Understanding the Importance of Hourly Wage Conversion

Converting hourly wages to weekly income is a crucial step in understanding take-home pay, budgeting, and financial planning. Knowing how much one earns on a weekly basis enables individuals to make informed decisions about their finances, plan for the future, and achieve their long-term goals. By converting hourly wages to weekly income, individuals can better manage their expenses, create a realistic budget, and avoid financial stress. Moreover, understanding weekly income helps individuals to negotiate salary, evaluate job offers, and make informed decisions about their career.

In today’s fast-paced economy, it is essential to have a clear understanding of one’s earning potential. With the rise of the gig economy and variable work schedules, calculating weekly income from hourly wages has become more complex. However, with the right tools and knowledge, individuals can unlock their earning potential and take control of their financial future. Whether you’re a freelancer, entrepreneur, or employee, understanding how to convert hourly wages to weekly income is a vital skill that can benefit your financial well-being.

How to Calculate Your Weekly Income from Hourly Wages

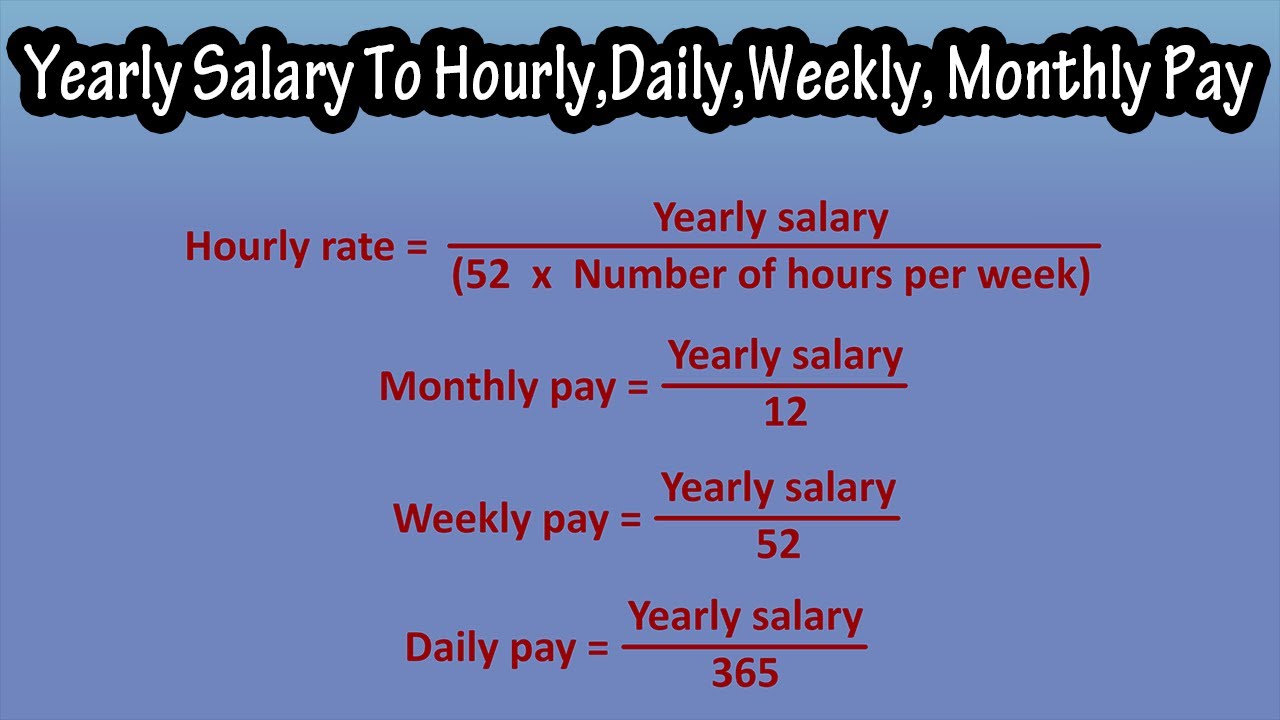

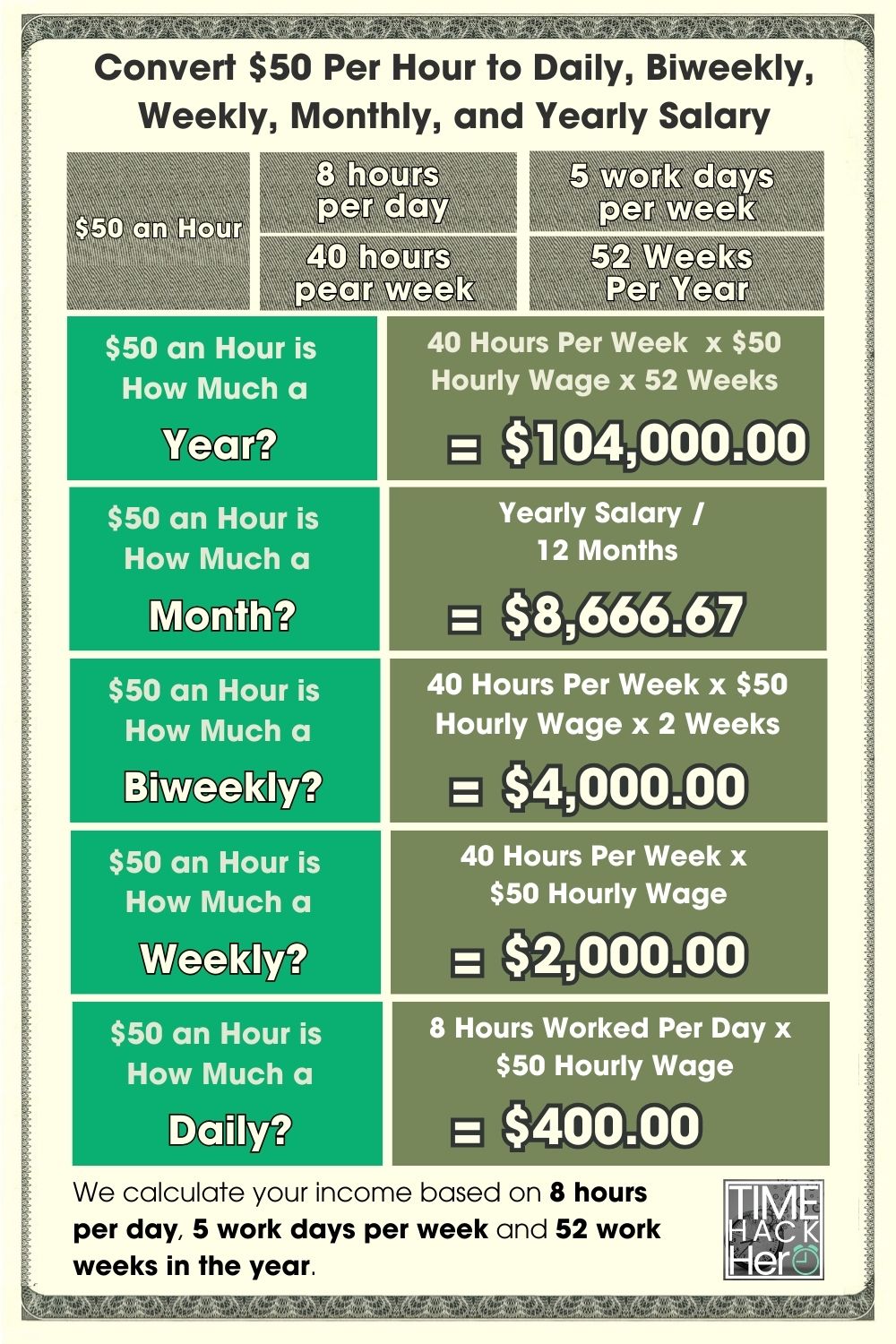

Calculating weekly income from hourly wages is a straightforward process that requires basic arithmetic. The formula to calculate weekly income is: Weekly Income = Hourly Wage x Number of Hours Worked per Week. For example, if you earn $50 an hour and work 40 hours a week, your weekly income would be $50 x 40 = $2,000 per week.

To calculate your weekly income, follow these steps:

- Determine your hourly wage

- Calculate the number of hours you work per week

- Multiply your hourly wage by the number of hours you work per week

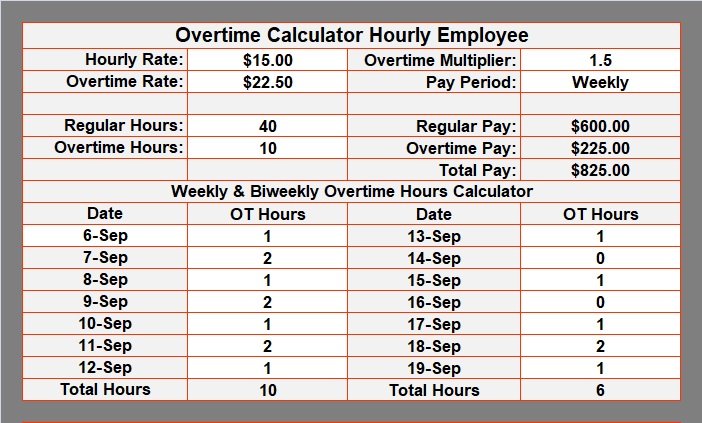

Using the example above, if you earn $50 an hour and work 40 hours a week, your weekly income would be $2,000 per week. However, if you work overtime, your weekly income may be higher. For instance, if you work 50 hours a week, including 10 hours of overtime, your weekly income would be $50 x 50 = $2,500 per week.

