Breaking Free from Unnecessary Banking Fees

Small businesses often face a multitude of challenges, from managing cash flow to navigating complex financial regulations. One common obstacle that can hinder a business’s growth is unnecessary banking fees. Monthly maintenance fees, overdraft fees, and ATM fees can add up quickly, eating into a business’s bottom line and impacting its overall financial health.

For example, a business with a low balance may be charged a monthly maintenance fee, which can range from $10 to $30 per month. Additionally, overdraft fees can be as high as $35 per transaction, and ATM fees can range from $2 to $5 per withdrawal. These fees may seem insignificant on their own, but they can quickly accumulate and become a significant expense for small businesses.

Furthermore, these fees can be particularly burdensome for small businesses with limited financial resources. According to a recent survey, 60% of small businesses have less than $50,000 in annual revenue, making it difficult for them to absorb the costs of banking fees. As a result, many small businesses are seeking alternatives to traditional banking, such as no-fee small business checking accounts.

No-fee small business checking accounts offer a range of benefits, including no monthly maintenance fees, no overdraft fees, and no ATM fees. These accounts are designed to help small businesses manage their finances more effectively, without the burden of unnecessary fees. By switching to a no-fee account, small businesses can save money, reduce financial stress, and focus on growing their business.

In addition to cost savings, no-fee small business checking accounts often offer a range of innovative features, such as online banking, mobile banking, and real-time account alerts. These features enable small businesses to manage their finances more efficiently, make informed decisions, and stay on top of their financial situation.

Overall, unnecessary banking fees can be a significant obstacle for small businesses. By switching to a no-fee small business checking account, businesses can break free from these fees and focus on growing their business. With the right account, small businesses can save money, reduce financial stress, and achieve their financial goals.

What to Look for in a No-Fee Business Checking Account

What to Look for in a No-Fee Business Checking Account

When searching for a no-fee business checking account, there are several key features to consider. First and foremost, look for an account with no monthly maintenance fees, no overdraft fees, and no ATM fees. These fees can add up quickly, so it’s essential to find an account that eliminates them altogether.

In addition to no fees, consider an account with online banking and mobile banking capabilities. These features allow you to manage your finances on the go, making it easier to stay on top of your account activity and make informed decisions. Look for an account with a user-friendly online platform and mobile app that allows you to check your balance, transfer funds, and pay bills.

Customer support is also crucial when it comes to a no-fee business checking account. Look for an account with 24/7 customer support, either by phone, email, or live chat. This ensures that you can get help when you need it, whether it’s to resolve an issue or answer a question.

Another important feature to consider is the account’s minimum balance requirements. Some no-fee business checking accounts may require a minimum balance to avoid fees, while others may not have any minimum balance requirements at all. Be sure to review the account’s terms and conditions to understand any minimum balance requirements.

Finally, consider the account’s scalability. As your business grows, you’ll want an account that can grow with you. Look for an account with features such as payroll processing, invoicing, and accounting integration. These features can help you manage your finances more efficiently and make it easier to scale your business.

By considering these key features, you can find a no-fee business checking account that meets your needs and helps you manage your finances more effectively. Remember to always review the account’s terms and conditions and ask questions before opening an account.

A no-fee small business checking account can be a game-changer for your business, providing you with the tools and resources you need to manage your finances and grow your business. By doing your research and finding the right account, you can take control of your finances and achieve your business goals.

