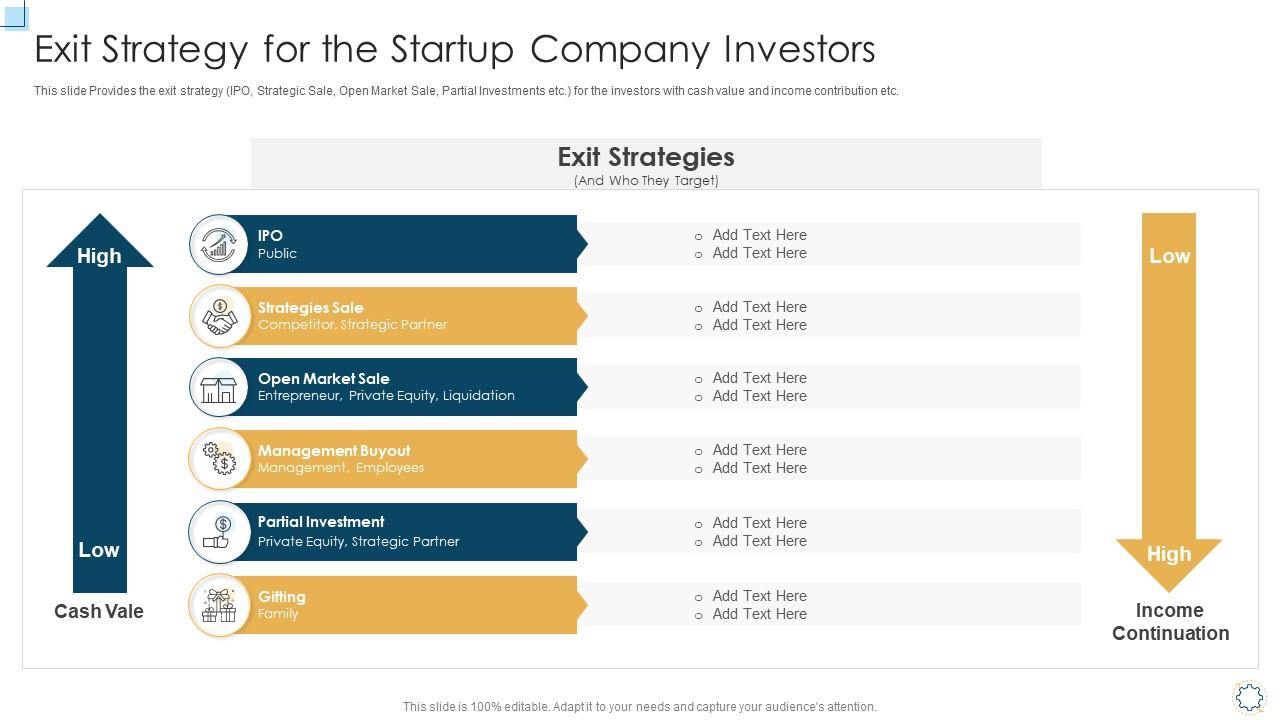

Exploring Different Exit Options: M&A, IPO, and More

When it comes to startup growth exit strategies, there are several options available to founders and investors. Each option has its pros and cons, and the right choice will depend on the startup’s specific goals, industry, and circumstances. In this article, we’ll explore the different exit options available, including mergers and acquisitions (M&A), initial public offerings (IPO), and strategic partnerships.

Mergers and acquisitions (M&A) are a common exit option for startups. This involves the sale of the startup to another company, often a larger corporation. M&A can provide a quick exit for founders and investors, and can also provide access to new resources and expertise. However, M&A can also be a complex and time-consuming process, and may require significant due diligence and negotiation.

Initial public offerings (IPO) are another exit option for startups. This involves the sale of shares to the public, often through a stock exchange. IPOs can provide a high level of visibility and credibility for the startup, and can also provide access to new capital and resources. However, IPOs can also be a complex and time-consuming process, and may require significant regulatory compliance and disclosure.

