What is a Home Equity Loan: Understanding the Basics

A home equity loan is a type of loan that allows homeowners to borrow money using the equity in their property as collateral. Equity is the difference between the market value of a home and the amount still owed on the mortgage. For example, if a homeowner’s property is worth $200,000 and they owe $150,000 on their mortgage, they have $50,000 in equity. A home equity loan enables homeowners to tap into this equity to access funds for various purposes.

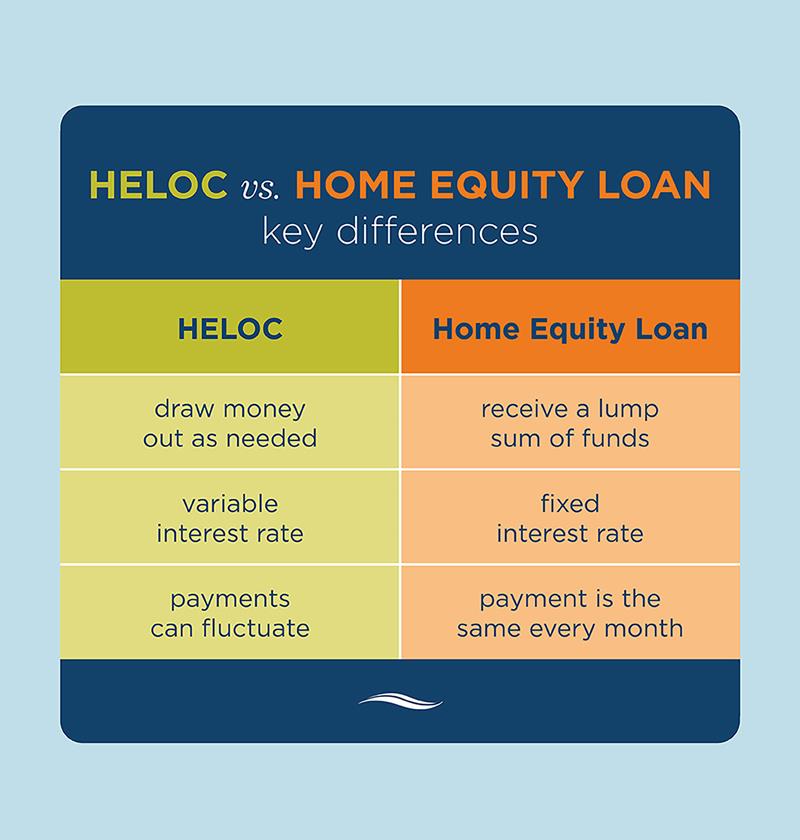

Home equity loans are often confused with home equity lines of credit (HELOCs), but they are not the same thing. A

How to Tap into Your Home’s Equity: A Step-by-Step Guide

Applying for a home equity loan can seem daunting, but with a clear understanding of the process, homeowners can navigate it with ease. To get started, it’s essential to gather the necessary documents, which typically include:

- Identification: A valid government-issued ID, such as a driver’s license or passport

- Income verification: Recent pay stubs, W-2 forms, or tax returns

- Asset verification: Bank statements, investment accounts, or retirement accounts

- Property information: Deed, title, or mortgage statement

In addition to the required documents, lenders typically consider credit score, income, and debt-to-income ratio when evaluating a home equity loan application. A good credit score can help homeowners qualify for better interest rates and terms.

Once the application is submitted, the lender will review the documents and order an appraisal of the property to determine its value. This process can take several weeks to a few months, depending on the lender and the complexity of the application.

After the appraisal is complete, the lender will provide a loan offer, which includes the interest rate, repayment terms, and fees. Homeowners should carefully review the offer and compare it to other options to ensure they’re getting the best deal.

Shopping around for the best interest rates and terms is crucial when applying for a home equity loan. Homeowners can compare offers from multiple lenders, including banks, credit unions, and online lenders, to find the one that best suits their needs.

