How to Choose the Best Credit Card for Your Needs

When it comes to selecting a credit card, it’s essential to choose one that aligns with your spending habits and financial goals. With so many options available, it can be overwhelming to determine which credit card is the best fit for you. To make an informed decision, consider the following key factors: interest rates, fees, and rewards structures.

Interest rates play a significant role in determining the overall cost of your credit card. Look for cards with competitive interest rates, especially if you plan to carry a balance. Some credit cards offer 0% introductory APRs, which can be beneficial for those who need to finance a large purchase or pay off debt.

Fees are another crucial aspect to consider. Many credit cards come with annual fees, foreign transaction fees, or late payment fees. Make sure you understand the fee structure before applying for a credit card. Some cards, like the Chase Sapphire Preferred, offer no foreign transaction fees, making them ideal for frequent travelers.

Rewards structures are also a vital consideration. If you’re looking for credit cards with the best welcome bonus, you’ll want to focus on cards that offer generous sign-up bonuses. The Capital One Quicksilver, for example, offers a one-time bonus of $150 after spending $500 within the first three months. Other cards, like the Citi Double Cash, offer ongoing rewards structures, such as 2% cashback on all purchases.

By carefully evaluating these factors, you can find a credit card that meets your needs and provides the best welcome bonus. Remember to always read the terms and conditions before applying, and consider your individual financial situation and goals. With the right credit card, you can maximize your rewards and make the most of your spending.

Unbeatable Welcome Bonuses: Top Credit Cards to Consider

When it comes to credit cards with the best welcome bonus, several options stand out from the rest. The Chase Sapphire Preferred, Capital One Quicksilver, and Citi Double Cash are among the top credit cards that offer lucrative sign-up bonuses. Here’s a brief overview of each card’s features and benefits:

The Chase Sapphire Preferred offers a 60,000-point bonus after spending $4,000 in the first three months. This card also features a 2X points earning structure on travel and dining purchases, making it ideal for frequent travelers and foodies. Additionally, the card offers a 25% points bonus when redeemed for travel through Chase Ultimate Rewards.

The Capital One Quicksilver offers a one-time bonus of $150 after spending $500 within the first three months. This card also features a 1.5% cashback earning structure on all purchases, with no rotating categories or spending limits. The card also offers a 0% introductory APR for 15 months on purchases and balance transfers.

The Citi Double Cash offers a 2% cashback earning structure on all purchases, with no rotating categories or spending limits. This card also features a 0% introductory APR for 18 months on balance transfers. While it doesn’t offer a traditional sign-up bonus, the card’s ongoing rewards structure makes it a great option for those who want to earn cashback on all their purchases.

These credit cards offer some of the best welcome bonuses in the industry, but it’s essential to consider your individual needs and financial goals before applying. By choosing the right credit card, you can maximize your rewards and make the most of your spending.

Earning and Redeeming Rewards: A Deep Dive

Now that we’ve introduced the top credit cards with the best welcome bonuses, let’s dive deeper into how to earn and redeem rewards with each card. Understanding the rewards earning structures, redemption options, and potential restrictions or limitations is crucial to maximizing your rewards.

The Chase Sapphire Preferred offers a 2X points earning structure on travel and dining purchases, and 1X point on all other purchases. Points can be redeemed for travel, cashback, or transferred to popular airline and hotel loyalty programs. However, there is a 25% points bonus when redeemed for travel through Chase Ultimate Rewards, making it a great option for frequent travelers.

The Capital One Quicksilver offers a 1.5% cashback earning structure on all purchases, with no rotating categories or spending limits. Cashback rewards can be redeemed for statement credits, checks, or gift cards. Additionally, there are no foreign transaction fees, making it a great option for international travelers.

The Citi Double Cash offers a 2% cashback earning structure on all purchases, with no rotating categories or spending limits. Cashback rewards can be redeemed for statement credits, checks, or gift cards. However, there is a 0% introductory APR for 18 months on balance transfers, making it a great option for those who want to pay off debt.

When redeeming rewards, it’s essential to consider the redemption options and potential restrictions or limitations. For example, some credit cards may have blackout dates or restrictions on travel redemptions. Others may have minimum redemption thresholds or fees associated with redeeming rewards.

By understanding the rewards earning structures, redemption options, and potential restrictions or limitations, you can maximize your rewards and make the most of your credit card. Remember to always read the terms and conditions before applying, and consider your individual needs and financial goals when selecting a credit card.

Comparing the Competition: How Top Credit Cards Stack Up

When it comes to credit cards with the best welcome bonus, there are several options to consider. In this section, we’ll compare the features and benefits of the top credit cards mentioned earlier, including the Chase Sapphire Preferred, Capital One Quicksilver, and Citi Double Cash.

