Breaking Down the Barriers: Understanding the Challenges of No-Cosigner Student Loans

Securing personal student loans without a cosigner can be a daunting task for many students. The lack of credit history and higher interest rates can make it difficult for students to qualify for loans, leaving them with limited options to fund their education. However, it’s essential to explore alternative options and understand the challenges associated with no-cosigner student loans.

One of the primary challenges students face is the lack of credit history. Many lenders require a credit history to determine the borrower’s creditworthiness, but students often don’t have an established credit history. This can lead to higher interest rates or stricter repayment terms, making it more challenging for students to manage their debt.

Another challenge is the higher interest rates associated with no-cosigner student loans. Without a cosigner, lenders view the loan as riskier, resulting in higher interest rates to compensate for the increased risk. This can lead to higher monthly payments and a larger total debt burden.

Despite these challenges, it’s crucial for students to explore alternative options for personal student loans without a cosigner. By understanding the challenges and limitations, students can make informed decisions about their loan options and take control of their financial future.

How to Get a Student Loan Without a Cosigner: A Step-by-Step Guide

Securing personal student loans without a cosigner requires careful planning and research. To increase the chances of approval, it’s essential to understand the necessary documents, credit score requirements, and loan options. In this section, we’ll provide a comprehensive guide on how to apply for personal student loans without a cosigner.

Step 1: Check Your Credit Score

Before applying for a personal student loan without a cosigner, it’s crucial to check your credit score. A good credit score can help you qualify for better interest rates and terms. You can check your credit score for free on various websites, such as Credit Karma or Credit Sesame.

Step 2: Gather Necessary Documents

To apply for a personal student loan without a cosigner, you’ll need to provide various documents, including:

- Proof of income or employment

- Proof of enrollment in a degree-granting program

- Transcripts or academic records

- Identification documents, such as a driver’s license or passport

Step 3: Explore Loan Options

There are various loan options available for students without a cosigner, including federal student loans and private student loans. Federal student loans, such as Direct Subsidized and Unsubsidized Loans, offer more favorable terms and benefits, including income-driven repayment plans and loan forgiveness options.

Private student loans, on the other hand, offer more flexible repayment terms and competitive interest rates. However, they often require a credit check and may have stricter repayment terms.

Step 4: Apply for the Loan

Once you’ve gathered the necessary documents and explored loan options, it’s time to apply for the loan. You can apply online or through a mobile app, and the lender will review your application and provide a decision.

By following these steps, you can increase your chances of securing a personal student loan without a cosigner. Remember to carefully review the loan terms and conditions before signing the agreement.

Exploring Alternative Lenders: A Review of No-Cosigner Student Loan Providers

When it comes to securing personal student loans without a cosigner, students often have limited options. However, there are alternative lenders that offer no-cosigner student loans with competitive interest rates and flexible repayment terms. In this section, we’ll review some of the top alternative lenders that offer personal student loans without a cosigner.

SoFi: SoFi is a popular alternative lender that offers no-cosigner student loans with interest rates as low as 3.5%. They also offer a range of repayment terms, including 5, 7, and 10-year plans. SoFi’s loans are designed for students who are pursuing a degree in a high-demand field, such as STEM or business.

Earnest: Earnest is another alternative lender that offers no-cosigner student loans with interest rates as low as 3.5%. They also offer a range of repayment terms, including 5, 7, and 10-year plans. Earnest’s loans are designed for students who are pursuing a degree in a high-demand field, such as STEM or business.

CommonBond: CommonBond is a non-profit alternative lender that offers no-cosigner student loans with interest rates as low as 3.5%. They also offer a range of repayment terms, including 5, 7, and 10-year plans. CommonBond’s loans are designed for students who are pursuing a degree in a high-demand field, such as STEM or business.

Comparison of Alternative Lenders:

| Lender | Interest Rate | Repayment Terms | Borrower Benefits |

|---|---|---|---|

| SoFi | 3.5% – 7.5% | 5, 7, 10 years | Autopay discount, interest rate reduction |

| Earnest | 3.5% – 7.5% | 5, 7, 10 years | Autopay discount, interest rate reduction |

| CommonBond | 3.5% – 7.5% | 5, 7, 10 years | Autopay discount, interest rate reduction |

When choosing an alternative lender, it’s essential to compare interest rates, repayment terms, and borrower benefits. By doing so, students can make an informed decision about their loan options and secure a personal student loan without a cosigner that meets their needs.

