Why Investing in the Right Businesses Matters

In today’s fast-paced and ever-evolving economy, investing in the right businesses is crucial for achieving financial success and securing a stable financial future. With the rise of new technologies, industries, and market trends, it’s essential to stay ahead of the curve and make informed investment decisions. Investing in businesses that have potential for growth and returns can help individuals achieve their financial goals, whether it’s saving for retirement, funding a down payment on a house, or simply building wealth.

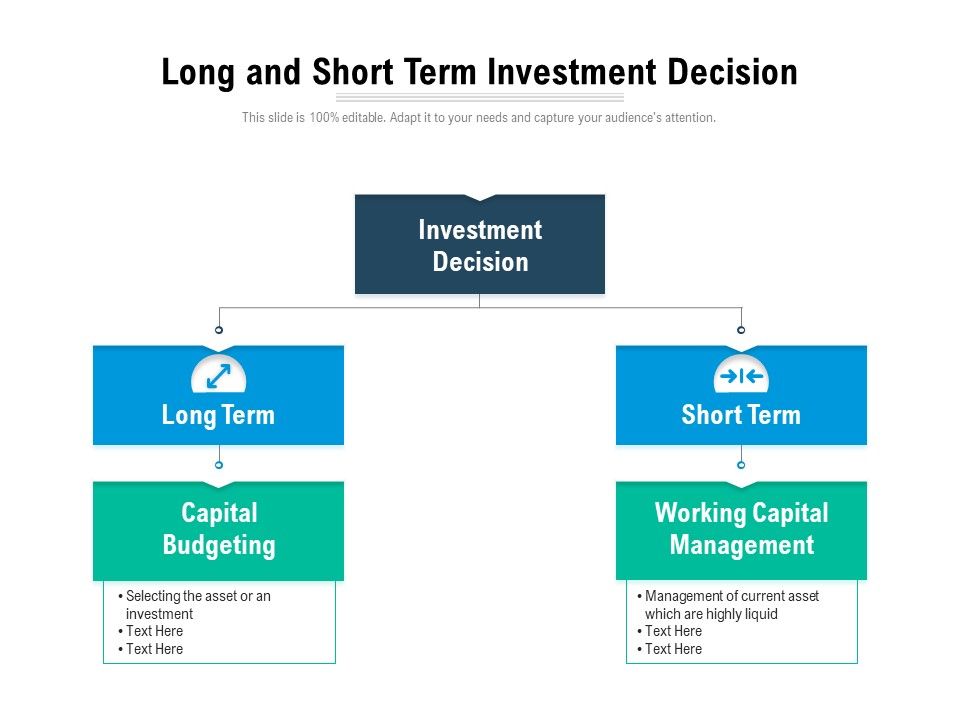

When it comes to investing in businesses, it’s essential to consider the potential for long-term growth and returns. This means looking beyond short-term gains and focusing on companies that have a solid track record of success, a strong management team, and a competitive edge in their industry. By investing in the right businesses, individuals can benefit from the potential for long-term growth, income generation, and wealth creation.

Moreover, investing in businesses can provide a sense of security and stability, especially during times of economic uncertainty. By diversifying a portfolio with a mix of low-risk and high-risk investments, individuals can minimize their exposure to market volatility and maximize their potential for returns. With the right investment strategy, individuals can achieve their financial goals and secure their financial future.

So, what are the key characteristics of businesses to invest in right now? Look for companies with a strong track record of success, a solid financial position, and a competitive edge in their industry. Consider investing in industries that are expected to experience significant growth in the coming years, such as renewable energy, healthcare technology, and e-commerce. By doing your research and making informed investment decisions, you can increase your potential for long-term success and achieve your financial goals.

How to Identify Lucrative Investment Opportunities

Identifying lucrative investment opportunities requires a combination of research, analysis, and due diligence. When searching for businesses to invest in right now, it’s essential to consider several key factors that can help you make informed investment decisions. Here are some tips and strategies to help you identify businesses that are worth investing in:

First, research the market and industry trends to identify areas with potential for growth and returns. Look for industries that are expected to experience significant growth in the coming years, such as renewable energy, healthcare technology, and e-commerce. Analyze the competitive landscape and identify companies that have a strong market position, a solid financial position, and a competitive edge in their industry.

