Understanding the Purpose of the W4 Form

The W4 form is a crucial document that determines the amount of taxes withheld from an employee’s paycheck. The form is used to report an employee’s income, deductions, and exemptions to the employer, who then uses this information to calculate the correct amount of taxes to withhold. The W4 form is essential for ensuring that employees are not over- or under-withheld, which can result in a large tax bill or a smaller refund at the end of the year.

Recent changes to the W4 form have made it more important than ever to complete it accurately. The new form takes into account the Tax Cuts and Jobs Act (TCJA) and other tax law changes, which have impacted the way taxes are calculated. To ensure that employees are not caught off guard by these changes, it’s essential to understand the purpose of the W4 form and how to complete it correctly.

One of the primary reasons for completing the W4 form accurately is to avoid over-withholding. When an employee is over-withheld, they may receive a large refund at the end of the year, but this can also mean that they have been giving the government an interest-free loan throughout the year. On the other hand, under-withholding can result in a large tax bill and potential penalties. By completing the W4 form correctly, employees can ensure that they are not over- or under-withheld and that they are taking home the correct amount of money each month.

To complete the W4 form accurately, employees need to understand how to report their income, deductions, and exemptions. This includes understanding the different types of income, such as wages, salaries, and tips, as well as the various deductions and exemptions available, such as the standard deduction and exemptions for dependents. By taking the time to understand the W4 form and how to complete it correctly, employees can ensure that they are not missing out on valuable tax savings and that they are in compliance with tax laws.

Learning how to fill out the new W4 form is a crucial step in managing one’s taxes effectively. By taking the time to understand the form and how to complete it accurately, employees can avoid common mistakes and ensure that they are taking home the correct amount of money each month. Whether you’re a new employee or have been working for years, understanding the W4 form is essential for managing your taxes and avoiding potential penalties.

Gathering Necessary Information Before You Start

Before filling out the new W4 form, it’s essential to gather all the necessary information to ensure accurate completion. This includes personal and financial information that will help determine the correct amount of taxes to withhold. To get started, employees should have the following documents and information readily available:

A valid Social Security number or Individual Taxpayer Identification Number (ITIN)

Current address and any previous addresses for the past year

Dependent information, including names, dates of birth, and Social Security numbers

Information about other income sources, such as investments, self-employment income, or income from other jobs

Information about deductions and exemptions, such as mortgage interest, charitable donations, or education expenses

Employees should also have a copy of their previous year‘s tax return, as well as any relevant tax documents, such as W-2s and 1099s. Having this information readily available will help ensure that the W4 form is completed accurately and efficiently.

When gathering information, employees should also consider any changes that may have occurred since the previous year, such as a change in marital status, number of dependents, or income level. These changes can impact the amount of taxes withheld, so it’s essential to report them accurately on the W4 form.

By taking the time to gather all the necessary information, employees can ensure that their W4 form is completed accurately and that they are not over- or under-withheld. This will help minimize the risk of errors and ensure that employees are taking home the correct amount of money each month. Learning how to fill out the new W4 form requires attention to detail and a thorough understanding of the information required.

