Understanding Your Health Insurance Options

Selecting the right health insurance plan is a crucial decision that can significantly impact your financial well-being and access to quality healthcare. With numerous providers and plans available, it’s essential to understand the factors to consider when choosing a health insurance plan. Coverage, cost, and network are key considerations that can make or break your decision. In this article, we’ll delve into the world of health insurance and compare two popular providers: Anthem Blue Cross and Kaiser. By the end of this comprehensive comparison, you’ll be equipped with the knowledge to make an informed decision about your health insurance needs.

When evaluating health insurance options, it’s vital to consider your individual needs and priorities. Do you have a pre-existing condition that requires ongoing treatment? Are you looking for a plan with a low deductible or copay? Perhaps you’re interested in a provider with a wide network of doctors and hospitals. Whatever your needs, it’s crucial to weigh the pros and cons of each plan and provider. Anthem Blue Cross and Kaiser are two prominent health insurance providers that offer a range of plans and benefits. But how do they stack up against each other? In the following sections, we’ll explore the key differences between Anthem Blue Cross and Kaiser, including their plan options, network coverage, and customer satisfaction ratings.

As you navigate the complex world of health insurance, it’s essential to remember that there’s no one-size-fits-all solution. What works for your friend or family member may not work for you. By taking the time to understand your health insurance options and carefully evaluating the pros and cons of each plan, you can make an informed decision that meets your unique needs and priorities. In the next section, we’ll take a closer look at Anthem Blue Cross and Kaiser, including their history, mission, and values.

Anthem Blue Cross vs Kaiser: An Overview of Each Provider

Anthem Blue Cross and Kaiser are two of the most well-established health insurance providers in the United States. Both companies have a long history of providing quality healthcare coverage to millions of Americans. In this section, we’ll take a closer look at each provider, including their history, mission, and values.

Anthem Blue Cross, a subsidiary of Anthem, Inc., has been providing health insurance coverage for over 75 years. With a strong presence in 14 states, Anthem Blue Cross offers a range of plans, including HMO, PPO, and EPO options. The company’s mission is to improve the health and well-being of its members, and it has a reputation for providing high-quality, affordable healthcare coverage.

Kaiser, on the other hand, has been a leader in healthcare for over 70 years. With a strong presence in eight states, Kaiser offers a range of plans, including HMO and PPO options. The company’s mission is to provide high-quality, affordable healthcare coverage to its members, and it has a reputation for innovation and excellence in healthcare.

Both Anthem Blue Cross and Kaiser have their respective strengths and weaknesses. Anthem Blue Cross is known for its wide network of providers and hospitals, making it a great option for those who value flexibility and choice. Kaiser, on the other hand, is known for its integrated healthcare system, which provides seamless coordination of care and a high level of quality.

When comparing Anthem Blue Cross and Kaiser, it’s essential to consider their unique features and benefits. Anthem Blue Cross offers a range of wellness programs and resources, including fitness discounts and health coaching. Kaiser, on the other hand, offers a range of innovative healthcare services, including telemedicine and online health management tools.

In the next section, we’ll take a closer look at the key factors to consider when choosing between Anthem Blue Cross and Kaiser, including network coverage, plan options, premium costs, and out-of-pocket expenses.

How to Choose Between Anthem Blue Cross and Kaiser: Key Factors to Consider

When choosing between Anthem Blue Cross and Kaiser, there are several key factors to consider. These factors can help you make an informed decision about which provider is best for your individual needs and priorities. In this section, we’ll discuss the key factors to consider, including network coverage, plan options, premium costs, and out-of-pocket expenses.

Network coverage is a critical factor to consider when choosing a health insurance provider. Anthem Blue Cross and Kaiser both have extensive networks of providers and hospitals, but there are some differences to consider. Anthem Blue Cross has a larger network of providers, with over 90,000 doctors and hospitals in its network. Kaiser, on the other hand, has a more limited network, but it is highly integrated and coordinated, which can be beneficial for those who value seamless care.

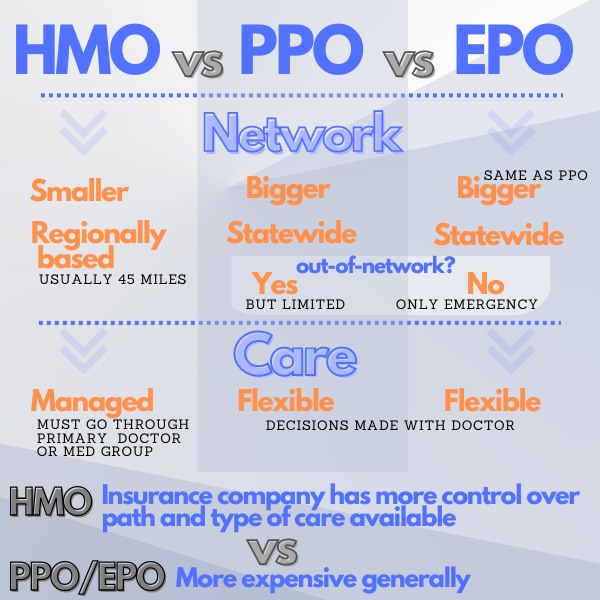

Plan options are another important factor to consider. Both Anthem Blue Cross and Kaiser offer a range of plans, including HMO, PPO, and EPO options. Anthem Blue Cross plans tend to be more flexible, with more options for customization and a wider range of deductibles and copays. Kaiser plans, on the other hand, are more standardized, but they often come with lower premiums and out-of-pocket expenses.

