Why Choosing the Right Career is Crucial for Financial Success

When it comes to achieving financial success, selecting the right career is a crucial decision that can have a lasting impact on one’s wealth and overall well-being. The best careers to get rich are often those that offer a combination of high salary potential, growth opportunities, and job satisfaction. By choosing a career that aligns with your financial goals, you can set yourself up for long-term success and create a foundation for building wealth.

Research has shown that individuals who are satisfied with their careers are more likely to experience financial success and overall happiness. This is because a fulfilling career can provide a sense of purpose and motivation, leading to increased productivity and job performance. Furthermore, careers with high growth potential can offer opportunities for advancement and increased earning potential, making it easier to achieve financial goals.

In addition to job satisfaction and growth opportunities, salary potential is also a critical factor to consider when choosing a career. The best careers to get rich often offer high salary ranges, providing individuals with the financial resources needed to invest, save, and build wealth. By selecting a career with high salary potential, individuals can create a solid financial foundation and set themselves up for long-term success.

Ultimately, choosing the right career is a personal decision that requires careful consideration of one’s financial goals, skills, and interests. By taking the time to research and explore different career options, individuals can make informed decisions that set them up for financial success and create a foundation for building wealth. Whether you’re just starting out or looking to make a career change, selecting a career that aligns with your financial goals is a crucial step towards achieving financial success and creating a brighter financial future.

