Understanding the Annual Salary Breakdown

An annual salary is a fixed amount of money paid to an employee over a 12-month period. It’s a common way for employers to compensate their employees, and it’s often used as a benchmark to compare salaries across different industries and jobs. However, the way annual salaries are structured can vary significantly depending on the company, industry, and job type. For instance, some companies may offer a base salary plus bonuses, while others may provide a salary range with opportunities for overtime pay.

In the United States, the Fair Labor Standards Act (FLSA) requires employers to pay their employees at least the minimum wage for all hours worked. However, many employees earn much more than the minimum wage, with some salaries exceeding $100,000 per year. But have you ever wondered how much $100k a year is really worth? To answer this question, we need to break down the annual salary into smaller components, including the hourly wage, taxes, and benefits.

For example, let’s consider a software engineer with an annual salary of $120,000. On the surface, this may seem like a lucrative salary, but when we break it down to an hourly wage, the picture changes. Assuming a 40-hour workweek and 52 weeks per year, the hourly wage would be approximately $57 per hour. However, this doesn’t take into account taxes, benefits, and other deductions that can reduce the take-home pay.

Understanding the annual salary breakdown is crucial for employees to make informed decisions about their careers and financial goals. By knowing how much they earn per hour, employees can better negotiate their salaries, plan their finances, and make smart decisions about their careers.

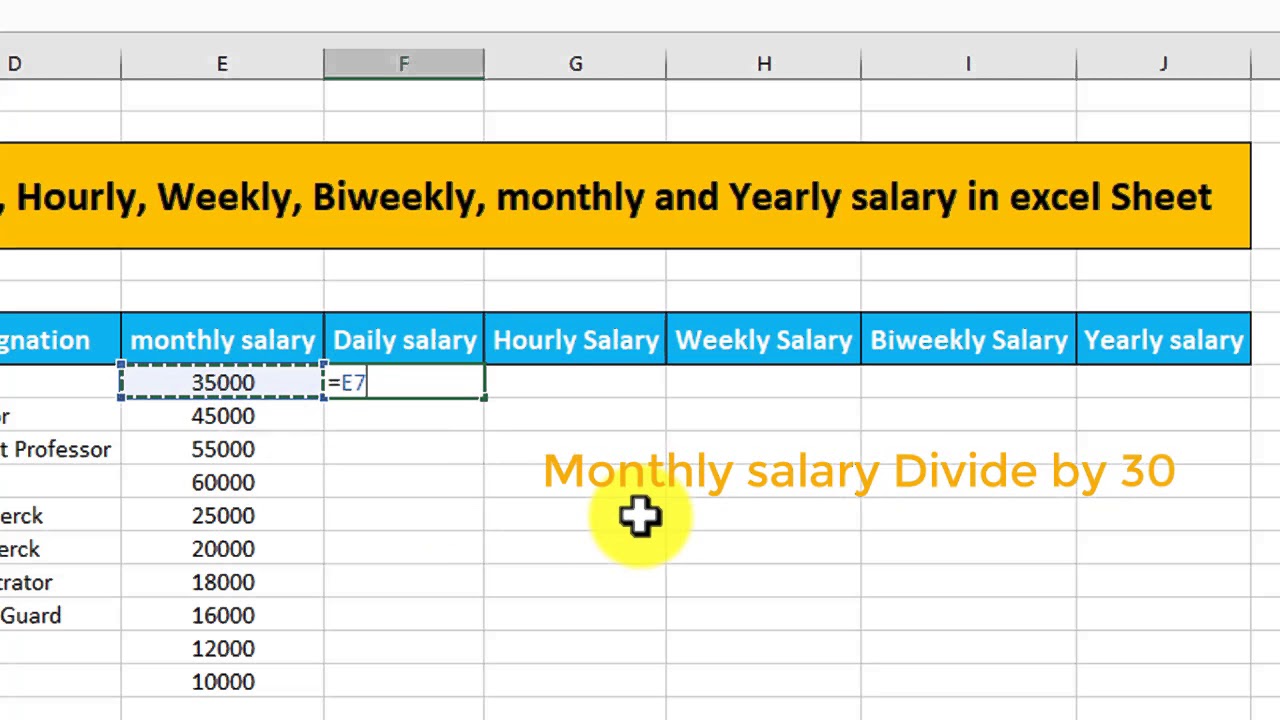

Converting Annual Salary to Hourly Wage: The Math Behind the Magic

To convert an annual salary to an hourly wage, we need to make a few assumptions. First, we assume a standard full-time schedule of 40 hours per week and 52 weeks per year. This gives us a total of 2,080 hours worked per year. Next, we divide the annual salary by the total number of hours worked to get the hourly wage.