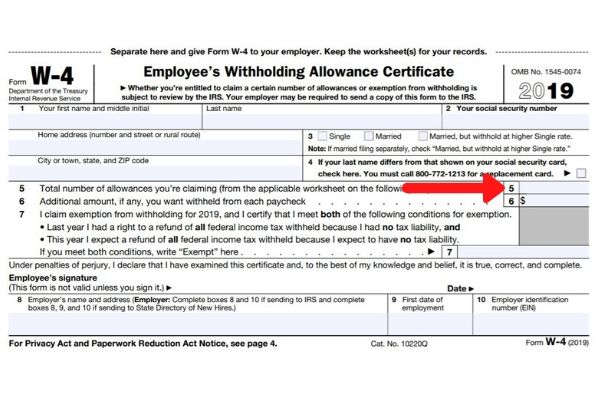

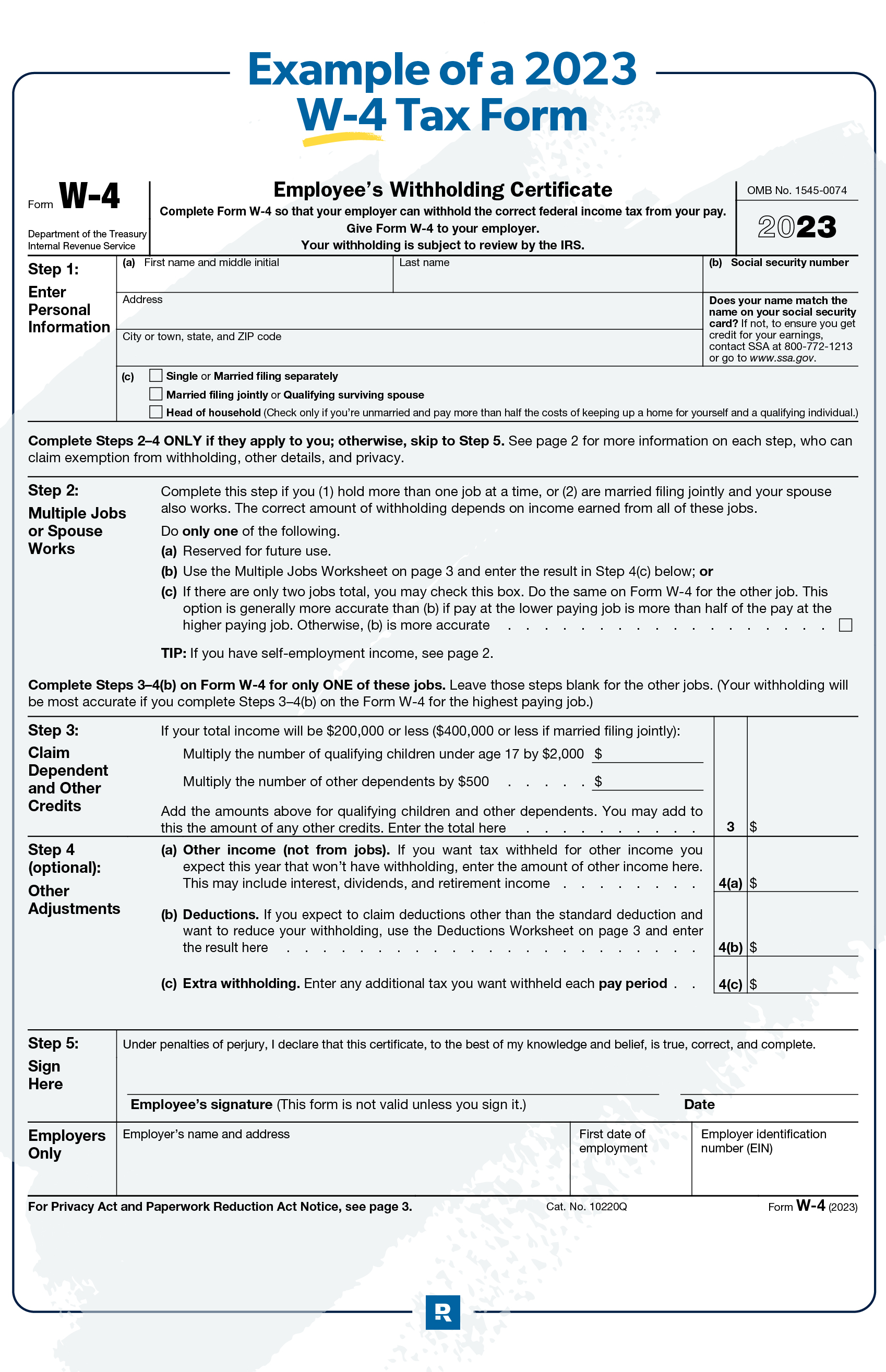

Breaking Down the New W4 Form: Sections and Fields Explained

The new W4 form is divided into several sections, each with its own set of fields and requirements. Understanding each section and field is crucial for accurate completion of the form. Here’s a breakdown of the different sections and fields:

**Section 1: Employee Information**

This section requires employees to provide their name, Social Security number, and address. It’s essential to ensure that this information is accurate, as it will be used to identify the employee and determine their tax withholdings.

**Section 2: Filing Status**

In this section, employees must select their filing status, which determines their tax withholdings. The options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

**Section 3: Dependents**

Employees can claim dependents in this section, which can impact their tax withholdings. Dependents can include children, spouses, and other relatives who meet specific requirements.

**Section 4: Other Income**

This section requires employees to report other income sources, such as investments, self-employment income, and income from other jobs. This information is used to determine the employee’s total income and tax withholdings.

