Understanding Your Funding Needs: A Reality Check

When it comes to tech startup funding options, it’s essential to have a clear understanding of your business’s financial needs and goals. This reality check will help you determine the right funding route for your startup. Start by evaluating your revenue projections, expenses, and growth potential. Consider your current cash flow, burn rate, and the amount of funding required to achieve your business goals.

A thorough understanding of your financial needs will enable you to make informed decisions about the type and amount of funding to pursue. It’s crucial to be realistic about your startup’s financial situation and avoid overestimating or underestimating your funding requirements. This will help you avoid common pitfalls, such as running out of cash or taking on too much debt.

When evaluating your funding needs, consider the following factors:

- Revenue projections: Estimate your startup’s revenue growth over the next 6-12 months.

- Expenses: Calculate your startup’s monthly expenses, including salaries, rent, and marketing costs.

- Growth potential: Assess your startup’s potential for growth and scalability.

By taking the time to understand your funding needs, you’ll be better equipped to navigate the complex world of tech startup funding options and make informed decisions about your business’s financial future.

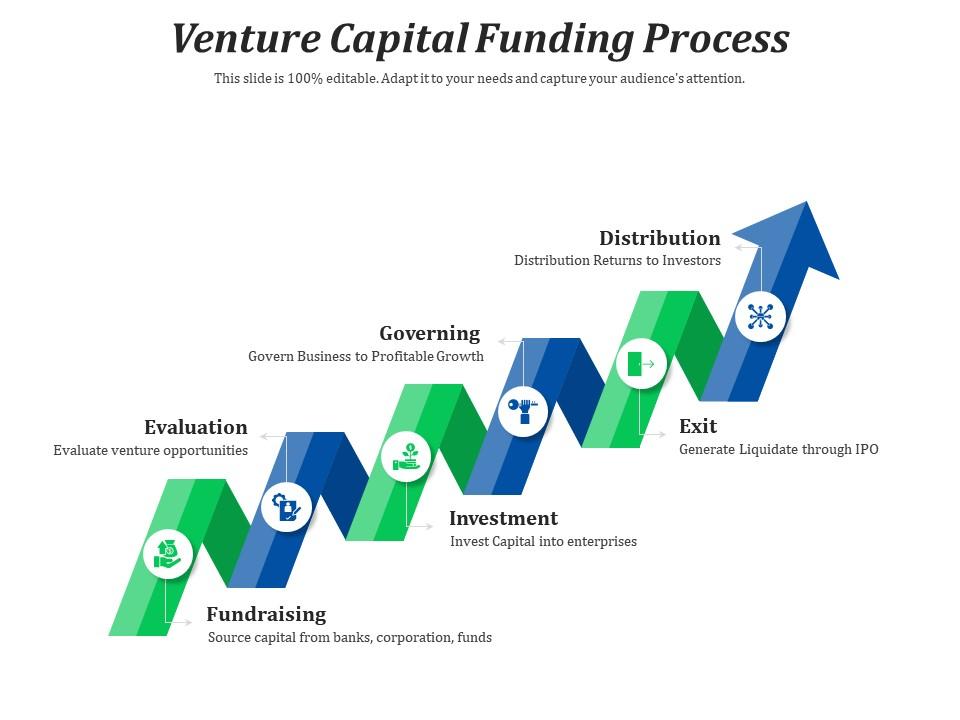

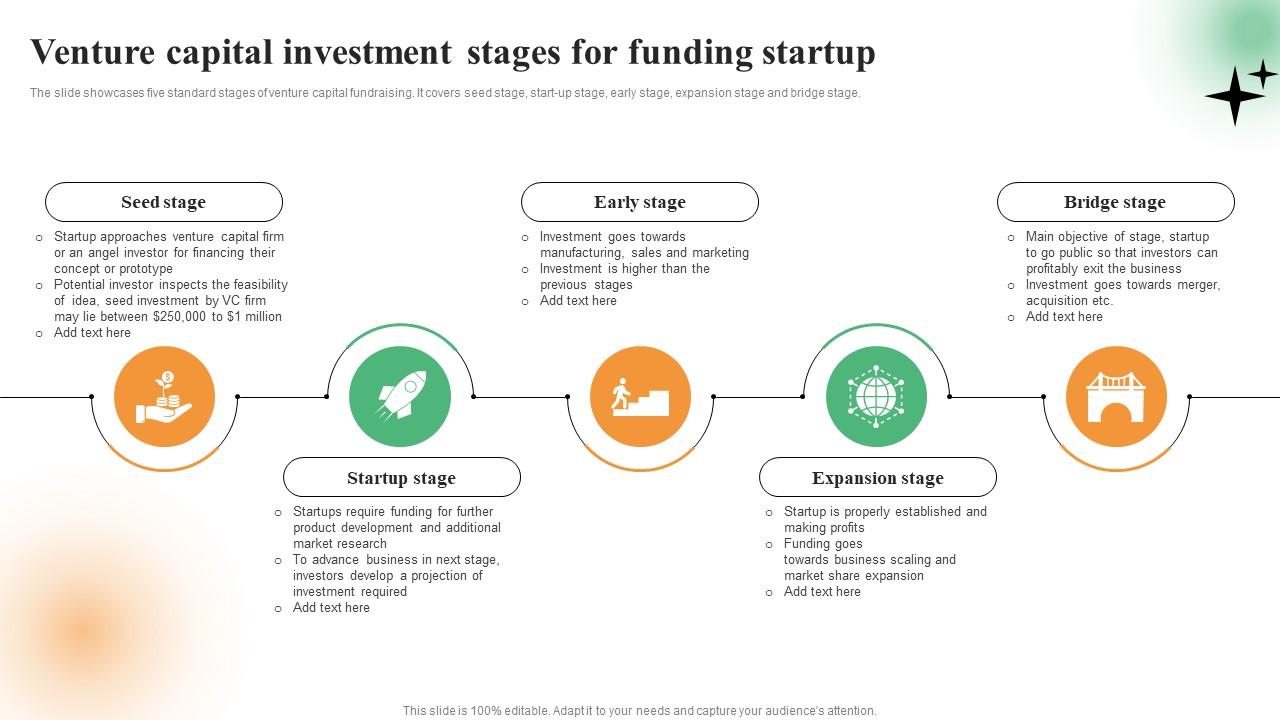

Exploring Alternative Funding Routes: Beyond Venture Capital

While venture capital is a popular funding option for tech startups, it’s not the only route available. Alternative funding options, such as crowdfunding, angel investors, and incubators, can provide the necessary capital for startups to grow and succeed.

Crowdfunding platforms, such as Kickstarter and Indiegogo, allow startups to raise funds from a large number of people, typically in exchange for rewards or equity. This option is ideal for startups with a strong product or service that resonates with a wide audience. For example, Pebble Watch, a smartwatch startup, raised over $10 million on Kickstarter in 2012.

Angel investors, on the other hand, are high-net-worth individuals who invest in startups in exchange for equity. They often provide valuable guidance and mentorship, in addition to funding. AngelList, a popular platform for angel investors, has helped startups like Uber and Airbnb raise funds.

Incubators and accelerators provide startups with resources, mentorship, and funding in exchange for equity. These programs are designed to help startups grow and scale quickly. Y Combinator, a well-known accelerator, has helped startups like Airbnb and Dropbox raise funds and achieve success.

