Unlocking the Secrets of Successful Buying and Selling

Buying and selling for profit is a complex and multifaceted process that requires a deep understanding of market trends, data analysis, and informed decision-making. In today’s fast-paced and ever-changing market landscape, it’s essential to stay ahead of the curve and adapt to shifting conditions. This comprehensive guide is designed to provide readers with a framework for achieving long-term success in buying and selling for profit, regardless of their level of experience or expertise.

At its core, buying and selling for profit involves identifying opportunities to purchase assets at a low price and selling them at a higher price, thereby generating a profit. However, this simplistic definition belies the complexity and nuance of the process. Successful buying and selling for profit requires a deep understanding of market trends, including the ability to analyze data, identify patterns, and make informed decisions.

One of the key challenges in buying and selling for profit is managing risk. This involves identifying potential pitfalls and taking steps to mitigate them, such as diversifying portfolios, setting stop-loss orders, and monitoring market conditions. By taking a proactive and informed approach to risk management, buyers and sellers can minimize their exposure to potential losses and maximize their returns.

In addition to managing risk, successful buying and selling for profit also requires a deep understanding of market psychology. This involves understanding the emotions and motivations that drive market participants, including fear, greed, and sentiment. By understanding these psychological factors, buyers and sellers can make more informed decisions and avoid common pitfalls, such as impulsive decisions and emotional trading.

Ultimately, the key to success in buying and selling for profit is to approach the process with a clear and informed mindset. This involves staying up-to-date with market news and trends, analyzing data, and making informed decisions. By following these principles and staying focused on their goals, buyers and sellers can achieve long-term success and maximize their returns.

How to Identify Lucrative Opportunities in the Market

Identifying profitable opportunities is a crucial aspect of buying and selling for profit. To stay ahead of the curve and capitalize on emerging trends, it’s essential to conduct thorough market research, analyze trends, and assess risk. By combining these key factors, traders can make informed decisions and maximize their returns.

Market research is a critical component of identifying lucrative opportunities. This involves analyzing market data, trends, and news to identify potential areas of growth. Traders can use various tools and resources, such as financial news websites, market analysis reports, and social media, to stay informed and up-to-date with market developments.

Trend analysis is another essential aspect of identifying profitable opportunities. By analyzing charts, patterns, and indicators, traders can identify trends and make informed decisions. Technical analysis can be used to identify trends, while fundamental analysis can be used to assess the underlying value of an asset.

Risk assessment is also a critical factor in identifying lucrative opportunities. Traders must assess the potential risks and rewards of a particular trade and make informed decisions based on their risk tolerance. This involves considering factors such as market volatility, liquidity, and potential losses.

To stay ahead of the curve and capitalize on emerging trends, traders must be proactive and adaptable. This involves continuously monitoring market developments, analyzing data, and adjusting strategies accordingly. By combining market research, trend analysis, and risk assessment, traders can identify lucrative opportunities and maximize their returns.

Some effective strategies for identifying profitable opportunities include:

- Using technical indicators, such as moving averages and relative strength index (RSI), to identify trends and patterns.

- Analyzing fundamental data, such as earnings reports and economic indicators, to assess the underlying value of an asset.

- Monitoring market news and developments to stay informed and up-to-date with market trends.

- Using risk management techniques, such as stop-loss orders and position sizing, to minimize potential losses.

By incorporating these strategies into their trading plan, traders can increase their chances of identifying lucrative opportunities and achieving long-term success in buying and selling for profit.

The Psychology of Profitable Trading: Managing Emotions and Minimizing Risk

Buying and selling for profit is not just about analyzing data and making informed decisions; it’s also about managing emotions and minimizing risk. The psychology of trading plays a crucial role in determining success, and understanding the emotional and psychological aspects of trading can help traders make better decisions and achieve their goals.

Emotional control is essential for profitable trading. Fear, greed, and anxiety can lead to impulsive decisions, which can result in significant losses. Traders must learn to manage their emotions and stay focused on their goals. This involves developing a trading plan, setting clear goals, and sticking to a strategy.

Discipline is another critical aspect of profitable trading. Traders must be disciplined in their approach, sticking to their plan and avoiding impulsive decisions. This involves setting clear rules for buying and selling, and adhering to those rules even when emotions run high.

