Understanding the Importance of Car Rental Insurance

Renting a car can be a convenient and liberating experience, but it also comes with significant risks. Without adequate insurance coverage, drivers may be exposed to financial losses and potential legal issues in the event of an accident or theft. The costs of repairing or replacing a damaged vehicle can be substantial, and liability claims can quickly add up. Furthermore, car rental companies often charge high fees for their own insurance coverage, which can increase the overall cost of the rental.

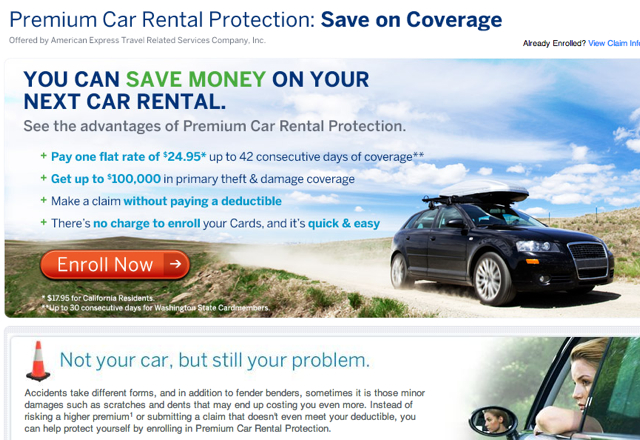

This is where credit card car rental insurance coverage comes in – a convenient and cost-effective solution that can provide peace of mind for travelers. Many credit cards offer car rental insurance coverage as a benefit, which can help mitigate the risks associated with renting a car. By understanding the importance of car rental insurance and how credit card coverage works, drivers can make informed decisions and avoid costly surprises.

Car rental insurance coverage credit card benefits can vary widely depending on the issuer and the specific card. Some credit cards offer primary coverage, which means that the credit card company will pay out claims directly, while others offer secondary coverage, which means that the credit card company will only pay out claims after the driver’s primary insurance has been exhausted. It’s essential to carefully review the terms and conditions of the credit card agreement to understand the scope of coverage and any limitations or exclusions.

In addition to the financial benefits, credit card car rental insurance coverage can also provide a level of convenience and flexibility. For example, some credit cards offer coverage for rentals in foreign countries, which can be particularly useful for international travelers. Others may offer coverage for certain types of vehicles, such as luxury cars or SUVs.

Overall, car rental insurance coverage credit card benefits can be a valuable addition to any traveler’s wallet. By understanding the risks associated with renting a car and the benefits of credit card coverage, drivers can make informed decisions and enjoy a more stress-free travel experience.

How to Choose a Credit Card with Comprehensive Car Rental Insurance

When selecting a credit card that offers car rental insurance coverage, there are several key factors to consider. One of the most important is the policy limit, which is the maximum amount of coverage provided by the credit card company. Look for credit cards with high policy limits, such as $50,000 or more, to ensure that you have adequate coverage in the event of an accident or theft.

Another important factor to consider is the deductible, which is the amount you must pay out of pocket before the credit card company will pay out a claim. Some credit cards have low or no deductibles, while others may have higher deductibles. Be sure to review the terms and conditions of the credit card agreement to understand the deductible and how it applies to your coverage.

Coverage exclusions are also an important consideration. Some credit cards may exclude coverage for certain types of vehicles, such as luxury cars or SUVs, or for rentals in specific countries. Be sure to review the terms and conditions of the credit card agreement to understand any exclusions that may apply.

Some popular credit cards that offer robust car rental insurance benefits include the Chase Sapphire Preferred and the American Express Platinum. The Chase Sapphire Preferred offers primary coverage, which means that the credit card company will pay out claims directly, and has a policy limit of $50,000. The American Express Platinum also offers primary coverage and has a policy limit of $75,000.

Other credit cards that offer car rental insurance coverage include the Citi Premier, the Capital One Venture, and the Barclays Arrival Plus. Be sure to review the terms and conditions of each credit card agreement to understand the scope of coverage and any limitations or exclusions.

