Understanding the Difference Between Savings and Money Market Accounts

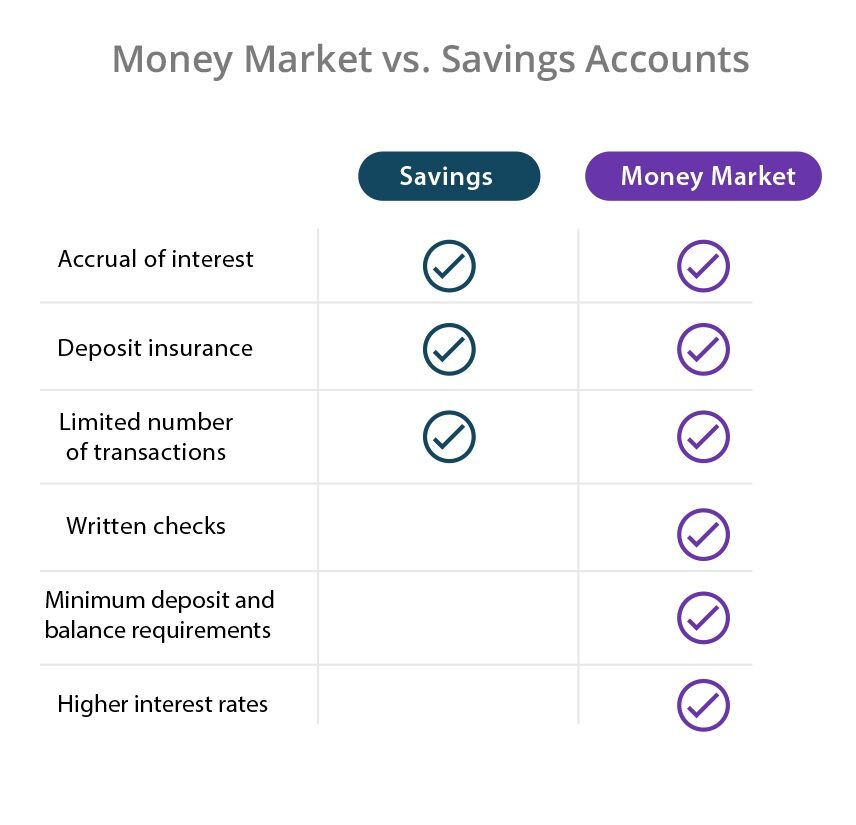

When it comes to saving money, two popular options are savings accounts and money market accounts. While both types of accounts can help individuals save and earn interest, there are key differences between them. Understanding these differences is crucial in choosing the right account for your financial needs.

A savings account is a type of deposit account that allows individuals to store their money while earning a small amount of interest. Savings accounts are liquid, meaning that account holders can access their money at any time. They typically come with debit cards, checks, or online banking services, making it easy to manage and access funds. However, savings accounts often have lower interest rates compared to other types of savings vehicles.

On the other hand, a money market account is a type of savings account that may offer higher interest rates than a traditional savings account. Money market accounts often come with limited check-writing and debit card privileges, which can help account holders avoid unnecessary spending and stay disciplined with their savings. Additionally, money market accounts may offer features such as tiered interest rates, which can reward account holders for maintaining higher balances.

One of the main differences between savings and money market accounts is the minimum balance requirement. Savings accounts often have lower or no minimum balance requirements, making them more accessible to individuals who are just starting to save. Money market accounts, however, may require higher minimum balances to avoid monthly maintenance fees or to earn interest.

Another key difference is the level of liquidity. Savings accounts are generally more liquid than money market accounts, meaning that account holders can access their money more easily. Money market accounts, on the other hand, may have restrictions on withdrawals or transfers, which can help account holders avoid dipping into their savings unnecessarily.

Ultimately, the choice between a savings account and a money market account depends on individual financial goals and needs. If you’re looking for a low-risk, liquid savings option with easy access to your money, a savings account may be the better choice. However, if you’re willing to maintain a higher balance and want to earn a higher interest rate, a money market account could be a better fit.