For example, let’s say we have an annual salary of $100,000. To calculate the hourly wage, we would divide $100,000 by 2,080 hours, which gives us an hourly wage of approximately $48.08 per hour. However, this is just a rough estimate and doesn’t take into account factors like taxes, benefits, and overtime pay.

Another important factor to consider is the number of hours worked per week. If we assume a 30-hour workweek instead of 40, the hourly wage would increase to approximately $64.10 per hour. This highlights the importance of considering the actual number of hours worked when calculating the hourly wage.

Additionally, we need to consider the impact of taxes and benefits on the hourly wage. For instance, if we assume a 25% tax bracket and a 10% benefit package, the take-home pay would be reduced, resulting in a lower hourly wage. To get an accurate estimate of the hourly wage, we need to factor in these deductions.

By understanding the math behind converting annual salary to hourly wage, we can gain a better appreciation for the value of our salary and make more informed decisions about our careers and financial goals.

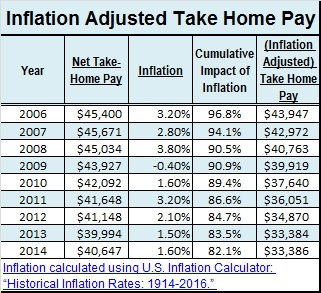

The Impact of Taxes and Benefits on Your Take-Home Pay

When calculating the hourly wage from a $100k annual salary, it’s essential to consider the impact of taxes and benefits on take-home pay. Taxes, in particular, can significantly reduce the amount of money you take home. For instance, if we assume a 25% tax bracket, the take-home pay would be reduced by $25,000, leaving $75,000 per year. This translates to an hourly wage of approximately $36.06 per hour, assuming a 40-hour workweek and 52 weeks per year.

Benefits, such as health insurance, retirement plans, and paid time off, can also affect the hourly wage. For example, if an employer offers a comprehensive benefits package worth 10% of the annual salary, the take-home pay would be further reduced. In this case, the hourly wage would be approximately $32.55 per hour.

It’s also important to note that different tax brackets and benefit packages can influence the hourly wage. For instance, if an individual is in a higher tax bracket, their take-home pay would be reduced, resulting in a lower hourly wage. On the other hand, if an employer offers a more comprehensive benefits package, the hourly wage may be higher.

To illustrate the impact of taxes and benefits on hourly wage, let’s consider an example. Suppose an individual has a $100k annual salary, with a 25% tax bracket and a 10% benefits package. The take-home pay would be $67,500 per year, which translates to an hourly wage of approximately $32.55 per hour. However, if the tax bracket is increased to 30%, the take-home pay would be reduced to $60,000 per year, resulting in an hourly wage of approximately $28.85 per hour.

By understanding the impact of taxes and benefits on take-home pay, individuals can make more informed decisions about their careers and financial goals. It’s essential to consider these factors when calculating the hourly wage from a $100k annual salary.

How to Calculate Your Hourly Wage from $100k a Year

Calculating your hourly wage from a $100k annual salary requires a few simple steps. First, you need to determine the number of hours you work per week and the number of weeks you work per year. For this example, let’s assume a standard full-time schedule of 40 hours per week and 52 weeks per year.

Next, you need to calculate your annual salary before taxes and benefits. In this case, we’ll use the full $100k annual salary. Then, you need to calculate your take-home pay by subtracting taxes and benefits from your annual salary. For this example, let’s assume a 25% tax bracket and a 10% benefits package.

Now, let’s do the math. First, calculate your take-home pay: $100k x 0.75 (1 – 0.25 tax bracket) = $75k. Then, subtract the benefits package: $75k x 0.90 (1 – 0.10 benefits package) = $67.5k. Finally, divide your take-home pay by the number of hours worked per year: $67.5k ÷ 2,080 hours (40 hours/week x 52 weeks/year) = approximately $32.45 per hour.

By following these steps, you can calculate your hourly wage from a $100k annual salary. Keep in mind that this is just an estimate and your actual hourly wage may vary depending on your individual circumstances.

Here’s a summary of the steps to calculate your hourly wage from a $100k annual salary:

- Determine the number of hours you work per week and the number of weeks you work per year.

- Calculate your annual salary before taxes and benefits.

- Calculate your take-home pay by subtracting taxes and benefits from your annual salary.

- Divide your take-home pay by the number of hours worked per year.

By following these steps, you can get a better understanding of your hourly wage and make more informed decisions about your career and financial goals.

What Can You Buy with $100k a Year? A Reality Check

When considering a salary of $100k a year, it’s essential to understand what that amount can actually buy in terms of lifestyle, expenses, and savings. While $100k may seem like a significant amount, the reality is that it can be quickly consumed by various expenses, taxes, and other deductions.