Premium costs and out-of-pocket expenses are also critical factors to consider. Anthem Blue Cross and Kaiser both offer competitive pricing, but there are some differences to consider. Anthem Blue Cross plans tend to be more expensive, but they often come with more comprehensive coverage and a wider range of benefits. Kaiser plans, on the other hand, are often less expensive, but they may come with higher deductibles and copays.

To evaluate these factors, it’s essential to consider your individual needs and priorities. Do you value flexibility and customization in your health insurance plan? Or do you prioritize affordability and seamless care? By considering these factors and evaluating your individual needs, you can make an informed decision about which provider is best for you.

In the next section, we’ll take a closer look at the plan options offered by Anthem Blue Cross and Kaiser, including their respective HMO, PPO, and EPO plans.

Anthem Blue Cross vs Kaiser: A Comparison of Plan Options

Anthem Blue Cross and Kaiser both offer a range of plan options to suit different needs and budgets. In this section, we’ll compare the plan options offered by each provider, including their respective HMO, PPO, and EPO plans.

Anthem Blue Cross offers a range of plans, including HMO, PPO, and EPO options. Their HMO plans are designed for individuals who want a more affordable option with a narrower network of providers. Their PPO plans, on the other hand, offer more flexibility and a wider range of providers, but at a higher cost. Anthem Blue Cross also offers EPO plans, which are designed for individuals who want a balance between affordability and flexibility.

Kaiser, on the other hand, offers a range of plans, including HMO and PPO options. Their HMO plans are designed for individuals who want a more affordable option with a narrower network of providers. Their PPO plans offer more flexibility and a wider range of providers, but at a higher cost. Kaiser also offers a range of specialized plans, including Medicare and Medicaid plans.

When comparing the plan options offered by Anthem Blue Cross and Kaiser, it’s essential to consider the differences in coverage, deductibles, and copays. Anthem Blue Cross plans tend to have higher deductibles and copays, but they also offer more comprehensive coverage and a wider range of benefits. Kaiser plans, on the other hand, tend to have lower deductibles and copays, but they may have more limited coverage and benefits.

For example, Anthem Blue Cross’s HMO plan has a deductible of $1,500 and a copay of $30 for primary care visits. Kaiser’s HMO plan, on the other hand, has a deductible of $1,000 and a copay of $20 for primary care visits. However, Anthem Blue Cross’s plan offers more comprehensive coverage, including dental and vision benefits, while Kaiser’s plan does not.

In the next section, we’ll compare the network coverage of Anthem Blue Cross and Kaiser, including their respective provider networks, hospital affiliations, and pharmacy networks.

Network Coverage: How Anthem Blue Cross and Kaiser Stack Up

Network coverage is a critical factor to consider when choosing a health insurance plan. Anthem Blue Cross and Kaiser both have extensive networks of providers and hospitals, but there are some differences to consider. In this section, we’ll compare the network coverage of Anthem Blue Cross and Kaiser, including their respective provider networks, hospital affiliations, and pharmacy networks.

Anthem Blue Cross has a large network of providers, with over 90,000 doctors and hospitals in its network. This includes a wide range of specialists and primary care physicians, as well as many top-ranked hospitals. Anthem Blue Cross also has a strong network of pharmacies, with over 60,000 pharmacies participating in its network.

Kaiser, on the other hand, has a more limited network of providers, but it is highly integrated and coordinated. Kaiser’s network includes over 20,000 doctors and hospitals, as well as many top-ranked medical centers. Kaiser also has a strong network of pharmacies, with over 10,000 pharmacies participating in its network.

When comparing the network coverage of Anthem Blue Cross and Kaiser, it’s essential to consider the differences in provider networks, hospital affiliations, and pharmacy networks. Anthem Blue Cross has a larger network of providers, but Kaiser’s network is more integrated and coordinated. This can be beneficial for individuals who value seamless care and coordination between providers.

For example, Anthem Blue Cross’s network includes many top-ranked hospitals, such as Cedars-Sinai Medical Center and UCLA Medical Center. Kaiser’s network, on the other hand, includes many top-ranked medical centers, such as Kaiser Permanente Los Angeles Medical Center and Kaiser Permanente San Francisco Medical Center.

In the next section, we’ll compare the premium costs and out-of-pocket expenses of Anthem Blue Cross and Kaiser plans, and explain the factors that affect costs, such as age, location, and plan selection.

