Understanding the Basics of Student Loan Repayment

When it comes to managing student loan debt, understanding the various repayment options is crucial for borrowers to make informed decisions about their financial stability. With the numerous plans available, it can be overwhelming to navigate the complexities of student loan repayment. Two popular options, Pay As You Earn (PAYE) and Income-Based Repayment (IBR), offer borrowers flexibility in managing their debt. However, it’s essential to comprehend the differences between these plans and how they impact borrowers’ financial situations.

In the United States, student loan debt has become a significant concern, with over 44 million borrowers owing more than $1.7 trillion in debt. The burden of student loan repayment can be substantial, and borrowers must carefully consider their options to avoid default or delinquency. By understanding the basics of student loan repayment, borrowers can make informed decisions about their financial future.

One of the primary benefits of PAYE and IBR plans is their ability to adjust monthly payments based on income and family size. This feature allows borrowers to manage their debt more effectively, especially during periods of financial hardship. However, it’s crucial to note that these plans have distinct eligibility criteria, benefits, and repayment terms. Borrowers must carefully evaluate their financial situation and choose the plan that best suits their needs.

In the next sections, we will delve into the specifics of PAYE and IBR plans, exploring their similarities and differences. By understanding the intricacies of these plans, borrowers can make informed decisions about their student loan repayment and take the first step towards achieving financial stability.

What is Pay As You Earn (PAYE)? How Does it Work?

The Pay As You Earn (PAYE) plan is a popular income-driven repayment option for borrowers with federal student loans. Introduced in 2012, PAYE aims to make student loan repayment more manageable by capping monthly payments at 10% of a borrower’s discretionary income. To be eligible for PAYE, borrowers must have taken out a federal student loan on or after October 1, 2007, and received a disbursement of a Direct Loan on or after October 1, 2011.

One of the primary benefits of PAYE is its ability to adjust monthly payments based on income and family size. Borrowers who enroll in PAYE will have their monthly payments calculated as 10% of their discretionary income, which is defined as the amount by which their adjusted gross income (AGI) exceeds 150% of the federal poverty guideline for their family size. This means that borrowers who experience a decrease in income or an increase in family size may see a reduction in their monthly payments.

PAYE also offers several benefits, including interest subsidies and forgiveness options. Borrowers who enroll in PAYE may be eligible for interest subsidies, which can help reduce the amount of interest that accrues on their loans. Additionally, borrowers who make 20 years of qualifying payments under PAYE may be eligible for loan forgiveness, which can help eliminate any remaining balance on their loans.

While PAYE can be a valuable option for borrowers who need help managing their student loan debt, it’s essential to understand the plan’s terms and conditions. Borrowers who enroll in PAYE will need to recertify their income and family size annually to ensure that their monthly payments remain affordable. Failure to recertify can result in increased monthly payments or even default.

In the next section, we will explore the Income-Based Repayment (IBR) plan, which offers similar benefits to PAYE but with some key differences. By understanding the similarities and differences between PAYE and IBR, borrowers can make informed decisions about their student loan repayment and choose the plan that best suits their needs.

