Understanding the Math Behind Hourly and Weekly Earnings

Converting hourly wages to weekly earnings is a straightforward process that requires a basic understanding of math. The key to accurate calculations lies in considering the number of hours worked per week. This may seem obvious, but it’s surprising how often this factor is overlooked, leading to incorrect assumptions about take-home pay. For instance, if someone earns $30 an hour, it’s tempting to assume that their weekly earnings would be $30 multiplied by the number of hours worked. However, this calculation doesn’t take into account the variability of hours worked per week, which can significantly impact weekly earnings.

To illustrate this point, consider two individuals who earn $30 an hour. Person A works 40 hours a week, while Person B works 35 hours a week. Although they earn the same hourly wage, their weekly earnings will differ due to the difference in hours worked. Person A’s weekly earnings would be $30 x 40 = $1200, while Person B’s weekly earnings would be $30 x 35 = $1050. This example highlights the importance of considering the number of hours worked per week when calculating weekly earnings.

Furthermore, understanding the math behind hourly and weekly earnings can help individuals make informed decisions about their finances. By knowing how to calculate their weekly earnings accurately, they can better budget their expenses, plan for the future, and make adjustments to their work schedule as needed.

How to Calculate Your Weekly Earnings from an Hourly Wage

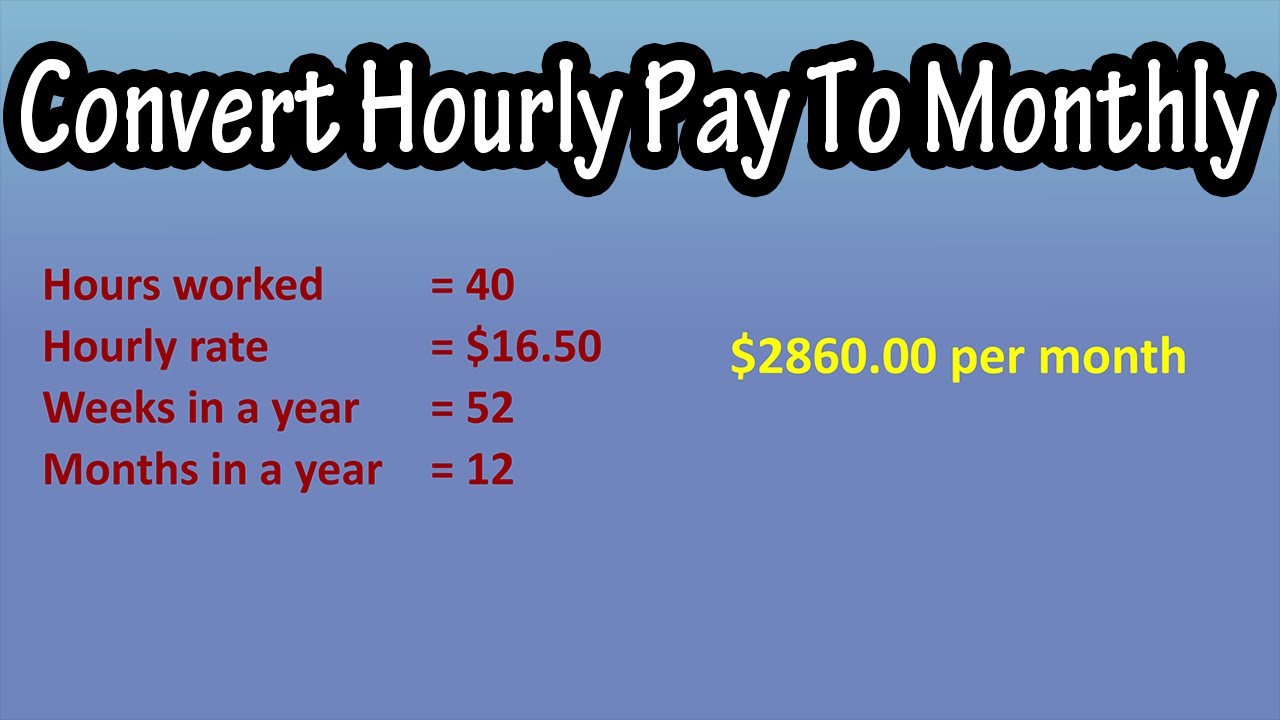

Calculating weekly earnings from an hourly wage is a simple process that requires just a few pieces of information. To get started, you’ll need to know your hourly wage and the number of hours you work per week. Once you have this information, you can use the following formula to calculate your weekly earnings:

Weekly Earnings = Hourly Wage x Number of Hours Worked per Week

For example, let’s say you earn $30 an hour and work 40 hours per week. Using the formula above, your weekly earnings would be:

Weekly Earnings = $30 x 40 = $1200

This calculation assumes that you work a standard 40-hour workweek, but what if you work more or fewer hours? To calculate your weekly earnings in these cases, simply adjust the number of hours worked per week in the formula. For instance, if you work 35 hours per week, your weekly earnings would be:

Weekly Earnings = $30 x 35 = $1050

It’s also important to note that this calculation does not take into account overtime pay, which can significantly impact your weekly earnings. We’ll discuss the impact of overtime and variable hours on weekly earnings in more detail later in this article.

The Impact of Overtime and Variable Hours on Weekly Earnings

Overtime and variable hours can significantly impact weekly earnings, and it’s essential to consider these factors when calculating take-home pay. Overtime pay is typically calculated at a rate of 1.5 times the regular hourly wage, and it can add up quickly. For example, if you earn $30 an hour and work 10 hours of overtime in a week, your overtime pay would be:

Overtime Pay = $30 x 1.5 x 10 = $450

This amount would be added to your regular weekly earnings, resulting in a higher take-home pay. However, it’s crucial to note that overtime pay can vary depending on the employer, industry, and location.

Variable hours, on the other hand, can affect weekly earnings in different ways. If you work a variable schedule, your hours may fluctuate from week to week, impacting your weekly earnings. For instance, if you work 40 hours one week and 35 hours the next, your weekly earnings would be different for each week.

To accurately calculate weekly earnings with variable hours, it’s essential to keep track of the number of hours worked each week. This can be done using a timesheet or a scheduling app. By accurately tracking hours worked, you can ensure that your weekly earnings are calculated correctly, taking into account any overtime or variable hours.

In addition to overtime and variable hours, other factors can impact weekly earnings, such as shift differentials, bonuses, and commissions. These factors can add complexity to the calculation of weekly earnings, but they can also provide opportunities for increased take-home pay.

A Real-Life Example: Converting $30 an Hour to a Weekly Wage

Let’s use the example of $30 an hour to illustrate how to calculate weekly earnings. Assume that an individual works 40 hours per week at this hourly wage. To calculate their weekly earnings, we can use the formula:

Weekly Earnings = Hourly Wage x Number of Hours Worked per Week

Plugging in the numbers, we get:

Weekly Earnings = $30 x 40 = $1200

This means that if someone earns $30 an hour and works 40 hours per week, their weekly earnings would be $1200. However, this calculation assumes a standard 40-hour workweek, and actual hours worked may vary.

Now, let’s consider a scenario where the individual works 35 hours per week instead of 40. Using the same formula, we get:

Weekly Earnings = $30 x 35 = $1050

This shows that even a small change in the number of hours worked per week can impact weekly earnings. In this case, the individual’s weekly earnings would be $150 less than if they worked 40 hours per week.

This example highlights the importance of accurately calculating weekly earnings based on the actual number of hours worked. By using the correct formula and considering the number of hours worked, individuals can get a more accurate picture of their take-home pay.