By understanding the differences between savings and money market accounts, individuals can make informed decisions about their savings strategy and choose the account that best aligns with their financial goals.

How to Choose the Best Savings Account for Your Financial Goals

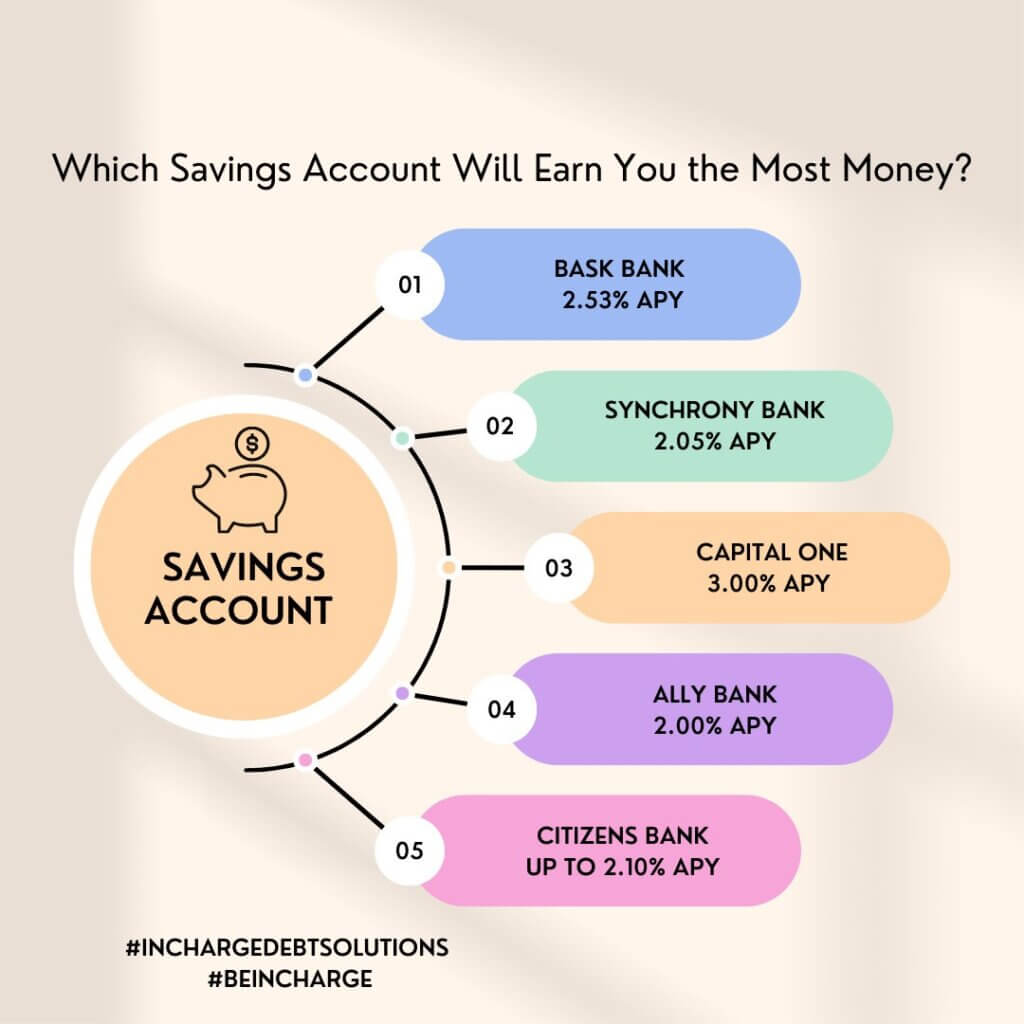

Choosing the right savings account can be a daunting task, especially with the numerous options available in the market. However, by considering a few key factors, individuals can make an informed decision that aligns with their financial goals. When selecting a savings account, it’s essential to evaluate the interest rate, fees, and mobile banking capabilities.

Interest rates play a crucial role in determining the growth of your savings over time. Look for a savings account that offers a competitive interest rate, especially if you’re planning to maintain a large balance. Some savings accounts may offer tiered interest rates, which can reward account holders for maintaining higher balances. Additionally, consider the compounding frequency, as it can impact the overall interest earned.