The Role of Credit Score in Securing a No-Cosigner Student Loan

Credit score plays a significant role in determining loan eligibility and interest rates for personal student loans without a cosigner. A good credit score can help students qualify for better interest rates and terms, while a poor credit score can lead to higher interest rates or even loan denial.

What is a Good Credit Score?

A good credit score is typically considered to be 700 or higher. However, some lenders may have different credit score requirements, so it’s essential to check with the lender before applying. A good credit score demonstrates responsible credit behavior, such as making on-time payments and keeping credit utilization low.

How to Improve Credit Score

Improving credit score requires time and effort, but it’s essential for securing a personal student loan without a cosigner. Here are some tips to improve credit score:

- Make on-time payments: Payment history accounts for 35% of credit score, so making on-time payments is crucial.

- Keep credit utilization low: Keep credit utilization below 30% to demonstrate responsible credit behavior.

- Monitor credit report: Check credit report regularly to ensure it’s accurate and up-to-date.

- Avoid new credit inquiries: Avoid applying for multiple credit cards or loans in a short period, as this can negatively impact credit score.

Options for Students with Poor or No Credit History

Students with poor or no credit history may face challenges when applying for personal student loans without a cosigner. However, there are options available:

- Consider a co-signer: If possible, consider having a co-signer with good credit to increase chances of approval.

- Look for lenders that don’t require credit history: Some lenders offer personal student loans without a cosigner that don’t require credit history.

- Apply for federal student loans: Federal student loans don’t require credit history and offer more favorable terms and benefits.

By understanding the role of credit score in securing a personal student loan without a cosigner, students can take steps to improve their credit score and increase their chances of approval.

Income-Driven Repayment Plans: A Safety Net for Borrowers

Income-driven repayment plans are a type of repayment plan that can help borrowers manage their debt and avoid default. These plans are designed to make monthly payments more affordable by capping them at a percentage of the borrower’s income.