Income-Based Repayment (IBR): A Viable Alternative to PAYE

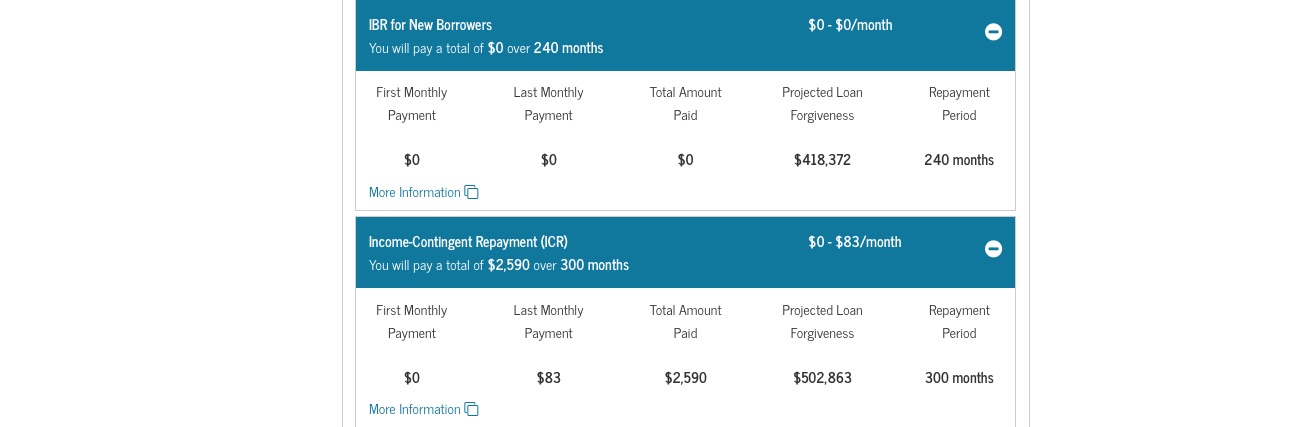

Income-Based Repayment (IBR) is another popular income-driven repayment plan that offers borrowers a flexible way to manage their student loan debt. While IBR shares some similarities with Pay As You Earn (PAYE), it has distinct features that make it a viable alternative for borrowers with high debt-to-income ratios. To be eligible for IBR, borrowers must have a partial financial hardship, which is defined as a situation where the borrower’s monthly payment under the Standard Repayment Plan is more than 15% of their discretionary income.

One of the primary benefits of IBR is its ability to adjust monthly payments based on income and family size. Borrowers who enroll in IBR will have their monthly payments calculated as 10% or 15% of their discretionary income, depending on when they took out their loans. This means that borrowers who experience a decrease in income or an increase in family size may see a reduction in their monthly payments.

IBR also offers several benefits, including interest subsidies and forgiveness options. Borrowers who enroll in IBR may be eligible for interest subsidies, which can help reduce the amount of interest that accrues on their loans. Additionally, borrowers who make 20 or 25 years of qualifying payments under IBR may be eligible for loan forgiveness, which can help eliminate any remaining balance on their loans.

While IBR is similar to PAYE in many ways, there are some key differences between the two plans. For example, IBR has a higher payment cap than PAYE, which means that borrowers who enroll in IBR may have higher monthly payments. However, IBR also offers more flexibility for borrowers with high debt-to-income ratios, as it allows borrowers to qualify for the plan even if they have a higher debt burden.

In the next section, we will explore the key differences between PAYE and IBR, including their distinct features and benefits. By understanding the similarities and differences between these two plans, borrowers can make informed decisions about their student loan repayment and choose the plan that best suits their needs.

Key Differences Between PAYE and IBR: Which Plan is Right for You?

When it comes to choosing between Pay As You Earn (PAYE) and Income-Based Repayment (IBR), borrowers need to consider several key differences between the two plans. While both plans offer flexible repayment options, they have distinct features that may make one plan more suitable for a borrower’s financial situation than the other.