In addition to the policy limit, deductible, and coverage exclusions, it’s also important to consider the credit card’s overall benefits and rewards program. Look for credit cards that offer rewards in categories that align with your spending habits, such as travel or dining, and that have a low annual fee.

By carefully reviewing the terms and conditions of each credit card agreement and considering the key factors outlined above, you can choose a credit card that offers comprehensive car rental insurance coverage and meets your overall financial needs.

Car rental insurance coverage credit card benefits can vary widely depending on the issuer and the specific card. By doing your research and choosing a credit card that offers robust coverage, you can enjoy peace of mind when renting a car and avoid costly surprises.

What’s Covered Under Credit Card Car Rental Insurance?

Credit card car rental insurance coverage typically includes three main types of coverage: collision damage, theft, and liability. Collision damage coverage pays for damages to the rental car if it is involved in an accident, regardless of who is at fault. Theft coverage pays for the loss of the rental car if it is stolen. Liability coverage pays for damages or injuries to third parties if the rental car is involved in an accident.

Collision damage coverage usually includes coverage for damages to the rental car’s body, engine, and other components. However, some credit cards may exclude coverage for certain types of damages, such as tire damage or windshield damage. Theft coverage usually includes coverage for the loss of the rental car, as well as any personal belongings that were in the car at the time of the theft.

Liability coverage usually includes coverage for damages or injuries to third parties, such as other drivers, pedestrians, or property owners. However, some credit cards may exclude coverage for certain types of liability, such as liability for damages to the rental car itself.

It’s also important to note that credit card car rental insurance coverage may have limitations or exclusions for certain types of vehicles or rentals in specific countries. For example, some credit cards may exclude coverage for luxury cars or SUVs, or for rentals in countries with high crime rates. Be sure to review the terms and conditions of the credit card agreement to understand any limitations or exclusions that may apply.

In addition to the main types of coverage, some credit cards may also offer additional benefits, such as roadside assistance or travel insurance. Roadside assistance can provide help if the rental car breaks down or is involved in an accident, while travel insurance can provide coverage for trip cancellations or interruptions.

Car rental insurance coverage credit card benefits can vary widely depending on the issuer and the specific card. By understanding what’s covered under credit card car rental insurance, you can make informed decisions and choose a credit card that meets your needs.

Some popular credit cards that offer comprehensive car rental insurance coverage include the Chase Sapphire Preferred, American Express Platinum, and Citi Premier. These cards offer high policy limits, low deductibles, and broad coverage for collision damage, theft, and liability.

When choosing a credit card with car rental insurance coverage, be sure to carefully review the terms and conditions of the agreement to understand what’s covered and what’s not. This can help you avoid costly surprises and ensure that you have adequate coverage in the event of an accident or theft.

How to Activate and Use Your Credit Card Car Rental Insurance

Activating and using your credit card car rental insurance coverage is a straightforward process. Here are the steps to follow:

Step 1: Review your credit card agreement to ensure that you have car rental insurance coverage. Check the terms and conditions to understand what is covered and what is not.

Step 2: When renting a car, decline the car rental company’s insurance coverage. This is usually offered at the rental counter, and it can be expensive. By declining this coverage, you can save money and rely on your credit card’s car rental insurance coverage instead.

Step 3: Use your credit card to pay for the car rental. This will activate the car rental insurance coverage. Make sure to use the same credit card for all rental-related expenses, including gas and parking fees.

Step 4: Keep a record of your rental agreement and any receipts or documentation related to the rental. This will be useful if you need to file a claim.

Step 5: If you are involved in an accident or the rental car is stolen, contact your credit card company immediately. They will guide you through the claims process and help you get the coverage you need.

It’s essential to carefully review your credit card agreement and understand the terms and conditions of the car rental insurance coverage. This will help you avoid any surprises or misunderstandings when filing a claim.

In addition to following these steps, it’s also important to keep in mind the following:

Make sure to read and understand the car rental agreement before signing. This will help you avoid any unexpected fees or charges.

Take photos of the rental car before and after the rental period. This will help document any damages or issues with the vehicle.

Keep a record of any communication with the car rental company or your credit card company. This will help you track any issues or claims.