Interest rates are an essential factor to consider when choosing a credit card. The Chase Sapphire Preferred offers a variable APR of 15.99% – 22.99%, while the Capital One Quicksilver offers a variable APR of 14.49% – 24.49%. The Citi Double Cash offers a variable APR of 15.49% – 25.49%. While these rates may seem high, it’s essential to remember that you can avoid interest charges by paying your balance in full each month.

Fees are another critical factor to consider. The Chase Sapphire Preferred has an annual fee of $95, while the Capital One Quicksilver has no annual fee. The Citi Double Cash also has no annual fee. However, the Citi Double Cash has a 3% foreign transaction fee, while the Chase Sapphire Preferred and Capital One Quicksilver have no foreign transaction fees.

Rewards earning potential is also a crucial factor to consider. The Chase Sapphire Preferred offers 2X points on travel and dining purchases, while the Capital One Quicksilver offers 1.5% cashback on all purchases. The Citi Double Cash offers 2% cashback on all purchases, with no rotating categories or spending limits.

Ultimately, the best credit card with a welcome bonus for you will depend on your individual needs and financial goals. If you’re a frequent traveler, the Chase Sapphire Preferred may be the best option. If you’re looking for a card with no annual fee and a simple rewards structure, the Capital One Quicksilver may be the best option. If you’re looking for a card with a high rewards earning potential and no foreign transaction fees, the Citi Double Cash may be the best option.

By comparing the features and benefits of these top credit cards, you can make an informed decision and choose the best credit card with a welcome bonus for your needs.

Maximizing Your Welcome Bonus: Tips and Strategies

Now that you’ve chosen a credit card with a welcome bonus, it’s essential to maximize the offer to get the most value out of it. Here are some tips and strategies to help you do so:

Meet the Minimum Spend Requirements: To qualify for the welcome bonus, you’ll typically need to meet a minimum spend requirement within a specified timeframe. Make sure you understand the requirements and plan your spending accordingly. Consider using the credit card for your daily expenses, such as groceries, gas, and dining, to help meet the minimum spend requirement.

Avoid Interest Charges: To avoid interest charges, make sure to pay your balance in full each month. This will also help you avoid overspending and accumulating debt. Consider setting up automatic payments to ensure you never miss a payment.

Redeem Rewards for Maximum Value: When redeeming your rewards, make sure to do so for maximum value. For example, if you have a credit card that offers travel rewards, consider redeeming your points for travel bookings or transferring them to a partner airline or hotel loyalty program.

Take Advantage of Additional Perks: Many credit cards with welcome bonuses offer additional perks, such as travel insurance, purchase protection, or concierge services. Make sure to take advantage of these perks to get the most value out of your credit card.

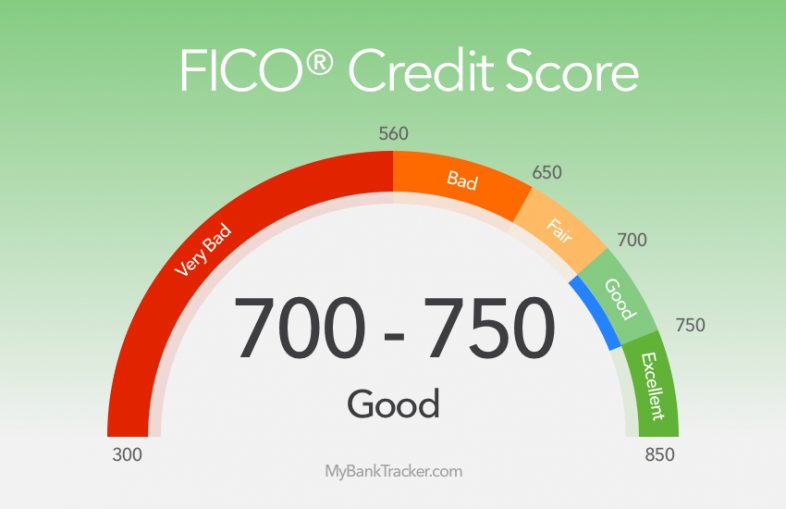

Monitor Your Credit Score: Finally, make sure to monitor your credit score regularly to ensure you’re maintaining good credit habits. This will help you avoid negative marks on your credit report and ensure you’re eligible for future credit card offers.

By following these tips and strategies, you can maximize your welcome bonus and get the most value out of your credit card. Remember to always read the terms and conditions of your credit card agreement and understand the requirements for the welcome bonus.

