Why Timing is Everything in the Stock Market

When it comes to investing in the stock market, timing is crucial. The ability to make informed investment decisions at the right moment can significantly impact returns. Market trends and economic conditions play a substantial role in determining stock performance, and understanding these factors is essential for making smart investment choices. A well-timed investment can lead to substantial gains, while a poorly timed one can result in losses.

For instance, investing in the best stocks to invest in right now can be a lucrative strategy, but it requires a deep understanding of market trends and economic conditions. A thorough analysis of financial statements, industry trends, and company performance is necessary to identify top-performing stocks. By doing so, investors can make informed decisions and increase their potential for long-term success.

Market trends, such as bull and bear markets, can significantly impact stock performance. A bull market, characterized by rising stock prices and high investor confidence, can be an ideal time to invest in growth stocks. On the other hand, a bear market, marked by declining stock prices and low investor confidence, may be a better time to invest in defensive stocks. Understanding these trends and adjusting investment strategies accordingly can help investors navigate the market and make informed decisions.

Economic conditions, such as interest rates and inflation, also play a crucial role in determining stock performance. Changes in interest rates can impact stock prices, and understanding the relationship between interest rates and stock performance is essential for making informed investment decisions. Similarly, inflation can impact stock prices, and investors must be aware of the potential effects of inflation on their investments.

By understanding market trends and economic conditions, investors can make informed decisions and increase their potential for long-term success. Timing is everything in the stock market, and the ability to make smart investment choices at the right moment can significantly impact returns. Whether investing in the best stocks to invest in right now or adjusting investment strategies based on market trends and economic conditions, a deep understanding of the market is essential for achieving long-term success.

How to Identify Top-Performing Stocks in Today’s Market

Identifying top-performing stocks requires a combination of research, analysis, and due diligence. One of the key factors to consider is the company’s financial health, including its revenue growth, profit margins, and return on equity. Investors should also evaluate industry trends and assess the company’s competitive position within its sector.

For example, Amazon and Microsoft have been two of the best stocks to invest in right now, with strong performance in recent years. Amazon’s dominance in e-commerce and cloud computing has driven its stock price to new heights, while Microsoft’s successful transition to a cloud-based business model has made it a leader in the tech sector. By analyzing these companies’ financial statements and industry trends, investors can gain a better understanding of their potential for long-term growth.

Another important factor to consider is the company’s management team and its track record of success. A strong management team with a proven track record of delivering results can be a key indicator of a company’s potential for long-term success. Investors should also evaluate the company’s products or services and assess their potential for growth and profitability.

In addition to these factors, investors should also consider the company’s valuation and assess whether its stock price is reasonable based on its financial performance and growth prospects. This can be done by evaluating key metrics such as the price-to-earnings ratio, dividend yield, and return on equity. By using these metrics, investors can compare stocks and make informed investment decisions.

Some of the top-performing stocks in today’s market include those in the technology and healthcare sectors. These sectors have been driven by innovation and growth, and companies such as Alphabet, Facebook, and Johnson & Johnson have been among the best stocks to invest in right now. By identifying these trends and evaluating the financial performance and growth prospects of these companies, investors can make informed investment decisions and potentially achieve long-term success.

Ultimately, identifying top-performing stocks requires a combination of research, analysis, and due diligence. By evaluating a company’s financial health, industry trends, management team, products or services, and valuation, investors can gain a better understanding of its potential for long-term growth and make informed investment decisions.