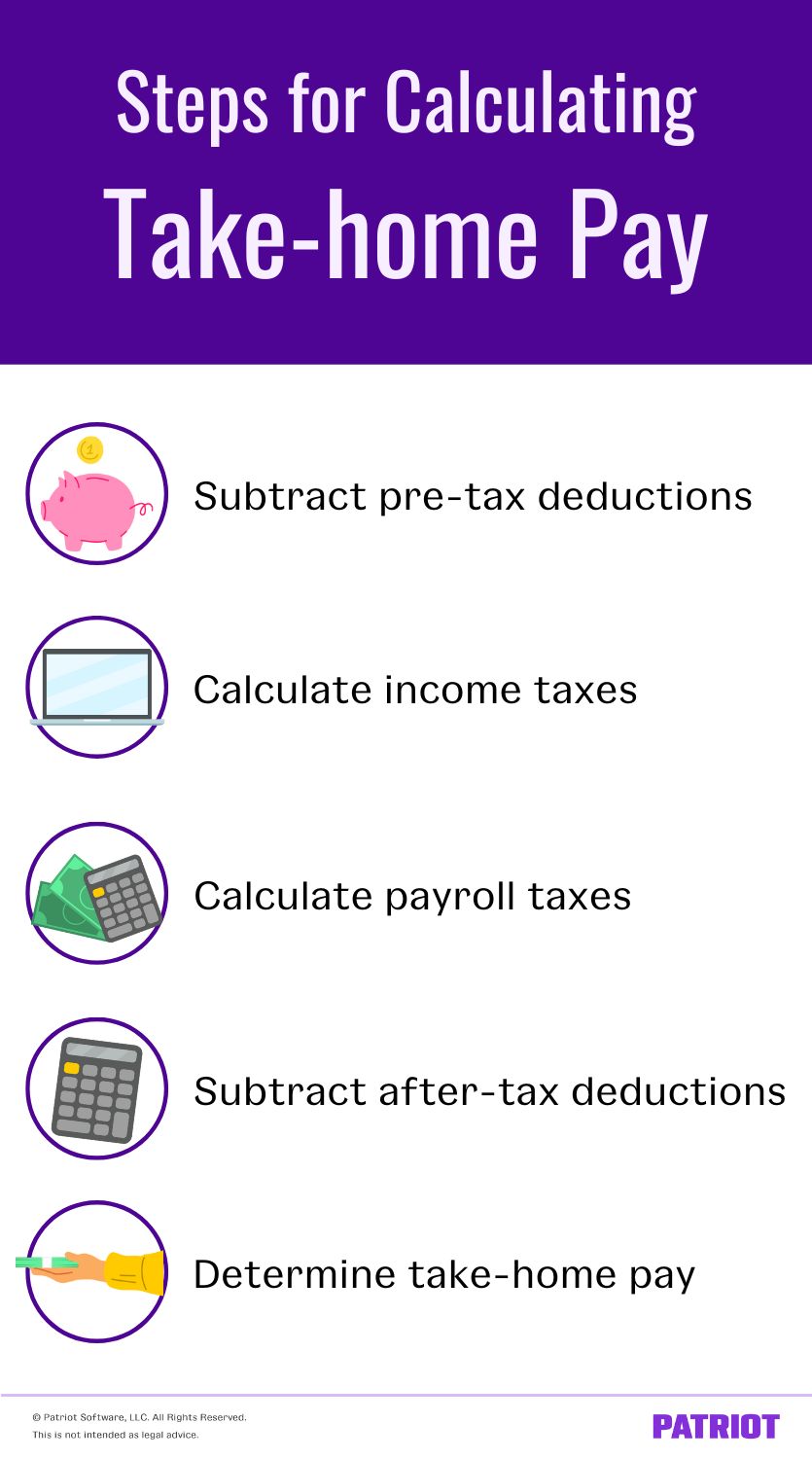

Factors That Can Influence Your Take-Home Pay

When calculating weekly earnings, it’s essential to consider various factors that can impact take-home pay. Taxes, deductions, and benefits can all affect the amount of money you take home each week. For example, if you earn $30 an hour and work 40 hours per week, your weekly earnings would be $1200. However, after taxes and deductions, your take-home pay might be significantly lower.

Taxes can be a significant factor in reducing take-home pay. Federal, state, and local taxes can all take a bite out of your weekly earnings. Additionally, deductions such as health insurance, retirement plans, and other benefits can also reduce your take-home pay.

Benefits, on the other hand, can increase your take-home pay. For example, if you receive a bonus or overtime pay, your take-home pay will increase accordingly. However, it’s essential to note that benefits can also be subject to taxes and deductions, which can reduce their value.

To accurately calculate take-home pay, it’s crucial to consider all the factors that can impact it. This includes taxes, deductions, benefits, and any other factors that may affect your weekly earnings. By taking these factors into account, you can get a more accurate picture of your take-home pay and make informed decisions about your finances.

