Why Buying an Existing Small Business Can Be a Smart Move

When considering entrepreneurship, many individuals opt to start their own business from scratch. However, buying an existing small business can be a smart move, offering several benefits that can set you up for success. For one, purchasing an existing business reduces startup risks, as the company already has an established customer base, revenue stream, and market presence. This can be particularly advantageous for those who are new to entrepreneurship or looking to expand their portfolio.

Another significant advantage of buying an existing small business is the potential for immediate cash flow. Unlike startups, which often require significant upfront investment and may take years to generate revenue, existing businesses typically have a established customer base and revenue stream. This can provide a steady income stream from day one, allowing you to focus on growing and expanding the business rather than just trying to stay afloat.

In addition to reduced startup risks and immediate cash flow, buying an existing small business can also provide access to established systems, processes, and infrastructure. This can save you time and money, as you won’t have to invest in building these systems from scratch. Furthermore, existing businesses often have established relationships with suppliers, vendors, and partners, which can be invaluable in helping you navigate the market and build your business.

When searching for a small business to buy, it’s essential to consider your goals, resources, and expertise. Look for businesses that align with your interests and skills, and that have a strong potential for growth and profitability. You can find small businesses for sale through online marketplaces, business brokers, and networking with other entrepreneurs. By doing your research and finding the right business, you can set yourself up for success and achieve your entrepreneurial goals.

Whether you’re a seasoned entrepreneur or just starting out, buying an existing small business can be a smart move. With reduced startup risks, immediate cash flow, and established systems and infrastructure, you can focus on growing and expanding your business rather than just trying to stay afloat. So why not consider buying an existing small business and take the first step towards achieving your entrepreneurial dreams?

How to Find the Right Small Business for Sale

When searching for a small business to buy, it’s essential to know where to look. With numerous options available, it can be overwhelming to find the right business that meets your needs and goals. In this section, we’ll explore the best ways to find small businesses for sale, including online marketplaces, business brokers, and networking with other entrepreneurs.

Online marketplaces are a great place to start your search. Websites like BizBuySell, BizQuest, and Merger Labs offer a wide range of small businesses for sale, from retail stores to restaurants and service-based companies. These platforms provide a convenient way to browse listings, filter by location and industry, and connect with sellers directly.

Another option is to work with a business broker. Business brokers specialize in buying and selling businesses and can provide valuable guidance throughout the process. They often have access to a network of businesses for sale and can help you find the right opportunity. Additionally, business brokers can assist with negotiations, due diligence, and other aspects of the buying process.

Networking with other entrepreneurs is also an effective way to find small businesses for sale. Attend industry events, join business organizations, and connect with other business owners in your network. You can also leverage social media platforms like LinkedIn to connect with potential sellers and learn about businesses for sale.

When searching for a small business to buy, it’s crucial to consider your goals, resources, and expertise. Look for businesses that align with your interests and skills, and that have a strong potential for growth and profitability. By exploring online marketplaces, working with business brokers, and networking with other entrepreneurs, you can find the right small business for sale and achieve your entrepreneurial goals.

Remember, finding the right small business for sale takes time and effort. Be patient, persistent, and thorough in your search, and don’t be afraid to seek advice from professionals along the way. With the right approach, you can find a business that meets your needs and sets you up for success.

Top Online Marketplaces to Buy Small Businesses

When searching for a small business to buy, online marketplaces can be a valuable resource. These platforms provide a convenient way to browse listings, filter by location and industry, and connect with sellers directly. In this section, we’ll review some of the top online marketplaces for buying small businesses, including BizBuySell, BizQuest, and Merger Labs.

BizBuySell is one of the largest online marketplaces for buying and selling businesses. With over 100,000 listings, it offers a wide range of small businesses for sale, from retail stores to restaurants and service-based companies. BizBuySell provides a user-friendly interface, allowing buyers to filter listings by location, industry, and price range. Additionally, the platform offers a range of tools and resources, including business valuation calculators and financing options.

BizQuest is another popular online marketplace for buying small businesses. With over 50,000 listings, it offers a diverse range of businesses for sale, including franchises, restaurants, and retail stores. BizQuest provides a comprehensive search function, allowing buyers to filter listings by location, industry, and price range. The platform also offers a range of resources, including business valuation guides and financing options.