Avoiding Common Pitfalls: How to Use Your Credit Card Responsibly

While credit cards with the best welcome bonuses can be a great way to earn rewards and benefits, it’s essential to use them responsibly to avoid common pitfalls. Here are some tips on how to maintain good credit habits and avoid debt:

Overspending: One of the most common pitfalls of using credit cards is overspending. To avoid this, make sure to set a budget and track your expenses regularly. Consider using a budgeting app or spreadsheet to help you stay on top of your spending.

Interest Charges: Another common pitfall is accumulating interest charges. To avoid this, make sure to pay your balance in full each month. If you’re unable to pay your balance in full, consider making a payment plan to pay off your debt over time.

Fees: Credit cards often come with fees, such as annual fees, late fees, and foreign transaction fees. To avoid these fees, make sure to read the terms and conditions of your credit card agreement carefully and understand the fees associated with your card.

Debt: Finally, it’s essential to avoid accumulating debt when using credit cards. To do this, make sure to only charge what you can afford to pay back and avoid using credit cards for non-essential purchases.

By following these tips, you can maintain good credit habits and avoid common pitfalls associated with using credit cards. Remember, credit cards are a tool to help you earn rewards and benefits, but they should be used responsibly.

Additionally, consider the following best practices to use your credit card responsibly:

Make on-time payments: Pay your credit card bill on time, every time, to avoid late fees and interest charges.

Keep your credit utilization ratio low: Keep your credit utilization ratio below 30% to avoid negatively affecting your credit score.

Monitor your credit report: Check your credit report regularly to ensure it’s accurate and up-to-date.

By following these best practices, you can use your credit card responsibly and maintain good credit habits.

Long-Term Value: How to Get the Most Out of Your Credit Card

While the welcome bonus is a significant incentive for signing up for a credit card, it’s essential to consider the long-term value of the card as well. Here are some tips on how to get the most out of your credit card in the long term:

Continue Earning Rewards: To maximize the rewards earning potential of your credit card, make sure to continue using it for your daily purchases. Consider using the credit card for categories such as groceries, gas, and dining, where you can earn rewards points or cashback.

Avoid Interest Charges: To avoid interest charges, make sure to pay your balance in full each month. If you’re unable to pay your balance in full, consider making a payment plan to pay off your debt over time.

Maintain Good Credit Habits: To maintain good credit habits, make sure to make on-time payments, keep your credit utilization ratio low, and monitor your credit report regularly.

Take Advantage of Additional Perks: Many credit cards offer additional perks, such as travel insurance, purchase protection, and concierge services. Make sure to take advantage of these perks to get the most value out of your credit card.

Consider Upgrading or Downgrading: If you find that your credit card is no longer meeting your needs, consider upgrading or downgrading to a different card. This can help you take advantage of new features and benefits, or avoid unnecessary fees.

By following these tips, you can get the most out of your credit card in the long term and maximize the value of your rewards. Remember to always read the terms and conditions of your credit card agreement and understand the fees and rewards structures associated with your card.

Additionally, consider the following best practices to get the most out of your credit card:

Use the credit card for everyday purchases: Use the credit card for your daily purchases, such as groceries, gas, and dining, to earn rewards points or cashback.

Take advantage of rotating categories: If your credit card offers rotating categories, make sure to take advantage of them to earn bonus rewards points or cashback.

Use the credit card for travel: If you have a credit card that offers travel rewards, consider using it for your travel purchases to earn rewards points or miles.

By following these best practices, you can get the most out of your credit card and maximize the value of your rewards.

Conclusion: Finding the Best Credit Card for Your Needs

In conclusion, finding the best credit card with a welcome bonus requires careful consideration of your individual needs and financial goals. By understanding the key factors to consider, such as interest rates, fees, and rewards structures, you can make an informed decision and choose a credit card that aligns with your spending habits and financial goals.

Remember to consider the pros and cons of each credit card, including the welcome bonus, rewards earning potential, and any potential restrictions or limitations. Additionally, make sure to read the terms and conditions of the credit card agreement and understand the fees and rewards structures associated with the card.

By following the tips and strategies outlined in this article, you can maximize your welcome bonus and get the most out of your credit card. Whether you’re looking for a credit card with a lucrative sign-up offer or a card with ongoing rewards and benefits, there are many options available to suit your needs.

Ultimately, the best credit card with a welcome bonus is one that meets your individual needs and financial goals. By doing your research and considering your options carefully, you can find a credit card that provides you with the rewards and benefits you need to achieve your financial goals.

So, what are you waiting for? Start exploring your options today and find the best credit card with a welcome bonus for your needs.