Next, analyze the financial statements of potential investment opportunities to evaluate their financial health and potential for growth. Look for companies with a strong track record of revenue growth, profitability, and cash flow generation. Evaluate the company’s management team and their ability to execute on their business strategy.

Finally, evaluate the potential risks and challenges associated with each investment opportunity. Consider factors such as market volatility, regulatory risks, and competitive risks. By carefully evaluating these factors, you can make informed investment decisions and increase your potential for long-term success.

Some popular tools and resources for identifying lucrative investment opportunities include financial databases, industry reports, and investment research platforms. These resources can provide valuable insights and data to help you make informed investment decisions. Additionally, consider consulting with a financial advisor or investment professional to get personalized advice and guidance.

Top Industries to Invest in for Long-Term Growth

When it comes to investing in businesses to invest in right now, it’s essential to consider industries that are expected to experience significant growth in the coming years. Here are some top industries to consider:

Renewable Energy: The renewable energy industry is expected to experience significant growth in the coming years, driven by increasing demand for clean energy and government policies supporting the transition to renewable energy. Companies like Vestas, Siemens Gamesa, and SunPower are leading the way in this industry.

Healthcare Technology: The healthcare technology industry is expected to experience significant growth in the coming years, driven by the increasing demand for digital health solutions and the need for more efficient healthcare systems. Companies like Athenahealth, Teladoc Health, and Illumina are leading the way in this industry.

E-commerce: The e-commerce industry is expected to experience significant growth in the coming years, driven by the increasing demand for online shopping and the need for more efficient supply chain management. Companies like Amazon, Shopify, and Alibaba are leading the way in this industry.

These industries offer a range of investment opportunities, from established companies to startups and small businesses. By investing in these industries, you can tap into the potential for long-term growth and returns. However, it’s essential to do your research and evaluate the potential risks and challenges associated with each investment opportunity.

Other industries to consider include fintech, cybersecurity, and artificial intelligence. These industries are expected to experience significant growth in the coming years, driven by the increasing demand for digital solutions and the need for more efficient systems.