By following these steps and carefully evaluating the loan offer, homeowners can tap into their home’s equity and achieve their financial goals. Whether it’s financing a home renovation, consolidating debt, or covering unexpected expenses, a home equity loan can provide the necessary funds to get the job done.

The Benefits of Home Equity Loans: Why They’re a Popular Choice

Home equity loans have become a popular choice for homeowners looking to tap into their property’s value. One of the primary benefits of home equity loans is their lower interest rates compared to credit cards and personal loans. This is because home equity loans are secured by the property itself, reducing the lender’s risk and allowing for more favorable terms.

In addition to lower interest rates, home equity loans also offer tax-deductible interest. This can provide significant savings for homeowners, especially those in higher tax brackets. Furthermore, the funds from a home equity loan can be used for a variety of purposes, including home improvements, debt consolidation, and major purchases.

Home improvements are a common use for home equity loans. By using the funds to upgrade or renovate their property, homeowners can increase its value and potentially sell it for a higher price in the future. Additionally, home equity loans can be used to consolidate high-interest debt, such as credit card balances, into a single, lower-interest loan.

Another benefit of home equity loans is their flexibility. Homeowners can choose from a variety of repayment terms, including fixed-rate and adjustable-rate loans. This allows them to select a loan that fits their financial situation and goals. Furthermore, home equity loans often have lower fees compared to other types of loans, making them a more cost-effective option.

Overall, home equity loans offer a range of benefits that make them a popular choice for homeowners. From lower interest rates and tax-deductible interest to flexibility and lower fees, home equity loans can provide the funds needed to achieve financial goals. By understanding the benefits of home equity loans, homeowners can make informed decisions about their financial future.

Home Equity Loan vs. HELOC: Which is Right for You?

When it comes to tapping into your home’s equity, you have two main options: a home equity loan and a home equity line of credit (HELOC). Both options allow you to borrow money using your home as collateral, but they have distinct differences in terms of interest rates, repayment terms, and fees.

A home equity loan is a lump-sum loan that provides a single amount of money upfront. It typically has a fixed interest rate and a set repayment term, usually 5-15 years. Home equity loans are ideal for homeowners who need a large sum of money for a specific purpose, such as financing a home renovation or paying for college tuition.

A HELOC, on the other hand, is a revolving line of credit that allows you to borrow and repay funds as needed. It typically has a variable interest rate and a draw period, usually 5-10 years, during which you can borrow and repay funds. HELOCs are ideal for homeowners who need access to a line of credit for ongoing expenses, such as home improvements or debt consolidation.

When deciding between a home equity loan and a HELOC, consider your financial goals and needs. If you need a large sum of money for a specific purpose, a home equity loan may be the better option. However, if you need access to a line of credit for ongoing expenses, a HELOC may be more suitable.

It’s also essential to consider the interest rates and fees associated with each option. Home equity loans often have lower interest rates than HELOCs, but HELOCs may have lower fees. Additionally, consider the repayment terms and ensure you understand the repayment schedule and any potential penalties for late payments.

Ultimately, the choice between a home equity loan and a HELOC depends on your individual financial situation and goals. By understanding the differences between these two options, you can make an informed decision and choose the best option for your needs.

Common Uses for Home Equity Loans: Real-Life Examples

Home equity loans have been a popular choice for homeowners looking to tap into their property’s value to achieve various financial goals. From financing home renovations to paying for college tuition, the uses for home equity loans are diverse and numerous. In this section, we’ll explore some real-life examples of how homeowners have utilized home equity loans to improve their financial situation.

One common use for home equity loans is to finance home improvements or renovations. For instance, a homeowner may use a home equity loan to add a new deck, renovate their kitchen, or install new windows. By using the equity in their property, homeowners can increase the value of their home while also enjoying the benefits of a lower interest rate compared to other types of loans. For example, a homeowner who borrows $20,000 through a home equity loan at 4% interest may be able to increase the value of their property by $30,000 or more, depending on the project.

