What is Real Estate Crowdfunding?

Real estate crowdfunding is a modern investment approach that allows multiple individuals to collectively fund property developments or real estate ventures. By pooling resources through online platforms, investors gain access to this lucrative asset class, which was previously exclusive to high-net-worth individuals and institutional players. This democratization of real estate investment opportunities has fueled the growing significance of real estate crowdfunding in the contemporary investment landscape.

How to Navigate the Crowded Real Estate Crowdfunding Space

Real estate crowdfunding has emerged as a popular investment avenue, with numerous platforms vying for investors’ attention. To successfully navigate this congested market, it is crucial to understand the nuances of the platforms and the factors that distinguish one from another. Here are some key aspects to consider when selecting a real estate crowdfunding platform:

- Transparency: A trustworthy platform should provide clear, comprehensive, and up-to-date information about its investment offerings, fees, and track record. Transparency fosters confidence and helps investors make informed decisions.

- Track Record: Assessing a platform’s past performance is essential to gauge its reliability and competence. While past success does not guarantee future results, it can serve as a useful indicator of the platform’s ability to identify and manage quality investments.

- Fees: Understanding the fee structure is vital to evaluating the overall cost of investing through a particular platform. Common fees include management fees, platform fees, and transaction fees. Investors should compare fees across platforms to ensure they are getting the best value for their money.

- Investment Options: The diversity and quality of investment opportunities offered by a platform can significantly impact an investor’s returns. Consider the types of properties, investment structures, and geographical locations available, as well as the minimum investment requirements.

By carefully examining these factors, real estate crowdfunding beginners can select a platform that aligns with their investment goals and risk tolerance, thereby increasing their chances of success in this burgeoning market.

Understanding the Different Types of Real Estate Crowdfunding Investments

Real estate crowdfunding offers a variety of investment structures, each with its unique set of risks and rewards. Familiarizing yourself with these options is crucial for real estate crowdfunding beginners to make informed investment decisions. Here are the most common investment structures:

- Equity Investments: In this structure, investors receive a share of the property’s ownership, entitling them to a portion of the rental income and capital appreciation. Equity investments typically offer higher potential returns but come with higher risk, as the value of the property may decline. Examples of platforms offering equity investments include Fundrise and RealtyMogul.

- Debt Investments: Also known as real estate loans or mortgage notes, debt investments involve lending money to a developer or property owner in exchange for interest payments and the return of the principal. Debt investments generally provide lower returns than equity investments but offer more predictable income and lower risk. Examples of platforms offering debt investments are PeerStreet and Groundfloor.

- Revenue Sharing: This structure involves investors receiving a predetermined share of the property’s revenues, typically in the form of periodic payments. Revenue sharing is often used for short-term, income-generating projects, such as commercial or residential redevelopments. An example of a platform offering revenue sharing is RealtyShares.

When evaluating these investment structures, consider your risk tolerance, financial goals, and investment horizon. For instance, if you’re seeking stable income and have a low-risk tolerance, debt investments might be more suitable. On the other hand, if you’re willing to accept higher risk in pursuit of potentially higher returns, equity investments could be a better fit. By understanding the different types of real estate crowdfunding investments, beginners can create a well-diversified portfolio tailored to their unique investment objectives.

Assessing Your Risk Tolerance and Financial Goals: A Crucial Step for Real Estate Crowdfunding Beginners

Real estate crowdfunding for beginners involves understanding the importance of aligning investment choices with personal risk tolerance and financial aspirations. By evaluating these factors, investors can make informed decisions that support their long-term financial well-being. Here’s how to get started:

- Identify your risk appetite: Assess your comfort level with financial risk by considering factors such as your investment horizon, financial stability, and emotional resilience. Generally, a shorter investment horizon and greater financial stability correspond to a lower risk tolerance. Conversely, a longer investment horizon and less financial stability may indicate a higher risk tolerance.

- Define your financial objectives: Clearly outline your short- and long-term financial goals, such as saving for retirement, building an emergency fund, or generating passive income. By understanding your objectives, you can select real estate crowdfunding investments that align with your overall financial strategy.

- Match investments with risk tolerance and financial goals: Once you’ve identified your risk appetite and financial objectives, you can choose real estate crowdfunding investments that align with these factors. For instance, if you have a low risk tolerance and seek stable income, debt investments might be more suitable. However, if you’re willing to accept higher risk in pursuit of potentially higher returns, equity investments could be a better fit.

By considering your risk tolerance and financial goals, real estate crowdfunding beginners can create a well-balanced investment strategy tailored to their unique needs. Regularly review and adjust your investment choices as your financial situation and risk appetite evolve to ensure continued alignment with your objectives.

Diversification: The Key to a Successful Real Estate Crowdfunding Portfolio

Real estate crowdfunding for beginners involves understanding the importance of diversification in building a robust investment portfolio. By spreading investments across various property types, geographical locations, and investment structures, investors can optimize returns and mitigate risks. Here’s how to create a diversified real estate crowdfunding portfolio:

- Invest in multiple property types: Diversify your portfolio by allocating funds to different property types, such as residential, commercial, industrial, and retail. Each property type carries unique risks and rewards, and diversification can help minimize the impact of underperforming assets.