Cost Comparison: Anthem Blue Cross vs Kaiser

When it comes to choosing a health insurance plan, cost is a critical factor to consider. Anthem Blue Cross and Kaiser both offer a range of plans with varying premium costs and out-of-pocket expenses. In this section, we’ll compare the premium costs and out-of-pocket expenses of Anthem Blue Cross and Kaiser plans, and explain the factors that affect costs, such as age, location, and plan selection.

Anthem Blue Cross plans tend to be more expensive than Kaiser plans, especially for individuals and families. However, Anthem Blue Cross plans often offer more comprehensive coverage and a wider range of benefits. Kaiser plans, on the other hand, are often more affordable, but may have more limited coverage and benefits.

For example, Anthem Blue Cross’s HMO plan for individuals costs around $450 per month, while Kaiser’s HMO plan for individuals costs around $350 per month. However, Anthem Blue Cross’s plan offers more comprehensive coverage, including dental and vision benefits, while Kaiser’s plan does not.

Out-of-pocket expenses are also an important factor to consider when choosing a health insurance plan. Anthem Blue Cross plans tend to have higher deductibles and copays than Kaiser plans, but they also offer more comprehensive coverage and a wider range of benefits. Kaiser plans, on the other hand, have lower deductibles and copays, but may have more limited coverage and benefits.

For example, Anthem Blue Cross’s HMO plan has a deductible of $1,500 and a copay of $30 for primary care visits. Kaiser’s HMO plan, on the other hand, has a deductible of $1,000 and a copay of $20 for primary care visits.

In the next section, we’ll discuss the customer satisfaction ratings of Anthem Blue Cross and Kaiser, based on reviews and ratings from various sources. We’ll highlight the strengths and weaknesses of each provider in terms of customer service.

Customer Satisfaction: What Members Say About Anthem Blue Cross and Kaiser

Customer satisfaction is a critical factor to consider when choosing a health insurance provider. Anthem Blue Cross and Kaiser both have a strong reputation for customer service, but there are some differences to consider. In this section, we’ll discuss the customer satisfaction ratings of Anthem Blue Cross and Kaiser, based on reviews and ratings from various sources.

Anthem Blue Cross has a strong reputation for customer service, with a rating of 4.5 out of 5 stars on the National Committee for Quality Assurance (NCQA) website. Members praise Anthem Blue Cross for its easy-to-use online portal, helpful customer service representatives, and comprehensive coverage options.

Kaiser, on the other hand, has a slightly lower rating of 4.2 out of 5 stars on the NCQA website. Members praise Kaiser for its integrated care model, which allows for seamless coordination between providers. However, some members have reported difficulty with Kaiser’s customer service, citing long wait times and unhelpful representatives.

According to a survey by the California Department of Managed Health Care, Anthem Blue Cross members reported higher satisfaction rates with their provider network, with 85% of members reporting that they were satisfied with their provider network. Kaiser members reported lower satisfaction rates, with 78% of members reporting that they were satisfied with their provider network.

When it comes to customer service, Anthem Blue Cross has a 24/7 customer service hotline, as well as an online chat feature that allows members to get help quickly and easily. Kaiser also has a 24/7 customer service hotline, but some members have reported difficulty getting help through the online portal.

In the next section, we’ll provide tips and recommendations for choosing the best health insurance plan, based on the comparison of Anthem Blue Cross and Kaiser. We’ll emphasize the importance of evaluating individual needs and priorities.

Making an Informed Decision: Tips for Choosing the Best Health Insurance Plan

Choosing the right health insurance plan can be a daunting task, but by considering the factors outlined in this article, you can make an informed decision that meets your individual needs and priorities. When comparing Anthem Blue Cross and Kaiser, it’s essential to evaluate your individual needs and priorities, including your budget, health status, and provider preferences.

Here are some tips for choosing the best health insurance plan:

1. Evaluate your budget: Consider your income, expenses, and financial goals when choosing a health insurance plan. Anthem Blue Cross and Kaiser offer a range of plans with varying premium costs and out-of-pocket expenses.

2. Assess your health status: If you have ongoing health needs, consider a plan with more comprehensive coverage and a wider range of benefits. Anthem Blue Cross and Kaiser both offer plans with varying levels of coverage and benefits.

3. Consider your provider preferences: If you have a preferred provider or hospital, consider a plan that includes them in their network. Anthem Blue Cross and Kaiser both have extensive networks of providers and hospitals.

4. Evaluate the plan’s coverage and benefits: Consider the plan’s coverage and benefits, including deductibles, copays, and coinsurance. Anthem Blue Cross and Kaiser both offer plans with varying levels of coverage and benefits.

5. Read reviews and ratings: Research the provider’s reputation and read reviews from other members. Anthem Blue Cross and Kaiser both have strong reputations for customer service and quality care.

By following these tips and considering the factors outlined in this article, you can make an informed decision that meets your individual needs and priorities. Remember to evaluate your budget, health status, provider preferences, and plan coverage and benefits when choosing between Anthem Blue Cross and Kaiser.

.33b565c969a14b48898e6caaecb50628.jpg)