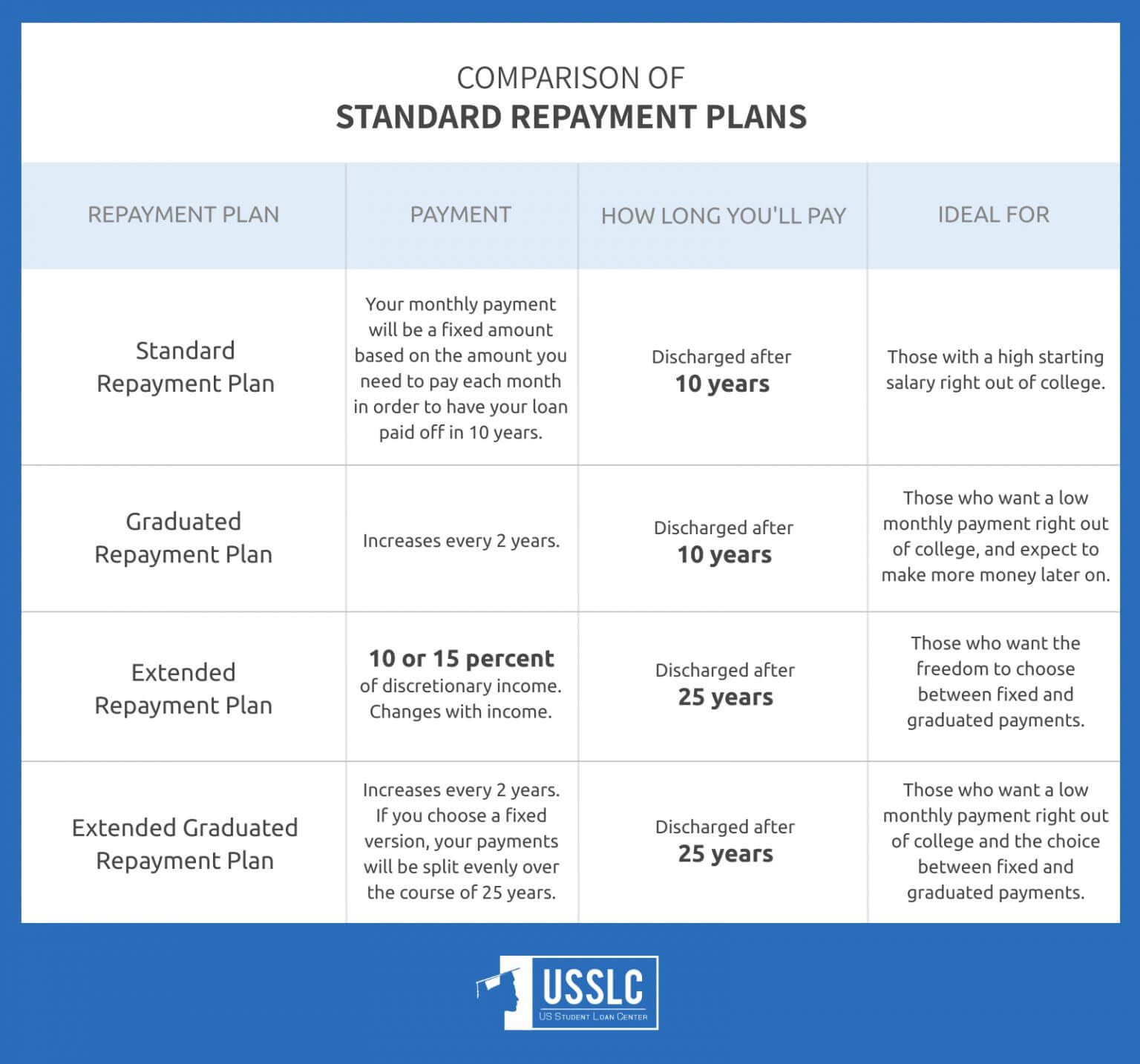

Types of Income-Driven Repayment Plans

There are several types of income-driven repayment plans available, including:

- Income-Based Repayment (IBR) Plan: This plan caps monthly payments at 10% or 15% of the borrower’s discretionary income.

- Pay As You Earn (PAYE) Plan: This plan caps monthly payments at 10% of the borrower’s discretionary income.

- Revised Pay As You Earn (REPAYE) Plan: This plan caps monthly payments at 5% or 10% of the borrower’s discretionary income.

Benefits of Income-Driven Repayment Plans

Income-driven repayment plans offer several benefits, including:

- Lower monthly payments: By capping monthly payments at a percentage of the borrower’s income, income-driven repayment plans can make monthly payments more affordable.

- Loan forgiveness: Some income-driven repayment plans offer loan forgiveness after a certain number of years of qualifying payments.

- Interest subsidies: Some income-driven repayment plans offer interest subsidies, which can help reduce the amount of interest paid over the life of the loan.

How to Apply for an Income-Driven Repayment Plan

To apply for an income-driven repayment plan, borrowers must meet certain eligibility requirements, including:

- Having a partial financial hardship: Borrowers must demonstrate a partial financial hardship, which means that their monthly payments would exceed 10% or 15% of their discretionary income.

- Having a qualifying loan: Borrowers must have a qualifying loan, such as a Direct Subsidized or Unsubsidized Loan.

By applying for an income-driven repayment plan, borrowers can take control of their debt and make monthly payments more affordable.

Maximizing Borrower Benefits: How to Make the Most of Your No-Cosigner Student Loan

When it comes to personal student loans without a cosigner, borrowers can maximize their benefits by understanding the loan terms and conditions. By taking advantage of autopay discounts, interest rate reductions, and loan forgiveness programs, borrowers can save money and make their loan more manageable.

Autopay Discounts

Many lenders offer autopay discounts to borrowers who set up automatic payments. This can be a great way to save money on interest and make monthly payments more affordable. By setting up autopay, borrowers can typically save 0.25% to 0.50% on their interest rate.

