What is Stash Invest and How Does it Work?

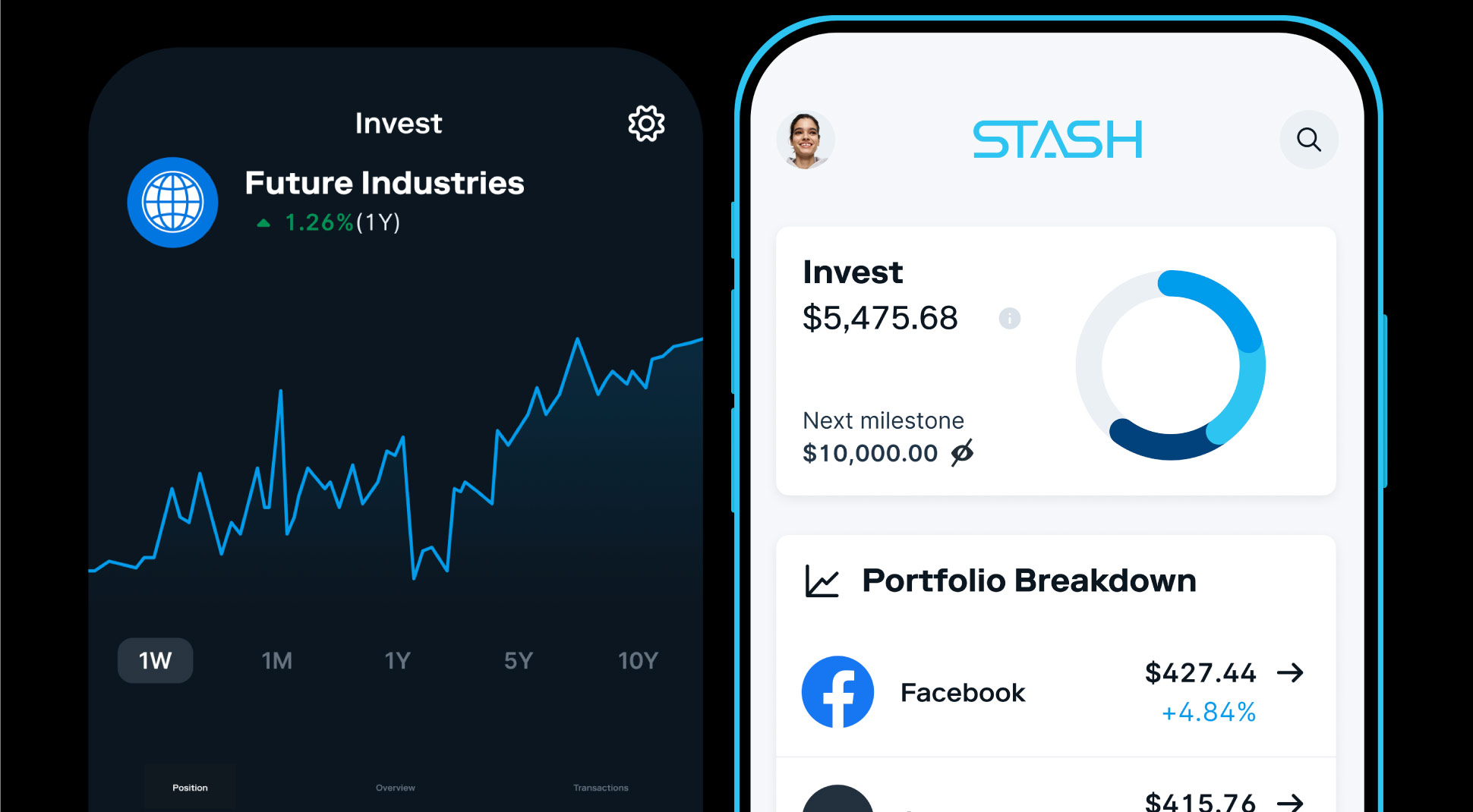

Stash Invest is a popular micro-investing app that allows users to invest small amounts of money into a diversified portfolio of stocks, ETFs, and other investment options. The app is designed to make investing accessible and easy to understand, with a user-friendly interface and a range of educational resources. One of the key benefits of Stash Invest is its automated investing feature, which allows users to set up a regular investment schedule and let the app handle the rest.

