Understanding the Basics of Roth IRAs

A Roth Individual Retirement Account (IRA) is a type of retirement savings account that allows individuals to contribute after-tax dollars, which then grow tax-free and can be withdrawn tax-free in retirement. This makes Roth IRAs an attractive option for those who want to minimize their tax liability in retirement. When considering a traditional Roth vs Roth IRA, it’s essential to understand the basics of how Roth IRAs work.

Roth IRAs were introduced in 1997 as part of the Taxpayer Relief Act, and since then, they have become a popular choice for retirement savings. The key benefits of Roth IRAs include tax-free growth and withdrawals, which means that the money in the account grows without being subject to taxes, and withdrawals are tax-free in retirement. Additionally, Roth IRAs do not have required minimum distributions (RMDs), which means that account holders are not required to take withdrawals at a certain age.

Another advantage of Roth IRAs is that they offer flexibility in terms of withdrawals. Account holders can withdraw contributions (not earnings) at any time tax-free and penalty-free. However, it’s essential to note that withdrawing earnings before age 59 1/2 or within five years of opening the account may result in taxes and penalties.

When evaluating traditional Roth vs Roth IRA options, it’s crucial to consider individual circumstances, such as income level, tax bracket, and retirement goals. By understanding the basics of Roth IRAs, individuals can make informed decisions about their retirement savings and create a strategy that aligns with their financial objectives.

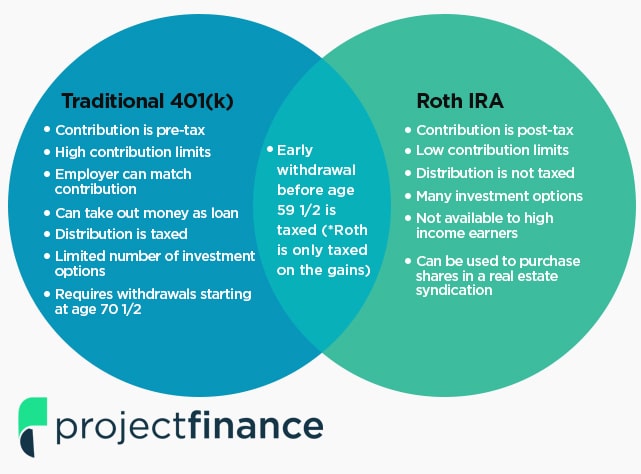

Traditional vs Roth IRA: What’s the Difference?

When it comes to retirement savings, two popular options are traditional IRAs and Roth IRAs. While both types of accounts offer tax benefits, there are key differences in contribution rules, tax implications, and withdrawal requirements. Understanding these differences is crucial when deciding between a traditional and Roth IRA, especially when considering the traditional Roth vs Roth IRA debate.

One of the main differences between traditional and Roth IRAs is the tax treatment of contributions. Traditional IRA contributions are tax-deductible, which means that the money contributed to the account is subtracted from taxable income. In contrast, Roth IRA contributions are made with after-tax dollars, which means that the money contributed to the account has already been subject to income tax.

Another significant difference between traditional and Roth IRAs is the tax treatment of withdrawals. Traditional IRA withdrawals are taxed as ordinary income, which means that the account holder will pay taxes on the money withdrawn from the account. In contrast, Roth IRA withdrawals are tax-free, which means that the account holder will not pay taxes on the money withdrawn from the account.

In addition to tax implications, traditional and Roth IRAs also have different withdrawal requirements. Traditional IRAs require account holders to take required minimum distributions (RMDs) starting at age 72, which means that the account holder must withdraw a certain amount of money from the account each year. In contrast, Roth IRAs do not have RMDs, which means that the account holder is not required to take withdrawals from the account.

When evaluating traditional vs Roth IRA options, it’s essential to consider individual circumstances, such as income level, tax bracket, and retirement goals. By understanding the key differences between traditional and Roth IRAs, individuals can make informed decisions about their retirement savings and create a strategy that aligns with their financial objectives.