These alternative funding options offer several benefits, including:

- Increased accessibility: Alternative funding options can provide access to capital for startups that may not qualify for traditional venture capital.

- Flexibility: Alternative funding options can offer more flexible terms and conditions than traditional venture capital.

- Networking opportunities: Alternative funding options can provide startups with access to valuable networks and mentorship.

However, alternative funding options also have their drawbacks, including:

- Higher costs: Alternative funding options can be more expensive than traditional venture capital.

- Less control: Alternative funding options can result in less control for the startup, as investors may have more say in the business.

- Reputation risk: Alternative funding options can carry a reputation risk, as some investors may view these options as less legitimate.

Ultimately, the choice of funding option depends on the specific needs and goals of the startup. By exploring alternative funding routes, tech startups can find the right fit for their business and achieve success.

How to Prepare for a Successful Funding Round

Preparing for a funding round is a crucial step in securing the necessary capital for your tech startup. A well-prepared startup is more likely to attract investors and secure the funding needed to grow and succeed. In this section, we will discuss the key elements to focus on when preparing for a funding round.

Developing a Solid Business Plan

A solid business plan is essential for any startup looking to secure funding. A business plan should outline your startup’s mission, goals, and financial projections. It should also provide a detailed analysis of your market, competition, and target audience. A well-written business plan will help you articulate your vision and demonstrate your startup’s potential for growth and success.

Building a Strong Team

A strong team is critical to the success of any startup. Investors want to see a team that is passionate, dedicated, and has the necessary skills and expertise to execute on your startup’s vision. When building your team, focus on hiring individuals who share your startup’s values and are committed to its mission.

Creating a Persuasive Pitch

A persuasive pitch is essential for securing funding. Your pitch should clearly articulate your startup’s value proposition, market opportunity, and competitive advantage. It should also demonstrate your startup’s traction and scalability. A well-crafted pitch will help you stand out from the competition and attract the attention of investors.