By following these steps and tips, you can ensure that you get the most out of your credit card car rental insurance coverage and avoid any costly surprises.

Car rental insurance coverage credit card benefits can provide peace of mind and financial protection when renting a car. By understanding how to activate and use this coverage, you can enjoy a stress-free rental experience and avoid any unexpected expenses.

Real-Life Scenarios: When Credit Card Car Rental Insurance Saves the Day

Car rental insurance coverage credit card benefits can be a lifesaver in unexpected situations. Here are some real-life examples of individuals who have successfully used their credit card car rental insurance coverage to mitigate losses or expenses:

Scenario 1: A traveler rented a car in Europe and was involved in an accident. The car rental company’s insurance coverage would have cost an additional $20 per day, but the traveler’s credit card car rental insurance coverage kicked in and covered the damages.

Scenario 2: A business traveler rented a car for a conference and the car was stolen from the hotel parking lot. The credit card car rental insurance coverage reimbursed the traveler for the stolen car and provided additional coverage for the rental car company’s administrative fees.

Scenario 3: A family rented a car for a vacation and the car broke down on the side of the road. The credit card car rental insurance coverage provided roadside assistance and covered the cost of a replacement car.

These scenarios illustrate the importance of having car rental insurance coverage credit card benefits. By having this coverage, individuals can avoid costly surprises and financial losses in unexpected situations.

In each of these scenarios, the credit card car rental insurance coverage provided valuable protection and saved the individual from financial losses. By understanding the benefits and limitations of credit card car rental insurance coverage, individuals can make informed decisions and choose the right credit card for their needs.

Car rental insurance coverage credit card benefits can provide peace of mind and financial protection when renting a car. By understanding how to use this coverage and what is covered, individuals can avoid costly surprises and enjoy a stress-free rental experience.

It’s essential to carefully review the terms and conditions of the credit card agreement to understand what is covered and what is not. This will help individuals avoid any misunderstandings or surprises when filing a claim.

By choosing a credit card with comprehensive car rental insurance coverage, individuals can enjoy a worry-free rental experience and avoid costly surprises. Whether you’re a frequent traveler or an occasional renter, credit card car rental insurance coverage can provide valuable protection and peace of mind.

Common Misconceptions About Credit Card Car Rental Insurance

There are several common misconceptions about credit card car rental insurance coverage that can lead to confusion and misunderstandings. Here are some of the most common myths and misconceptions, along with the facts:

Myth: All credit cards offer equal car rental insurance coverage.

Fact: Not all credit cards offer the same level of car rental insurance coverage. Some credit cards may offer more comprehensive coverage, while others may have limitations or exclusions.

Myth: Credit card car rental insurance coverage is always automatic.

Fact: While some credit cards may offer automatic car rental insurance coverage, others may require you to opt-in or activate the coverage. It’s essential to review your credit card agreement to understand the terms and conditions of the coverage.

Myth: Credit card car rental insurance coverage is only available for certain types of vehicles.

Fact: Most credit cards offer car rental insurance coverage for a wide range of vehicles, including cars, trucks, and SUVs. However, some credit cards may exclude coverage for certain types of vehicles, such as luxury cars or motorcycles.

Myth: Credit card car rental insurance coverage is only available for rentals in the United States.

Fact: Many credit cards offer car rental insurance coverage for rentals worldwide, including international destinations. However, some credit cards may have limitations or exclusions for certain countries or regions.

Myth: Credit card car rental insurance coverage is not as comprehensive as traditional insurance options.

Fact: Credit card car rental insurance coverage can be just as comprehensive as traditional insurance options, including standalone car rental insurance policies or coverage offered by car rental companies. However, it’s essential to review the terms and conditions of the coverage to understand what is included and what is excluded.

By understanding the facts and myths about credit card car rental insurance coverage, you can make informed decisions and choose the right credit card for your needs. Remember to always review your credit card agreement and ask questions to ensure you understand the terms and conditions of the coverage.

Car rental insurance coverage credit card benefits can provide valuable protection and peace of mind when renting a car. By understanding the common misconceptions and myths, you can avoid costly surprises and make the most of your credit card benefits.