**Section 5: Deductions and Exemptions**

In this section, employees can claim deductions and exemptions, such as mortgage interest, charitable donations, and education expenses. These deductions and exemptions can reduce the employee’s taxable income and lower their tax withholdings.

**Section 6: Additional Withholdings**

Employees can request additional withholdings in this section, which can help reduce their tax liability. This can be useful for employees who have other sources of income or who want to minimize their tax bill.

By understanding each section and field on the new W4 form, employees can ensure accurate completion and minimize errors. It’s essential to take the time to review each section carefully and provide accurate information to avoid any issues with tax withholdings.

Learning how to fill out the new W4 form requires attention to detail and a thorough understanding of the different sections and fields. By following these guidelines, employees can ensure accurate completion and minimize errors.

Claiming Dependents and Reporting Income: What You Need to Know

Claiming dependents and reporting income are two crucial aspects of filling out the new W4 form. Understanding the rules and guidelines for claiming dependents and reporting income can help employees minimize their tax liability and ensure accurate completion of the form.

**Defining a Dependent**

A dependent is an individual who meets specific requirements and is claimed on the W4 form. Dependents can include children, spouses, and other relatives who meet the requirements. To qualify as a dependent, the individual must meet one of the following tests:

Relationship test: The individual must be a relative, such as a child, spouse, or parent.

Residency test: The individual must have lived with the employee for at least six months of the year.

Income test: The individual must have gross income below a certain threshold, which is adjusted annually for inflation.

Support test: The employee must have provided more than half of the individual’s support for the year.

**Reporting Income from Multiple Jobs or Sources**

Employees who work multiple jobs or have income from other sources must report this income on the W4 form. This includes income from self-employment, investments, and other jobs. Employees must also report any income that is not subject to withholding, such as income from a side hustle or freelance work.

**How to Report Income**

To report income from multiple jobs or sources, employees must complete the following steps:

1. List all income sources, including jobs, self-employment income, and investments.

2. Calculate the total income from all sources.

3. Report the total income on the W4 form.

**Impact on Tax Withholdings**

Claiming dependents and reporting income can impact tax withholdings. Employees who claim dependents may be eligible for a larger standard deduction, which can reduce their tax liability. Reporting income from multiple jobs or sources can also impact tax withholdings, as employees may be subject to a higher tax rate.

By understanding the rules and guidelines for claiming dependents and reporting income, employees can ensure accurate completion of the W4 form and minimize their tax liability. Learning how to fill out the new W4 form requires attention to detail and a thorough understanding of the different sections and fields.

Multiple Jobs and Income Sources: How to Complete the W4 Form

Completing the W4 form can be more complex when working multiple jobs or having income from other sources. Employees who have multiple jobs or income sources must report this income on the W4 form to ensure accurate tax withholdings.

**Reporting Multiple Jobs**

Employees who work multiple jobs must report all income from each job on the W4 form. This includes income from part-time jobs, freelance work, and other sources of income. Employees must also report any income that is not subject to withholding, such as income from a side hustle or investments.

**Reporting Self-Employment Income**

Employees who are self-employed must report their self-employment income on the W4 form. This includes income from freelance work, consulting, and other self-employment activities. Self-employed individuals must also report any business expenses related to their self-employment income.

**Reporting Investments**

Employees who have investments must report any income from these investments on the W4 form. This includes income from stocks, bonds, and other investments. Employees must also report any capital gains or losses from the sale of investments.

**How to Report Multiple Income Sources**

To report multiple income sources, employees must complete the following steps:

1. List all income sources, including jobs, self-employment income, and investments.

2. Calculate the total income from all sources.

3. Report the total income on the W4 form.

**Impact on Tax Withholdings**

Reporting multiple income sources can impact tax withholdings. Employees who have multiple jobs or income sources may be subject to a higher tax rate, which can impact their take-home pay. By accurately reporting all income sources on the W4 form, employees can ensure that their tax withholdings are accurate and minimize any potential tax liability.

Learning how to fill out the new W4 form requires attention to detail and a thorough understanding of the different sections and fields. By following these guidelines, employees can ensure accurate completion of the W4 form and minimize any potential tax liability.

