Emergency Funding: Why You Need a Fast Cash Plan

Unexpected expenses and financial emergencies can strike at any moment, leaving individuals and families struggling to make ends meet. Having a plan in place for such situations is crucial to avoid going into debt or experiencing financial hardship. This is where quick cash solutions come into play. Knowing how to get money fast can be a lifesaver during emergency situations, providing a much-needed financial cushion to fall back on.

According to a recent survey, nearly 40% of Americans struggle to cover unexpected expenses, such as car repairs or medical bills. This highlights the importance of having a fast cash plan in place to mitigate financial stress. By understanding the options available for quick cash, individuals can better prepare themselves for unexpected expenses and avoid financial pitfalls.

A fast cash plan can include a variety of strategies, such as building an emergency fund, having a side hustle, or knowing where to find quick cash loans. By having a plan in place, individuals can reduce their financial stress and anxiety, knowing that they have a safety net to fall back on. In this article, we will explore various ways to get money fast, providing readers with a comprehensive guide to emergency funding.

Whether it’s a medical emergency, car breakdown, or unexpected home repair, having access to quick cash can make all the difference. By understanding the options available and having a plan in place, individuals can avoid financial hardship and get back on their feet quickly. In the following sections, we will delve into the various ways to get money fast, providing readers with a valuable resource for emergency funding.

High-Paying Gig Economy Jobs for Fast Cash

The gig economy has revolutionized the way people work, offering flexible and lucrative opportunities for those looking to make money quickly. With the rise of online platforms and apps, it’s easier than ever to find high-paying gig economy jobs that can generate fast cash. In this section, we’ll explore some of the most popular and profitable options.

Freelancing is one of the most popular gig economy jobs, with platforms like Upwork, Fiverr, and Freelancer offering a range of opportunities for skilled professionals. From writing and graphic design to web development and social media management, freelancing allows individuals to monetize their skills and work on a project-by-project basis. With the ability to set their own rates and choose their own projects, freelancers can earn up to $100 per hour or more, making it an attractive option for those looking to get money fast.

Ride-sharing and task-based work are also lucrative gig economy jobs that can generate fast cash. Companies like Uber and Lyft offer drivers the opportunity to earn up to $25 per hour or more, while task-based platforms like TaskRabbit and Amazon’s Mechanical Turk allow individuals to complete small tasks for pay. With the ability to work on their own schedule and choose their own tasks, ride-sharing and task-based workers can earn up to $500 per week or more.

Other high-paying gig economy jobs include online tutoring, pet-sitting, and house-sitting. With platforms like TutorMe and Chegg, individuals can offer their teaching services and earn up to $20 per hour or more. Pet-sitting and house-sitting platforms like Rover and HouseSitter.com offer individuals the opportunity to earn up to $30 per hour or more, taking care of pets and homes while their owners are away.

To get started with gig economy jobs, individuals can simply sign up for the relevant platforms and apps, create a profile, and start applying for jobs or tasks. With the ability to work on their own schedule and choose their own projects, gig economy workers can earn fast cash and achieve financial stability. Whether you’re looking to supplement your income or make a full-time living, gig economy jobs offer a flexible and lucrative way to get money fast.

Selling Unwanted Items: A Fast Way to Make Money

Decluttering and selling unwanted items is a quick and easy way to make money fast. Many people have items lying around their homes that they no longer need or use, and these items can be turned into cash with minimal effort. In this section, we’ll explore the best ways to sell unwanted items and make some extra money.

Online marketplaces are a great place to start when looking to sell unwanted items. Platforms like eBay, Craigslist, and Facebook Marketplace allow users to list their items for sale and reach a large audience. When selling online, it’s essential to take clear photos, write detailed descriptions, and set competitive prices to attract buyers.

Garage sales and yard sales are another excellent way to sell unwanted items quickly. These events allow sellers to showcase their items in person and attract local buyers. To host a successful garage sale, it’s crucial to advertise the event, organize items attractively, and be prepared to negotiate prices.

Consignment shops are also a great option for selling unwanted items, especially for those who want to sell higher-end or specialty items. Consignment shops will take a commission on the sale price, but they will handle the sales process and provide a convenient way to sell items.