Demonstrating Traction and Scalability

Demonstrating traction and scalability is critical to securing funding. Investors want to see that your startup has a proven track record of success and has the potential to scale quickly. When preparing for a funding round, focus on demonstrating your startup’s progress and potential for growth.

Best Practices for Preparing for a Funding Round

When preparing for a funding round, there are several best practices to keep in mind. These include:

- Start early: Preparing for a funding round takes time, so start early to ensure you are well-prepared.

- Be clear and concise: Clearly articulate your startup’s value proposition and market opportunity.

- Focus on traction and scalability: Demonstrate your startup’s progress and potential for growth.

- Practice your pitch: Practice your pitch to ensure you are confident and persuasive.

By following these best practices and focusing on the key elements outlined above, you can increase your chances of securing the funding needed to grow and succeed.

Bootstrapping vs. Seeking Funding: Weighing the Pros and Cons

When it comes to funding a tech startup, entrepreneurs often face a difficult decision: whether to bootstrap or seek funding from external sources. Both options have their pros and cons, and the right choice depends on the specific needs and goals of the startup.

Bootstrapping: The Pros

Bootstrapping, or self-funding, can be a great way to maintain control and ownership of a startup. By using personal savings, revenue, or loans from friends and family, entrepreneurs can avoid diluting their equity and maintain decision-making power. Additionally, bootstrapping can help startups stay lean and agile, as they are forced to be frugal and efficient with their resources.

Bootstrapping: The Cons

However, bootstrapping also has its drawbacks. Limited resources can hinder a startup’s ability to scale and grow quickly, and the financial burden can be significant. Additionally, bootstrapping can be stressful and all-consuming, as entrepreneurs must take on multiple roles and responsibilities.

Seeking Funding: The Pros

Seeking funding from external sources, such as venture capitalists or angel investors, can provide a startup with the necessary resources to scale and grow quickly. Funding can also bring in expertise and networks, as investors often have valuable connections and experience. Additionally, funding can help startups validate their business model and gain credibility.

Seeking Funding: The Cons

However, seeking funding also has its drawbacks. Diluting equity can result in loss of control and ownership, and the pressure to meet investor expectations can be intense. Additionally, the fundraising process can be time-consuming and distracting, taking away from the core business.

Examples of Successful Bootstrapped Startups

Some successful startups have bootstrapped their way to success, including:

- Mailchimp, which bootstrapped for 10 years before raising funding

- HubSpot, which bootstrapped for 5 years before raising funding

Examples of Successful Funded Startups

Other successful startups have raised funding from external sources, including:

- Uber, which raised over $20 billion in funding

- Airbnb, which raised over $4 billion in funding

Ultimately, the decision to bootstrap or seek funding depends on the specific needs and goals of the startup. By weighing the pros and cons of each option, entrepreneurs can make an informed decision that sets their startup up for success.

Government Funding Options for Tech Startups

Government funding options are a viable source of capital for tech startups, providing access to grants, tax credits, and subsidies. These programs are designed to support innovation, job creation, and economic growth, and can be a valuable resource for startups looking to scale and grow.

Types of Government Funding Options

There are several types of government funding options available to tech startups, including:

- Grants: Competitive grants that provide funding for specific projects or initiatives.

- Tax Credits: Tax credits that provide a reduction in taxes owed in exchange for investing in research and development or other qualified activities.

- Subsidies: Subsidies that provide funding for specific industries or sectors, such as renewable energy or biotechnology.

Eligibility Criteria

To be eligible for government funding options, tech startups must meet specific criteria, including:

- Location: Startups must be located in a specific region or country.

- Industry: Startups must be operating in a specific industry or sector.

- Size: Startups must meet specific size requirements, such as number of employees or revenue.

Application Process

The application process for government funding options typically involves submitting a proposal or application, which includes:

- Business plan: A detailed business plan that outlines the startup’s goals, objectives, and financial projections.

- Financial statements: Financial statements that demonstrate the startup’s financial stability and potential for growth.

- Technical documentation: Technical documentation that demonstrates the startup’s innovative technology or product.

Examples of Successful Government Funding Recipients

Several tech startups have successfully received government funding, including:

- Google, which received a grant from the National Science Foundation to develop its search engine technology.

- Amazon, which received a tax credit from the state of Washington to support its research and development efforts.

Conclusion

Government funding options can be a valuable resource for tech startups looking to scale and grow. By understanding the types of funding options available, eligibility criteria, and application process, startups can increase their chances of securing government funding and achieving success.

Corporate Venture Capital: A New Avenue for Funding

Corporate venture capital (CVC) is a growing trend in the startup funding landscape. CVC involves large corporations investing in startups, often in exchange for equity. This type of funding can provide startups with access to resources, expertise, and networks that can help them scale and grow.