Another popular use for home equity loans is to consolidate high-interest debt. Homeowners who have accumulated debt from credit cards, personal loans, or other sources may use a home equity loan to pay off these debts and simplify their financial situation. By consolidating debt into a single loan with a lower interest rate, homeowners can save money on interest payments and reduce their monthly expenses. For example, a homeowner who consolidates $10,000 in credit card debt with an 18% interest rate into a home equity loan at 6% interest may save hundreds of dollars per year in interest payments.

Home equity loans can also be used to cover major expenses, such as college tuition or medical bills. Homeowners who need to cover a large expense may use a home equity loan to access the funds they need without having to dip into their savings or retirement accounts. For example, a homeowner who needs to pay for their child’s college tuition may use a home equity loan to borrow $10,000 at 5% interest, rather than taking out a higher-interest student loan or personal loan.

Finally, home equity loans can be used to fund major purchases, such as a new car or a down payment on a second home. Homeowners who need to make a large purchase may use a home equity loan to access the funds they need without having to save up for years. For example, a homeowner who wants to buy a new car may use a home equity loan to borrow $15,000 at 4% interest, rather than taking out a higher-interest auto loan.

As these examples illustrate, home equity loans can be a versatile and powerful tool for homeowners looking to tap into their property’s value. By understanding the different uses for home equity loans, homeowners can make informed decisions about how to use this type of financing to achieve their financial goals.

Understanding Home Equity Loan Risks: What You Need to Know

While home equity loans can be a valuable financial tool for homeowners, they also come with potential risks that need to be carefully considered. Understanding these risks is crucial to making informed decisions and avoiding financial pitfalls. In this section, we’ll explore the potential risks associated with home equity loans and provide guidance on how to mitigate them.

One of the most significant risks associated with home equity loans is the risk of foreclosure. When a homeowner takes out a home equity loan, they are using their property as collateral, which means that if they fail to make payments, the lender can seize the property to recoup their losses. This risk is particularly high for homeowners who are already struggling to make mortgage payments or who have a history of missed payments.

Another risk associated with home equity loans is debt accumulation. Home equity loans can provide a large sum of money upfront, which can be tempting to use for non-essential purchases or to consolidate debt. However, this can lead to a cycle of debt accumulation, where homeowners take on more debt to pay off existing debt, ultimately increasing their financial burden. For example, a homeowner who takes out a home equity loan to consolidate credit card debt may find themselves struggling to make payments on the new loan, leading to further debt accumulation.

Negative equity is another risk associated with home equity loans. If the housing market declines or the homeowner fails to make payments, the value of the property may decrease, leaving the homeowner with a loan balance that exceeds the value of the property. This can make it difficult to sell the property or refinance the loan, leaving the homeowner with limited options.

Finally, home equity loans can also come with fees and charges that can add up quickly. Origination fees, closing costs, and annual fees can all contribute to the overall cost of the loan, making it more expensive than initially anticipated. For example, a homeowner who takes out a home equity loan with a 5% origination fee may find themselves paying thousands of dollars in fees upfront, in addition to the loan balance.

To mitigate these risks, it’s essential to approach home equity loans with caution and careful planning. Homeowners should carefully review the terms and conditions of the loan, including the interest rate, repayment terms, and fees. They should also consider their financial situation and goals, ensuring that the loan aligns with their overall financial strategy. Additionally, homeowners should prioritize responsible borrowing practices, such as making timely payments and avoiding debt accumulation.

By understanding the potential risks associated with home equity loans and taking steps to mitigate them, homeowners can make informed decisions and avoid financial pitfalls. Remember, a home equity loan is a significant financial commitment, and it’s essential to approach it with caution and careful planning.

Maximizing Your Home’s Equity: Tips for Homeowners

As a homeowner, maximizing your home’s equity is crucial to achieving long-term financial goals. By maintaining a good credit score, keeping up with mortgage payments, and making smart home improvements, homeowners can increase the value of their property and unlock the full potential of their home equity. In this section, we’ll provide tips and strategies for homeowners to maximize their home’s equity.