Other options for selling unwanted items include flea markets, pawn shops, and local buy/sell/trade groups on social media. When selling items, it’s essential to be realistic about prices and to be prepared to negotiate. With a little creativity and effort, selling unwanted items can be a quick and easy way to make money fast.

Some popular items to sell for fast cash include:

- Gently used clothing and accessories

- Electronics, such as phones, laptops, and tablets

- Furniture and household items

- Books, CDs, and DVDs

- Toys and games

By decluttering and selling unwanted items, individuals can make some extra money quickly and easily. Whether you’re looking to pay off debt, build up your savings, or simply make some extra cash, selling unwanted items is a great way to get started.

Participating in Online Surveys for Quick Rewards

Participating in online surveys is a legitimate way to earn quick rewards and make money fast. Many companies and market research firms conduct online surveys to gather opinions and feedback from consumers, and they are willing to pay individuals for their participation. In this section, we’ll explore the opportunities for making money through online surveys and provide tips on how to get started.

There are numerous websites and apps that offer online surveys for rewards, including Swagbucks, Survey Junkie, and Vindale Research. These platforms connect individuals with companies that need feedback on their products or services, and participants can earn cash, gift cards, or other rewards for completing surveys.

To participate in online surveys, individuals typically need to create an account on a survey website or app and provide some basic demographic information. This information helps companies match participants with relevant surveys and ensures that the feedback is from the target audience. Once an account is created, participants can browse available surveys and start earning rewards.

Some popular survey websites and apps include:

- Swagbucks: Earn points for taking surveys, watching videos, and shopping online, redeemable for gift cards or cash.

- Survey Junkie: Take surveys and earn points, redeemable for cash or e-gift cards.

- Vindale Research: Participate in surveys and earn cash payouts, with opportunities to review products and services.

- Toluna: Take surveys and earn points, redeemable for cash, gift cards, or other rewards.

While participating in online surveys won’t make you rich, it’s a legitimate way to earn some extra money in your free time. To maximize earnings, it’s essential to be honest and thorough in survey responses, as well as to take advantage of other rewards opportunities on survey websites and apps.

When searching for online survey opportunities, it’s crucial to be cautious of scams and ensure that the website or app is reputable. Look for platforms that are transparent about their rewards and payout structures, and read reviews from other participants to get a sense of their experiences.

By participating in online surveys, individuals can earn quick rewards and make some extra money in their free time. Whether you’re looking to supplement your income or simply make some extra cash, online surveys are a legitimate and convenient way to get started.

Delivering Food or Packages for Fast Cash

Delivering food or packages is a flexible and lucrative way to make money fast. With the rise of the gig economy, companies like Uber Eats, DoorDash, and Amazon Flex have created opportunities for individuals to earn money by delivering food or packages to customers. In this section, we’ll explore the options for making money by delivering food or packages and provide tips on how to get started.

Uber Eats is one of the most popular food delivery services, allowing individuals to earn money by delivering food to customers. To become an Uber Eats delivery partner, individuals need to sign up for an account, provide some basic information, and pass a background check. Once approved, delivery partners can start receiving requests and earning money.

DoorDash is another popular food delivery service that allows individuals to earn money by delivering food to customers. To become a DoorDash delivery partner, individuals need to sign up for an account, provide some basic information, and pass a background check. Once approved, delivery partners can start receiving requests and earning money.

Amazon Flex is a package delivery service that allows individuals to earn money by delivering packages to customers. To become an Amazon Flex delivery partner, individuals need to sign up for an account, provide some basic information, and pass a background check. Once approved, delivery partners can start receiving requests and earning money.

Other companies that offer delivery opportunities include GrubHub, Postmates, and Instacart. These companies allow individuals to earn money by delivering food or packages to customers, and often offer flexible scheduling and competitive pay.

To succeed as a delivery partner, it’s essential to have a reliable vehicle, a smartphone, and a strong work ethic. Delivery partners should also be prepared to work in a fast-paced environment and provide excellent customer service.

Some benefits of delivering food or packages for fast cash include:

- Flexible scheduling: Delivery partners can choose when they want to work and how many hours they want to put in.