It’s essential to note that this calculation does not take into account taxes, benefits, or other factors that may affect your take-home pay. However, it provides a basic understanding of how to calculate weekly income from hourly wages. By using this formula, you can estimate your weekly income and make informed decisions about your finances.

Factors Affecting Your Weekly Income: Overtime, Taxes, and Benefits

While calculating weekly income from hourly wages is a straightforward process, there are several factors that can impact take-home pay. Overtime pay, taxes, and benefits are just a few examples of factors that can affect weekly income. Understanding how these factors work can help individuals make informed decisions about their finances and maximize their earning potential.

Overtime pay, for instance, can significantly impact weekly income. If an individual earns $50 an hour and works 10 hours of overtime per week, their weekly income would increase by $500. However, overtime pay is often subject to different tax rates, which can affect take-home pay. Additionally, some employers may offer benefits, such as health insurance or retirement plans, which can also impact weekly income.

Taxes are another factor that can affect weekly income. Income tax rates vary depending on the individual’s tax bracket, and taxes can be deducted from weekly income. For example, if an individual earns $2,000 per week and is in a 25% tax bracket, their take-home pay would be $1,500 per week. Benefits, such as health insurance or retirement plans, can also be affected by taxes.

Benefits, such as paid time off or sick leave, can also impact weekly income. Some employers may offer benefits that are not subject to taxes, which can increase take-home pay. However, other benefits, such as health insurance, may be subject to taxes and affect weekly income.

Understanding how these factors work can help individuals make informed decisions about their finances and maximize their earning potential. By taking into account overtime pay, taxes, and benefits, individuals can get a more accurate picture of their weekly income and make informed decisions about their financial future.

Converting Hourly Wages to Weekly Income: Real-Life Examples

Let’s consider a few real-life examples of converting hourly wages to weekly income. These examples will help illustrate how different hourly wages, work hours, and overtime pay can impact weekly income.

Example 1: John earns $25 an hour and works 40 hours a week. His weekly income would be $25 x 40 = $1,000 per week.

Example 2: Sarah earns $50 an hour and works 30 hours a week. Her weekly income would be $50 x 30 = $1,500 per week. If she works 10 hours of overtime per week, her weekly income would increase to $50 x 40 = $2,000 per week.

Example 3: Michael earns $30 an hour and works 50 hours a week, including 10 hours of overtime. His weekly income would be $30 x 50 = $1,500 per week. However, if he earns double time for his overtime hours, his weekly income would increase to $30 x 40 + $60 x 10 = $1,800 per week.

These examples demonstrate how different hourly wages, work hours, and overtime pay can impact weekly income. By understanding how to convert hourly wages to weekly income, individuals can better manage their finances and make informed decisions about their earnings.

In addition to these examples, it’s also important to consider the impact of taxes and benefits on weekly income. For instance, if John earns $1,000 per week and is in a 25% tax bracket, his take-home pay would be $750 per week. Similarly, if Sarah earns $2,000 per week and has a benefits package that includes health insurance and retirement savings, her take-home pay may be affected by these benefits.

By considering these factors and using the examples provided, individuals can gain a better understanding of how to convert hourly wages to weekly income and make informed decisions about their financial future.

Maximizing Your Earning Potential: Tips and Strategies

Now that you understand how to convert hourly wages to weekly income, it’s time to explore ways to maximize your earning potential. Whether you’re looking to increase your salary, take on side hustles, or invest in education and training, there are several strategies that can help you achieve your financial goals.

Negotiating salary is one of the most effective ways to increase your earning potential. If you’re currently earning $50 an hour, for example, negotiating a 10% raise could increase your weekly income by $500. To negotiate a salary increase, research the market rate for your position, prepare a solid case for why you deserve a raise, and be confident in your negotiation.

Taking on side hustles is another way to increase your earning potential. Whether it’s freelancing, consulting, or starting a small business, side hustles can provide a supplemental income stream that can help you achieve your financial goals. Consider your skills and interests, and explore opportunities that align with your strengths.

Investing in education and training is also a great way to increase your earning potential. By acquiring new skills or certifications, you can increase your value to your employer and potentially earn a higher salary. Consider taking courses or attending workshops that align with your career goals, and explore opportunities for professional development.