Merger Labs is a relatively new online marketplace for buying and selling businesses. With a focus on technology and e-commerce businesses, it offers a unique range of listings for buyers. Merger Labs provides a user-friendly interface, allowing buyers to filter listings by location, industry, and price range. The platform also offers a range of resources, including business valuation calculators and financing options.

When using online marketplaces to buy a small business, it’s essential to be cautious and thorough in your search. Make sure to research the platform, read reviews, and understand the fees associated with using the service. Additionally, be prepared to provide detailed information about your business goals and financial situation to ensure a successful transaction.

By leveraging online marketplaces, buyers can access a wide range of small businesses for sale, from local retail stores to national franchises. Whether you’re a seasoned entrepreneur or just starting out, online marketplaces can provide a valuable resource for finding the right business opportunity.

The Role of Business Brokers in Small Business Sales

When buying or selling a small business, working with a business broker can be a valuable asset. Business brokers specialize in facilitating the buying and selling process, providing expertise and guidance throughout the transaction. In this section, we’ll explore the role of business brokers in small business sales and how they can help facilitate a smooth transaction.

One of the primary services offered by business brokers is valuation. They can help determine the value of the business, taking into account factors such as financial performance, market trends, and growth potential. This information is crucial in determining a fair purchase price and ensuring a successful transaction.

Business brokers also play a key role in marketing the business. They can help create a marketing plan, including advertising, networking, and other promotional activities. This helps attract potential buyers and increases the chances of a successful sale.

Another important service offered by business brokers is negotiation. They can help facilitate communication between the buyer and seller, ensuring that both parties are on the same page and that the transaction is completed smoothly. Business brokers can also help negotiate the purchase price and terms, ensuring that the deal is fair and beneficial to both parties.

In addition to these services, business brokers can also provide guidance on the buying and selling process. They can help navigate the complexities of the transaction, ensuring that all necessary paperwork is completed and that the transfer of ownership is smooth.

When working with a business broker, it’s essential to choose a reputable and experienced professional. Look for a broker who has a proven track record of success and who is knowledgeable about the industry and market. By working with a qualified business broker, you can ensure a successful transaction and achieve your goals.

Business brokers can be a valuable resource for both buyers and sellers. By providing expertise and guidance throughout the transaction, they can help facilitate a smooth and successful sale. Whether you’re looking to buy or sell a small business, consider working with a business broker to ensure a successful outcome.

What to Look for When Buying a Small Business

When buying a small business, it’s essential to conduct a thorough evaluation to ensure you’re making a smart investment. In this section, we’ll outline key factors to consider when evaluating a small business for sale, including financials, market trends, and growth potential.

Financials are a critical aspect of any business, and it’s essential to review the company’s financial statements, including income statements, balance sheets, and cash flow statements. This will help you understand the business’s revenue streams, expenses, and profitability. Look for any red flags, such as declining revenue or increasing expenses, and assess the company’s overall financial health.

Market trends are another important factor to consider when buying a small business. Research the industry and market to understand the current trends and outlook. Is the industry growing or declining? Are there any changes in consumer behavior or technology that could impact the business? Understanding market trends will help you assess the business’s potential for growth and profitability.

Growth potential is also a critical factor to consider when buying a small business. Look for businesses with a strong potential for growth, such as those with a unique product or service, a strong online presence, or a growing customer base. Assess the company’s competitive advantage and its ability to adapt to changes in the market.

In addition to financials, market trends, and growth potential, it’s also essential to evaluate the business’s management team, employees, and operations. Look for businesses with a strong, experienced management team and a skilled workforce. Assess the company’s operational efficiency and its ability to adapt to changes in the market.

When evaluating a small business for sale, it’s also essential to consider the company’s online presence, including its website, social media, and online reviews. A strong online presence can help attract new customers and increase revenue. Look for businesses with a professional website, active social media accounts, and positive online reviews.

By considering these key factors, you can make an informed decision when buying a small business. Remember to conduct thorough research, assess the company’s financials, market trends, and growth potential, and evaluate the business’s management team, employees, and operations.