Maintaining a good credit score is essential to maximizing your home’s equity. A good credit score can help you qualify for better interest rates on home equity loans and lines of credit, which can save you thousands of dollars in interest payments over the life of the loan. To maintain a good credit score, homeowners should make timely payments on all debts, keep credit utilization ratios low, and monitor their credit report for errors.

Keeping up with mortgage payments is also crucial to maximizing your home’s equity. By making timely payments, homeowners can build equity in their property over time, which can be used to secure a home equity loan or line of credit. Additionally, making extra payments on your mortgage can help you pay off the principal balance faster, which can increase the value of your home and unlock more equity.

Making smart home improvements is another way to maximize your home’s equity. Homeowners who invest in renovations and upgrades that increase the value of their property can unlock more equity and potentially sell their home for a higher price. Some of the most valuable home improvements include kitchen and bathroom renovations, adding a deck or patio, and installing new windows and doors.

Regular maintenance is also essential to maximizing your home’s equity. Homeowners who keep their property well-maintained can prevent costly repairs and maintain the value of their home over time. Regular maintenance tasks include inspecting and replacing the roof, maintaining the HVAC system, and keeping the property clean and free of clutter.

Finally, homeowners should consider working with a financial advisor or real estate expert to develop a long-term plan for maximizing their home’s equity. A financial advisor can help homeowners create a budget and investment plan that aligns with their financial goals, while a real estate expert can provide guidance on the best home improvements and renovations to increase the value of the property.

By following these tips and strategies, homeowners can maximize their home’s equity and unlock the full potential of their property. Remember, maximizing your home’s equity takes time and effort, but the rewards can be significant. With careful planning and maintenance, homeowners can increase the value of their property and achieve long-term financial goals.

Making the Most of Your Home Equity Loan: Long-Term Financial Planning

Once you’ve secured a home equity loan, it’s essential to make the most of it by creating a long-term financial plan. A well-thought-out plan will help you achieve your financial goals, avoid common pitfalls, and maximize the benefits of your home equity loan. In this section, we’ll provide guidance on how to create a long-term financial plan and make the most of your home equity loan.

The first step in creating a long-term financial plan is to set clear financial goals. What do you want to achieve with your home equity loan? Are you looking to finance home renovations, pay off high-interest debt, or cover major expenses? By setting specific goals, you’ll be able to determine the best way to use your home equity loan and create a plan to achieve your objectives.

Next, it’s essential to assess your financial situation and create a budget. A budget will help you understand your income and expenses, identify areas for cost-cutting, and allocate your home equity loan funds effectively. Consider using the 50/30/20 rule as a guideline for allocating your income: 50% for necessary expenses, 30% for discretionary spending, and 20% for saving and debt repayment.

Another crucial aspect of long-term financial planning is avoiding common pitfalls such as overspending or accumulating new debt. Home equity loans can provide a significant amount of funds, but it’s essential to use them wisely and avoid making impulse purchases or taking on new debt. Consider setting up a separate account for your home equity loan funds and using a budgeting app to track your expenses.

In addition to avoiding pitfalls, it’s also essential to consider the tax implications of your home equity loan. The interest on your home equity loan may be tax-deductible, but it’s crucial to consult with a tax professional to understand the specific tax implications of your loan. By understanding the tax implications, you can make informed decisions about your home equity loan and minimize your tax liability.

Finally, it’s essential to review and adjust your long-term financial plan regularly. Your financial situation and goals may change over time, and it’s crucial to adapt your plan accordingly. Consider reviewing your plan annually or whenever you experience a significant change in your financial situation.

By creating a long-term financial plan and making the most of your home equity loan, you can achieve your financial goals and maximize the benefits of your loan. Remember, a home equity loan is a powerful financial tool, but it’s essential to use it wisely and responsibly. With careful planning and discipline, you can unlock the full potential of your home equity loan and achieve long-term financial success.