Understanding the Importance of Car Loan Interest Rates

When it comes to financing a vehicle, the interest rate on car loans plays a crucial role in determining the overall cost of owning a car. A lower interest rate can save you thousands of dollars over the life of the loan, while a higher rate can lead to increased monthly payments and a larger total cost. In this article, we will delve into the world of car loan interest rates, exploring the factors that influence them, the different types of car loans available, and providing tips on how to secure the best interest rate for your needs.

Whether you’re a first-time car buyer or a seasoned owner, understanding car loan interest rates is essential to making informed decisions about your financing options. By grasping the concepts outlined in this article, you’ll be better equipped to navigate the complex world of auto financing and find the best deal for your situation. So, let’s get started and explore the ins and outs of car loan interest rates.

What Determines Car Loan Interest Rates?

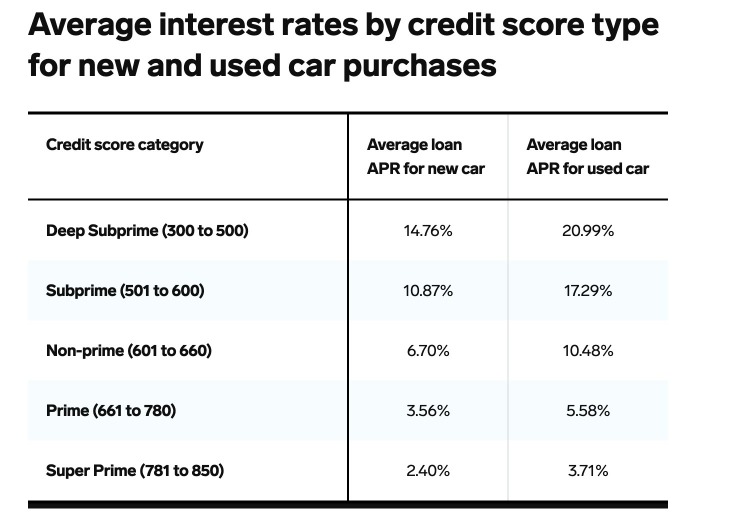

Car loan interest rates are influenced by a combination of factors, including credit score, loan term, vehicle type, and lender. A borrower’s credit score plays a significant role in determining the interest rate on their car loan. A good credit score can lead to a lower interest rate, while a poor credit score can result in a higher interest rate. For example, a borrower with a credit score of 750 or higher may qualify for an interest rate of 4.5%, while a borrower with a credit score of 600 or lower may be offered an interest rate of 7.5% or higher.

The loan term also affects the interest rate on a car loan. A longer loan term typically results in a higher interest rate, while a shorter loan term typically results in a lower interest rate. For instance, a 60-month car loan may have an interest rate of 5.5%, while a 36-month car loan may have an interest rate of 4.5%. Additionally, the type of vehicle being financed can also impact the interest rate. Luxury vehicles, for example, may have higher interest rates than economy vehicles.

The lender also plays a significant role in determining the interest rate on a car loan. Different lenders offer different interest rates, and some may offer more competitive rates than others. For example, a bank may offer an interest rate of 5.5% on a car loan, while a credit union may offer an interest rate of 4.5%. Online lenders may also offer more competitive interest rates than traditional lenders.

Types of Car Loans and Their Associated Interest Rates

When it comes to car loans, there are several types of loans available, each with its own associated interest rate. Understanding the different types of car loans can help borrowers make informed decisions about their financing options. Here are some of the most common types of car loans and their associated interest rates:

Fixed-rate car loans are one of the most popular types of car loans. With a fixed-rate loan, the interest rate remains the same for the entire term of the loan. This type of loan offers borrowers stability and predictability, as they know exactly how much they will be paying each month. Fixed-rate car loans typically have interest rates ranging from 4.5% to 7.5%.

Variable-rate car loans, on the other hand, have interest rates that can fluctuate over the term of the loan. This type of loan can be riskier for borrowers, as they may face higher interest rates if market conditions change. Variable-rate car loans typically have interest rates ranging from 4% to 8%.

Balloon car loans are another type of loan that offers borrowers a lower interest rate for a shorter term. With a balloon loan, the borrower makes lower monthly payments for a set period of time, usually 3-5 years. At the end of the term, the borrower must make a large payment, known as a balloon payment, to pay off the remaining balance of the loan. Balloon car loans typically have interest rates ranging from 5% to 9%.

It’s essential for borrowers to carefully consider the pros and cons of each type of car loan and their associated interest rates before making a decision. By understanding the different types of car loans and their interest rates, borrowers can make informed decisions about their financing options and find the best deal for their needs.

How to Get the Best Interest Rate on Your Car Loan

Securing the best interest rate on a car loan requires some research and planning. Here are some tips and strategies to help you get the best interest rate on your car loan:

Improving your credit score is one of the most effective ways to get a better interest rate on your car loan. A good credit score can help you qualify for lower interest rates and better loan terms. You can improve your credit score by paying your bills on time, reducing your debt, and avoiding negative marks on your credit report.

Shopping around for lenders is another way to get the best interest rate on your car loan. Different lenders offer different interest rates, so it’s essential to compare rates from multiple lenders before making a decision. You can check with banks, credit unions, and online lenders to find the best interest rate for your needs.