- Competitive pay: Delivery partners can earn up to $25 per hour or more, depending on the company and the location.

- Opportunity to meet new people: Delivery partners interact with customers and other delivery partners, making it a great way to meet new people.

By delivering food or packages, individuals can earn fast cash and achieve financial stability. Whether you’re looking to supplement your income or make a full-time living, delivering food or packages is a flexible and lucrative way to make money fast.

Part-time Jobs for Fast Cash: Opportunities and Tips

Part-time jobs are an excellent way to earn fast cash, especially for those who need to supplement their income or pay off debt. With the rise of the gig economy, there are numerous part-time job opportunities available that can generate fast cash. In this section, we’ll explore the options for part-time jobs that can generate fast cash and provide tips on how to find and succeed in these roles.

Some popular part-time jobs for fast cash include:

- Customer service representative: Many companies hire part-time customer service representatives to handle customer inquiries and provide support.

- Data entry clerk: Data entry clerks are responsible for entering information into computer systems and can work part-time for various companies.

- Freelance writing or editing: Freelance writers and editors can work on a part-time basis for various clients and projects.

- Tutoring or teaching: Part-time tutors and teachers can work with students and provide educational support.

- House sitting or pet sitting: House sitters and pet sitters can take care of homes and pets while the owners are away and earn fast cash.

To find part-time jobs for fast cash, individuals can search online job boards, such as Indeed or LinkedIn, or check with local companies and businesses. Networking with friends and family can also lead to part-time job opportunities.

Some tips for succeeding in part-time jobs for fast cash include:

- Be flexible: Part-time jobs often require flexibility in terms of scheduling and availability.

- Be reliable: Showing up on time and being reliable is crucial for part-time jobs.

- Be professional: Maintaining a professional attitude and demeanor is essential for part-time jobs.

- Be proactive: Taking initiative and being proactive can lead to more opportunities and faster cash.

Part-time jobs for fast cash can provide a quick solution to financial needs, but it’s essential to remember that these jobs may not provide long-term financial stability. Creating a sustainable financial plan that includes budgeting, saving, and investing is crucial for long-term financial success.

By exploring part-time job opportunities and following the tips outlined above, individuals can earn fast cash and achieve financial stability. Whether you’re looking to supplement your income or pay off debt, part-time jobs for fast cash can provide a quick solution to financial needs.

Avoiding Scams: How to Stay Safe While Making Money Fast

When trying to make money fast, it’s essential to be aware of the potential scams and pitfalls that can lead to financial loss. Scammers often target individuals who are desperate for quick cash, and it’s crucial to be cautious and vigilant when exploring opportunities for making money fast. In this section, we’ll discuss common scams and pitfalls and provide advice on how to stay safe and avoid financial risks.

Some common scams to watch out for include:

- Pyramid schemes: These schemes promise high returns for recruiting new members, but they often collapse, leaving participants with significant financial losses.

- Phishing scams: Scammers may pose as legitimate companies or individuals, asking for personal or financial information to steal identities or money.

- Advance fee scams: Scammers may promise a loan or investment opportunity, but require an upfront fee, which is often never refunded.

- Online job scams: Scammers may post fake job ads, asking for payment or personal information in exchange for a job that doesn’t exist.

To avoid these scams, it’s essential to be cautious and do your research before investing in any opportunity. Here are some tips to stay safe:

- Research the company or individual: Check for reviews, ratings, and testimonials from other customers or clients.

- Verify the opportunity: Make sure the opportunity is legitimate and not a scam.

- Be wary of upfront fees: Be cautious of opportunities that require an upfront fee, especially if it’s a significant amount.

- Keep personal and financial information private: Never share personal or financial information with strangers or unverified sources.

Additionally, it’s essential to be aware of the warning signs of a scam, including:

- Guaranteed high returns: If an opportunity promises unusually high returns, it’s likely a scam.

- Pressure to act quickly: Scammers often try to create a sense of urgency to get you to act quickly, without doing your research.

- Lack of transparency: If an opportunity is unclear or secretive about its terms or conditions, it’s likely a scam.