Due Diligence: A Critical Step in the Buying Process

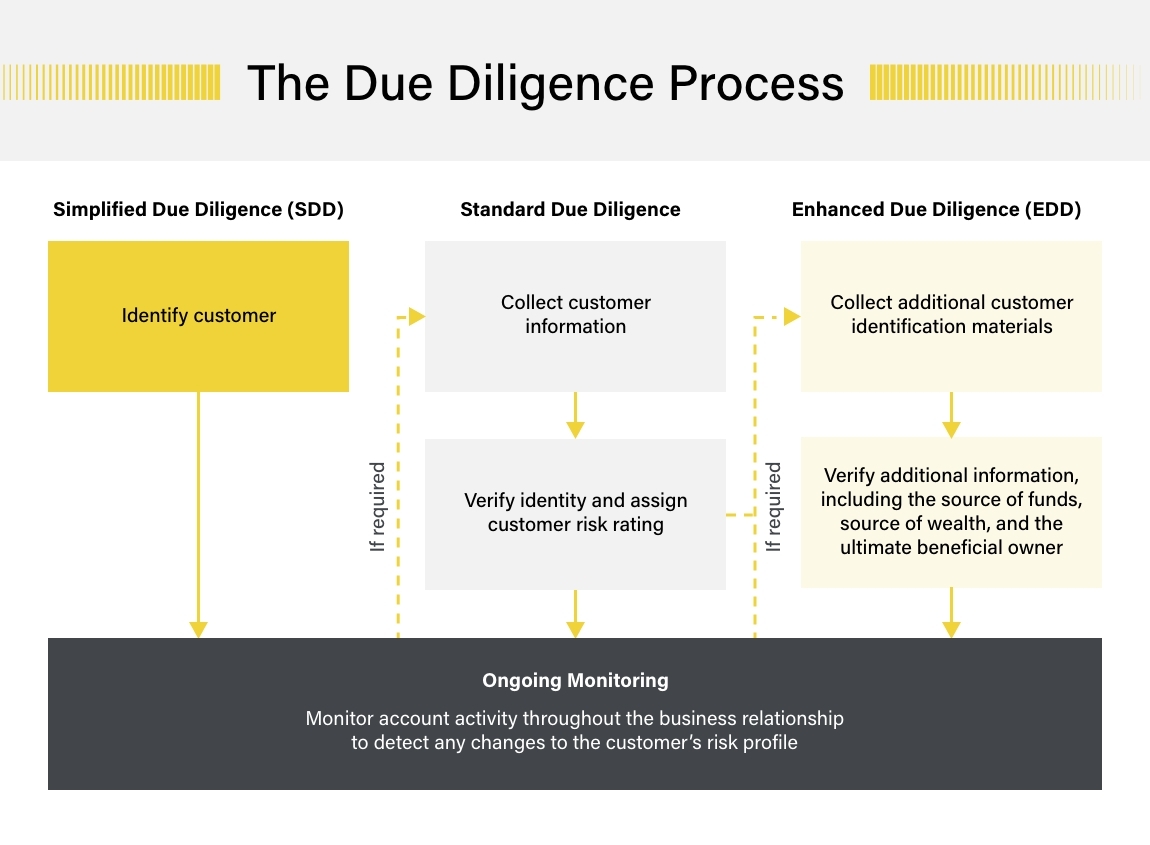

Due diligence is a critical step in the buying process when purchasing a small business. It involves a thorough examination of the business’s financial statements, operations, and other aspects to ensure that you’re making a smart investment. In this section, we’ll emphasize the importance of conducting thorough due diligence and provide guidance on what to look for during this process.

Reviewing financial statements is a crucial part of due diligence. This includes examining the business’s income statements, balance sheets, and cash flow statements to understand its revenue streams, expenses, and profitability. Look for any red flags, such as declining revenue or increasing expenses, and assess the company’s overall financial health.

Assessing liabilities is also an important part of due diligence. This includes examining the business’s debts, loans, and other financial obligations to ensure that you understand the company’s financial obligations. Look for any potential risks or liabilities that could impact the business’s financial health.