Comparing Credit Card Car Rental Insurance to Traditional Insurance Options

When it comes to car rental insurance coverage, there are several options available, including credit card car rental insurance, standalone car rental insurance policies, and coverage offered by car rental companies. Each option has its pros and cons, and it’s essential to understand the differences to make an informed decision.

Credit card car rental insurance coverage is a convenient and cost-effective option that is often included with many credit cards. This type of coverage typically provides collision damage, theft, and liability coverage, and can be activated by using the credit card to pay for the car rental. One of the main advantages of credit card car rental insurance coverage is that it can be more comprehensive than traditional insurance options, and can provide additional benefits such as roadside assistance and travel insurance.

Standalone car rental insurance policies, on the other hand, are separate insurance policies that can be purchased specifically for car rentals. These policies can provide more comprehensive coverage than credit card car rental insurance, but can also be more expensive. One of the main advantages of standalone car rental insurance policies is that they can provide more flexibility and customization options, allowing drivers to choose the level of coverage they need.

Coverage offered by car rental companies is another option available to drivers. This type of coverage is typically more expensive than credit card car rental insurance or standalone car rental insurance policies, but can provide more comprehensive coverage and additional benefits such as roadside assistance and travel insurance. One of the main advantages of coverage offered by car rental companies is that it can provide more convenience and ease of use, as it is often included in the car rental agreement.

When comparing credit card car rental insurance coverage to traditional insurance options, it’s essential to consider the pros and cons of each option. Credit card car rental insurance coverage can be a convenient and cost-effective option, but may have limitations and exclusions. Standalone car rental insurance policies can provide more comprehensive coverage, but can be more expensive. Coverage offered by car rental companies can provide more convenience and ease of use, but can also be more expensive.

Ultimately, the best option for car rental insurance coverage will depend on the individual’s needs and circumstances. By understanding the pros and cons of each option, drivers can make an informed decision and choose the coverage that is right for them.

Car rental insurance coverage credit card benefits can provide valuable protection and peace of mind when renting a car. By comparing credit card car rental insurance coverage to traditional insurance options, drivers can make an informed decision and choose the coverage that is right for them.

Maximizing Your Credit Card Benefits: Tips and Strategies

To get the most out of your credit card car rental insurance coverage, it’s essential to understand the terms and conditions of your policy. Here are some expert tips and strategies to help you maximize your benefits:

1. Carefully review your credit card agreement: Before renting a car, make sure you understand the terms and conditions of your credit card car rental insurance coverage. Check the policy limits, deductibles, and coverage exclusions to ensure you have adequate coverage.

2. Combine coverage with other insurance options: If you have other insurance options, such as personal auto insurance or travel insurance, consider combining them with your credit card car rental insurance coverage. This can provide more comprehensive coverage and help you save money.

3. Negotiate with car rental companies: If you’re renting a car, negotiate with the car rental company to see if they can offer any discounts or promotions. Some car rental companies may offer discounts for customers who have credit card car rental insurance coverage.

4. Ask questions: If you’re unsure about any aspect of your credit card car rental insurance coverage, ask questions. Contact your credit card company or car rental company to get clarification on any issues you’re unsure about.

5. Keep records: Keep records of your car rental agreement, credit card statement, and any other relevant documents. This can help you prove your coverage and make claims easier.

By following these tips and strategies, you can maximize your credit card car rental insurance coverage and get the most out of your benefits. Remember to always carefully review your policy terms and conditions and ask questions to ensure you understand your coverage.

Car rental insurance coverage credit card benefits can provide valuable protection and peace of mind when renting a car. By understanding how to maximize your benefits, you can enjoy a stress-free rental experience and avoid costly surprises.

In addition to these tips and strategies, it’s also essential to understand the importance of carefully reviewing your credit card agreement and asking questions. This can help you avoid any misunderstandings or surprises when filing a claim.

By combining these tips and strategies with a thorough understanding of your credit card car rental insurance coverage, you can maximize your benefits and enjoy a worry-free rental experience.