Fees can quickly eat into your savings, so it’s essential to choose an account with minimal or no fees. Look for accounts with no monthly maintenance fees, overdraft fees, or ATM fees. Some accounts may offer fee waivers or rebates, which can help reduce the overall cost of maintaining the account.

Mobile banking capabilities are also an essential consideration, especially in today’s digital age. Look for an account that offers a user-friendly mobile app, allowing you to easily manage your account, transfer funds, and monitor your activity. Some accounts may also offer mobile deposit capabilities, which can save you time and effort.

When choosing a savings account, it’s also essential to consider your financial goals. Are you saving for a short-term goal, such as a vacation or a down payment on a house? Or are you saving for a long-term goal, such as retirement or a child’s education? Different accounts may offer features that cater to specific financial goals, such as savings accounts with budgeting tools or money market accounts with investment options.

Ultimately, the key to choosing the best savings account is to align your financial goals with the features of the account. By considering the interest rate, fees, mobile banking capabilities, and financial goals, individuals can make an informed decision that helps them achieve their savings objectives.

Some popular savings accounts that offer competitive interest rates, low fees, and robust mobile banking capabilities include those offered by online banks, such as Ally and Marcus. These accounts often offer higher interest rates and lower fees compared to traditional brick-and-mortar banks.

By doing your research and considering your options carefully, you can find a savings account that meets your financial needs and helps you achieve your savings goals.

The Benefits of Money Market Accounts: Higher Interest Rates and Flexibility

Money market accounts offer a unique combination of higher interest rates and flexibility, making them an attractive option for savers who want to earn more interest on their deposits. Unlike traditional savings accounts, money market accounts often come with limited check-writing and debit card privileges, which can help account holders avoid unnecessary spending and stay disciplined with their savings.

One of the primary benefits of money market accounts is the potential to earn higher interest rates. Money market accounts often offer tiered interest rates, which can reward account holders for maintaining higher balances. Additionally, money market accounts may offer higher interest rates than traditional savings accounts, making them a more attractive option for savers who want to maximize their earnings.

Another benefit of money market accounts is their flexibility. Money market accounts often come with limited check-writing and debit card privileges, which can help account holders avoid unnecessary spending and stay disciplined with their savings. However, money market accounts may also offer online banking and mobile banking capabilities, making it easy to manage and access funds.

Money market accounts can be an excellent option for savers who want to earn more interest on their deposits and stay disciplined with their savings. By limiting check-writing and debit card privileges, money market accounts can help account holders avoid unnecessary spending and stay focused on their savings goals.

In addition to higher interest rates and flexibility, money market accounts may also offer other benefits, such as low fees and high-yield interest rates. Some money market accounts may also offer budgeting tools and financial education resources, which can help account holders manage their finances more effectively.

When considering a money market account, it’s essential to evaluate the interest rate, fees, and mobile banking capabilities. Look for accounts that offer competitive interest rates, low fees, and robust mobile banking capabilities. Additionally, consider the minimum balance requirements and any restrictions on withdrawals or transfers.

By choosing a money market account that aligns with your financial goals and needs, you can earn more interest on your deposits and stay disciplined with your savings. Whether you’re saving for a short-term goal or a long-term goal, a money market account can be an excellent option for maximizing your earnings and achieving your financial objectives.

Savings Account Options: Traditional, High-Yield, and Online Banks

When it comes to choosing a savings account, there are several options available, each with its own unique features and benefits. Traditional savings accounts, high-yield savings accounts, and online banks are three popular options that cater to different types of savers.

Traditional savings accounts are offered by brick-and-mortar banks and credit unions. These accounts typically come with a low interest rate, but offer easy access to funds through a network of branches and ATMs. Traditional savings accounts are a good option for those who value face-to-face banking and want to be able to visit a branch in person.