Strategic partnerships are another exit option for startups. This involves the formation of a partnership with another company, often a larger corporation. Strategic partnerships can provide access to new resources and expertise, and can also provide a quick exit for founders and investors. However, strategic partnerships can also be complex and time-consuming to negotiate, and may require significant due diligence and compliance.

Other exit options for startups include venture capital-backed buyouts, private equity-backed buyouts, and employee stock ownership plans (ESOPs). Each of these options has its pros and cons, and the right choice will depend on the startup’s specific goals, industry, and circumstances.

In the context of startup growth exit strategies, it’s essential to consider the different exit options available and to choose the one that best aligns with the startup’s goals and circumstances. By understanding the pros and cons of each exit option, founders and investors can make informed decisions and achieve their goals.

For example, a startup that is looking to exit through an M&A may need to prepare for due diligence and negotiation with potential acquirers. This may involve organizing financial records, protecting intellectual property, and building a strong corporate governance structure.

On the other hand, a startup that is looking to exit through an IPO may need to prepare for regulatory compliance and disclosure. This may involve filing with the Securities and Exchange Commission (SEC), disclosing financial information, and complying with listing requirements.

Ultimately, the right exit option will depend on the startup’s specific goals, industry, and circumstances. By understanding the different exit options available and choosing the one that best aligns with the startup’s goals, founders and investors can achieve their goals and succeed.

Preparing Your Startup for Due Diligence and Acquisition

When it comes to startup growth exit strategies, preparation is key. One of the most critical steps in preparing for an exit is due diligence and acquisition. Due diligence is the process of thoroughly examining a startup’s financial, operational, and strategic performance to determine its value and potential for growth. Acquisition, on the other hand, is the process of purchasing a startup by another company.

To prepare for due diligence and acquisition, startups should take several steps. First, they should organize their financial records, including income statements, balance sheets, and cash flow statements. This will help potential acquirers understand the startup’s financial performance and make informed decisions about the acquisition.

Second, startups should protect their intellectual property, including patents, trademarks, and copyrights. This will help prevent competitors from copying their ideas and products, and will also increase the startup’s value to potential acquirers.

Third, startups should build a strong corporate governance structure, including a board of directors, executive team, and audit committee. This will help ensure that the startup is well-managed and that its financial statements are accurate and reliable.

Finally, startups should prepare for the emotional and psychological aspects of exit, including the impact on founders, employees, and investors. This may involve providing counseling and support to employees, communicating clearly with investors, and ensuring that founders are prepared for the transition.

In the context of startup growth exit strategies, preparation is critical for success. By organizing financial records, protecting intellectual property, building a strong corporate governance structure, and preparing for the emotional and psychological aspects of exit, startups can increase their chances of a successful exit and achieve their goals.

For example, a startup that is preparing for an acquisition may need to provide detailed financial information to potential acquirers. This may involve creating a data room, where financial documents and other information can be stored and accessed by potential acquirers.

On the other hand, a startup that is preparing for an IPO may need to prepare for the scrutiny of public markets. This may involve hiring a chief financial officer (CFO) with experience in public markets, and ensuring that financial statements are accurate and reliable.

Ultimately, preparation is key to a successful exit. By taking the necessary steps to prepare for due diligence and acquisition, startups can increase their chances of success and achieve their goals.

Managing the Emotional and Psychological Aspects of Exit

When it comes to startup growth exit strategies, the emotional and psychological aspects of exit are often overlooked. However, these aspects can have a significant impact on the success of the exit and the well-being of the founders, employees, and investors.

For founders, the exit process can be a highly emotional experience. It can be a time of great excitement and anticipation, but also a time of uncertainty and anxiety. Founders may struggle with the idea of letting go of their creation and the fear of the unknown.

Employees may also experience a range of emotions during the exit process. They may be concerned about their job security, the future of the company, and the impact of the exit on their careers.