High-Demand Fields with Lucrative Salary Ranges

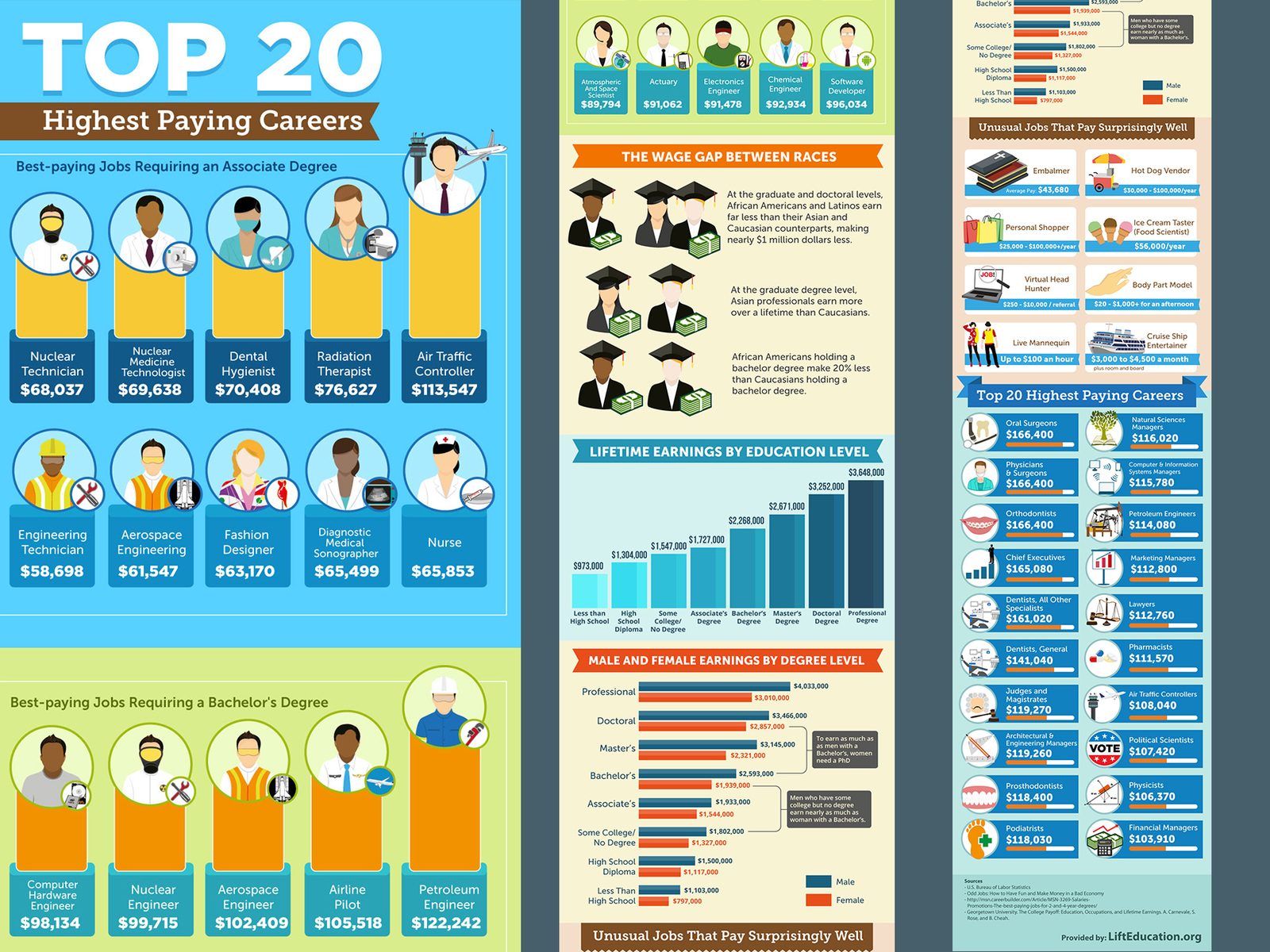

Several high-demand fields offer lucrative salary ranges, making them attractive options for individuals seeking the best careers to get rich. The tech industry, for instance, is known for its high-paying job roles, such as software engineering, data science, and product management. These careers often come with six-figure salaries and opportunities for bonuses and stock options.

The finance sector is another high-paying field, with careers like investment banking, hedge fund management, and private equity offering lucrative salary ranges. These roles often require advanced degrees and specialized skills, but can provide significant financial rewards. For example, investment bankers can earn salaries ranging from $100,000 to over $500,000 per year, depending on experience and performance.

The healthcare industry is also a high-paying field, with certain physician specialties offering salaries ranging from $400,000 to over $600,000 per year. Careers like orthopedic surgery, cardiology, and gastroenterology are in high demand and can provide significant financial rewards. Additionally, the healthcare industry is expected to continue growing, with the Bureau of Labor Statistics predicting a 14% increase in employment opportunities through 2028.

Other high-demand fields with lucrative salary ranges include consulting, law, and aerospace engineering. These careers often require specialized skills and education, but can provide significant financial rewards and opportunities for advancement. By pursuing a career in one of these high-demand fields, individuals can set themselves up for financial success and create a foundation for building wealth.

It’s worth noting that while salary is an important consideration, it’s not the only factor to consider when choosing a career. Job satisfaction, growth opportunities, and work-life balance are also important considerations. By finding a career that aligns with your financial goals and personal values, you can set yourself up for long-term success and create a fulfilling and lucrative career.

Emerging Industries with High Growth Potential

As technology continues to advance and the global economy evolves, new industries are emerging that offer high growth potential and lucrative career opportunities. Renewable energy, cybersecurity, and e-commerce are just a few examples of emerging industries that are expected to experience significant growth in the coming years.

The renewable energy industry, for instance, is expected to grow by 10% annually over the next decade, driven by increasing demand for sustainable energy sources and government policies supporting the development of renewable energy infrastructure. Careers in renewable energy, such as solar engineering and wind turbine maintenance, offer competitive salaries and opportunities for advancement.

Cybersecurity is another emerging industry with high growth potential. As technology advances and more businesses move online, the demand for cybersecurity professionals is increasing rapidly. Careers in cybersecurity, such as penetration testing and incident response, offer high salaries and opportunities for advancement, making them some of the best careers to get rich.

E-commerce is also an emerging industry with high growth potential. The rise of online shopping has created a demand for professionals with expertise in digital marketing, logistics, and supply chain management. Careers in e-commerce, such as digital marketing specialist and supply chain manager, offer competitive salaries and opportunities for advancement.

Other emerging industries with high growth potential include artificial intelligence, blockchain, and biotechnology. These industries are expected to experience significant growth in the coming years, driven by advances in technology and increasing demand for innovative solutions. By pursuing a career in one of these emerging industries, individuals can position themselves for long-term success and create a foundation for building wealth.

It’s worth noting that while emerging industries offer high growth potential, they also come with unique challenges and requirements. Professionals in these industries must be adaptable, innovative, and willing to continuously learn and develop new skills. By staying ahead of the curve and developing the skills and expertise needed to succeed in these industries, individuals can unlock new career opportunities and create a path to financial success.

How to Leverage Your Skills for Maximum Earning Potential

To maximize earning potential in your chosen career, it’s essential to develop in-demand skills, build a strong professional network, and negotiate salary effectively. By focusing on these key areas, individuals can position themselves for success and increase their earning potential.