High-yield savings accounts, on the other hand, offer a higher interest rate than traditional savings accounts. These accounts are often offered by online banks and credit unions, and may come with some restrictions on withdrawals or transfers. High-yield savings accounts are a good option for those who want to earn a higher interest rate on their savings and are willing to manage their account online.

Online banks are another popular option for savings accounts. These banks operate entirely online, and often offer higher interest rates and lower fees than traditional banks. Online banks are a good option for those who are comfortable with online banking and want to earn a higher interest rate on their savings.

When choosing a savings account, it’s essential to consider the interest rate, fees, and mobile banking capabilities. Look for accounts that offer competitive interest rates, low fees, and robust mobile banking capabilities. Additionally, consider the minimum balance requirements and any restrictions on withdrawals or transfers.

Some popular online banks that offer high-yield savings accounts include Ally, Marcus, and Discover. These banks offer competitive interest rates, low fees, and robust mobile banking capabilities, making them a good option for those who want to earn a higher interest rate on their savings.

Traditional banks, such as Bank of America and Wells Fargo, also offer savings accounts with competitive interest rates and low fees. However, these accounts may come with some restrictions on withdrawals or transfers, and may not offer the same level of mobile banking capabilities as online banks.

Ultimately, the choice between a traditional savings account, high-yield savings account, and online bank will depend on your individual financial goals and needs. By considering the interest rate, fees, and mobile banking capabilities, you can choose a savings account that aligns with your financial objectives and helps you achieve your savings goals.

Money Market Account Alternatives: CDs and Treasury Bills

While money market accounts can be a great option for savers who want to earn a higher interest rate on their deposits, there are other alternatives to consider. Certificates of deposit (CDs) and Treasury bills are two popular options that offer fixed interest rates and low risk.

CDs are time deposits offered by banks with a fixed interest rate and maturity date. They tend to offer higher interest rates than traditional savings accounts, but require you to keep your money locked in the CD for the specified term. If you withdraw your money before the maturity date, you may face penalties.

Treasury bills, on the other hand, are short-term government securities with maturities ranging from a few weeks to a year. They offer a fixed interest rate and are backed by the full faith and credit of the US government, making them a very low-risk investment.

Both CDs and Treasury bills offer fixed interest rates, which can be beneficial in a rising interest rate environment. However, they also come with some drawbacks. CDs require you to keep your money locked in the account for the specified term, which may not be ideal if you need access to your money. Treasury bills, on the other hand, offer a very low return on investment, which may not be enough to keep pace with inflation.

Despite these drawbacks, CDs and Treasury bills can be a good option for savers who want to earn a fixed interest rate on their deposits. They can provide a low-risk investment option for those who are risk-averse or want to diversify their portfolio.

When considering CDs and Treasury bills, it’s essential to evaluate the interest rate, term, and fees associated with each option. Look for CDs with competitive interest rates and flexible terms, and consider Treasury bills with maturities that align with your financial goals.

Some popular banks that offer CDs include Ally, Marcus, and Discover. These banks offer competitive interest rates and flexible terms, making them a good option for those who want to earn a higher interest rate on their deposits.

Ultimately, the choice between a money market account, CD, and Treasury bill will depend on your individual financial goals and needs. By considering the interest rate, term, and fees associated with each option, you can choose the best investment for your money.

Managing Your Savings: Strategies for Success

Managing your savings effectively is crucial to achieving your financial goals. Whether you’re saving for a short-term goal or a long-term goal, having a solid savings strategy in place can help you stay on track and make the most of your money.

One of the most effective ways to manage your savings is to set clear financial goals. What do you want to achieve with your savings? Are you saving for a down payment on a house, a vacation, or a big purchase? Having a specific goal in mind will help you stay focused and motivated to save.

Another key strategy for managing your savings is to automate your savings. Set up automatic transfers from your checking account to your savings account, and take advantage of employer-matched retirement accounts such as 401(k) or IRA. This way, you’ll ensure that you’re saving consistently and making the most of your money.

Avoiding unnecessary fees is also crucial to managing your savings effectively. Look for savings accounts with low or no fees, and avoid accounts with high minimum balance requirements or excessive overdraft fees. Additionally, be mindful of fees associated with ATM withdrawals, wire transfers, and other services.