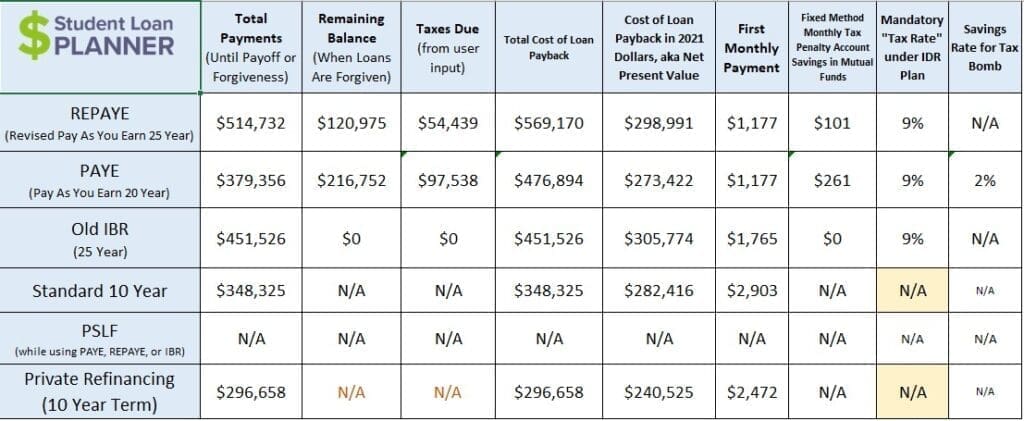

One of the main differences between PAYE and IBR is the payment cap. PAYE has a lower payment cap than IBR, which means that borrowers who enroll in PAYE may have lower monthly payments. However, IBR offers more flexibility for borrowers with high debt-to-income ratios, as it allows borrowers to qualify for the plan even if they have a higher debt burden.

Another key difference between PAYE and IBR is the interest subsidy. PAYE offers a more generous interest subsidy than IBR, which means that borrowers who enroll in PAYE may pay less interest over the life of the loan. However, IBR offers a longer forgiveness period than PAYE, which means that borrowers who enroll in IBR may be eligible for loan forgiveness after 20 or 25 years of qualifying payments.

In addition to these differences, borrowers should also consider the eligibility criteria for each plan. PAYE has stricter eligibility criteria than IBR, which means that borrowers who do not meet the eligibility criteria for PAYE may still be eligible for IBR.

Ultimately, the choice between PAYE and IBR depends on a borrower’s individual financial situation and goals. Borrowers who want to minimize their monthly payments may prefer PAYE, while borrowers who want to maximize their forgiveness options may prefer IBR. By understanding the key differences between these two plans, borrowers can make informed decisions about their student loan repayment and choose the plan that best suits their needs.

In the next section, we will provide a step-by-step guide for borrowers to determine which plan is best suited for their financial situation, including assessing income, expenses, and debt obligations.

How to Choose Between PAYE and IBR: A Step-by-Step Guide

Choosing between Pay As You Earn (PAYE) and Income-Based Repayment (IBR) can be a daunting task, especially for borrowers who are new to income-driven repayment plans. However, by following a step-by-step guide, borrowers can make an informed decision about which plan is best suited for their financial situation.

Step 1: Assess Your Income

Borrowers should start by assessing their income, including their gross income, taxes, and any other sources of income. This will help them determine their discretionary income, which is the amount of income that is available for loan payments.

Step 2: Calculate Your Monthly Payments

Next, borrowers should calculate their monthly payments under both PAYE and IBR. This can be done using a repayment calculator or by contacting their loan servicer. Borrowers should compare their monthly payments under both plans to determine which one is more affordable.

Step 3: Evaluate Your Debt Obligations

Borrowers should also evaluate their debt obligations, including their student loan debt, credit card debt, and any other debt obligations. This will help them determine which plan is best suited for their overall financial situation.

Step 4: Consider Your Forgiveness Options

Borrowers should also consider their forgiveness options under both PAYE and IBR. PAYE offers forgiveness after 20 years of qualifying payments, while IBR offers forgiveness after 20 or 25 years of qualifying payments. Borrowers should consider which plan offers the most generous forgiveness options.

Step 5: Review Your Plan Terms

Finally, borrowers should review their plan terms, including their payment schedule, interest rate, and any fees associated with the plan. Borrowers should make sure they understand the terms of their plan and are comfortable with the repayment schedule.

By following these steps, borrowers can make an informed decision about which plan is best suited for their financial situation. Whether you choose PAYE or IBR, it’s essential to understand the terms of your plan and make timely payments to avoid default.

Managing Your Student Loans with PAYE or IBR: Tips and Strategies

Once you’ve enrolled in Pay As You Earn (PAYE) or Income-Based Repayment (IBR), it’s essential to manage your student loans effectively to ensure you’re making the most of these plans. Here are some tips and strategies to help you optimize your payments, monitor your credit reports, and seek assistance when needed.

Optimize Your Payments

To maximize the benefits of PAYE or IBR, it’s crucial to optimize your payments. This means making timely payments, paying more than the minimum payment when possible, and taking advantage of interest subsidies. By doing so, you can reduce the amount of interest you owe and pay off your loans faster.

