Understanding the Standard Deduction: What You Need to Know

The standard deduction is a fundamental concept in the US tax system, allowing taxpayers to reduce their taxable income without needing to itemize deductions. For the 2023 tax year, the standard deduction has undergone changes that may impact taxpayers’ liability. In this article, we will delve into the world of standard deductions, exploring its purpose, eligibility criteria, and how it affects tax liability.

The standard deduction is a fixed amount that taxpayers can subtract from their taxable income, reducing the amount of income subject to taxation. This deduction is available to all taxpayers, regardless of their filing status or income level. For the 2023 tax year, the standard deduction amounts are as follows: $13,850 for single filers, $27,700 for joint filers, and $20,800 for head of household filers.

The standard deduction serves several purposes. Firstly, it simplifies the tax filing process by eliminating the need to itemize deductions. Secondly, it provides a minimum level of tax relief to all taxpayers, regardless of their income level. Finally, it helps to reduce the administrative burden on taxpayers and the IRS by minimizing the number of tax returns that require itemized deductions.

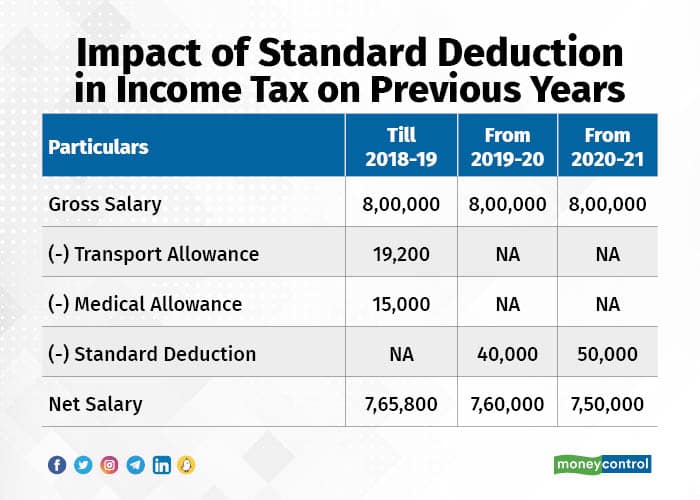

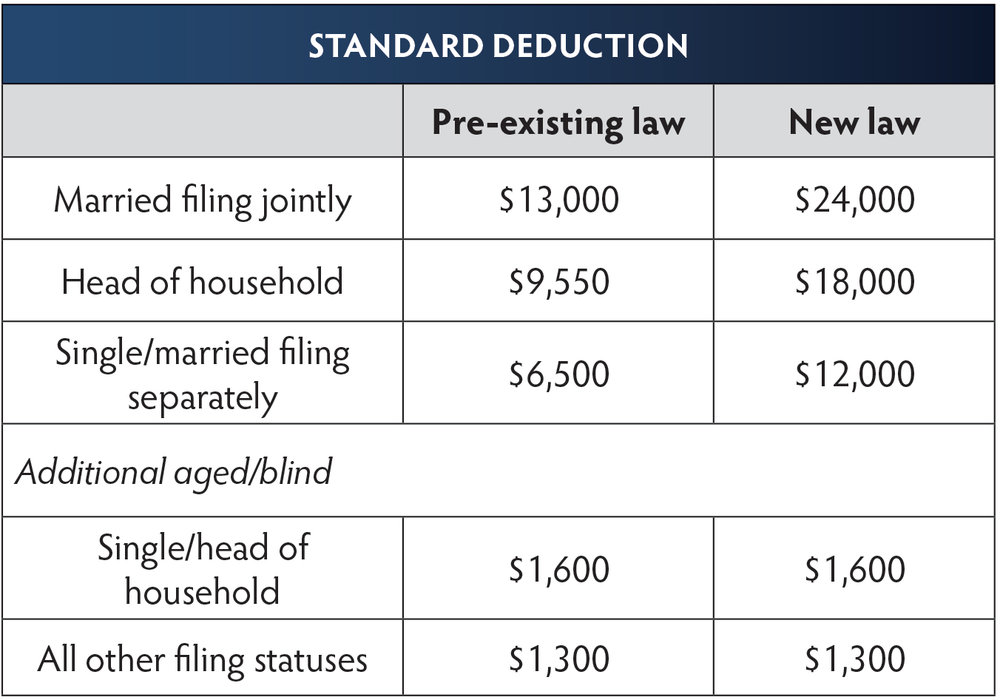

Despite its benefits, the standard deduction has undergone changes in recent years. The Tax Cuts and Jobs Act (TCJA) increased the standard deduction amounts for the 2018 tax year, and these changes have been extended through the 2023 tax year. Additionally, the TCJA eliminated the personal exemption, which was previously available to taxpayers. These changes have significantly impacted taxpayers’ liability, and it is essential to understand how they affect your tax situation.