How to Choose Between a Traditional and Roth IRA

When it comes to retirement savings, choosing between a traditional and Roth IRA can be a daunting task. Both types of accounts offer tax benefits, but they have different rules and requirements. To make an informed decision, it’s essential to consider individual circumstances, such as income level, tax bracket, and retirement goals. In this section, we’ll provide guidance on how to decide between a traditional and Roth IRA, especially when considering the traditional Roth vs Roth IRA debate.

Income level is a crucial factor to consider when choosing between a traditional and Roth IRA. If you’re in a high tax bracket, a traditional IRA may be a better option, as the tax deduction on contributions can provide significant tax savings. On the other hand, if you’re in a lower tax bracket, a Roth IRA may be a better choice, as the tax-free growth and withdrawals can provide more benefits in the long run.

Tax bracket is another important factor to consider. If you expect to be in a higher tax bracket in retirement, a Roth IRA may be a better option, as the tax-free withdrawals can provide more benefits. On the other hand, if you expect to be in a lower tax bracket in retirement, a traditional IRA may be a better choice, as the tax deduction on contributions can provide more benefits.

Retirement goals are also essential to consider when choosing between a traditional and Roth IRA. If you want to create a tax-free income stream in retirement, a Roth IRA may be a better option. On the other hand, if you want to reduce your taxable income in retirement, a traditional IRA may be a better choice.

Ultimately, the decision between a traditional and Roth IRA depends on individual circumstances. By considering income level, tax bracket, and retirement goals, individuals can make an informed decision and choose the type of account that best aligns with their financial objectives.