Monitor Your Credit Reports

Monitoring your credit reports is essential to ensure that your payments are being reported accurately. You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year. Review your reports carefully to ensure that your payments are being reported correctly and that there are no errors or inaccuracies.

Seek Assistance When Needed

If you’re struggling to make payments or need help understanding your loan terms, don’t hesitate to seek assistance. You can contact your loan servicer or a student loan counselor for guidance. Additionally, there are many non-profit organizations that offer free or low-cost counseling and assistance to borrowers.

Take Advantage of Forgiveness Options

Both PAYE and IBR offer forgiveness options after a certain number of years of qualifying payments. To maximize these benefits, it’s essential to understand the forgiveness options available to you and to make qualifying payments consistently. By doing so, you can reduce the amount of debt you owe and achieve financial stability faster.

By following these tips and strategies, you can effectively manage your student loans with PAYE or IBR and achieve financial stability. Remember to stay informed, optimize your payments, and seek assistance when needed to make the most of these plans.

Common Pitfalls to Avoid When Enrolling in PAYE or IBR

When enrolling in Pay As You Earn (PAYE) or Income-Based Repayment (IBR), it’s essential to avoid common pitfalls that can lead to financial difficulties or even default. Here are some common mistakes to avoid when enrolling in PAYE or IBR plans.

Neglecting to Recertify Income

One of the most common mistakes borrowers make is neglecting to recertify their income annually. This can lead to increased monthly payments or even default. Borrowers must recertify their income every year to ensure that their monthly payments remain affordable.

Failing to Understand Plan Terms

Another common mistake is failing to understand the terms of the PAYE or IBR plan. Borrowers must carefully review their plan terms, including the payment schedule, interest rate, and any fees associated with the plan. This will help them avoid any unexpected surprises or financial difficulties.

Not Monitoring Credit Reports

Borrowers must also monitor their credit reports regularly to ensure that their payments are being reported accurately. This will help them avoid any errors or inaccuracies that can negatively impact their credit score.

Not Seeking Assistance When Needed

Finally, borrowers must not hesitate to seek assistance when needed. If they are struggling to make payments or need help understanding their loan terms, they should contact their loan servicer or a student loan counselor for guidance.

By avoiding these common pitfalls, borrowers can ensure that they are making the most of their PAYE or IBR plan and achieving financial stability. Remember to stay informed, recertify your income annually, and seek assistance when needed to avoid any financial difficulties.

Maximizing Forgiveness Options with PAYE and IBR

One of the most attractive features of Pay As You Earn (PAYE) and Income-Based Repayment (IBR) plans is the potential for loan forgiveness. Both plans offer forgiveness options after a certain number of years of qualifying payments, which can help borrowers eliminate their debt and achieve financial stability.

Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness (PSLF) is a forgiveness program that is available to borrowers who work in public service jobs, such as teachers, nurses, and government employees. To be eligible for PSLF, borrowers must make 120 qualifying payments under a PAYE or IBR plan while working in a public service job. After 120 payments, borrowers may be eligible for loan forgiveness, which can eliminate their entire debt balance.

Tax Implications of Forgiveness

While loan forgiveness can be a significant benefit, it’s essential to consider the tax implications of forgiveness. Under current tax law, forgiven debt is considered taxable income, which means that borrowers may be required to pay taxes on the amount of debt that is forgiven. However, there are some exceptions to this rule, such as PSLF, which is tax-free.

Maximizing Forgiveness Options

To maximize forgiveness options with PAYE and IBR, borrowers should carefully review their plan terms and understand the forgiveness options that are available to them. Borrowers should also make timely payments and ensure that they are making qualifying payments under their plan. By doing so, borrowers can increase their chances of achieving loan forgiveness and eliminating their debt.

By understanding the forgiveness options available under PAYE and IBR, borrowers can make informed decisions about their student loan repayment and achieve financial stability. Remember to carefully review your plan terms, make timely payments, and seek assistance when needed to maximize your forgiveness options.