Understanding the Benefits of Joint Filing

Filing taxes jointly as a married couple can have several advantages, including the potential for lower tax rates and increased standard deductions. When married couples file jointly, their combined income is taxed at a lower rate compared to filing separately. This can result in significant tax savings, especially for couples with disparate incomes. Additionally, joint filers are eligible for a higher standard deduction, which can further reduce their tax liability.

Joint filing can also simplify the tax preparation process and reduce the risk of errors. When filing jointly, couples only need to complete one tax return, which can be less complicated than preparing separate returns. This can also reduce the likelihood of errors, as there is less chance of discrepancies between the two returns.

Furthermore, joint filing can provide greater flexibility in terms of tax credits and deductions. For example, joint filers may be eligible for the earned income tax credit (EITC), which can provide a significant refund. Additionally, joint filers can claim the mortgage interest deduction, which can be a substantial tax savings for homeowners.

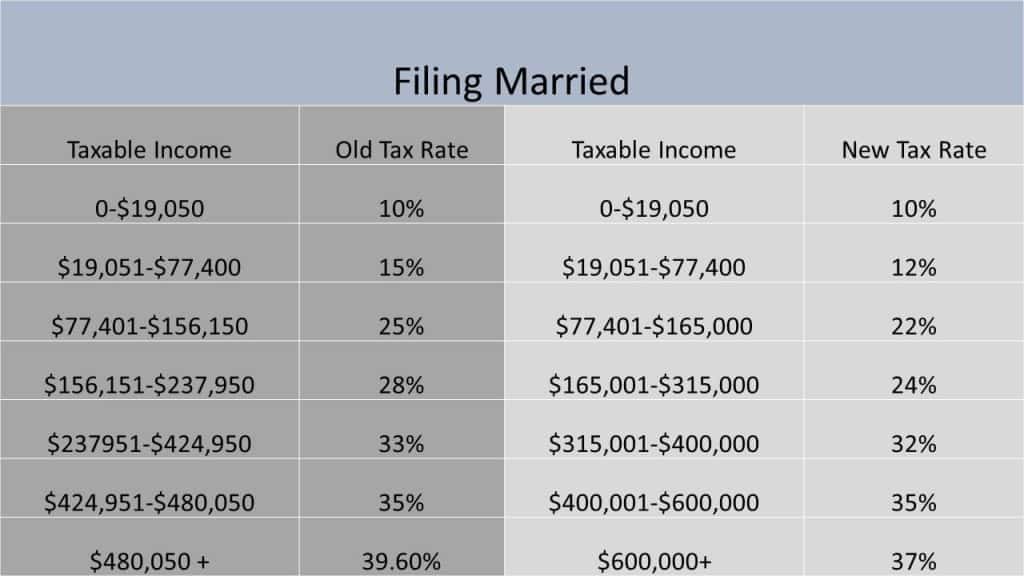

It’s worth noting that the tax rate for married filing jointly is generally lower than the tax rate for single filers. For the current tax year, the tax brackets for married filing jointly are as follows: 10% for taxable income up to $19,400, 12% for taxable income between $19,401 and $80,250, and so on. This means that couples who file jointly can take advantage of lower tax rates on their combined income.

Overall, filing taxes jointly as a married couple can provide significant tax savings and simplify the tax preparation process. By understanding the benefits of joint filing, couples can make informed decisions about their tax strategy and minimize their tax liability.

How to Determine Your Tax Filing Status

Determining the correct tax filing status is crucial for married couples to ensure they are taking advantage of the most beneficial tax rates and deductions. The Internal Revenue Service (IRS) provides guidelines for married couples to determine their tax filing status, which can be either married filing jointly (MFJ) or married filing separately (MFS).

To qualify for MFJ, couples must meet the following requirements:

- Be married as of December 31st of the tax year

- Not be separated or divorced as of the last day of the tax year

- Not be considered unmarried for tax purposes due to a separation agreement or decree

If couples meet these requirements, they can file jointly and take advantage of the benefits associated with MFJ, including lower tax rates and increased standard deductions.

However, there are scenarios where filing separately may be beneficial. For example:

- If one spouse has significant medical expenses, filing separately may allow them to deduct more of these expenses

- If one spouse has a large amount of debt, filing separately may protect the other spouse’s income from being used to pay off the debt

- If couples are separated but not divorced, filing separately may be the only option

It’s essential to note that filing separately can result in higher tax rates and reduced deductions, so couples should carefully consider their situation before making a decision.

In addition to MFJ and MFS, there are other tax filing statuses that may apply to married couples, such as head of household or qualifying widow(er). Couples should consult with a tax professional to determine the best filing status for their specific situation.

Ultimately, determining the correct tax filing status is crucial for married couples to ensure they are taking advantage of the most beneficial tax rates and deductions. By understanding the requirements and implications of each filing status, couples can make informed decisions about their tax strategy and minimize their tax liability.