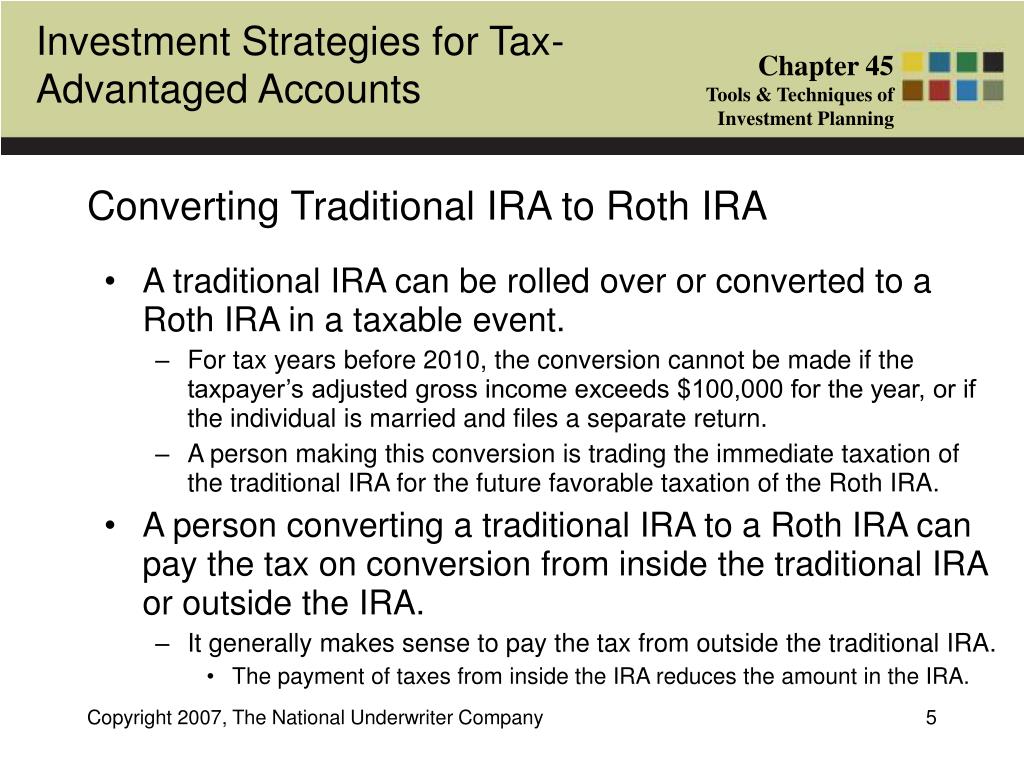

The Benefits of Converting a Traditional IRA to a Roth IRA

Converting a traditional IRA to a Roth IRA can be a strategic move for individuals seeking to optimize their retirement savings. This process, also known as a Roth IRA conversion, involves transferring funds from a traditional IRA to a Roth IRA, allowing the account holder to potentially benefit from tax-free growth and withdrawals. Understanding the benefits and implications of this conversion is crucial for making an informed decision.

One of the primary advantages of converting a traditional IRA to a Roth IRA is the potential for tax-free growth and withdrawals. Unlike traditional IRAs, which require account holders to pay taxes on withdrawals in retirement, Roth IRAs allow tax-free withdrawals if certain conditions are met. This can be particularly beneficial for individuals who expect to be in a higher tax bracket in retirement or who want to minimize their tax liability.

Another benefit of converting to a Roth IRA is the ability to avoid required minimum distributions (RMDs). Traditional IRAs require account holders to take RMDs starting at age 72, which can increase taxable income and potentially impact Social Security benefits or Medicare premiums. Roth IRAs, on the other hand, do not have RMDs during the account holder’s lifetime, providing more flexibility and control over retirement income.

In addition to these benefits, converting a traditional IRA to a Roth IRA can also provide estate planning advantages. Roth IRAs are generally more inheritance-friendly than traditional IRAs, as beneficiaries can take tax-free withdrawals and are not subject to RMDs. This can be an important consideration for individuals who want to leave a tax-efficient legacy for their heirs.

It’s essential to note that converting a traditional IRA to a Roth IRA is a taxable event, and the account holder will need to pay taxes on the converted amount. However, this tax liability can be mitigated by spreading the conversion over several years or by using tax-loss harvesting strategies. It’s also important to consider the impact of the conversion on overall tax liability and to consult with a financial advisor or tax professional before making a decision.

When deciding whether to convert a traditional IRA to a Roth IRA, it’s crucial to weigh the benefits against the potential costs and consider individual circumstances. Factors to consider include income level, tax bracket, retirement goals, and overall financial situation. By carefully evaluating these factors and seeking professional guidance, individuals can make an informed decision about whether a Roth IRA conversion is right for them.

Understanding Roth IRA Contribution Limits and Rules

Roth Individual Retirement Accounts (IRAs) offer a tax-advantaged way to save for retirement, but it’s essential to understand the contribution limits and rules to maximize the benefits. The rules governing Roth IRA contributions can be complex, and failing to comply with them can result in penalties and taxes. This section will provide an overview of the contribution limits and rules for Roth IRAs.

The annual contribution limit for Roth IRAs is $6,000 in 2022, or $7,000 if you are 50 or older. However, the ability to contribute to a Roth IRA is subject to income limits. For the 2022 tax year, you can contribute to a Roth IRA if your income is below $137,500 for single filers or $208,500 for joint filers. The contribution limit is phased out as income approaches these limits, and no contributions are allowed above $152,500 for single filers or $228,500 for joint filers.

In addition to the income limits, Roth IRA contributions are also subject to an annual deadline. Contributions for a given tax year must be made by the tax filing deadline, typically April 15th of the following year. It’s essential to note that Roth IRA contributions are made with after-tax dollars, which means you’ve already paid income tax on the money. As a result, Roth IRA contributions are not tax-deductible.

Roth IRA contributions can also impact your eligibility for other tax deductions and credits. For example, contributing to a Roth IRA may reduce your eligibility for the Savers Credit, a tax credit designed to encourage low- and moderate-income workers to save for retirement. Additionally, Roth IRA contributions may impact your eligibility for other tax deductions, such as the mortgage interest deduction or the charitable contribution deduction.