In the following sections, we will explore the eligibility criteria for taking the standard deduction, how to claim it on your tax return, and how it affects your tax liability. We will also discuss tax planning strategies for maximizing your standard deduction and common mistakes to avoid when claiming it.

How to Claim the Standard Deduction on Your Tax Return

Claiming the standard deduction on a tax return is a straightforward process that can help reduce taxable income and lower the amount of taxes owed. To claim the standard deduction for the 2023 tax year, follow these step-by-step instructions:

Step 1: Determine Eligibility

Before claiming the standard deduction, ensure eligibility by reviewing the income limits and filing status requirements. For the 2023 tax year, the standard deduction amounts are as follows:

- Single filers: $13,850

- Married filing jointly: $27,700

- Married filing separately: $13,850

- Head of household: $20,800

- Qualifying widow(er): $27,700

Step 2: Choose the Correct Tax Form

Use Form 1040 to claim the standard deduction. This form is used for personal income tax returns and is the most commonly used tax form. Ensure the correct form is used to avoid delays or errors in processing the tax return.

Step 3: Report Income and Claim the Standard Deduction

Report all income on Form 1040, including wages, salaries, tips, and any other income. Then, claim the standard deduction on Line 12 of Form 1040. The standard deduction amount will be subtracted from total income to determine taxable income.

Step 4: Review and Submit the Tax Return

Review the tax return carefully to ensure accuracy and completeness. Submit the tax return electronically or by mail, depending on the preferred filing method. If filing electronically, the tax return will be processed quickly, and any refund will be issued promptly.

By following these steps, taxpayers can easily claim the standard deduction on their tax return and reduce their taxable income. Remember to review the eligibility criteria and use the correct tax form to avoid any errors or delays in processing the tax return. The standard deduction for the 2023 tax year can provide significant tax savings, so it’s essential to take advantage of this deduction if eligible.

Who Can Take the Standard Deduction: Eligibility and Limitations

The standard deduction for the 2023 tax year is available to most taxpayers, but there are certain eligibility criteria and limitations that must be met. Understanding these requirements is essential to ensure that taxpayers can take advantage of the standard deduction and minimize their tax liability.

Eligibility Criteria:

To be eligible for the standard deduction, taxpayers must meet the following criteria:

- Be a U.S. citizen or resident

- Have a valid Social Security number or Individual Taxpayer Identification Number (ITIN)

- File a tax return (Form 1040)

- Not be claimed as a dependent on another taxpayer’s return

Filing Status:

The standard deduction amount varies depending on the taxpayer’s filing status. The following filing statuses are eligible for the standard deduction:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Income Limits:

There are no income limits for claiming the standard deduction, but taxpayers with higher incomes may be subject to certain limitations. For example, taxpayers with incomes above $250,000 (single) or $500,000 (joint) may be subject to the Pease limitation, which reduces the total amount of itemized deductions that can be claimed.

Other Limitations:

Certain taxpayers may be subject to additional limitations or restrictions on claiming the standard deduction. For example:

- Non-resident aliens may not be eligible for the standard deduction

- Taxpayers who file Form 2555 (Foreign Earned Income) may be subject to special rules and limitations

- Taxpayers who have a net operating loss (NOL) may need to adjust their standard deduction accordingly

By understanding the eligibility criteria and limitations for the standard deduction, taxpayers can ensure that they are taking advantage of this valuable tax benefit and minimizing their tax liability for the 2023 tax year.

Standard Deduction vs. Itemized Deductions: Which is Right for You?

When it comes to tax deductions, taxpayers have two main options: the standard deduction and itemized deductions. The standard deduction for the 2023 tax year is a fixed amount that can be claimed without needing to itemize deductions. On the other hand, itemized deductions require taxpayers to list and calculate their individual deductions. So, which approach is right for you?