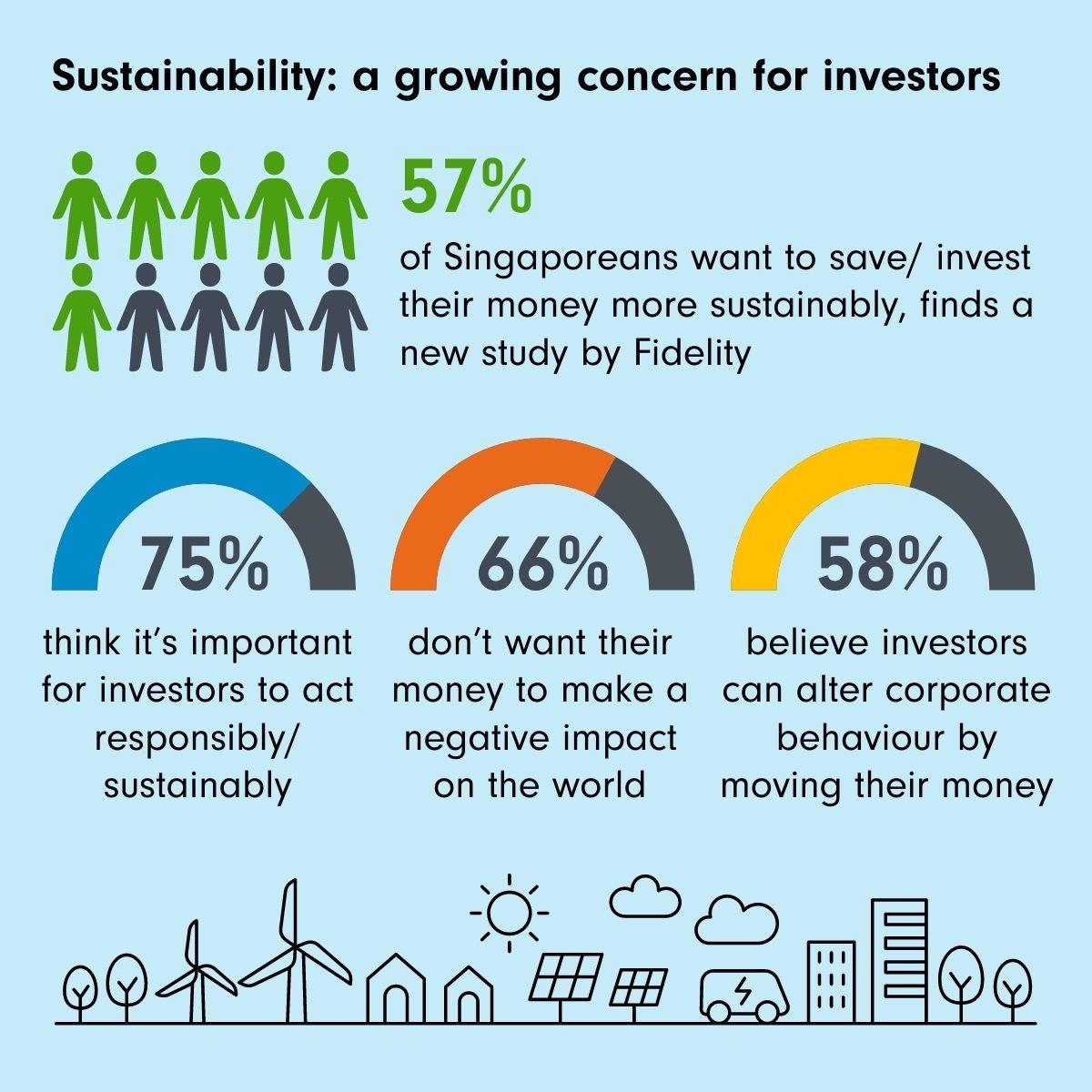

The Rise of Sustainable Investing: Opportunities and Challenges

Sustainable investing is a growing trend that involves investing in businesses that prioritize environmental, social, and governance (ESG) factors. This approach to investing is gaining popularity as investors become increasingly aware of the impact of their investments on the environment and society. When it comes to businesses to invest in right now, sustainable investing offers a range of opportunities for long-term growth and returns.

One of the key benefits of sustainable investing is the potential for long-term growth. Companies that prioritize ESG factors are more likely to be resilient in the face of environmental and social challenges, and are better positioned to capitalize on emerging trends and opportunities. Additionally, sustainable investing can help to reduce risk by avoiding companies that are exposed to ESG-related risks.

However, sustainable investing also presents some challenges. One of the main challenges is the lack of standardization in ESG reporting, which can make it difficult to compare the ESG performance of different companies. Additionally, sustainable investing often requires a long-term perspective, which can be challenging for investors who are focused on short-term gains.

Despite these challenges, there are many successful sustainable companies that offer attractive investment opportunities. For example, companies like Patagonia and REI are leaders in the outdoor apparel industry and have made a commitment to sustainability. Other companies like Vestas and Siemens Gamesa are leading the way in the renewable energy industry.

When it comes to investing in sustainable businesses, there are a range of options to consider. Investors can choose to invest in individual companies, or they can invest in sustainable funds or ETFs. Additionally, investors can consider impact investing, which involves investing in companies that have a specific social or environmental impact.

How to Invest in Small Businesses and Startups

Investing in small businesses and startups can be a lucrative way to grow your wealth, but it requires careful consideration and a solid understanding of the risks and rewards. When it comes to businesses to invest in right now, small businesses and startups offer a range of opportunities for growth and returns.

One way to invest in small businesses and startups is through crowdfunding. Crowdfunding platforms like Kickstarter and Indiegogo allow individuals to invest small amounts of money in exchange for equity or rewards. This approach can be a great way to support innovative ideas and products, but it’s essential to do your research and carefully evaluate the potential risks and returns.

Another way to invest in small businesses and startups is through angel investing. Angel investors provide funding to early-stage companies in exchange for equity, and can offer valuable guidance and mentorship to entrepreneurs. However, angel investing requires a significant amount of capital and a high level of risk tolerance.

Venture capital is another option for investing in small businesses and startups. Venture capital firms provide funding to early-stage companies with high growth potential, and can offer valuable expertise and resources to entrepreneurs. However, venture capital investing requires a significant amount of capital and a high level of risk tolerance.

When investing in small businesses and startups, it’s essential to carefully evaluate the potential risks and returns. Consider factors like the company’s financials, management team, and competitive landscape, and be sure to diversify your portfolio to minimize risk.