Stash Invest works by allowing users to invest as little as $5 into a range of investment options, including ETFs, stocks, and themed portfolios. The app uses a proprietary algorithm to diversify the user’s portfolio and minimize risk. Users can choose from a range of investment options, including conservative, moderate, and aggressive portfolios, and can adjust their investment strategy as needed.

One of the key advantages of Stash Invest is its low fees. The app charges a monthly fee of just $1 for accounts under $1,000, and 0.25% per year for accounts over $1,000. This makes it an attractive option for investors who are just starting out or who want to invest small amounts of money. Additionally, Stash Invest offers a range of educational resources, including articles, videos, and webinars, to help users learn more about investing and make informed decisions.

So, is Stash Invest worth it? For many users, the answer is yes. The app’s low fees, user-friendly interface, and range of investment options make it an attractive option for investors who want to get started with micro-investing. However, as with any investment app, it’s essential to do your research and understand the risks involved before investing. In the next section, we’ll take a closer look at how to get started with Stash Invest and provide a step-by-step guide to setting up an account.

How to Get Started with Stash Invest: A Step-by-Step Guide

Getting started with Stash Invest is a straightforward process that can be completed in just a few minutes. Here’s a step-by-step guide to help you get started:

Step 1: Download the Stash Invest App

Start by downloading the Stash Invest app from the App Store or Google Play. Once the app is installed, tap “Sign Up” to create a new account.

Step 2: Provide Basic Information

Enter your basic information, including your name, email address, and password. You’ll also need to provide your date of birth and social security number to comply with regulatory requirements.

Step 3: Fund Your Account

Once your account is created, you’ll need to fund it with an initial deposit. You can do this by linking a bank account or using a debit card. The minimum deposit is just $5, making it easy to get started with micro-investing.

Step 4: Choose Your Investment Portfolio

Stash Invest offers a range of investment portfolios to choose from, each with its own unique characteristics and risk level. Take some time to review the different options and choose the one that best aligns with your investment goals and risk tolerance.

Step 5: Set Your Financial Goals

Finally, take some time to set your financial goals. What are you trying to achieve with your investments? Are you saving for a specific goal, such as a down payment on a house or a vacation? Or are you looking to build wealth over the long-term? Whatever your goals, Stash Invest can help you get there.

So, is Stash Invest worth it? By following these simple steps, you can start investing with Stash Invest and begin building wealth over time. Remember to always do your research and understand the risks involved before investing. In the next section, we’ll take a closer look at the pros and cons of using Stash Invest.

Pros and Cons of Using Stash Invest: An Honest Review

As with any investment app, Stash Invest has its pros and cons. In this section, we’ll take a closer look at the advantages and disadvantages of using Stash Invest to help you decide if it’s the right choice for your investment goals.

Pros:

One of the biggest advantages of Stash Invest is its ease of use. The app is designed to be user-friendly, making it easy for beginners to get started with investing. Additionally, Stash Invest offers low fees, with a monthly fee of just $1 for accounts under $1,000. This makes it an attractive option for investors who are just starting out or who want to invest small amounts of money.

Another advantage of Stash Invest is its diversified portfolios. The app offers a range of investment options, including ETFs, stocks, and themed portfolios, which can help to minimize risk and maximize returns. Additionally, Stash Invest’s automated investing feature makes it easy to invest regularly and consistently, which can help to reduce emotional decision-making and improve investment outcomes.

Cons:

One of the biggest disadvantages of Stash Invest is its limited investment options. While the app offers a range of ETFs and stocks, it does not offer as many investment options as some other apps, such as Robinhood or eToro. Additionally, Stash Invest’s fees can be higher for larger accounts, with a 0.25% annual fee for accounts over $1,000.

Another disadvantage of Stash Invest is its customer support. While the app offers a range of educational resources and customer support options, some users have reported difficulty in getting help when they need it. This can be frustrating for users who are new to investing or who have questions about their accounts.