Considering alternative financing options is also a good idea. For example, you may be able to get a better interest rate by financing your car through a dealership or a manufacturer’s financing program. Additionally, you may be able to get a better interest rate by using a co-signer or making a larger down payment.

Finally, be sure to read the fine print and understand the terms of your loan before signing. Make sure you understand the interest rate, loan term, and any fees associated with the loan. By doing your research and understanding the terms of your loan, you can make an informed decision and get the best interest rate on your car loan.

Car Loan Interest Rates: A Comparison of Top Lenders

When it comes to car loan interest rates, different lenders offer different rates. Here’s a comparison of car loan interest rates from top lenders, including banks, credit unions, and online lenders:

Banks: Banks are traditional lenders that offer car loans with interest rates ranging from 4.5% to 7.5%. Some of the top banks for car loans include Wells Fargo, Bank of America, and Chase. While banks offer competitive interest rates, they may have stricter credit requirements and higher fees.

Credit Unions: Credit unions are member-owned financial cooperatives that offer car loans with interest rates ranging from 4% to 7%. Some of the top credit unions for car loans include Navy Federal Credit Union, Alliant Credit Union, and PenFed Credit Union. Credit unions often offer more competitive interest rates and better loan terms than banks.

Online Lenders: Online lenders are a relatively new type of lender that offers car loans with interest rates ranging from 3.5% to 6.5%. Some of the top online lenders for car loans include LightStream, Capital One, and LendingTree. Online lenders often offer more competitive interest rates and faster approval times than traditional lenders.

When comparing car loan interest rates from different lenders, it’s essential to consider the pros and cons of each lender. For example, banks may offer more competitive interest rates, but they may have stricter credit requirements and higher fees. Credit unions may offer better loan terms, but they may have limited membership requirements. Online lenders may offer faster approval times, but they may have higher interest rates.

The Impact of Interest Rates on Car Loan Repayments

Interest rates can have a significant impact on car loan repayments. A higher interest rate can result in higher monthly payments, while a lower interest rate can result in lower monthly payments. For example, a $20,000 car loan with an interest rate of 6% over 60 months would result in monthly payments of approximately $386. However, if the interest rate were to increase to 8%, the monthly payments would increase to approximately $424.

Similarly, a lower interest rate can result in significant savings over the life of the loan. For example, a $20,000 car loan with an interest rate of 4% over 60 months would result in monthly payments of approximately $334. Over the life of the loan, this would result in savings of approximately $2,400 compared to a loan with an interest rate of 6%.

It’s essential to consider the impact of interest rates on car loan repayments when choosing a loan. Borrowers should carefully review the loan terms and calculate the total cost of the loan, including interest, to ensure they are getting the best deal. Additionally, borrowers should consider making extra payments or paying off the loan early to reduce the total interest paid over the life of the loan.

In conclusion, interest rates can have a significant impact on car loan repayments. Borrowers should carefully consider the interest rate and loan terms when choosing a loan, and should aim to secure the lowest interest rate possible to minimize their monthly payments and total interest paid over the life of the loan.

Common Mistakes to Avoid When Choosing a Car Loan

When choosing a car loan, there are several common mistakes to avoid. One of the most significant mistakes is not shopping around for interest rates. Many borrowers assume that all lenders offer the same interest rates, but this is not the case. Different lenders offer different interest rates, and shopping around can help you find the best deal.

Another mistake to avoid is not considering all costs. In addition to the interest rate, there are other costs associated with a car loan, such as fees and charges. Borrowers should carefully review the loan terms and calculate the total cost of the loan, including interest and fees, to ensure they are getting the best deal.

Not reading the fine print is another common mistake to avoid. Borrowers should carefully review the loan agreement and understand the terms and conditions before signing. This includes understanding the interest rate, loan term, and any fees or charges associated with the loan.

Additionally, borrowers should avoid falling for low-interest rate gimmicks. Some lenders may offer low-interest rates for a short period, but then increase the rate after the introductory period ends. Borrowers should carefully review the loan terms and understand the interest rate and any conditions that may apply.

Finally, borrowers should avoid using a dealership’s financing options without shopping around. Dealerships often have partnerships with lenders and may offer financing options that are not in the borrower’s best interest. Borrowers should shop around and compare rates from different lenders to ensure they are getting the best deal.

Conclusion: Finding the Best Car Loan Interest Rate for Your Needs

In conclusion, finding the best car loan interest rate requires research, patience, and a thorough understanding of the factors that influence interest rates. By understanding the different types of car loans, the factors that determine interest rates, and the common mistakes to avoid, borrowers can make informed decisions and secure the best interest rate for their needs.

Remember, the interest rate on a car loan can have a significant impact on the overall cost of owning a vehicle. A lower interest rate can save borrowers thousands of dollars over the life of the loan, while a higher interest rate can result in higher monthly payments and a larger total cost.

To find the best car loan interest rate, borrowers should shop around and compare rates from different lenders. They should also consider alternative financing options, such as credit unions and online lenders, and carefully review the loan terms and conditions before signing.

By doing their research and taking the time to understand the complex world of car loan interest rates, borrowers can make informed decisions and secure the best interest rate for their needs. Don’t settle for a high-interest rate – take control of your finances and find the best deal on your car loan.