Minimizing Tax Withholdings: Strategies for Reducing Your Tax Liability

Minimizing tax withholdings is an essential aspect of managing one’s tax liability. By understanding the strategies for reducing tax withholdings, employees can ensure that they are not over-withholding and minimize their tax liability.

**Adjusting Income Reporting**

One strategy for minimizing tax withholdings is to adjust income reporting. Employees can report their income more accurately by taking into account any deductions or exemptions they are eligible for. This can include deductions for mortgage interest, charitable donations, or education expenses.

**Claiming Deductions**

Claiming deductions is another strategy for minimizing tax withholdings. Employees can claim deductions for expenses related to their job, such as travel expenses or professional fees. They can also claim deductions for expenses related to their home, such as mortgage interest or property taxes.

**Utilizing Tax Credits**

Utilizing tax credits is a third strategy for minimizing tax withholdings. Tax credits can provide a direct reduction in tax liability, rather than just a deduction from income. Employees can claim tax credits for expenses related to education, childcare, or retirement savings.

**Other Strategies**

Other strategies for minimizing tax withholdings include:

1. Taking advantage of tax-deferred savings options, such as 401(k) or IRA accounts.

2. Investing in tax-efficient investments, such as index funds or municipal bonds.

3. Considering a Roth IRA conversion to reduce tax liability in retirement.

**Impact on Tax Withholdings**

By implementing these strategies, employees can minimize their tax withholdings and reduce their tax liability. This can result in a lower tax bill and more take-home pay. By understanding the strategies for minimizing tax withholdings, employees can take control of their tax situation and make informed decisions about their financial future.

Learning how to fill out the new W4 form requires attention to detail and a thorough understanding of the different sections and fields. By following these guidelines, employees can ensure accurate completion of the W4 form and minimize any potential tax liability.

Avoiding Common Mistakes: Tips for Accurate W4 Form Completion

Completing the W4 form accurately is crucial to ensure that employees are not over- or under-withheld. However, common mistakes can occur, leading to errors and potential penalties. Here are some tips to avoid common mistakes when filling out the W4 form:

**Incorrect Social Security Number**

One of the most common mistakes is entering an incorrect Social Security number. This can lead to delays in processing the form and potential errors in tax withholdings. Employees should double-check their Social Security number to ensure it is accurate.

**Incomplete Information**

Another common mistake is providing incomplete information. Employees should ensure that they provide all required information, including their name, address, and dependent information.

**Miscalculations**

Miscalculations can also occur when filling out the W4 form. Employees should double-check their calculations to ensure that they are accurate and complete.

**Other Common Mistakes**

Other common mistakes to avoid include:

1. Not signing and dating the form.

2. Not providing required documentation, such as proof of dependent status.

3. Not reporting all income sources, including self-employment income and investments.

**Tips for Accurate Completion**

To avoid common mistakes, employees should:

1. Read the instructions carefully before filling out the form.

2. Use a calculator to ensure accurate calculations.

3. Double-check all information for accuracy and completeness.

4. Sign and date the form.

By following these tips, employees can avoid common mistakes and ensure accurate completion of the W4 form. Learning how to fill out the new W4 form requires attention to detail and a thorough understanding of the different sections and fields.

Review and Submission: Final Steps for Completing the W4 Form

Once the W4 form is complete, it’s essential to review it for accuracy and completeness. This step is crucial to ensure that the form is filled out correctly and that all required information is included.

**Reviewing the W4 Form**

When reviewing the W4 form, employees should check for the following:

1. Accuracy of Social Security number and name.

2. Completeness of dependent information.

3. Accuracy of income reporting and deductions.

4. Completeness of signature and date.

**Submitting the W4 Form**

Once the W4 form is reviewed and complete, employees should submit it to their employer. The employer will use the information on the W4 form to determine the correct amount of taxes to withhold from the employee’s paycheck.

**Instructions for Submission**

Employees should follow these steps to submit the W4 form to their employer:

1. Sign and date the form.

2. Make a copy of the form for their records.

3. Submit the original form to their employer.

**Importance of Accurate Submission**

Accurate submission of the W4 form is crucial to ensure that taxes are withheld correctly. If the form is not submitted accurately, it can lead to errors in tax withholdings and potential penalties.

By following these steps, employees can ensure that their W4 form is complete and accurate, and that it is submitted correctly to their employer. Learning how to fill out the new W4 form requires attention to detail and a thorough understanding of the different sections and fields.