Evaluating the business’s online presence is also critical during due diligence. This includes examining the company’s website, social media accounts, and online reviews to understand its online reputation and presence. Look for any potential issues or concerns that could impact the business’s online reputation.

Conducting due diligence can be a time-consuming and complex process, but it’s essential to ensure that you’re making a smart investment. By reviewing financial statements, assessing liabilities, and evaluating the business’s online presence, you can gain a comprehensive understanding of the business and make an informed decision.

It’s also important to note that due diligence is not a one-time process, but rather an ongoing process that continues throughout the buying process. As you gather more information and conduct further research, you may need to adjust your approach or reassess your decision to purchase the business.

By conducting thorough due diligence, you can minimize the risks associated with buying a small business and ensure that you’re making a smart investment. Remember to stay vigilant and continue to gather information throughout the buying process to ensure a successful outcome.

Negotiating the Purchase Price and Terms

Negotiating the purchase price and terms is a critical step in the buying process when purchasing a small business. It’s essential to approach this step with a clear understanding of the business’s value, the seller’s motivations, and the terms of the sale. In this section, we’ll offer advice on how to negotiate the purchase price and terms, including understanding the seller’s motivations, using data to support your offer, and being prepared to walk away.

Understanding the seller’s motivations is crucial when negotiating the purchase price and terms. Ask questions about the seller’s reasons for selling, their desired sale price, and their expectations for the sale process. This information can help you tailor your offer and negotiation strategy to meet the seller’s needs.

Using data to support your offer is also essential when negotiating the purchase price and terms. Gather financial data, market research, and other relevant information to support your offer and demonstrate the business’s value. This data can help you make a strong case for your offer and negotiate a better price.

Being prepared to walk away is also critical when negotiating the purchase price and terms. If the seller is unwilling to meet your offer or negotiate the terms, be prepared to walk away from the deal. This demonstrates that you’re not desperate and can help you negotiate a better price.

Negotiating the purchase price and terms can be a complex and time-consuming process, but it’s essential to get it right. By understanding the seller’s motivations, using data to support your offer, and being prepared to walk away, you can negotiate a fair price and terms that meet your needs.

It’s also important to note that negotiation is a give-and-take process. Be open to compromise and willing to make concessions to reach a mutually beneficial agreement. Remember, the goal is to reach a fair and reasonable agreement that meets both parties’ needs.

By following these tips and being prepared, you can negotiate a successful purchase price and terms that meet your needs and ensure a smooth transition.

Finalizing the Purchase and Ensuring a Smooth Transition

Once you’ve negotiated the purchase price and terms, it’s time to finalize the purchase and ensure a smooth transition. This involves drafting a purchase agreement, transferring ownership, and planning for a successful transition. In this section, we’ll discuss the final steps in the buying process and provide guidance on how to ensure a smooth transition.

Drafting a purchase agreement is a critical step in the buying process. This document outlines the terms of the sale, including the purchase price, payment terms, and any conditions or contingencies. It’s essential to work with a lawyer or attorney to ensure that the agreement is comprehensive and protects your interests.

Transferring ownership is also a critical step in the buying process. This involves updating the business’s records, notifying the relevant authorities, and transferring the ownership of any assets or property. It’s essential to work with a lawyer or attorney to ensure that the transfer is done correctly and that all necessary paperwork is completed.

Planning for a successful transition is also essential. This involves developing a transition plan, which outlines the steps necessary to ensure a smooth transition. This plan should include details on how to transfer ownership, update records, and notify employees and customers.

Ensuring a smooth transition is critical to the success of the business. It’s essential to work closely with the seller to ensure that the transition is done correctly and that all necessary steps are taken. This includes providing training and support to employees, updating systems and processes, and ensuring that all necessary paperwork is completed.

By following these steps and working closely with the seller, you can ensure a smooth transition and set the business up for success. Remember to stay organized, communicate effectively, and be prepared to address any issues that may arise during the transition process.

Finalizing the purchase and ensuring a smooth transition is a critical step in the buying process. By working closely with the seller, drafting a comprehensive purchase agreement, and planning for a successful transition, you can ensure that the business is set up for success and that the transition is done correctly.

/BuyingABusiness-56a82f873df78cf7729cdf36.jpg)