Understanding the Importance of Annual Salary Calculations

Knowing your annual salary is crucial for understanding your financial situation and making informed decisions about your career and personal life. Annual salary calculations provide a clear picture of your total earnings, enabling you to assess your purchasing power, negotiate salary, and plan for taxes. Having a comprehensive understanding of your annual salary can also help you create a realistic budget, prioritize expenses, and make smart financial decisions. In today’s competitive job market, being aware of your annual salary can give you a competitive edge when negotiating salary or considering job offers. Furthermore, accurate annual salary calculations can help you avoid financial pitfalls, such as underestimating your tax liability or overspending. By understanding the importance of annual salary calculations, you can take control of your financial future and make informed decisions that align with your goals and aspirations.

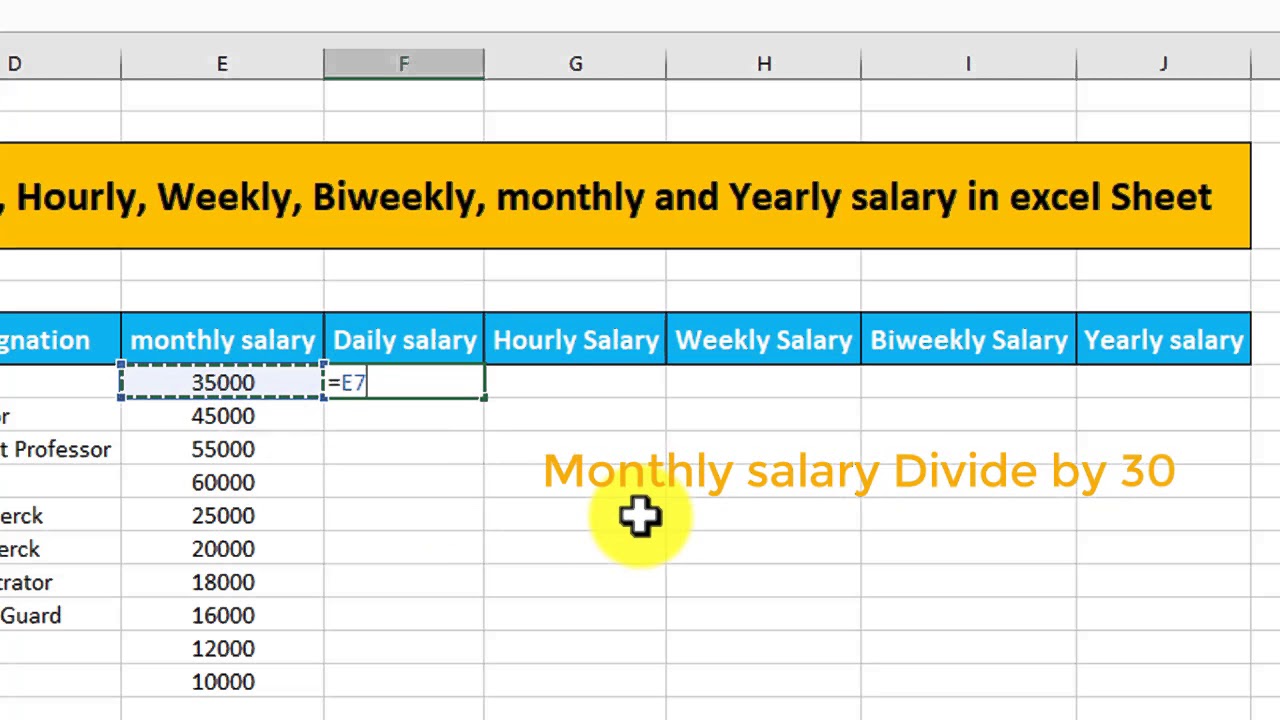

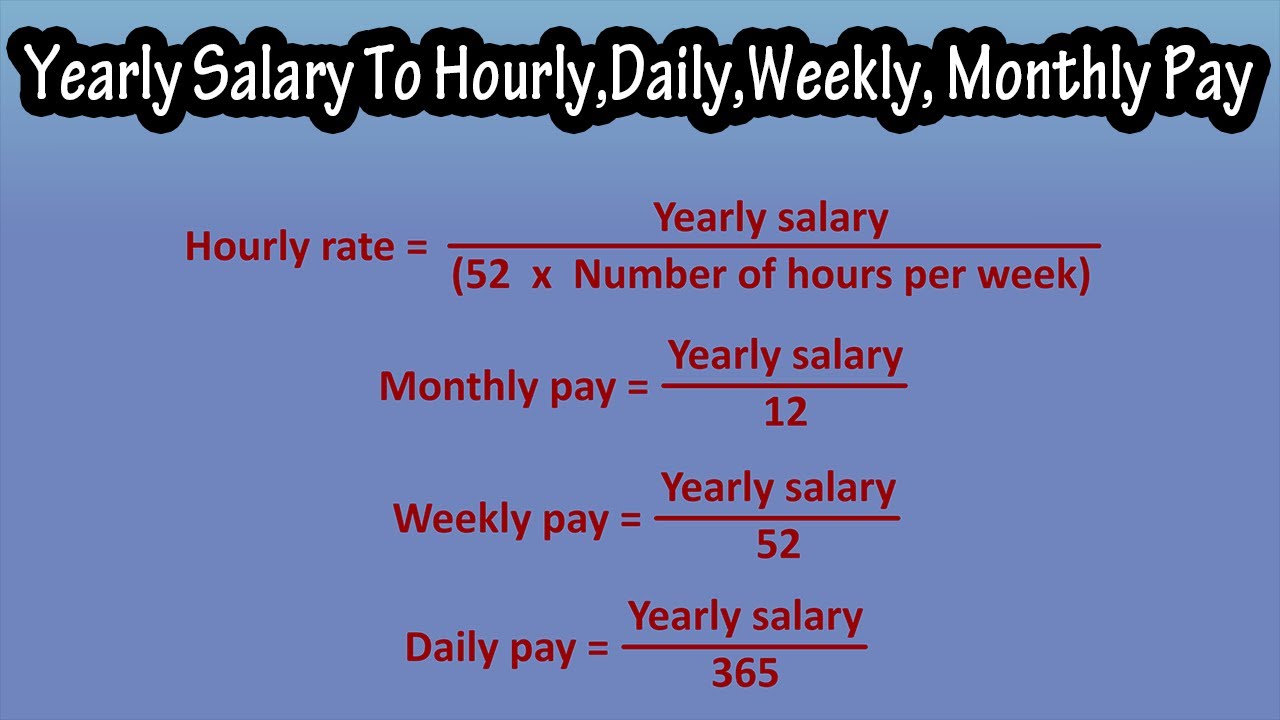

How to Calculate Annual Salary from Monthly Income

Calculating annual salary from monthly income is a straightforward process that requires only a few simple steps. To calculate your annual salary, you can use the following formula: Annual Salary = Monthly Salary x 12. For example, if you earn $2000 a month, your annual salary would be $2000 x 12 = $24,000. This calculation assumes that you work a standard 12-month year and do not take into account any bonuses, overtime, or other forms of compensation. By using this formula, you can easily convert your monthly income to an annual salary, giving you a better understanding of your total earnings and helping you to make more informed financial decisions.

What is $2000 a Month Annually? A Real-World Example

Let’s take a closer look at what $2000 a month annually translates to in terms of annual salary. Using the formula we discussed earlier (Annual Salary = Monthly Salary x 12), we can calculate the annual salary as follows: $2000 x 12 = $24,000. This means that if you earn $2000 a month, your annual salary would be $24,000. But what does this mean in real-world terms? For example, if you’re considering a job offer with a monthly salary of $2000, knowing the annual salary equivalent can help you better understand the total compensation package. Additionally, having a clear understanding of your annual salary can also help you plan for taxes, benefits, and other expenses. In this example, knowing that $2000 a month annually is equivalent to $24,000 can help you make more informed decisions about your financial planning and career goals.