It’s also important to note that Roth IRA contributions are subject to a five-year rule. This rule states that you must wait at least five years from the date of your first Roth IRA contribution to withdraw earnings tax-free and penalty-free. If you withdraw earnings before the five-year period has elapsed, you may be subject to a 10% penalty and income tax on the withdrawn amount.

Finally, it’s essential to understand the rules governing Roth IRA conversions. If you have a traditional IRA, you may be able to convert it to a Roth IRA, which can provide tax-free growth and withdrawals in retirement. However, the conversion process can be complex, and it’s essential to seek the advice of a financial advisor or tax professional to ensure you comply with the rules and avoid any potential penalties.

In conclusion, understanding the contribution limits and rules for Roth IRAs is crucial to maximizing the benefits of these tax-advantaged accounts. By following the rules and guidelines outlined above, you can ensure that your Roth IRA contributions are made correctly and that you’re on track to achieving your retirement goals.

Investment Options for Roth IRAs: A Guide to Getting Started

When it comes to investing in a Roth Individual Retirement Account (IRA), there are numerous options available to help you grow your retirement savings. From stocks and bonds to exchange-traded funds (ETFs) and mutual funds, the choices can be overwhelming, especially for those new to investing. In this section, we’ll explore the various investment options available for Roth IRAs and provide tips on how to get started.

Stocks: Stocks offer the potential for long-term growth and can be a great addition to a Roth IRA portfolio. When investing in stocks, it’s essential to diversify across various sectors and industries to minimize risk. Consider investing in a mix of large-cap, mid-cap, and small-cap stocks to spread out your risk.

Bonds: Bonds provide a relatively stable source of income and can help balance out the risk in your portfolio. Government bonds, corporate bonds, and municipal bonds are popular options for Roth IRA investors. When investing in bonds, consider the creditworthiness of the issuer and the bond’s duration to ensure it aligns with your investment goals.

ETFs: ETFs offer a diversified portfolio of stocks, bonds, or other securities and can be traded on an exchange like stocks. They provide flexibility and can be used to gain exposure to specific sectors or asset classes. When investing in ETFs, consider the underlying holdings and the fund’s expense ratio to ensure it aligns with your investment objectives.

Mutual Funds: Mutual funds offer a professionally managed portfolio of stocks, bonds, or other securities. They provide diversification and can be a great option for those new to investing. When investing in mutual funds, consider the fund’s investment objective, expense ratio, and performance history to ensure it aligns with your investment goals.

Index Funds: Index funds track a specific market index, such as the S&P 500, and provide broad diversification and low costs. They can be a great option for those looking for a low-maintenance investment strategy. When investing in index funds, consider the underlying index and the fund’s expense ratio to ensure it aligns with your investment objectives.

Real Estate: Real estate can provide a tangible asset and a potential source of income. When investing in real estate through a Roth IRA, consider the property type, location, and management requirements to ensure it aligns with your investment goals.

Getting Started: When getting started with investing in a Roth IRA, it’s essential to consider your investment goals, risk tolerance, and time horizon. Consider the following tips:

Start with a solid understanding of your investment options and the fees associated with each.

Develop a diversified investment strategy to minimize risk.

Consider working with a financial advisor or investment professional to help you get started.

Monitor and adjust your portfolio regularly to ensure it remains aligned with your investment objectives.

By understanding the various investment options available for Roth IRAs and following these tips, you can create a diversified portfolio that helps you achieve your retirement goals.

Common Mistakes to Avoid When Managing a Roth IRA

Managing a Roth Individual Retirement Account (IRA) requires careful planning and attention to detail to ensure that you maximize your retirement savings. However, even with the best intentions, mistakes can occur. In this section, we’ll highlight common mistakes to avoid when managing a Roth IRA, including inadequate diversification, excessive fees, and poor investment choices.