- Geographical diversification: Spread your investments across various regions and cities to reduce concentration risk. Real estate markets can be influenced by local economic factors, natural disasters, and regulatory changes. Geographical diversification can help mitigate these risks and capitalize on opportunities in different markets.

- Investment structure diversification: Real estate crowdfunding offers various investment structures, including equity, debt, and revenue sharing. Equity investments provide potential capital appreciation but come with higher risk. Debt investments offer stable income and lower risk but may have lower returns. Revenue sharing, or participating debt, provides a balance between risk and reward.

By following these strategies, real estate crowdfunding beginners can create a well-diversified portfolio that aligns with their risk tolerance and financial objectives. Regularly review and adjust your investment choices as your financial situation and risk appetite evolve to ensure continued alignment with your objectives.

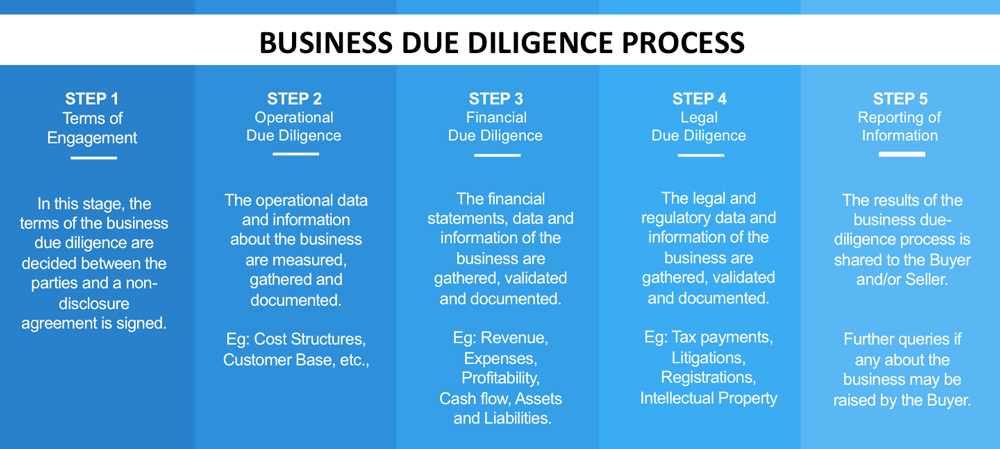

Due Diligence: A Non-Negotiable Step in Real Estate Crowdfunding for Beginners

Real estate crowdfunding for beginners involves understanding the importance of conducting thorough due diligence before investing in any opportunity. Proper research and investigation can help mitigate risks and ensure that the investment aligns with your financial objectives. Here are the key aspects to investigate when evaluating a real estate crowdfunding opportunity:

- Project sponsor: Research the project sponsor’s track record, experience, and reputation in the real estate industry. A reputable sponsor with a proven track record is more likely to successfully execute the project and generate returns.

- Financials: Review the project’s financial projections, budget, and historical performance data. Assess the feasibility of the project’s financial assumptions and the reasonableness of the projected returns.

- Legal structure: Understand the legal structure of the investment, such as the type of entity, the jurisdiction in which it is formed, and the applicable laws and regulations. Ensure that the legal structure is sound and protects your investment.

- Exit strategy: Evaluate the project’s exit strategy and timeline. Understand how and when you can liquidate your investment, and the potential risks and rewards associated with the exit strategy.

By conducting thorough due diligence, real estate crowdfunding beginners can make informed investment decisions that align with their risk tolerance and financial objectives. Regularly review and update your due diligence efforts as new information becomes available and as your financial situation and risk appetite evolve.

Monitoring Your Real Estate Crowdfunding Investments: A Crucial Step for Beginners

Real estate crowdfunding for beginners involves understanding the importance of regular monitoring of your investments. Regular tracking and evaluation of your investments can help you stay informed about their performance, mitigate risks, and make informed decisions about future investments. Here are some ways to monitor your real estate crowdfunding investments and the resources available to help you:

- Platform dashboards: Most real estate crowdfunding platforms provide a dashboard for investors to monitor their investments’ performance. These dashboards typically include information such as the project’s status, financial performance, and updates from the project sponsor. Regularly reviewing this information can help you stay informed about your investments’ progress and identify any potential issues.

- Third-party tools: There are several third-party tools available that can help you track the performance of your real estate crowdfunding investments. For example, some tools allow you to consolidate information from multiple platforms into one dashboard, making it easier to monitor your entire portfolio. Other tools provide market trends and industry developments, helping you stay informed about the broader real estate market.

- Regular communication: Maintaining regular communication with the project sponsor can help you stay informed about the project’s progress and any potential issues. Don’t hesitate to reach out to the sponsor with any questions or concerns you may have. Regular communication can also help build a relationship with the sponsor, which can be beneficial if any issues arise in the future.

By regularly monitoring your real estate crowdfunding investments, you can make informed decisions about future investments and optimize your portfolio’s performance. Staying informed about market trends and industry developments can also help you identify new investment opportunities and stay ahead of the curve in the real estate market.

Harvesting Your Real Estate Crowdfunding Gains: Exit Strategies and Tax Implications

Real estate crowdfunding for beginners involves understanding not only the investment process but also the exit strategies and tax implications. Exiting an investment is an essential aspect of real estate crowdfunding, and investors