Monitoring your account activity and adjusting your strategy as needed is also essential to managing your savings effectively. Keep track of your account balances, interest rates, and fees, and make adjustments as needed to stay on track with your financial goals.

Finally, consider working with a financial advisor or planner to help you manage your savings and achieve your financial goals. A professional can provide personalized advice and guidance to help you make the most of your money and achieve your financial objectives.

Some popular savings management tools and apps include Mint, Personal Capital, and YNAB (You Need a Budget). These tools can help you track your account activity, set financial goals, and automate your savings.

By following these strategies and tips, you can effectively manage your savings and achieve your financial goals. Remember to stay disciplined, patient, and informed, and you’ll be on your way to saving success.

Real-World Examples: Popular Savings and Money Market Accounts

When it comes to choosing a savings or money market account, it’s essential to consider real-world examples of popular accounts. This can help you compare features, benefits, and drawbacks of each account and make an informed decision.

Ally Bank’s Online Savings Account is a popular option for those looking for a high-yield savings account. With a competitive interest rate and no minimum balance requirement, this account is ideal for those who want to earn a higher interest rate on their savings.

Marcus by Goldman Sachs is another popular option for those looking for a high-yield savings account. With a competitive interest rate and no fees, this account is ideal for those who want to earn a higher interest rate on their savings without worrying about fees.

Discover’s Online Savings Account is a popular option for those looking for a savings account with a competitive interest rate and no fees. With a mobile banking app and online banking platform, this account is ideal for those who want to manage their savings on the go.

When comparing these accounts, it’s essential to consider the interest rate, fees, and minimum balance requirements. Ally Bank’s Online Savings Account has a competitive interest rate and no minimum balance requirement, making it ideal for those who want to earn a higher interest rate on their savings. Marcus by Goldman Sachs has a competitive interest rate and no fees, making it ideal for those who want to earn a higher interest rate on their savings without worrying about fees. Discover’s Online Savings Account has a competitive interest rate and no fees, making it ideal for those who want to earn a higher interest rate on their savings and manage their account on the go.

Ultimately, the choice between these accounts will depend on your individual financial goals and needs. By considering the interest rate, fees, and minimum balance requirements, you can choose the best account for your savings needs.

It’s also essential to read customer reviews and ratings to get a sense of the account’s performance and customer service. Websites like NerdWallet and Bankrate provide comprehensive reviews and ratings of savings and money market accounts, which can help you make an informed decision.

Conclusion: Finding the Right Account for Your Savings Needs

Choosing the right savings account for your financial goals is a crucial decision that can impact your financial future. With so many options available, it’s essential to do your research and consider your options carefully before making a decision.

In this article, we’ve discussed the main differences between savings and money market accounts, including interest rates, liquidity, and minimum balance requirements. We’ve also provided tips and considerations for choosing a savings account, including evaluating interest rates, fees, and mobile banking capabilities.

We’ve highlighted the advantages of money market accounts, including higher interest rates and limited check-writing and debit card privileges. We’ve also discussed alternative savings options, such as certificates of deposit (CDs) and Treasury bills, and provided examples of popular savings and money market accounts.

Ultimately, the key to finding the right savings account for your needs is to align your savings goals with the features of your account. By considering your financial goals, risk tolerance, and personal preferences, you can choose a savings account that helps you achieve your financial objectives.

Remember to always read the fine print and understand the terms and conditions of your account before opening it. It’s also essential to monitor your account activity and adjust your strategy as needed to ensure you’re getting the most out of your savings.

By following these tips and considering your options carefully, you can find a savings account that meets your needs and helps you achieve your financial goals.

:max_bytes(150000):strip_icc()/why-would-you-keep-funds-money-market-account-and-not-savings-account-ADD-Color-V3-e17a68d37eb9437eba385eb0c6452f49.jpg)

:max_bytes(150000):strip_icc()/dotdash-money_market_savings-Final-6a3f125ef6c74528ab7be85ce42e468c.jpg)