Patience is also essential for profitable trading. Traders must be willing to wait for the right opportunities, rather than rushing into trades based on emotions. This involves taking a long-term view, rather than focusing on short-term gains.

Risk management is also critical for profitable trading. Traders must be aware of the potential risks and take steps to minimize them. This involves setting stop-loss orders, limiting position size, and diversifying portfolios.

Some effective strategies for managing emotions and minimizing risk include:

- Developing a trading plan and sticking to it.

- Setting clear goals and risk tolerance.

- Using technical analysis to inform buying and selling decisions.

- Practicing discipline and patience in trading.

- Managing risk through stop-loss orders and position sizing.

By understanding the psychology of trading and incorporating these strategies into their approach, traders can improve their chances of success and achieve their goals in buying and selling for profit.

Additionally, traders can also benefit from:

- Keeping a trading journal to track progress and identify areas for improvement.

- Seeking support from a trading community or mentor.

- Continuously educating themselves on trading strategies and techniques.

- Staying up-to-date with market news and analysis.

By combining these strategies with a solid understanding of the psychology of trading, traders can develop a winning mindset and achieve long-term success in buying and selling for profit.

Building a Winning Trading Strategy: Tips and Best Practices

A successful trading strategy is the foundation of profitable buying and selling for profit. A well-crafted strategy can help traders navigate the markets with confidence, minimize risk, and maximize returns. In this section, we’ll outline the essential components of a winning trading strategy and provide tips on how to adapt them to individual needs.

Setting clear goals is the first step in building a successful trading strategy. Traders must define their risk tolerance, investment horizon, and financial objectives. This will help them determine the right assets to trade, the amount of capital to allocate, and the level of risk to take.

Defining risk tolerance is critical in trading. Traders must assess their ability to withstand losses and adjust their strategy accordingly. This involves setting stop-loss orders, limiting position size, and diversifying portfolios.

Selecting the right assets is also crucial in trading. Traders must choose assets that align with their goals, risk tolerance, and market analysis. This involves researching different asset classes, analyzing market trends, and selecting assets with high potential for growth.

Some effective strategies for building a winning trading strategy include:

- Using a combination of technical and fundamental analysis to inform trading decisions.

- Setting clear goals and risk tolerance.

- Selecting the right assets and adjusting position size accordingly.

- Using stop-loss orders and diversifying portfolios to manage risk.

- Continuously monitoring and adjusting the strategy as market conditions change.

Examples of successful trading strategies include:

- Day trading: This involves buying and selling assets within a single trading day, with the goal of profiting from intraday price movements.

- Swing trading: This involves holding positions for a shorter period than investing, but longer than day trading, with the goal of profiting from medium-term price movements.

- Position trading: This involves holding positions for an extended period, with the goal of profiting from long-term price movements.

By incorporating these strategies and tips into their trading plan, traders can build a winning trading strategy that helps them achieve their goals in buying and selling for profit.

Additionally, traders can also benefit from:

- Staying up-to-date with market news and analysis.

- Continuously educating themselves on trading strategies and techniques.

- Seeking support from a trading community or mentor.

- Using trading software and tools to streamline their strategy.

By combining these strategies and tips with a solid understanding of the markets and trading principles, traders can build a winning trading strategy that helps them achieve long-term success in buying and selling for profit.

The Role of Technical Analysis in Profitable Trading

Technical analysis is a crucial tool for traders looking to make informed buying and selling decisions. By analyzing charts, patterns, and indicators, traders can gain valuable insights into market trends and make more accurate predictions about future price movements.

Charts are a fundamental component of technical analysis. They provide a visual representation of price movements over time, allowing traders to identify trends, patterns, and potential areas of support and resistance. Common types of charts used in technical analysis include line charts, bar charts, and candlestick charts.

Patterns are another important aspect of technical analysis. They refer to the shapes and formations that appear on charts, such as triangles, wedges, and head and shoulders patterns. By recognizing these patterns, traders can gain insights into market sentiment and make more informed trading decisions.

Indicators are also widely used in technical analysis. They are mathematical formulas that are applied to price data to generate signals and trends. Common indicators include moving averages, relative strength index (RSI), and Bollinger Bands.

Some effective strategies for using technical analysis in profitable trading include:

- Using a combination of charts, patterns, and indicators to confirm trading decisions.