Investors may also have emotional and psychological concerns during the exit process. They may be concerned about the return on their investment, the timing of the exit, and the potential risks and challenges associated with the exit.

To manage the emotional and psychological aspects of exit effectively, it’s essential to communicate clearly and transparently with all stakeholders. This includes providing regular updates on the exit process, addressing concerns and questions, and offering support and guidance where needed.

It’s also essential to have a clear plan in place for the exit process, including a timeline, milestones, and key performance indicators (KPIs). This will help to reduce uncertainty and anxiety and ensure that all stakeholders are aligned and working towards the same goals.

In addition, it’s essential to prioritize the well-being of all stakeholders during the exit process. This includes providing access to counseling and support services, promoting a positive and inclusive company culture, and recognizing and rewarding the contributions of all stakeholders.

By managing the emotional and psychological aspects of exit effectively, startups can ensure a successful exit and a positive outcome for all stakeholders.

For example, a startup that is preparing for an acquisition may need to provide counseling and support services to employees who are concerned about their job security. This may involve hiring a professional counselor or providing access to an employee assistance program (EAP).

On the other hand, a startup that is preparing for an IPO may need to prioritize the well-being of its founders and employees during the exit process. This may involve providing access to wellness programs, promoting a positive and inclusive company culture, and recognizing and rewarding the contributions of all stakeholders.

Ultimately, managing the emotional and psychological aspects of exit is critical to a successful exit. By prioritizing the well-being of all stakeholders and communicating clearly and transparently, startups can ensure a positive outcome for all parties involved.

Lessons from Successful Startup Exits: Case Studies and Insights

When it comes to startup growth exit strategies, there is no one-size-fits-all approach. However, by studying successful startup exits, we can gain valuable insights and lessons that can inform our own exit strategies.

One successful startup exit that comes to mind is the acquisition of Instagram by Facebook in 2012. Instagram’s founders, Kevin Systrom and Mike Krieger, had a clear vision for their company and were able to execute a successful exit strategy that resulted in a $1 billion acquisition.

Another successful startup exit is the IPO of LinkedIn in 2011. LinkedIn’s founders, Reid Hoffman and Lee Hower, were able to take their company public and raise $353 million in the process.

So, what can we learn from these successful startup exits? First, it’s essential to have a clear vision and strategy for your company. This includes identifying your target market, developing a unique value proposition, and building a strong management team.

Second, it’s crucial to focus on building a strong brand and customer base. This includes developing a robust marketing strategy, building a loyal customer base, and creating a positive user experience.

Third, it’s essential to be prepared for the exit process. This includes organizing your financial records, protecting your intellectual property, and building a strong corporate governance structure.

Finally, it’s essential to be flexible and adaptable during the exit process. This includes being open to different exit options, such as mergers and acquisitions or initial public offerings, and being prepared to negotiate and compromise.

By studying successful startup exits and incorporating these lessons into our own exit strategies, we can increase our chances of success and achieve our goals.

In the context of startup growth exit strategies, it’s essential to be aware of the different exit options available and to be prepared for the exit process. By having a clear vision and strategy, building a strong brand and customer base, being prepared for the exit process, and being flexible and adaptable, startups can increase their chances of success and achieve their goals.

For example, a startup that is preparing for an acquisition may need to focus on building a strong brand and customer base, as well as being prepared for the exit process. This may involve developing a robust marketing strategy, building a loyal customer base, and organizing financial records.

On the other hand, a startup that is preparing for an IPO may need to focus on building a strong management team and corporate governance structure, as well as being prepared for the exit process. This may involve hiring a experienced management team, building a strong board of directors, and organizing financial records.

Ultimately, the key to a successful startup exit is to be prepared, flexible, and adaptable. By studying successful startup exits and incorporating these lessons into our own exit strategies, we can increase our chances of success and achieve our goals.