The Power of Diversification: Spreading Risk Across Asset Classes

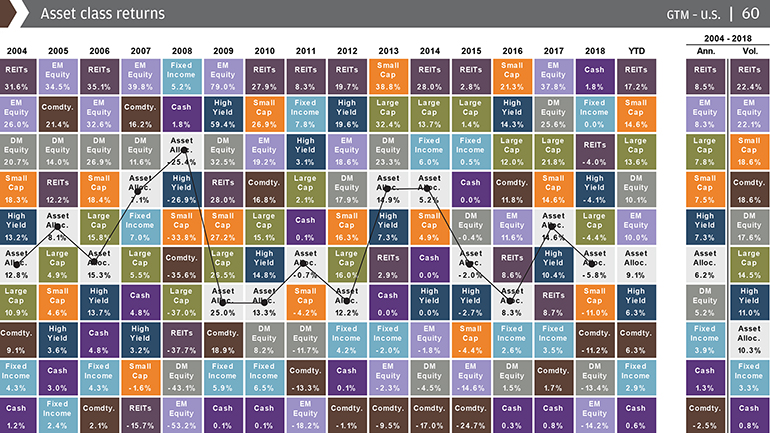

Diversification is a crucial aspect of investing, as it allows investors to spread risk across different asset classes, reducing volatility and increasing potential returns. By allocating investments across stocks, bonds, and other asset classes, investors can create a balanced portfolio that is better equipped to withstand market fluctuations.

One of the key benefits of diversification is that it can help reduce risk. By investing in a variety of assets, investors can minimize their exposure to any one particular market or sector. This can be especially important for investors who are looking to invest in the best stocks to invest in right now, as it can help them avoid putting all their eggs in one basket.

Another benefit of diversification is that it can increase potential returns. By investing in a variety of assets, investors can take advantage of different market trends and sectors, potentially leading to higher returns over the long-term. For example, investors who diversified their portfolios across stocks, bonds, and real estate during the 2008 financial crisis were better able to weather the storm and recover more quickly.

So, how can investors diversify their portfolios? One way is to allocate investments across different asset classes, such as stocks, bonds, and real estate. Investors can also consider investing in international markets, as well as alternative assets such as commodities or currencies. Additionally, investors can use investment vehicles such as mutual funds or exchange-traded funds (ETFs) to gain exposure to a variety of assets.

When it comes to allocating investments across asset classes, there is no one-size-fits-all approach. The key is to find a balance that works for the individual investor’s goals and risk tolerance. For example, a conservative investor may allocate a larger portion of their portfolio to bonds, while a more aggressive investor may allocate a larger portion to stocks.

Ultimately, diversification is a powerful tool that can help investors achieve their long-term goals. By spreading risk across different asset classes, investors can reduce volatility and increase potential returns, making it easier to invest in the best stocks to invest in right now and achieve long-term success.

What to Look for in a Stock: Key Metrics and Ratios

When evaluating a stock investment, there are several key metrics and ratios to consider. These metrics can help investors compare stocks and make informed investment decisions. Some of the most important metrics to consider include the price-to-earnings ratio (P/E ratio), dividend yield, and return on equity (ROE).

The P/E ratio is a measure of a stock’s price relative to its earnings. A high P/E ratio may indicate that a stock is overvalued, while a low P/E ratio may indicate that it is undervalued. For example, a stock with a P/E ratio of 20 may be considered expensive compared to a stock with a P/E ratio of 10. When looking for the best stocks to invest in right now, investors should consider the P/E ratio and how it compares to the industry average.

Dividend yield is another important metric to consider. Dividend yield is the ratio of a stock’s annual dividend payment to its current stock price. A high dividend yield may indicate that a stock is a good income investment, while a low dividend yield may indicate that it is not. For example, a stock with a dividend yield of 4% may be considered a good income investment compared to a stock with a dividend yield of 2%.

ROE is a measure of a company’s profitability. It is calculated by dividing net income by shareholder equity. A high ROE may indicate that a company is profitable and well-managed, while a low ROE may indicate that it is not. For example, a company with an ROE of 20% may be considered more profitable than a company with an ROE of 10%.

Other important metrics to consider include the debt-to-equity ratio, current ratio, and interest coverage ratio. These metrics can help investors evaluate a company’s financial health and make informed investment decisions. By considering these metrics and ratios, investors can gain a better understanding of a stock’s potential for long-term growth and make informed investment decisions.