- Identifying areas of support and resistance to determine potential entry and exit points.

- Using trend lines and channels to identify the direction and strength of market trends.

- Applying indicators to generate buy and sell signals.

However, technical analysis is not without its limitations. Some common pitfalls to avoid include:

- Over-reliance on a single indicator or chart pattern.

- Failing to consider fundamental analysis and market news.

- Ignoring the importance of risk management and position sizing.

By incorporating technical analysis into their trading strategy, traders can gain a deeper understanding of market trends and make more informed buying and selling decisions. However, it’s essential to remember that technical analysis is just one tool among many, and should be used in conjunction with other forms of analysis and risk management techniques.

Some popular technical analysis tools and software include:

- MetaTrader: A popular trading platform that offers a range of technical analysis tools and indicators.

- TradingView: A cloud-based platform that provides access to a wide range of technical analysis tools and indicators.

- Thinkorswim: A trading platform that offers a range of technical analysis tools and indicators, as well as paper trading and backtesting capabilities.

By leveraging these tools and software, traders can streamline their technical analysis and make more informed trading decisions.

Staying Ahead of the Curve: How to Stay Informed and Adapt to Changing Market Conditions

The world of buying and selling for profit is constantly evolving, with market conditions changing rapidly in response to economic, political, and social factors. To stay ahead of the curve and achieve long-term success, traders must be informed and adaptable, able to adjust their strategies in response to changing market conditions.

Staying informed is critical in today’s fast-paced market environment. Traders must stay up-to-date with market news, analysis, and trends, using a variety of sources to gather information and stay ahead of the curve. This includes:

- Financial news websites and publications.

- Market analysis reports and research studies.

- Social media and online forums.

- Industry events and conferences.

Analyzing data is also essential in staying informed and adaptable. Traders must be able to analyze market data, identify trends and patterns, and make informed decisions based on their analysis. This includes:

- Using technical analysis tools and indicators.

- Analyzing fundamental data, such as earnings reports and economic indicators.

- Identifying areas of support and resistance.

Adjusting strategies is critical in response to changing market conditions. Traders must be able to adapt their strategies in response to changes in market trends, economic conditions, and other factors. This includes:

- Adjusting position size and risk management strategies.

- Changing asset allocation and diversification strategies.

- Updating trading plans and strategies.

Some effective strategies for staying informed and adaptable include:

- Using a combination of technical and fundamental analysis to inform trading decisions.

- Staying up-to-date with market news and analysis.

- Analyzing data and identifying trends and patterns.

- Adjusting strategies in response to changing market conditions.

By staying informed and adaptable, traders can stay ahead of the curve and achieve long-term success in buying and selling for profit. This requires a combination of market knowledge, analytical skills, and strategic thinking, as well as the ability to adjust to changing market conditions.

Additionally, traders can also benefit from:

- Continuously educating themselves on market trends and analysis.

- Seeking support from a trading community or mentor.

- Using trading software and tools to streamline their strategy.

By incorporating these strategies and tips into their trading plan, traders can stay informed and adaptable, and achieve long-term success in buying and selling for profit.

Common Mistakes to Avoid When Buying and Selling for Profit

Buying and selling for profit can be a lucrative venture, but it’s not without its challenges. Even the most experienced traders can fall victim to common mistakes that can derail their plans and lead to significant losses. In this section, we’ll identify some of the most common mistakes to avoid when buying and selling for profit, and provide guidance on how to stay on track.

Impulsive decisions are a common mistake that can lead to significant losses. Traders must avoid making impulsive decisions based on emotions, and instead, take the time to analyze the market and make informed decisions. This includes:

- Avoiding emotional trading decisions.

- Taking the time to analyze market trends and data.

- Using technical analysis to inform trading decisions.

Lack of patience is another common mistake that can lead to significant losses. Traders must be patient and avoid making impulsive decisions based on short-term market fluctuations. This includes:

- Setting clear goals and risk tolerance.

- Using position sizing and risk management strategies.

- Avoiding over-trading and taking unnecessary risks.

Inadequate risk management is a common mistake that can lead to significant losses. Traders must use risk management strategies to minimize potential losses and maximize returns. This includes:

- Using stop-loss orders and position sizing.

- Diversifying portfolios and managing risk.