Some popular platforms for investing in small businesses and startups include Seedrs, Crowdfunder, and AngelList. These platforms offer a range of investment opportunities, from equity crowdfunding to venture capital investing.

Real Estate Investing: A Stable and Lucrative Option

Real estate investing is a popular and lucrative option for individuals looking to grow their wealth. When it comes to businesses to invest in right now, real estate offers a range of opportunities for stable and long-term returns. From rental income to property appreciation, real estate investing can provide a steady stream of income and a potential for long-term growth.

One of the key benefits of real estate investing is the potential for rental income. By investing in a rental property, individuals can earn a steady stream of income through rental payments. Additionally, real estate values tend to appreciate over time, providing a potential for long-term growth and returns.

Another benefit of real estate investing is the tax benefits. Real estate investors can deduct mortgage interest, property taxes, and operating expenses from their taxable income, reducing their tax liability. Additionally, real estate investors can also benefit from depreciation, which can provide a significant tax deduction.

When it comes to getting started with real estate investing, there are several options to consider. Individuals can invest in a rental property, a real estate investment trust (REIT), or a real estate crowdfunding platform. Each option has its own benefits and risks, and it’s essential to carefully evaluate the potential returns and risks before making an investment.

Some popular real estate investment platforms include Fundrise, Rich Uncles, and RealtyMogul. These platforms offer a range of investment options, from rental properties to REITs, and can provide a convenient and accessible way to invest in real estate.

Overall, real estate investing can be a stable and lucrative option for individuals looking to grow their wealth. By carefully evaluating the potential returns and risks, and considering the tax benefits and other advantages, individuals can make informed investment decisions and achieve their financial goals.

Diversifying Your Investment Portfolio for Maximum Returns

Diversifying an investment portfolio is crucial for minimizing risk and maximizing returns. When it comes to businesses to invest in right now, diversification can help spread risk and increase potential returns. By investing in different asset classes, sectors, and geographies, individuals can reduce their exposure to market volatility and increase their potential for long-term growth.

One way to diversify an investment portfolio is to invest in different asset classes. For example, individuals can invest in stocks, bonds, real estate, and commodities. Each asset class has its own unique characteristics and potential returns, and by investing in a mix of asset classes, individuals can reduce their risk and increase their potential returns.

Another way to diversify an investment portfolio is to invest in different sectors. For example, individuals can invest in technology, healthcare, finance, and consumer goods. Each sector has its own unique characteristics and potential returns, and by investing in a mix of sectors, individuals can reduce their risk and increase their potential returns.

Geographic diversification is also important for minimizing risk and maximizing returns. By investing in businesses in different countries and regions, individuals can reduce their exposure to market volatility and increase their potential for long-term growth.

Some popular ways to diversify an investment portfolio include index funds, exchange-traded funds (ETFs), and mutual funds. These investment vehicles offer a diversified portfolio of stocks, bonds, and other assets, and can provide a convenient and accessible way to invest in a mix of asset classes, sectors, and geographies.

Overall, diversifying an investment portfolio is crucial for minimizing risk and maximizing returns. By investing in different asset classes, sectors, and geographies, individuals can reduce their exposure to market volatility and increase their potential for long-term growth.

Conclusion: Investing in the Right Businesses for Long-Term Success

In conclusion, investing in the right businesses is crucial for long-term success. By doing your research and investing in businesses that align with your financial goals and values, you can increase your potential for long-term growth and returns. Remember to diversify your investment portfolio, invest in different asset classes, sectors, and geographies, and consider the benefits and risks of each investment opportunity.

When it comes to businesses to invest in right now, consider the top industries that are expected to experience significant growth in the coming years, such as renewable energy, healthcare technology, and e-commerce. Also, consider the growing trend of sustainable investing and its potential for long-term growth.

Additionally, consider investing in small businesses and startups, including crowdfunding, angel investing, and venture capital. Real estate investing is also a stable and lucrative option, providing rental income, property appreciation, and tax benefits.

By following these tips and strategies, you can make informed investment decisions and achieve your financial goals. Remember to always do your research, diversify your portfolio, and consider the potential risks and returns of each investment opportunity.

Investing in the right businesses can help you achieve long-term success and secure your financial future. By taking the time to research and invest in businesses that align with your financial goals and values, you can increase your potential for long-term growth and returns.