Tax Rates for Married Couples: What You Need to Know

Understanding the tax rate structure for married couples filing jointly is essential to minimize tax liability and maximize savings. The tax rate for married filing jointly (MFJ) is generally lower than the tax rate for single filers, making it a beneficial option for many couples.

For the current tax year, the tax brackets for MFJ are as follows:

- 10%: Taxable income between $0 and $19,400

- 12%: Taxable income between $19,401 and $80,250

- 22%: Taxable income between $80,251 and $171,050

- 24%: Taxable income between $171,051 and $326,600

- 32%: Taxable income between $326,601 and $414,700

- 35%: Taxable income between $414,701 and $622,050

- 37%: Taxable income over $622,050

These tax brackets apply to different types of income, including wages, investments, and self-employment income. For example, if a couple has a combined taxable income of $100,000, they would fall into the 24% tax bracket.

It’s essential to note that the tax rate for MFJ can vary depending on the couple’s specific situation. For instance, if one spouse has a significant amount of investment income, they may be subject to the net investment income tax (NIIT), which can increase their tax liability.

Additionally, married couples filing jointly may be eligible for certain tax credits and deductions, such as the earned income tax credit (EITC) and the mortgage interest deduction. These credits and deductions can help reduce their tax liability and increase their refund.

To take advantage of the tax rate for MFJ, couples should ensure they are filing jointly and reporting all their income and deductions accurately. They should also consider consulting with a tax professional to ensure they are taking advantage of all the tax savings available to them.

By understanding the tax rate structure for married couples filing jointly, couples can make informed decisions about their tax strategy and minimize their tax liability. This can help them save money and achieve their financial goals.

Claiming Deductions and Credits as a Married Couple

Married couples filing jointly can claim various deductions and credits to reduce their tax liability. These deductions and credits can provide significant tax savings, and it’s essential to understand which ones are available and how to claim them.

One of the most popular deductions for married couples is the mortgage interest deduction. This deduction allows couples to deduct the interest paid on their primary residence and/or second home. To qualify, the couple must itemize their deductions and have a mortgage on a qualified residence.

Another deduction available to married couples is the charitable contributions deduction. This deduction allows couples to deduct donations made to qualified charitable organizations. To qualify, the couple must itemize their deductions and have receipts for the donations.

In addition to deductions, married couples may also be eligible for various tax credits. One of the most popular credits is the earned income tax credit (EITC). This credit is designed for low-to-moderate-income working couples and can provide a significant refund. To qualify, the couple must meet certain income and eligibility requirements.

Other credits available to married couples include the child tax credit and the education credits. The child tax credit provides a credit of up to $2,000 per child, while the education credits provide a credit of up to $2,500 for education expenses.

To maximize these deductions and credits, married couples should keep accurate records of their expenses and donations. They should also consult with a tax professional to ensure they are taking advantage of all the deductions and credits available to them.

Some tips for maximizing deductions and credits include:

- Keep receipts for all charitable donations and mortgage interest payments

- Itemize deductions to claim the mortgage interest and charitable contributions deductions

- Claim the EITC if eligible, as it can provide a significant refund

- Take advantage of education credits for education expenses

- Consult with a tax professional to ensure all deductions and credits are claimed

By understanding the deductions and credits available to them, married couples can minimize their tax liability and maximize their refund. It’s essential to keep accurate records and consult with a tax professional to ensure all deductions and credits are claimed.

Strategies for Minimizing Your Tax Liability

As a married couple, minimizing your tax liability requires a combination of smart tax planning and strategic financial decisions. By implementing the right strategies, you can reduce your tax bill and keep more of your hard-earned money.

One effective strategy for minimizing tax liability is income splitting. This involves dividing income between spouses to take advantage of lower tax brackets. For example, if one spouse earns a significantly higher income than the other, it may be beneficial to split the income to reduce the overall tax liability.

Another strategy is tax-loss harvesting. This involves selling investments that have declined in value to offset gains from other investments. By doing so, you can reduce your tax liability and minimize the impact of investment losses.

Contributing to tax-advantaged retirement accounts is also an effective way to minimize tax liability. These accounts, such as 401(k)s and IRAs, allow you to contribute pre-tax dollars, reducing your taxable income and lowering your tax liability.

In addition to these strategies, it’s essential to consider the tax implications of major financial decisions, such as buying or selling a home, investing in a business, or receiving an inheritance. By understanding the tax implications of these decisions, you can make informed choices that minimize your tax liability.

Tax planning is not just a once-a-year task; it’s an ongoing process that requires regular monitoring and adjustments. By staying on top of tax law changes and adjusting your strategy accordingly, you can ensure that you’re always minimizing your tax liability.

Some additional tips for minimizing tax liability include:

- Keep accurate records of income and expenses to ensure accurate tax reporting

- Take advantage of tax credits and deductions, such as the earned income tax credit and the mortgage interest deduction

- Consider hiring a tax professional to provide personalized guidance and representation

- Stay informed about tax law changes and adjust your strategy accordingly

By implementing these strategies and staying informed about tax law changes, married couples can minimize their tax liability and keep more of their hard-earned money.