- Monitoring and adjusting risk management strategies.

Some effective strategies for avoiding common mistakes include:

- Using a combination of technical and fundamental analysis to inform trading decisions.

- Setting clear goals and risk tolerance.

- Using position sizing and risk management strategies.

- Avoiding emotional trading decisions.

By avoiding these common mistakes, traders can stay on track and achieve long-term success in buying and selling for profit. This requires a combination of market knowledge, analytical skills, and strategic thinking, as well as the ability to adapt to changing market conditions.

Additionally, traders can also benefit from:

- Continuously educating themselves on market trends and analysis.

- Seeking support from a trading community or mentor.

- Using trading software and tools to streamline their strategy.

By incorporating these strategies and tips into their trading plan, traders can avoid common mistakes and achieve long-term success in buying and selling for profit.

Scaling Your Profits: How to Grow Your Trading Business Over Time

Scaling your profits is a crucial aspect of building a successful trading business. As you gain more experience and confidence in your trading abilities, you’ll want to expand your portfolio and increase your returns. In this section, we’ll provide advice on how to scale your profits over time, including strategies for expanding your portfolio, managing risk, and optimizing returns.

Expanding your portfolio is a key component of scaling your profits. This involves diversifying your investments and adding new assets to your portfolio. By doing so, you can reduce your risk and increase your potential returns. Some effective strategies for expanding your portfolio include:

- Diversifying your investments across different asset classes.

- Adding new assets to your portfolio, such as stocks, bonds, or commodities.

- Using dollar-cost averaging to reduce your risk and increase your returns.

Managing risk is also critical when scaling your profits. As you expand your portfolio, you’ll want to ensure that you’re not taking on too much risk. Some effective strategies for managing risk include:

- Using stop-loss orders to limit your potential losses.

- Diversifying your portfolio to reduce your risk.

- Using position sizing to manage your risk and increase your returns.

Optimizing your returns is also essential when scaling your profits. This involves using various strategies to maximize your returns and minimize your losses. Some effective strategies for optimizing your returns include:

- Using technical analysis to identify trends and patterns in the market.

- Using fundamental analysis to identify undervalued assets.

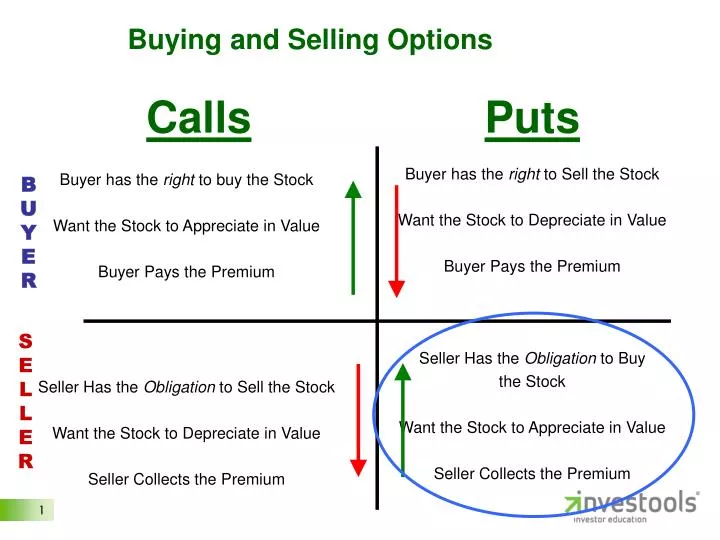

- Using options and other derivatives to increase your returns and manage your risk.

Some effective strategies for scaling your profits include:

- Using a combination of technical and fundamental analysis to inform your trading decisions.

- Diversifying your portfolio to reduce your risk and increase your returns.

- Using position sizing and risk management strategies to manage your risk and increase your returns.

By incorporating these strategies into your trading plan, you can scale your profits over time and achieve long-term success in buying and selling for profit. Remember to always stay focused, disciplined, and patient, and to continuously educate yourself on market trends and analysis.

Additionally, you can also benefit from:

- Seeking support from a trading community or mentor.

- Using trading software and tools to streamline your strategy.

- Continuously monitoring and adjusting your strategy to stay ahead of the curve.

By following these tips and strategies, you can scale your profits and achieve long-term success in buying and selling for profit.