So, is Stash Invest worth it? While the app has its pros and cons, it can be a great option for investors who are just starting out or who want to invest small amounts of money. However, it’s essential to do your research and understand the risks involved before investing. In the next section, we’ll compare Stash Invest with other popular micro-investing apps to help you make an informed decision.

Stash Invest vs. Other Micro-Investing Apps: A Comparison

When it comes to micro-investing, there are several apps to choose from. In this section, we’ll compare Stash Invest with other popular micro-investing apps, including Acorns and Robinhood. We’ll discuss their features, fees, and investment options to help you make an informed decision.

Acorns is another popular micro-investing app that allows users to invest small amounts of money into a diversified portfolio of ETFs. Like Stash Invest, Acorns offers a range of investment options and a user-friendly interface. However, Acorns has a slightly higher fee structure, with a $1 monthly fee for accounts under $1,000 and a 0.25% annual fee for accounts over $1,000.

Robinhood is a micro-investing app that offers commission-free trading of stocks, ETFs, and options. Unlike Stash Invest and Acorns, Robinhood does not offer a diversified portfolio of ETFs. Instead, users can choose from a range of individual stocks and ETFs to invest in. Robinhood also has a more limited range of investment options compared to Stash Invest and Acorns.

When it comes to fees, Stash Invest is generally the most affordable option. However, Acorns and Robinhood have their own strengths and weaknesses. Acorns offers a more comprehensive range of investment options, while Robinhood offers commission-free trading.

So, which micro-investing app is right for you? Ultimately, the decision will depend on your individual investment goals and preferences. If you’re looking for a user-friendly interface and a range of investment options, Stash Invest may be the best choice. If you’re looking for commission-free trading, Robinhood may be the way to go. And if you’re looking for a more comprehensive range of investment options, Acorns may be the best option.

Regardless of which app you choose, it’s essential to do your research and understand the risks involved before investing. In the next section, we’ll discuss whether Stash Invest is suitable for beginners and provide tips on how to get the most out of the app.

Is Stash Invest Worth It for Beginners?

Stash Invest is a popular micro-investing app that is designed to be user-friendly and accessible to beginners. But is it worth it for those just starting out with investing? In this section, we’ll discuss the pros and cons of using Stash Invest as a beginner and provide tips on how to get the most out of the app.

One of the biggest advantages of Stash Invest for beginners is its ease of use. The app is designed to be intuitive and easy to navigate, making it perfect for those who are new to investing. Additionally, Stash Invest offers a range of educational resources and customer support options, which can be helpful for beginners who are looking to learn more about investing.

Another advantage of Stash Invest for beginners is its low fees. The app charges a monthly fee of just $1 for accounts under $1,000, making it an affordable option for those who are just starting out with investing. Additionally, Stash Invest offers a range of investment options, including ETFs, stocks, and themed portfolios, which can help to diversify a beginner’s portfolio.

However, there are also some potential drawbacks to using Stash Invest as a beginner. One of the biggest disadvantages is the limited investment options. While Stash Invest offers a range of ETFs and stocks, it does not offer as many investment options as some other apps, such as Robinhood or eToro. Additionally, Stash Invest’s fees can be higher for larger accounts, which may be a disadvantage for beginners who are looking to invest larger amounts of money.

So, is Stash Invest worth it for beginners? Overall, the answer is yes. Stash Invest is a user-friendly and affordable app that is perfect for those who are just starting out with investing. While it may have some limitations, the app’s ease of use, educational resources, and low fees make it a great option for beginners. In the next section, we’ll take a closer look at Stash Invest’s investment options and discuss the risks and potential returns of each investment option.

Stash Invest’s Investment Options: A Deep Dive

Stash Invest offers a range of investment options, including ETFs, stocks, and themed portfolios. In this section, we’ll take a closer look at each of these investment options and discuss the risks and potential returns of each.