By being aware of these common scams and pitfalls, you can protect yourself from financial loss and stay safe while making money fast. Remember to always do your research, be cautious, and verify the opportunity before investing.

Creating a Sustainable Financial Plan for Long-term Success

While quick cash solutions can provide temporary financial relief, it’s essential to create a sustainable financial plan that goes beyond short-term fixes. A well-crafted financial plan can help individuals achieve long-term financial stability, reduce debt, and build wealth. In this section, we’ll discuss the importance of creating a sustainable financial plan and provide tips on how to get started.

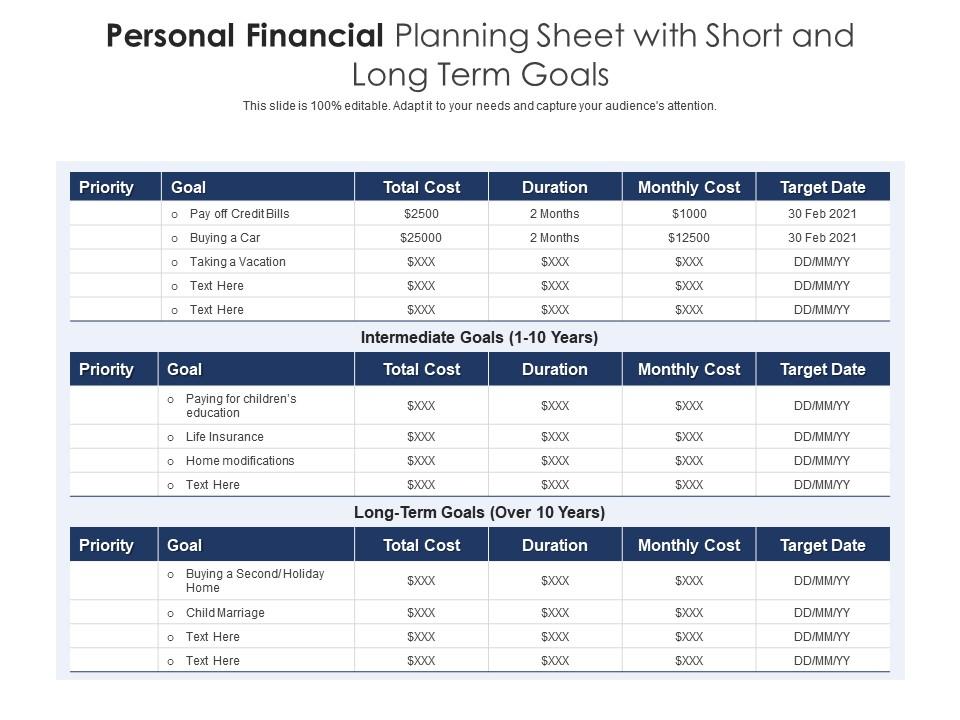

A sustainable financial plan should include the following components:

- Budgeting: Create a realistic budget that accounts for all income and expenses.

- Saving: Set aside a portion of income each month for short-term and long-term savings goals.

- Investing: Invest in a diversified portfolio of stocks, bonds, and other assets to grow wealth over time.

- Debt management: Develop a plan to pay off high-interest debt and avoid new debt.

- Emergency funding: Build an emergency fund to cover unexpected expenses and avoid going into debt.

To create a sustainable financial plan, individuals should start by assessing their current financial situation, including income, expenses, debts, and savings. Next, they should set clear financial goals, such as paying off debt, building an emergency fund, or saving for retirement. Finally, they should develop a plan to achieve these goals, including budgeting, saving, and investing.

Some tips for creating a sustainable financial plan include:

- Automate savings: Set up automatic transfers from checking to savings or investment accounts.

- Use the 50/30/20 rule: Allocate 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- Invest for the long-term: Avoid getting caught up in get-rich-quick schemes and focus on long-term investing.

- Monitor and adjust: Regularly review and adjust the financial plan to ensure it’s on track to meet goals.

By creating a sustainable financial plan, individuals can achieve long-term financial stability and reduce their reliance on quick cash solutions. Remember, financial stability is a marathon, not a sprint, and it’s essential to take a long-term approach to achieve success.