When evaluating a stock investment, it’s also important to consider the company’s industry and market trends. For example, a company in a growing industry may have more potential for long-term growth than a company in a declining industry. Additionally, investors should consider the company’s competitive position and its ability to adapt to changing market conditions.

By considering these key metrics and ratios, investors can make informed investment decisions and potentially achieve long-term success. Whether looking for the best stocks to invest in right now or evaluating a company’s potential for long-term growth, these metrics can provide valuable insights and help investors make informed decisions.

The Role of ETFs and Index Funds in a Long-Term Portfolio

Exchange-traded funds (ETFs) and index funds are popular investment vehicles that can play a crucial role in a long-term portfolio. These funds offer diversification, low costs, and potential for long-term growth, making them an attractive option for investors seeking to build wealth over time.

One of the primary benefits of ETFs and index funds is their ability to provide broad diversification. By investing in a single fund, investors can gain exposure to a wide range of assets, including stocks, bonds, and commodities. This can help reduce risk and increase potential returns, as different asset classes tend to perform well in different market conditions.

Another advantage of ETFs and index funds is their low cost structure. Unlike actively managed funds, which often come with high fees and expenses, ETFs and index funds typically have lower costs. This can help investors save money and keep more of their returns, which can add up over time.

In addition to their low costs, ETFs and index funds also offer the potential for long-term growth. By investing in a fund that tracks a particular market index, such as the S&P 500, investors can benefit from the growth of the overall market. This can be a more effective strategy than trying to pick individual stocks or actively managed funds, which can be riskier and more expensive.

When it comes to building a long-term portfolio, ETFs and index funds can be used in a variety of ways. Investors can use them as a core holding, providing broad diversification and low costs. They can also be used to gain exposure to specific asset classes or sectors, such as technology or healthcare.

Some popular ETFs and index funds for long-term investors include the Vanguard Total Stock Market ETF (VTI), the iShares Core S&P Total U.S. Stock Market ETF (ITOT), and the Schwab U.S. Broad Market ETF (SCHB). These funds offer broad diversification and low costs, making them a great option for investors seeking to build wealth over time.

When selecting an ETF or index fund, investors should consider their investment goals and risk tolerance. They should also evaluate the fund’s costs, performance, and holdings to ensure it aligns with their investment strategy. By doing so, investors can build a diversified portfolio that is well-positioned for long-term success.

Ultimately, ETFs and index funds can be a valuable addition to a long-term portfolio. By providing broad diversification, low costs, and potential for long-term growth, these funds can help investors achieve their financial goals and build wealth over time. Whether looking for the best stocks to invest in right now or seeking to build a diversified portfolio, ETFs and index funds are definitely worth considering.

How to Get Started with Investing in the Stock Market

Getting started with investing in the stock market can seem daunting, but it’s easier than you think. With a little knowledge and planning, you can begin building a portfolio that will help you achieve your long-term financial goals. Here’s a step-by-step guide to help you get started:

Step 1: Open a Brokerage Account

The first step to investing in the stock market is to open a brokerage account. This will give you access to a platform where you can buy and sell stocks, bonds, and other investment products. There are many online brokerages to choose from, such as Fidelity, Charles Schwab, and Robinhood. When selecting a brokerage, consider factors such as fees, commissions, and customer service.

Step 2: Set Your Investment Goals

Before you start investing, it’s essential to define your investment goals. What are you trying to achieve? Are you saving for retirement, a down payment on a house, or a big purchase? Knowing your goals will help you determine the right investment strategy and risk tolerance.

Step 3: Fund Your Account

Once you’ve opened your brokerage account and set your investment goals, it’s time to fund your account. You can do this by transferring money from your bank account or by setting up a regular investment plan.

Step 4: Choose Your Investments

Now it’s time to choose your investments. You can start by investing in a mix of low-risk investments, such as index funds or ETFs, and higher-risk investments, such as individual stocks. Consider investing in the best stocks to invest in right now, such as Amazon or Microsoft, but also be sure to diversify your portfolio to minimize risk.