Factors Affecting Annual Salary Calculations

While calculating annual salary from monthly income may seem straightforward, there are several factors that can affect the accuracy of the calculation. One of the most significant factors is taxes. Taxes can significantly impact the take-home pay, and failing to account for taxes can result in an inaccurate annual salary calculation. Additionally, deductions such as health insurance, retirement contributions, and other benefits can also impact the final annual salary amount. Bonuses and overtime pay can also affect annual salary calculations, as they may not be included in the regular monthly income. Furthermore, changes in salary or income during the year can also impact the accuracy of the calculation. It’s essential to consider these factors when calculating annual salary to ensure an accurate and realistic representation of total earnings.

Common Mistakes to Avoid When Calculating Annual Salary

When calculating annual salary, there are several common mistakes to avoid. One of the most significant mistakes is neglecting taxes and deductions. Failing to account for taxes and deductions can result in an inaccurate annual salary calculation, which can have significant implications for financial planning. Another common mistake is failing to consider bonuses and overtime pay. These additional forms of income can significantly impact the total annual salary, and neglecting to include them can result in an inaccurate calculation. Additionally, using outdated or incorrect information can also lead to errors in annual salary calculations. To avoid these mistakes, it’s essential to use accurate and up-to-date information, and to consider all forms of income and deductions when calculating annual salary. By avoiding these common mistakes, individuals can ensure that their annual salary calculations are accurate and reliable.

Using Online Tools to Calculate Annual Salary

Calculating annual salary can be a straightforward process, but it can also be time-consuming and prone to errors. Fortunately, there are many online tools and calculators that can help with annual salary calculations. These tools can provide accurate and instant calculations, taking into account various factors such as taxes, deductions, and bonuses. Some popular online tools for calculating annual salary include salary calculators, tax calculators, and financial planning tools. These tools can be found on websites such as PayScale, Glassdoor, and NerdWallet. When using online tools to calculate annual salary, it’s essential to ensure that the tool is accurate and reliable. Look for tools that are regularly updated and take into account the latest tax laws and regulations. Additionally, be sure to input accurate and up-to-date information to ensure accurate calculations. By using online tools to calculate annual salary, individuals can save time and reduce errors, making it easier to plan for their financial future.

How Annual Salary Affects Your Financial Planning

Knowing your annual salary is crucial for effective financial planning. It allows you to create a realistic budget, prioritize expenses, and make informed decisions about saving and investing. With a clear understanding of your annual salary, you can determine how much you can afford to spend on housing, transportation, and other living expenses. Additionally, knowing your annual salary can help you plan for taxes, benefits, and other deductions that can impact your take-home pay. By incorporating your annual salary into your financial planning, you can make more informed decisions about your money and achieve your long-term financial goals. For example, if you earn $2000 a month annually, you can use this information to determine how much you can afford to invest in a retirement account or save for a down payment on a house. By considering your annual salary in your financial planning, you can create a more accurate and effective financial plan.

Conclusion: The Importance of Accurate Annual Salary Calculations

In conclusion, accurate annual salary calculations are crucial for effective financial planning and decision-making. By understanding how to calculate annual salary from monthly income, individuals can make informed decisions about their career, finances, and long-term goals. Whether you’re negotiating a salary, planning for taxes, or simply trying to understand your purchasing power, knowing your annual salary is essential. By avoiding common mistakes and using online tools and resources, individuals can ensure that their annual salary calculations are accurate and reliable. Remember, knowing how much is 2000 a month annually can have a significant impact on your financial planning and decision-making. By taking the time to understand and calculate your annual salary, you can take control of your finances and achieve your long-term goals.