Developing in-demand skills is critical in today’s fast-paced job market. By acquiring skills that are in high demand, individuals can increase their value to employers and command higher salaries. Some of the most in-demand skills include data science, artificial intelligence, and cybersecurity. By investing in courses, training programs, or certifications, individuals can develop these skills and enhance their career prospects.

Building a strong professional network is also essential for career success. By connecting with professionals in your industry, individuals can gain access to job opportunities, learn about industry trends, and gain valuable advice and mentorship. Attend industry events, join professional organizations, and engage in online communities to build your network and increase your earning potential.

Negotiating salary is also a critical aspect of maximizing earning potential. By researching the market rate for your role and preparing a solid case for your salary requirements, individuals can negotiate a higher salary and increase their earning potential. It’s essential to be confident and assertive during salary negotiations, and to be prepared to discuss your skills, experience, and achievements.

Additionally, individuals can also consider freelancing or consulting to increase their earning potential. By offering high-demand skills on a freelance or consulting basis, individuals can command higher rates and increase their earning potential. Platforms like Upwork, Freelancer, and LinkedIn can provide access to freelance and consulting opportunities.

By developing in-demand skills, building a strong professional network, and negotiating salary effectively, individuals can maximize their earning potential and achieve financial success. Remember, the best careers to get rich are those that align with your skills, interests, and values, and offer opportunities for growth and advancement.

Ultimately, maximizing earning potential requires a combination of hard work, dedication, and strategic planning. By focusing on these key areas, individuals can position themselves for success and achieve their financial goals.

The Role of Entrepreneurship in Building Wealth

Entrepreneurship is a key driver of wealth creation, offering individuals the opportunity to turn their passions into lucrative businesses. By identifying a gap in the market and developing a innovative solution, entrepreneurs can create a successful business that generates significant revenue and builds wealth.

Successful entrepreneurs like Steve Jobs, Bill Gates, and Mark Zuckerberg have demonstrated the potential for entrepreneurship to generate wealth. These individuals have turned their business ideas into global brands, creating billions of dollars in revenue and building significant wealth.

However, entrepreneurship is not without its challenges. Starting a business requires significant investment, hard work, and dedication. Entrepreneurs must be willing to take risks, adapt to changing market conditions, and continuously innovate to stay ahead of the competition.

Despite the challenges, the potential rewards of entrepreneurship make it an attractive option for individuals seeking to build wealth. By developing a successful business, entrepreneurs can create a steady stream of income, build equity, and achieve financial independence.

So, how can individuals turn their business ideas into lucrative ventures? The first step is to identify a gap in the market and develop a innovative solution. This requires conducting market research, analyzing consumer trends, and identifying areas of opportunity.

Once a business idea has been identified, the next step is to develop a business plan. This should include a detailed analysis of the market, a description of the product or service, and a financial plan. A well-written business plan will help entrepreneurs to secure funding, attract investors, and build a successful business.

Finally, entrepreneurs must be willing to take risks and adapt to changing market conditions. This requires being open to new opportunities, continuously innovating, and being willing to pivot when necessary.

By following these steps, individuals can turn their business ideas into lucrative ventures and achieve financial success. Entrepreneurship is a key driver of wealth creation, and by embracing the challenges and opportunities of starting a business, individuals can build significant wealth and achieve their financial goals.

In the context of the best careers to get rich, entrepreneurship offers a unique opportunity for individuals to create their own wealth-generating machine. By developing a successful business, entrepreneurs can create a steady stream of income, build equity, and achieve financial independence.

Investing in Your Future: Education and Training for High-Paying Careers

Investing in education and training is a crucial step in accessing high-paying careers and achieving financial success. By acquiring the skills and knowledge required for in-demand jobs, individuals can position themselves for success and increase their earning potential.

One of the most effective ways to invest in your future is to pursue higher education. Graduate degrees, such as master’s and doctoral degrees, can provide individuals with advanced knowledge and skills that are highly valued by employers. Additionally, online courses and certifications can provide individuals with specialized skills and knowledge that are in high demand.

Some of the best careers to get rich require specialized education and training. For example, careers in tech, such as software engineering and data science, require advanced degrees and certifications. Similarly, careers in finance, such as investment banking and financial analysis, require specialized knowledge and skills that can be acquired through education and training.