Benefits of Corporate Venture Capital

CVC can offer several benefits to startups, including:

- Access to resources: Corporations often have extensive resources, including funding, expertise, and networks, that can help startups grow and scale.

- Strategic partnerships: CVC can lead to strategic partnerships between startups and corporations, which can help startups gain access to new markets, customers, and technologies.

- Validation: CVC can provide startups with validation and credibility, which can help them attract additional funding and talent.

Examples of Successful Corporate Venture Capital Investments

Several corporations have made successful CVC investments, including:

- Google Ventures, which has invested in startups like Uber and Robinhood

- Intel Capital, which has invested in startups like Airbnb and Dropbox

Challenges of Corporate Venture Capital

While CVC can offer several benefits, it also presents several challenges, including:

- Conflicting interests: Corporations may have conflicting interests with startups, which can lead to tension and difficulties in the investment process.

- Control: Corporations may seek to exert control over startups, which can limit their autonomy and flexibility.

Best Practices for Corporate Venture Capital

To succeed in CVC, startups should follow several best practices, including:

- Clearly define goals and objectives: Startups should clearly define their goals and objectives, and ensure that they align with those of the corporation.

- Build strong relationships: Startups should build strong relationships with the corporation, and establish open and transparent communication channels.

- Monitor progress: Startups should regularly monitor progress, and adjust their strategy as needed.

Conclusion

Corporate venture capital is a growing trend in the startup funding landscape, offering startups access to resources, expertise, and networks. While CVC presents several challenges, startups can succeed by following best practices and building strong relationships with corporations.

Funding for Social Impact Startups: A Growing Trend

Social impact startups are becoming increasingly popular, and funding options for these types of startups are growing. Impact investing and social venture capital are two types of funding that are specifically designed for social impact startups.

Impact Investing

Impact investing is a type of funding that focuses on generating both financial returns and positive social or environmental impact. This type of funding is often used by social impact startups that are working to address specific social or environmental issues.

Social Venture Capital

Social venture capital is a type of funding that is specifically designed for social impact startups. This type of funding is often used by startups that are working to address specific social or environmental issues, and are looking for funding that will help them scale and grow.

Benefits of Funding for Social Impact Startups

Funding for social impact startups can provide several benefits, including:

- Access to capital: Funding for social impact startups can provide access to capital that might not be available through traditional funding sources.

- Expertise: Funding for social impact startups can also provide access to expertise and networks that can help startups scale and grow.

- Validation: Funding for social impact startups can provide validation and credibility, which can help startups attract additional funding and talent.

Challenges of Funding for Social Impact Startups

While funding for social impact startups can provide several benefits, it also presents several challenges, including:

- Higher risk: Funding for social impact startups can be higher risk than traditional funding, as the focus is on generating both financial returns and positive social or environmental impact.

- Lower returns: Funding for social impact startups may also result in lower returns than traditional funding, as the focus is on generating positive social or environmental impact rather than solely on financial returns.

Examples of Successful Social Impact Startups

Several social impact startups have successfully secured funding and are making a positive impact, including:

- Warby Parker, which has secured funding from impact investors and is working to provide affordable eyewear to people in need.

- TOMS, which has secured funding from social venture capitalists and is working to provide shoes to people in need.

Conclusion

Funding for social impact startups is a growing trend, and can provide several benefits for startups that are working to address specific social or environmental issues. While there are challenges associated with this type of funding, it can be a valuable option for startups that are looking to make a positive impact.

Conclusion: Navigating the Complex World of Startup Funding

Navigating the complex world of startup funding can be a daunting task for entrepreneurs. With so many options available, it can be difficult to determine which route is best for your business. However, by understanding the various funding options available, including alternative funding routes, government funding options, corporate venture capital, and funding for social impact startups, entrepreneurs can make informed decisions about their funding needs.

Key Takeaways

When it comes to startup funding, there are several key takeaways to keep in mind:

- Understand your funding needs: Before exploring funding options, it’s essential to understand your startup’s financial needs and goals.

- Explore alternative funding routes: Alternative funding routes, such as crowdfunding, angel investors, and incubators, can provide access to capital and resources.

- Consider government funding options: Government funding options, such as grants, tax credits, and subsidies, can provide access to capital and resources.

- Look into corporate venture capital: Corporate venture capital can provide access to resources, expertise, and networks.

- Consider funding for social impact startups: Funding for social impact startups, including impact investing and social venture capital, can provide access to capital and resources.

Final Thoughts

In conclusion, navigating the complex world of startup funding requires a deep understanding of the various funding options available. By carefully considering your funding needs and exploring the most suitable options for your business, you can increase your chances of securing the funding you need to grow and succeed.

Remember, startup funding is a complex and ever-changing landscape. Stay informed, stay adaptable, and always be open to new opportunities and challenges.