For instance, if you earn $30 an hour and work 40 hours per week, your weekly earnings would be $1200. However, after taxes and deductions, your take-home pay might be around $900. This is a significant difference, and it’s essential to understand how these factors can impact your take-home pay.

Using Online Calculators and Tools to Simplify the Process

Calculating weekly earnings from an hourly wage can be a straightforward process, but it can also be time-consuming and prone to errors. Fortunately, there are many online calculators and tools available that can simplify the process and provide accurate results.

One popular online calculator is the Hourly Wage Calculator, which allows users to input their hourly wage and number of hours worked per week to calculate their weekly earnings. This calculator also takes into account overtime pay and variable hours, making it a useful tool for those who work irregular schedules.

Another useful tool is the Paycheck Calculator, which allows users to input their hourly wage, number of hours worked per week, and other factors such as taxes and deductions to calculate their take-home pay. This calculator provides a detailed breakdown of the user’s pay, including gross pay, taxes, and net pay.

In addition to online calculators, there are also many mobile apps available that can help simplify the process of calculating weekly earnings. For example, the Wage Calculator app allows users to input their hourly wage and number of hours worked per week to calculate their weekly earnings, and also provides a detailed breakdown of their pay.

Using online calculators and tools can save time and reduce errors when calculating weekly earnings. They can also provide a detailed breakdown of pay, including gross pay, taxes, and net pay, which can be useful for budgeting and financial planning.

For example, if you earn $30 an hour and work 40 hours per week, you can use an online calculator to calculate your weekly earnings. Simply input your hourly wage and number of hours worked per week, and the calculator will provide your weekly earnings. You can also use the calculator to calculate your take-home pay, including taxes and deductions.

Common Mistakes to Avoid When Calculating Weekly Earnings

When calculating weekly earnings, it’s easy to make mistakes that can lead to incorrect results. Here are some common mistakes to avoid:

Incorrect Assumptions: One of the most common mistakes is making incorrect assumptions about the number of hours worked per week. For example, assuming a standard 40-hour workweek when the actual hours worked may be more or less.

Miscalculations: Another common mistake is miscalculating the weekly earnings. This can happen when using incorrect formulas or failing to account for overtime or variable hours.

Ignoring Taxes and Deductions: Failing to account for taxes and deductions can also lead to incorrect results. This can result in an overestimation of take-home pay.

Not Considering Benefits: Benefits such as health insurance, retirement plans, and other perks can also impact take-home pay. Failing to consider these benefits can lead to an inaccurate calculation of weekly earnings.

To avoid these mistakes, it’s essential to carefully review the calculation and ensure that all factors are considered. Using online calculators and tools can also help simplify the process and reduce errors.

For example, if you earn $30 an hour and work 40 hours per week, you may assume that your weekly earnings are $1200. However, if you fail to account for taxes and deductions, your take-home pay may be significantly lower.

By avoiding these common mistakes, you can ensure that your calculation of weekly earnings is accurate and reliable.

Conclusion: Mastering the Art of Converting Hourly Wages to Weekly Earnings

In conclusion, converting hourly wages to weekly earnings is a straightforward process that requires a basic understanding of math. By considering the number of hours worked per week, overtime and variable hours, taxes, deductions, and benefits, individuals can accurately calculate their weekly earnings.

Using online calculators and tools can simplify the process and reduce errors. However, it’s essential to avoid common mistakes such as incorrect assumptions and miscalculations.

By mastering the art of converting hourly wages to weekly earnings, individuals can better understand their take-home pay and make informed decisions about their finances.

Remember, $30 an hour is how much a week? The answer depends on the number of hours worked per week, overtime and variable hours, taxes, deductions, and benefits. By considering these factors, individuals can accurately calculate their weekly earnings and take control of their finances.

Final tips and recommendations:

Always consider the number of hours worked per week when calculating weekly earnings.

Use online calculators and tools to simplify the process and reduce errors.

Avoid common mistakes such as incorrect assumptions and miscalculations.

Take into account overtime and variable hours, taxes, deductions, and benefits when calculating weekly earnings.

By following these tips and recommendations, individuals can master the art of converting hourly wages to weekly earnings and achieve financial stability.