Avoiding Common Tax Mistakes as a Married Couple

As a married couple, it’s essential to avoid common tax mistakes that can lead to errors, penalties, and even audits. By understanding these mistakes and taking steps to prevent them, you can ensure accurate tax reporting and minimize your tax liability.

One of the most common tax mistakes made by married couples is failing to report all income. This can include income from side jobs, investments, or self-employment. To avoid this mistake, make sure to report all income on your tax return, including income from sources that may not have issued a Form 1099.

Another common mistake is claiming incorrect deductions. This can include claiming deductions for expenses that are not eligible or claiming deductions for expenses that were not actually incurred. To avoid this mistake, make sure to keep accurate records of your expenses and only claim deductions that are eligible and supported by documentation.

Missing deadlines is another common tax mistake made by married couples. This can include missing the deadline for filing your tax return or missing the deadline for making estimated tax payments. To avoid this mistake, make sure to keep track of important tax deadlines and plan ahead to ensure that you meet them.

Other common tax mistakes made by married couples include:

- Failing to sign and date the tax return

- Not keeping accurate records of income and expenses

- Not reporting all income from sources such as investments or self-employment

- Claiming deductions for expenses that are not eligible

- Missing deadlines for filing the tax return or making estimated tax payments

To avoid these mistakes, it’s essential to take a proactive approach to tax planning. This includes:

- Keeping accurate records of income and expenses

- Reporting all income from all sources

- Only claiming deductions that are eligible and supported by documentation

- Meeting all tax deadlines, including the deadline for filing the tax return and making estimated tax payments

- Seeking professional tax help if you have complex tax situations or questions

By avoiding common tax mistakes and taking a proactive approach to tax planning, married couples can ensure accurate tax reporting and minimize their tax liability.

Tax Planning for Married Couples with Complex Financial Situations

Married couples with complex financial situations, such as self-employment income, rental properties, or investments, require specialized tax planning to minimize their tax liabilities. These situations can create unique tax challenges, and it’s essential to understand the tax implications of each situation to make informed decisions.

Self-employment income, for example, can create tax complexities, such as calculating self-employment tax and deducting business expenses. Married couples with self-employment income should consider consulting with a tax professional to ensure they are taking advantage of all eligible deductions and credits.

Rental properties can also create tax complexities, such as calculating rental income and deducting expenses. Married couples with rental properties should consider consulting with a tax professional to ensure they are meeting all tax requirements and taking advantage of all eligible deductions and credits.

Investments can also create tax complexities, such as calculating capital gains and losses. Married couples with investments should consider consulting with a tax professional to ensure they are meeting all tax requirements and taking advantage of all eligible deductions and credits.

To navigate these complex situations, married couples should consider the following tax planning strategies:

- Consult with a tax professional to ensure they are meeting all tax requirements and taking advantage of all eligible deductions and credits

- Keep accurate records of income and expenses to ensure accurate tax reporting

- Consider hiring a tax professional to provide personalized guidance and representation in case of an audit

- Stay informed about tax law changes and adjust their tax strategy accordingly

By understanding the tax implications of complex financial situations and implementing effective tax planning strategies, married couples can minimize their tax liabilities and achieve their financial goals.

Some additional tips for tax planning with complex financial situations include:

- Consider using tax-deferred accounts, such as 401(k)s or IRAs, to reduce taxable income

- Consider using tax-loss harvesting to offset capital gains

- Consider consulting with a financial advisor to ensure they are meeting all financial goals and objectives

By taking a proactive approach to tax planning and seeking professional guidance when needed, married couples with complex financial situations can ensure they are meeting all tax requirements and achieving their financial goals.

Seeking Professional Tax Help as a Married Couple

As a married couple, navigating the complexities of tax law can be overwhelming, especially if you have complex financial situations or questions. Seeking professional tax help can provide personalized guidance and representation, ensuring that you are taking advantage of all eligible deductions and credits.

A tax professional can help you navigate the tax implications of joint filing, including the tax rate structure and how to minimize your tax liability. They can also provide guidance on how to claim deductions and credits, such as the mortgage interest deduction and the earned income tax credit.

In addition to providing guidance on tax law, a tax professional can also represent you in case of an audit. This can provide peace of mind, knowing that you have a professional advocating on your behalf.

Some benefits of working with a tax professional include:

- Personalized guidance and representation

- Expert knowledge of tax law and regulations

- Ability to navigate complex financial situations

- Representation in case of an audit

When seeking professional tax help, it’s essential to find a qualified tax professional who has experience working with married couples. You can ask for referrals from friends or family members, or search online for tax professionals in your area.

Some questions to ask when seeking professional tax help include:

- What experience do you have working with married couples?

- What services do you offer, and what are your fees?

- How will you represent me in case of an audit?

- What is your approach to tax planning, and how will you help me minimize my tax liability?

By seeking professional tax help, married couples can ensure that they are taking advantage of all eligible deductions and credits, and minimizing their tax liability. This can provide peace of mind, knowing that you have a professional advocating on your behalf.