Inadequate Diversification: One of the most common mistakes when managing a Roth IRA is inadequate diversification. This can occur when you invest too heavily in a single asset class or sector, leaving your portfolio vulnerable to market fluctuations. To avoid this mistake, consider diversifying your portfolio across various asset classes, such as stocks, bonds, and real estate.

Excessive Fees: Excessive fees can eat into your retirement savings and reduce your overall returns. When managing a Roth IRA, be mindful of the fees associated with your investments, including management fees, administrative fees, and other expenses. Consider low-cost index funds or ETFs, which can provide broad diversification at a lower cost.

Poor Investment Choices: Poor investment choices can also negatively impact your Roth IRA. This can occur when you invest in assets that are not aligned with your investment goals or risk tolerance. To avoid this mistake, consider working with a financial advisor or investment professional who can help you develop a personalized investment strategy.

Not Monitoring and Adjusting Your Portfolio: Failing to monitor and adjust your portfolio regularly can also lead to poor investment performance. Consider reviewing your portfolio at least quarterly to ensure that it remains aligned with your investment objectives. Rebalance your portfolio as needed to maintain an optimal asset allocation.

Not Considering Tax Implications: When managing a Roth IRA, it’s essential to consider the tax implications of your investments. Consider the tax implications of your investments, including the potential for tax-free growth and withdrawals. Avoid investments that may trigger unnecessary taxes or penalties.

Not Keeping Records: Failing to keep accurate records of your Roth IRA contributions, investments, and withdrawals can lead to errors and penalties. Consider keeping detailed records of your Roth IRA activity, including contribution receipts, investment statements, and withdrawal records.

Not Understanding the Rules: Finally, not understanding the rules governing Roth IRAs can lead to mistakes and penalties. Consider familiarizing yourself with the rules governing Roth IRAs, including contribution limits, income limits, and withdrawal requirements.

By avoiding these common mistakes, you can ensure that your Roth IRA is managed effectively and efficiently, providing you with a secure source of retirement income. Remember to always prioritize your investment goals, risk tolerance, and time horizon when managing your Roth IRA.

Optimizing Your Roth IRA for Long-Term Growth

Optimizing a Roth Individual Retirement Account (IRA) for long-term growth requires a strategic approach to investing and managing your account. By implementing the right strategies, you can maximize your returns and achieve your retirement goals. In this section, we’ll explore three key strategies for optimizing your Roth IRA for long-term growth: dollar-cost averaging, tax-loss harvesting, and regular portfolio rebalancing.

Dollar-Cost Averaging: Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This approach helps to reduce the impact of market volatility and timing risks, allowing you to invest consistently and avoid making emotional decisions based on market fluctuations.

Tax-Loss Harvesting: Tax-loss harvesting is a strategy that involves selling securities that have declined in value to realize losses, which can be used to offset gains from other investments. This approach can help to minimize taxes and maximize after-tax returns, allowing you to keep more of your hard-earned money.

Regular Portfolio Rebalancing: Regular portfolio rebalancing is a strategy that involves periodically reviewing and adjusting your investment portfolio to ensure that it remains aligned with your investment objectives and risk tolerance. This approach helps to maintain an optimal asset allocation, reduce risk, and maximize returns over the long term.

Implementing these strategies requires discipline, patience, and a long-term perspective. By adopting a systematic approach to investing and managing your Roth IRA, you can optimize your account for long-term growth and achieve your retirement goals.

Additional Tips for Optimizing Your Roth IRA:

Consider working with a financial advisor or investment professional to develop a personalized investment strategy.

Take advantage of tax-free growth and withdrawals by contributing to a Roth IRA and avoiding withdrawals until age 59 1/2.

Monitor and adjust your portfolio regularly to ensure that it remains aligned with your investment objectives and risk tolerance.

Avoid making emotional decisions based on market fluctuations, and instead, focus on your long-term investment goals.

By following these strategies and tips, you can optimize your Roth IRA for long-term growth and achieve your retirement goals.

/medriva/media/post_banners/content/uploads/2023/12/roth-vs-traditional-iras-comparison-20231216040347.jpg)