Benefits of the Standard Deduction:

The standard deduction offers several benefits, including:

- Simplifies the tax filing process

- Reduces the need for record-keeping and documentation

- Provides a fixed amount of deductions without needing to itemize

Benefits of Itemized Deductions:

Itemized deductions, on the other hand, offer the following benefits:

- Allows taxpayers to claim deductions for specific expenses, such as mortgage interest and charitable donations

- Can provide a higher total deduction amount than the standard deduction

- Enables taxpayers to claim deductions for business expenses and other itemized deductions

When to Itemize Deductions:

Itemizing deductions may be beneficial in the following situations:

- High mortgage interest payments

- Significant charitable donations

- Large medical expenses

- Business expenses that exceed the standard deduction

Example:

Let’s say John has a mortgage with a high interest rate and pays $15,000 in interest per year. He also donates $5,000 to charity and has $3,000 in medical expenses. In this case, itemizing his deductions may provide a higher total deduction amount than the standard deduction.

When to Take the Standard Deduction:

On the other hand, taking the standard deduction may be beneficial in the following situations:

- Low mortgage interest payments

- Minimal charitable donations

- No significant medical expenses

- No business expenses

Example:

Let’s say Sarah has a small mortgage with low interest payments and doesn’t have any significant charitable donations or medical expenses. In this case, taking the standard deduction may be the simpler and more beneficial option.

Ultimately, the decision to take the standard deduction or itemize deductions depends on individual circumstances. Taxpayers should carefully review their expenses and consider consulting a tax professional to determine the best approach for their situation.

How the Standard Deduction Affects Your Tax Liability

The standard deduction for the 2023 tax year plays a significant role in determining tax liability. By reducing taxable income, the standard deduction can lower the amount of taxes owed. In this article, we’ll explore how the standard deduction impacts tax liability and provide examples to illustrate its effects.

Reducing Taxable Income:

The standard deduction reduces taxable income by subtracting a fixed amount from total income. This reduction in taxable income, in turn, reduces the amount of taxes owed. For example, if a taxpayer has a total income of $50,000 and claims the standard deduction of $13,850, their taxable income would be reduced to $36,150.

Impact on Tax Liability:

The standard deduction can significantly impact tax liability. By reducing taxable income, the standard deduction can lower the amount of taxes owed. For instance, if a taxpayer is in the 24% tax bracket and has a taxable income of $36,150, their tax liability would be $8,676. However, if they didn’t claim the standard deduction and had a taxable income of $50,000, their tax liability would be $12,000.

Example:

Let’s consider an example to illustrate the impact of the standard deduction on tax liability. Suppose John has a total income of $75,000 and claims the standard deduction of $13,850. His taxable income would be reduced to $61,150. If John is in the 32% tax bracket, his tax liability would be $19,568. However, if he didn’t claim the standard deduction and had a taxable income of $75,000, his tax liability would be $24,000.

Standard Deduction and Tax Credits:

The standard deduction can also impact tax

Tax Planning Strategies: Maximizing Your Standard Deduction

Tax planning is an essential part of maximizing the standard deduction for the 2023 tax year. By implementing effective tax planning strategies, taxpayers can minimize their taxable income and optimize their deductions. In this article, we’ll explore some tax planning strategies that can help taxpayers maximize their standard deduction.

Minimizing Taxable Income:

One of the most effective ways to maximize the standard deduction is to minimize taxable income. This can be achieved by:

- Contributing to tax-deferred retirement accounts, such as a 401(k) or an IRA

- Claiming deductions for mortgage interest and property taxes

- Donating to charity and claiming deductions for charitable donations

- Claiming deductions for medical expenses and other itemized deductions

Optimizing Deductions:

Optimizing deductions is another key strategy for maximizing the standard deduction. This can be achieved by:

- Keeping accurate records of expenses and deductions

- Claiming deductions for business expenses and other itemized deductions

- Utilizing tax credits, such as the Earned Income Tax Credit (EITC)

- Claiming deductions for education expenses and other qualified expenses

Bunching Deductions:

Bunching deductions is a tax planning strategy that involves grouping deductions into a single year to maximize the standard deduction. This can be achieved by:

- Grouping charitable donations into a single year

- Grouping medical expenses into a single year

- Grouping business expenses into a single year

Example:

Let’s consider an example to illustrate the benefits of tax planning. Suppose John has a taxable income of $50,000 and claims the standard deduction of $13,850. However, John also has $10,000 in charitable donations and $5,000 in medical expenses. By bunching these deductions into a single year, John can maximize his standard deduction and reduce his taxable income to $31,150.