Step 5: Monitor and Adjust Your Portfolio

Once you’ve made your initial investments, it’s essential to monitor and adjust your portfolio regularly. This will help you stay on track with your investment goals and ensure that your portfolio remains aligned with your risk tolerance.

Additional Tips:

– Start small and be consistent. Investing a little each month can add up over time.

– Educate yourself. Continuously learn about investing and personal finance to make informed decisions.

– Avoid emotional decision-making. Stay calm and patient, even in volatile markets.

By following these steps and tips, you can get started with investing in the stock market and begin building a portfolio that will help you achieve your long-term financial goals.

Common Mistakes to Avoid in Stock Investing

Investing in the stock market can be a great way to build wealth over time, but it’s not without its risks. One of the biggest mistakes investors make is letting emotions get in the way of their decision-making. This can lead to impulsive decisions, such as buying or selling stocks based on short-term market fluctuations rather than long-term fundamentals.

Another common mistake is lack of diversification. Investing too heavily in a single stock or sector can leave investors vulnerable to significant losses if that stock or sector experiences a downturn. By spreading investments across different asset classes and sectors, investors can reduce their risk and increase their potential for long-term returns.

Failure to monitor and adjust investments is also a common mistake. Investors should regularly review their portfolios to ensure they remain aligned with their investment goals and risk tolerance. This may involve rebalancing the portfolio, adjusting asset allocations, or making changes to individual investments.

Investors should also avoid trying to time the market. This involves attempting to predict when the market will rise or fall and making investment decisions based on those predictions. However, market timing is notoriously difficult, and investors who try to time the market often end up losing money.

Instead of trying to time the market, investors should focus on finding the best stocks to invest in right now and holding them for the long term. This involves doing thorough research, analyzing financial statements, and evaluating industry trends and company performance.

Investors should also be aware of the fees and expenses associated with their investments. High fees can eat into returns and reduce the overall performance of the portfolio. By choosing low-cost index funds or ETFs, investors can minimize their fees and maximize their returns.

Finally, investors should avoid getting caught up in the hype surrounding certain stocks or sectors. Just because a stock is popular or has been performing well in the short term doesn’t mean it’s a good investment. Investors should do their own research and make informed decisions based on their own analysis and goals.

By avoiding these common mistakes, investors can increase their chances of success in the stock market and achieve their long-term financial goals.

Staying Informed: How to Stay Up-to-Date on Market Trends and News

Staying informed about market trends and news is crucial for making informed investment decisions. With the vast amount of information available, it can be overwhelming to know where to start. However, by using the right sources and tools, investors can stay up-to-date and make informed decisions.

Financial news sources are a great place to start. Websites such as Bloomberg, CNBC, and The Wall Street Journal provide real-time news and analysis on market trends and economic conditions. Investors can also use financial news apps, such as Yahoo Finance or Google Finance, to stay informed on-the-go.

Analyst reports are another valuable resource for investors. These reports provide in-depth analysis of companies and industries, and can help investors make informed decisions. Investors can find analyst reports on websites such as Seeking Alpha or Thomson Reuters.

Social media is also a great way to stay informed about market trends and news. Investors can follow financial news sources, analysts, and industry experts on Twitter or LinkedIn to stay up-to-date on the latest news and trends.

Investors should also consider using online stock screeners to find the best stocks to invest in right now. These tools allow investors to filter stocks based on specific criteria, such as price, volume, and industry. Some popular online stock screeners include Finviz and Zacks.

By using these resources and tools, investors can stay informed about market trends and news, and make informed investment decisions. It’s also important to remember that staying informed is an ongoing process, and investors should regularly review and update their knowledge to stay ahead of the curve.

Additionally, investors should consider setting up a news aggregator, such as Google News or Apple News, to stay informed about market trends and news. These tools allow investors to customize their news feed to include specific topics and sources, and can help investors stay up-to-date on the latest news and trends.

By staying informed and using the right tools and resources, investors can make informed investment decisions and achieve their long-term financial goals.