Additionally, consider exploring alternative income streams, such as investing in stocks or real estate, or starting a blog or YouTube channel. These opportunities can provide a passive income stream that can help you achieve your financial goals.

Finally, don’t forget to take advantage of tax-advantaged savings opportunities, such as 401(k) or IRA accounts. By saving for retirement and taking advantage of tax benefits, you can increase your earning potential and achieve your long-term financial goals.

By implementing these strategies, you can maximize your earning potential and achieve your financial goals. Remember to stay focused, stay motivated, and always be looking for opportunities to increase your income and achieve financial success.

Common Mistakes to Avoid When Calculating Weekly Income

When calculating weekly income, it’s easy to make mistakes that can affect the accuracy of your results. Here are some common mistakes to avoid:

Forgetting to account for taxes: Taxes can significantly impact take-home pay, so it’s essential to factor them into your calculations. If you earn $50 an hour and work 40 hours a week, your weekly income before taxes might be $2,000. However, after taxes, your take-home pay might be closer to $1,500.

Not accounting for benefits: Benefits, such as health insurance or retirement plans, can also impact take-home pay. If you earn $50 an hour and work 40 hours a week, your weekly income might be $2,000. However, if you have benefits that cost $500 per month, your take-home pay might be closer to $1,500.

Not considering overtime pay: Overtime pay can significantly impact weekly income, so it’s essential to factor it into your calculations. If you earn $50 an hour and work 50 hours a week, including 10 hours of overtime, your weekly income might be $2,500.

Using incorrect hourly wage: Using an incorrect hourly wage can lead to inaccurate calculations. Make sure to use the correct hourly wage when calculating weekly income.

Not accounting for variable income: If you have a variable income, such as freelance work or commissions, it’s essential to account for this variability when calculating weekly income.

By avoiding these common mistakes, you can ensure that your weekly income calculations are accurate and reliable. Remember to always double-check your calculations and consider all the factors that might impact your take-home pay.

Using Online Calculators and Tools to Simplify the Process

Converting hourly wages to weekly income can be a complex process, but there are many online calculators and tools that can simplify the process. These tools can help you quickly and accurately calculate your weekly income, taking into account factors such as overtime pay, taxes, and benefits.

One popular online calculator is the Hourly Wage Calculator from PayScale. This calculator allows you to enter your hourly wage, number of hours worked per week, and other factors to calculate your weekly income. You can also use the calculator to compare your income to the national average and see how your income stacks up against others in your industry.

Another useful tool is the Weekly Income Calculator from NerdWallet. This calculator allows you to enter your hourly wage, number of hours worked per week, and other factors to calculate your weekly income. You can also use the calculator to see how changes in your hourly wage or number of hours worked per week can impact your weekly income.

In addition to online calculators, there are also many apps and software programs that can help you calculate your weekly income. For example, the Mint app allows you to track your income and expenses, and provides tools to help you calculate your weekly income. The QuickBooks software program also provides tools to help you calculate your weekly income, and can be used to manage your finances and track your income.

Using online calculators and tools can save you time and effort when calculating your weekly income. These tools can also help you make informed decisions about your finances and ensure that you are earning a fair income. Whether you are an employee or an independent contractor, using online calculators and tools can help you take control of your finances and achieve your financial goals.

For example, if you earn $50 an hour and work 40 hours a week, you can use an online calculator to quickly and accurately calculate your weekly income. Simply enter your hourly wage and number of hours worked per week, and the calculator will provide you with your weekly income. This can be a useful tool for anyone who wants to quickly and easily calculate their weekly income.

Conclusion: Taking Control of Your Financial Future

Understanding how to convert hourly wages to weekly income is a crucial step in taking control of your financial future. By knowing how to calculate your weekly income, you can make informed decisions about your earnings and plan for your financial goals. Whether you’re looking to increase your income, pay off debt, or save for retirement, having a clear understanding of your weekly income is essential.

As we’ve discussed throughout this article, converting hourly wages to weekly income is a simple process that requires just a few pieces of information. By using the formula and examples provided, you can quickly and accurately calculate your weekly income. Additionally, by considering factors such as overtime pay, taxes, and benefits, you can get a more accurate picture of your take-home pay.

Remember, taking control of your financial future requires more than just understanding how to convert hourly wages to weekly income. It also requires making informed decisions about your earnings and planning for your financial goals. By using the tips and strategies outlined in this article, you can maximize your earning potential and achieve financial success.

So, if you’re wondering “$50 an hour is how much a week?”, now you know the answer. By using the formula and examples provided, you can calculate your weekly income and take control of your financial future. Don’t let uncertainty about your earnings hold you back from achieving your financial goals. Take control of your financial future today and start building the life you want.