Investing in education and training can also provide individuals with a competitive edge in the job market. By acquiring the skills and knowledge required for in-demand jobs, individuals can differentiate themselves from other job candidates and increase their chances of landing a high-paying job.

Furthermore, investing in education and training can also provide individuals with a sense of personal fulfillment and satisfaction. By pursuing a career that aligns with their interests and passions, individuals can increase their job satisfaction and overall well-being.

Some popular options for education and training include online courses, certifications, and graduate degrees. Online courses, such as those offered by Coursera and Udemy, can provide individuals with specialized skills and knowledge that are in high demand. Certifications, such as those offered by Google and Microsoft, can provide individuals with advanced knowledge and skills that are highly valued by employers. Graduate degrees, such as master’s and doctoral degrees, can provide individuals with advanced knowledge and skills that are required for high-paying careers.

By investing in education and training, individuals can position themselves for success and increase their earning potential. Whether you’re just starting out or looking to advance your career, investing in education and training is a crucial step in achieving financial success and accessing the best careers to get rich.

Managing Your Finances for Long-Term Wealth

Managing your finances effectively is crucial for achieving long-term wealth and financial stability. By creating a budget, saving regularly, and investing wisely, individuals can ensure that their financial resources are working towards their goals.

Creating a budget is the first step in managing your finances effectively. By tracking income and expenses, individuals can identify areas where they can cut back and allocate their resources more efficiently. A budget should include categories for savings, investments, and emergency funds, as well as a plan for paying off debt.

Saving regularly is also essential for achieving long-term wealth. By setting aside a portion of their income each month, individuals can build up their savings over time and create a safety net for unexpected expenses. It’s recommended to save at least 10% to 20% of your income each month.

Investing wisely is also critical for achieving long-term wealth. By investing in a diversified portfolio of stocks, bonds, and other assets, individuals can grow their wealth over time and achieve their financial goals. It’s recommended to work with a financial advisor to create a personalized investment plan.

In addition to budgeting, saving, and investing, individuals should also prioritize debt repayment. By paying off high-interest debt, such as credit card balances, individuals can free up more money in their budget to save and invest.

Another important aspect of managing your finances is building an emergency fund. By setting aside 3-6 months’ worth of living expenses, individuals can ensure that they have a safety net in case of unexpected expenses or job loss.

Finally, individuals should also prioritize retirement savings. By contributing to a 401(k) or IRA, individuals can build up their retirement savings over time and achieve financial independence.

By following these tips, individuals can manage their finances effectively and achieve long-term wealth and financial stability. Remember, the best careers to get rich are those that align with your financial goals and provide opportunities for growth and advancement.

By combining a high-paying career with effective financial management, individuals can achieve financial success and build a secure financial future.

Staying Ahead of the Curve: Adapting to Changes in the Job Market

The job market is constantly evolving, with new technologies, industries, and job roles emerging all the time. To stay ahead of the curve and achieve financial success, it’s essential to be adaptable and open to new opportunities.

One of the most effective ways to stay adaptable is to engage in continuous learning. This can involve taking online courses, attending workshops and conferences, and reading industry publications. By staying up-to-date with the latest trends and developments in your field, you can position yourself for success and stay ahead of the competition.

Networking is also critical in a rapidly changing job market. By building relationships with colleagues, mentors, and industry leaders, you can gain access to new opportunities, learn about job openings before they’re advertised publicly, and get advice and guidance from experienced professionals.

Being open to new opportunities is also essential for staying ahead of the curve. This can involve being willing to take on new challenges, consider different career paths, and explore new industries. By being open to new opportunities, you can increase your earning potential, achieve financial success, and build a fulfilling career.

In addition to continuous learning, networking, and being open to new opportunities, it’s also essential to stay flexible and adaptable in your career. This can involve being willing to work remotely, take on freelance or contract work, or consider different types of employment arrangements.

By staying adaptable and open to new opportunities, you can achieve financial success and build a fulfilling career. Remember, the best careers to get rich are those that align with your financial goals and provide opportunities for growth and advancement.

By combining a high-paying career with adaptability and a willingness to learn, you can position yourself for success and achieve financial stability.

In conclusion, staying ahead of the curve in a rapidly changing job market requires a combination of continuous learning, networking, and being open to new opportunities. By staying adaptable and flexible, you can achieve financial success and build a fulfilling career.