For example, let’s consider the cost of living in a major city like New York or San Francisco. In these cities, the cost of housing, food, and transportation can be extremely high. A $100k salary may barely cover the costs of a modest lifestyle, leaving little room for savings or discretionary spending.

On the other hand, in cities with a lower cost of living, such as Des Moines or Omaha, a $100k salary can go much further. In these cities, the cost of housing, food, and transportation is significantly lower, allowing for a more comfortable lifestyle and potentially even some savings.

Another important consideration is the impact of taxes on take-home pay. As we discussed earlier, taxes can significantly reduce the amount of money you take home. For example, if we assume a 25% tax bracket, the take-home pay from a $100k salary would be approximately $75k per year.

So, what can you buy with $100k a year? Here are some examples of typical expenses and financial goals:

- Housing: A modest home in a major city, or a more luxurious home in a smaller city.

- Food: Eating out occasionally, or cooking at home with some discretionary spending for dining out.

- Transportation: A reliable car, or public transportation in a city with a good system.

- Savings: Some savings for retirement, emergencies, or big-ticket purchases.

- Discretionary spending: Some money for hobbies, travel, or entertainment.

Ultimately, the value of a $100k salary depends on your individual circumstances, location, and financial goals. By understanding what $100k a year can actually buy, you can make more informed decisions about your career and financial future.

Is $100k a Year a Good Salary? It Depends on Your Location

The value of a $100k salary can vary significantly depending on the location. In some cities, $100k can go a long way, while in others, it may barely cover the costs of living. To understand the purchasing power of $100k a year, we need to consider the cost of living in different locations.

For example, in cities like New York or San Francisco, the cost of living is extremely high. Housing, food, and transportation costs are significantly higher than in other parts of the country. In these cities, a $100k salary may not go as far as it would in smaller cities or rural areas.

On the other hand, in cities like Des Moines or Omaha, the cost of living is relatively low. Housing, food, and transportation costs are lower, making a $100k salary go further. In these cities, a $100k salary can provide a comfortable lifestyle, with some room for savings and discretionary spending.

Here are some examples of cities with high and low costs of living:

- High-cost cities: New York, San Francisco, Los Angeles, Chicago

- Low-cost cities: Des Moines, Omaha, Oklahoma City, Knoxville

In addition to the cost of living, we also need to consider the local economy and job market. In some cities, a $100k salary may be considered high, while in others, it may be average or even low.

Ultimately, whether $100k a year is a good salary depends on your individual circumstances, location, and financial goals. By understanding the cost of living in different locations, you can make more informed decisions about your career and financial future.

Maximizing Your Earnings: Tips to Boost Your Hourly Wage

While a $100k salary may seem like a significant amount, there are ways to increase your earnings and boost your hourly wage. Here are some tips to consider:

Negotiate your salary: If you’re not happy with your current salary, consider negotiating with your employer. Do your research and make a strong case for why you deserve a raise.

Take on side hustles: Consider taking on side hustles or freelance work to supplement your income. This can help you earn extra money and increase your hourly wage.

Pursue additional education and training: Investing in your education and training can help you increase your earning potential. Consider taking courses or getting certifications in your field.

Develop in-demand skills: Develop skills that are in high demand in your industry. This can help you increase your earning potential and boost your hourly wage.

Consider a career change: If you’re not happy with your current career, consider making a change. Research careers that pay well and have good growth opportunities.

Here are some examples of high-paying careers:

- Software engineer: $100k – $200k per year

- Data scientist: $100k – $200k per year

- Product manager: $100k – $200k per year

- Marketing manager: $80k – $150k per year

- Financial analyst: $60k – $120k per year

By following these tips, you can increase your earnings and boost your hourly wage. Remember to always do your research and consider your individual circumstances when making career decisions.

Conclusion: The True Value of $100k a Year

In conclusion, the value of $100k a year depends on various factors, including taxes, benefits, location, and individual circumstances. While $100k may seem like a significant amount, it’s essential to consider the actual take-home pay and the purchasing power of that amount in different locations.

By understanding the annual salary breakdown, converting annual salary to hourly wage, and considering the impact of taxes and benefits, individuals can make more informed decisions about their careers and financial goals.

Additionally, by maximizing earnings through negotiating salary, taking on side hustles, or pursuing additional education and training, individuals can increase their hourly wage and improve their overall financial situation.

Ultimately, the true value of $100k a year lies in its ability to provide a comfortable lifestyle, meet financial goals, and offer opportunities for growth and development. By thinking critically about their own salary and financial goals, individuals can make the most of their earnings and achieve financial success.

So, the next time you hear someone say “$100k a year is how much an hour?”, you’ll know that the answer is not as simple as it seems. It’s essential to consider the various factors that affect the value of $100k a year and make informed decisions about your career and financial goals.