Interest Rate Reductions

Some lenders offer interest rate reductions to borrowers who meet certain criteria, such as making on-time payments or achieving a certain credit score. By taking advantage of these reductions, borrowers can save money on interest and make their loan more manageable.

Loan Forgiveness Programs

Some lenders offer loan forgiveness programs to borrowers who meet certain criteria, such as working in a public service job or pursuing a degree in a high-need field. By taking advantage of these programs, borrowers can have a portion of their loan forgiven, which can be a great way to save money and make their loan more manageable.

Understanding Loan Terms and Conditions

By understanding the loan terms and conditions, borrowers can make informed decisions about their loan and maximize their benefits. This includes understanding the interest rate, repayment terms, and any fees associated with the loan. By taking the time to review the loan terms and conditions, borrowers can avoid any surprises and make the most of their loan.

Conclusion

By maximizing borrower benefits, students can make the most of their personal student loans without a cosigner. By taking advantage of autopay discounts, interest rate reductions, and loan forgiveness programs, borrowers can save money and make their loan more manageable. By understanding the loan terms and conditions, borrowers can make informed decisions about their loan and achieve their financial goals.

Navigating the Application Process: Tips and Tricks for Success

When applying for personal student loans without a cosigner, it’s essential to navigate the process carefully to avoid common mistakes and ensure a smooth experience. Here are some valuable tips to help you succeed:

1. Fill out the FAFSA accurately: The Free Application for Federal Student Aid (FAFSA) is a crucial step in determining your eligibility for federal student loans and other forms of financial aid. Make sure to fill out the form accurately and submit it on time to avoid delays.

2. Understand loan offers: When comparing loan offers from different lenders, pay attention to the interest rates, repayment terms, and borrower benefits. Consider factors like origination fees, late payment fees, and loan forgiveness options.

3. Compare lender terms: Don’t just focus on the interest rate; also compare the repayment terms, including the loan duration, monthly payment amount, and any prepayment penalties.

4. Watch out for hidden fees: Some lenders may charge hidden fees, such as origination fees or late payment fees. Make sure to read the fine print and understand all the fees associated with the loan.

5. Don’t overborrow: Only borrow what you need to cover your educational expenses. Overborrowing can lead to debt accumulation and financial difficulties down the line.

6. Consider income-driven repayment plans: Income-driven repayment plans can help you manage your debt and avoid default. These plans can lower your monthly payments and offer loan forgiveness options.

7. Read reviews and check lender ratings: Research the lender’s reputation and read reviews from other borrowers to ensure you’re working with a reputable lender.

8. Ask questions: Don’t hesitate to ask questions if you’re unsure about any aspect of the loan or application process. Lenders should be transparent and willing to help you understand the terms and conditions.

By following these tips and being mindful of common mistakes, you can navigate the application process for personal student loans without a cosigner with confidence. Remember to stay informed, plan carefully, and make smart financial decisions to secure your financial future.

Conclusion: Empowering Students to Take Control of Their Financial Future

In conclusion, securing personal student loans without a cosigner can be a challenging but achievable goal. By understanding the challenges and exploring alternative options, students can take control of their financial future and make informed decisions about their loan options.

Throughout this article, we have discussed the difficulties students face when trying to secure personal student loans without a cosigner, including the lack of credit history and higher interest rates. We have also provided a comprehensive guide on how to apply for personal student loans without a cosigner, including the necessary documents, credit score requirements, and loan options.

Additionally, we have introduced alternative lenders that offer personal student loans without a cosigner, such as SoFi, Earnest, and CommonBond, and compared their interest rates, repayment terms, and borrower benefits. We have also emphasized the importance of credit score in determining loan eligibility and interest rates, and offered tips on how to improve credit score and explore options for students with poor or no credit history.

Income-driven repayment plans have also been discussed as a safety net for borrowers, providing lower monthly payments and loan forgiveness options. Furthermore, we have provided advice on how to maximize borrower benefits, including autopay discounts, interest rate reductions, and loan forgiveness programs.

Ultimately, securing personal student loans without a cosigner requires careful planning, research, and consideration. By understanding the options available and making informed decisions, students can unlock their financial freedom and achieve their academic goals. Remember, taking control of your financial future is the first step towards a brighter tomorrow.