Tax Planning Tools:

There are several tax planning tools available that can help taxpayers maximize their standard deduction. These include:

- Tax software, such as TurboTax or H&R Block

- Tax calculators, such as the IRS Tax Withholding Estimator

- Tax planning apps, such as TaxAct or Credit Karma

By implementing effective tax planning strategies and utilizing tax planning tools, taxpayers can maximize their standard deduction and minimize their tax liability for the 2023 tax year.

Common Mistakes to Avoid When Claiming the Standard Deduction

Claiming the standard deduction for the 2023 tax year can be a straightforward process, but taxpayers should be aware of common mistakes that can lead to errors or even audits. In this article, we’ll identify common mistakes to avoid when claiming the standard deduction.

Incorrect Reporting of Income:

One of the most common mistakes taxpayers make when claiming the standard deduction is incorrect reporting of income. This can include:

- Failing to report all sources of income, such as freelance work or investments

- Reporting incorrect income amounts or dates

- Not accounting for income from self-employment or side hustles

Claiming Incorrect Deductions:

Another common mistake is claiming incorrect deductions. This can include:

- Claiming deductions for expenses that are not eligible, such as personal expenses

- Claiming deductions for expenses that are not properly documented

- Not accounting for changes in tax laws or regulations

Failure to Keep Records:

Failure to keep accurate records is another common mistake taxpayers make when claiming the standard deduction. This can include:

- Not keeping receipts or documentation for expenses

- Not keeping records of income or expenses for multiple years

- Not using tax software or accounting programs to track expenses

Not Accounting for Tax Law Changes:

Tax laws and regulations can change frequently, and taxpayers should be aware of these changes when claiming the standard deduction. This can include:

- Not accounting for changes in tax rates or brackets

- Not accounting for changes in deduction limits or phase-outs

- Not accounting for new tax credits or deductions

Example:

Let’s consider an example to illustrate the importance of avoiding common mistakes when claiming the standard deduction. Suppose John claims the standard deduction but fails to report income from his freelance work. If the IRS discovers this error, John may be subject to penalties and interest on the unreported income.

Best Practices:

To avoid common mistakes when claiming the standard deduction, taxpayers should follow best practices, such as:

- Keeping accurate records of income and expenses

- Using tax software or accounting programs to track expenses

- Staying informed about tax law changes and regulations

- Consulting with a tax professional or accountant

By avoiding common mistakes and following best practices, taxpayers can ensure a smooth and accurate tax filing process when claiming the standard deduction for the 2023 tax year.

Staying Up-to-Date with Tax Law Changes: What to Expect in 2023

As the 2023 tax year approaches, it’s essential to stay informed about tax law changes that may impact the standard deduction. The standard deduction for the 2023 tax year is expected to undergo changes, affecting taxpayers’ eligibility and the amount they can claim. Understanding these changes can help taxpayers maximize their deductions and minimize their tax liability.

The IRS typically announces inflation adjustments for the standard deduction annually. For the 2023 tax year, the standard deduction is expected to increase due to inflation. This means that taxpayers may be eligible for a higher standard deduction, reducing their taxable income and resulting tax liability.

In addition to inflation adjustments, tax law changes may also impact the standard deduction. For example, changes to the Tax Cuts and Jobs Act (TCJA) may affect the standard deduction for certain taxpayers. It’s crucial to stay up-to-date with these changes to ensure accurate tax planning and preparation.

To stay informed about tax law changes, taxpayers can:

- Visit the IRS website for updates on tax law changes and inflation adjustments.

- Consult with a tax professional or financial advisor to ensure accurate tax planning and preparation.

- Subscribe to tax-related newsletters and publications to stay informed about changes to the standard deduction and other tax laws.

By staying informed about tax law changes, taxpayers can maximize their standard deduction for the 2023 tax year and minimize their tax liability. It’s essential to be proactive and adapt to changes in tax laws to ensure accurate tax planning and preparation.

The standard deduction for the 2023 tax year is expected to be an essential aspect of tax planning. Taxpayers should be aware of the changes and updates to ensure they take advantage of the highest standard deduction possible. By understanding the changes and staying informed, taxpayers can navigate the tax season with confidence and maximize their deductions.