ETFs (Exchange-Traded Funds) are a popular investment option on Stash Invest. ETFs are a type of investment fund that is traded on a stock exchange, like individual stocks. They offer a diversified portfolio of stocks, bonds, or other assets, and can be a great way to spread risk and potentially increase returns. Stash Invest offers a range of ETFs, including those that track major stock market indexes, such as the S&P 500.

Stocks are another investment option on Stash Invest. Stocks represent ownership in individual companies, and can be a great way to invest in companies that you believe in. Stash Invest offers a range of stocks, including those from well-known companies like Apple and Amazon. However, investing in individual stocks can be riskier than investing in ETFs or other diversified portfolios.

Themed portfolios are a unique investment option on Stash Invest. These portfolios are designed around specific themes, such as technology or healthcare, and offer a diversified portfolio of stocks and ETFs that fit within that theme. Themed portfolios can be a great way to invest in areas that you’re interested in, and can potentially offer higher returns than more traditional investment options.

So, what are the risks and potential returns of each investment option on Stash Invest? ETFs are generally considered to be a lower-risk investment option, as they offer a diversified portfolio of assets. However, they may not offer the same level of returns as individual stocks or themed portfolios. Stocks, on the other hand, can be riskier, as their value can fluctuate rapidly. However, they also offer the potential for higher returns. Themed portfolios can offer a mix of risk and potential returns, depending on the specific theme and investment options.

Ultimately, the best investment option for you will depend on your individual financial goals and risk tolerance. It’s essential to do your research and understand the risks and potential returns of each investment option before investing. In the next section, we’ll break down Stash Invest’s fees and discuss how they impact investment returns.

Stash Invest’s Fees: What You Need to Know

Stash Invest charges a range of fees, including management fees, trading fees, and other expenses. In this section, we’ll break down these fees and discuss how they impact investment returns.

Management fees are the fees charged by Stash Invest to manage your investment portfolio. These fees are typically a percentage of your account balance, and can range from 0.25% to 0.50% per year, depending on the investment option you choose.

Trading fees are the fees charged by Stash Invest to buy and sell securities in your investment portfolio. These fees are typically a flat fee per trade, and can range from $1 to $5 per trade, depending on the type of security being traded.

Other expenses include fees for services such as account maintenance, customer support, and regulatory compliance. These fees are typically a flat fee per month, and can range from $1 to $5 per month, depending on the services used.

So, how do these fees impact investment returns? The answer is that they can have a significant impact, especially over the long-term. For example, a 0.25% management fee may not seem like a lot, but it can add up over time, especially if you have a large investment portfolio.

To minimize fees, it’s essential to understand the fee structure of Stash Invest and to choose the investment options that align with your financial goals and risk tolerance. Additionally, it’s essential to monitor your account regularly and to adjust your investment portfolio as needed to minimize fees.

By understanding the fees associated with Stash Invest and by choosing the right investment options, you can maximize your investment returns and achieve your financial goals. In the next section, we’ll summarize the article’s key points and provide a conclusion on whether Stash Invest is worth it for readers’ investment goals.

Conclusion: Is Stash Invest Worth It for Your Investment Goals?

In conclusion, Stash Invest is a popular micro-investing app that offers a range of features and benefits for investors. With its automated investing, diversified portfolios, and low fees, Stash Invest can be a great option for those looking to start investing or to diversify their existing investment portfolio.

However, as with any investment app, it’s essential to do your research and understand the risks involved before investing. Stash Invest’s fees, investment options, and customer support are all important factors to consider when deciding whether the app is right for you.

Ultimately, whether Stash Invest is worth it for your investment goals will depend on your individual financial situation and goals. If you’re looking for a user-friendly and affordable way to start investing, Stash Invest may be a great option. However, if you’re looking for more advanced investment options or lower fees, you may want to consider other apps.

Our final tips and recommendations for getting the most out of Stash Invest include:

– Start small and be consistent with your investments

– Take advantage of Stash Invest’s educational resources and customer support

– Monitor your account regularly and adjust your investment portfolio as needed

– Consider diversifying your investment portfolio across multiple apps and investment options

By following these tips and doing your research, you can make an informed decision about whether Stash Invest is right for you and get the most out of the app.