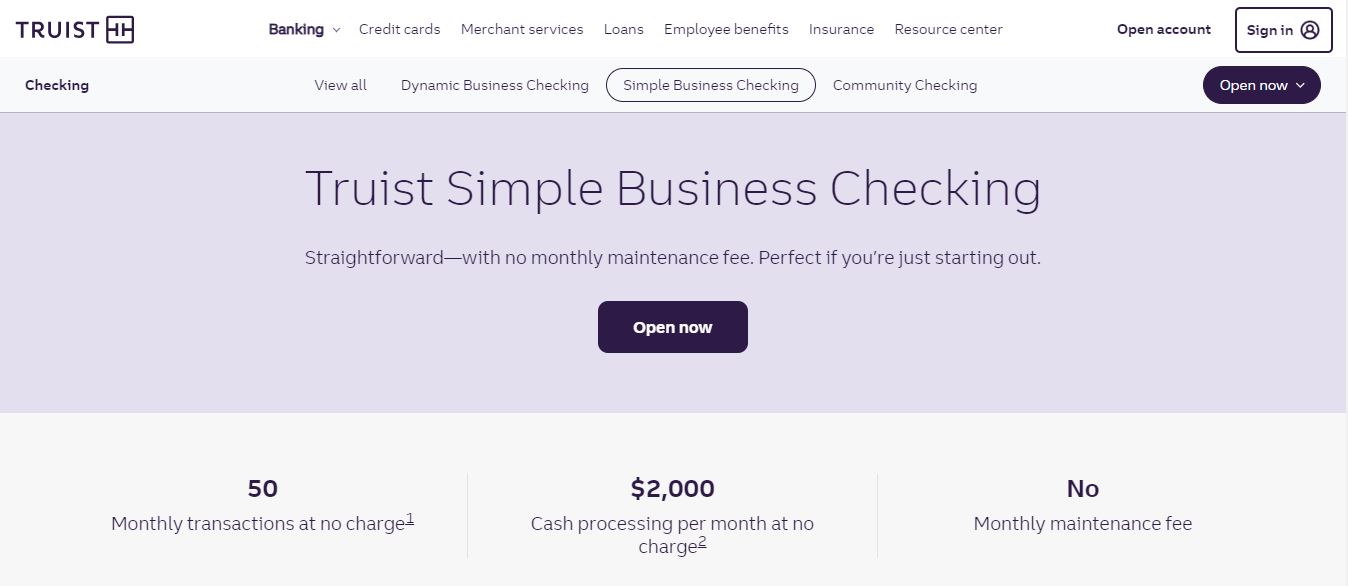

Top No-Fee Business Checking Accounts for Small Businesses

When it comes to no-fee business checking accounts, there are several options available for small businesses. Here are some of the top accounts to consider:

Axos Bank’s Business Interest Checking account is a popular choice for small businesses. This account offers no monthly maintenance fees, no overdraft fees, and no ATM fees. It also offers a competitive interest rate and a mobile banking app that allows you to manage your finances on the go.

NBKC Bank’s Business Checking account is another top option for small businesses. This account offers no monthly maintenance fees, no overdraft fees, and no ATM fees. It also offers a free debit card and a mobile banking app that allows you to manage your finances remotely.

Capital One’s Spark Business Checking account is a great option for small businesses that want a no-fee account with a lot of features. This account offers no monthly maintenance fees, no overdraft fees, and no ATM fees. It also offers a mobile banking app, online banking, and a free debit card.

When comparing these accounts, consider the features that are most important to your business. If you want a competitive interest rate, Axos Bank’s Business Interest Checking account may be the best choice. If you want a free debit card and a mobile banking app, NBKC Bank’s Business Checking account may be the way to go. If you want a lot of features and a user-friendly online platform, Capital One’s Spark Business Checking account may be the best option.

Ultimately, the best no-fee business checking account for your small business will depend on your specific needs and preferences. Be sure to do your research and compare the features and benefits of each account before making a decision.

Managing Your No-Fee Business Checking Account for Maximum Efficiency

Once you’ve opened a no-fee business checking account, it’s essential to manage it effectively to maximize its benefits. Here are some tips to help you get the most out of your account:

Track Your Expenses – Keeping track of your expenses is crucial to managing your finances effectively. Use your no-fee business checking account to track your expenses, including purchases, payments, and transfers. This will help you identify areas where you can cut costs and optimize your spending.

Reconcile Your Statements – Reconciling your statements regularly is essential to ensure that your account is accurate and up-to-date. This involves comparing your account statements with your internal records to identify any discrepancies or errors.

Avoid Overdrafts – Overdrafts can be costly, even with a no-fee business checking account. To avoid overdrafts, set up low-balance alerts and transfer funds from another account if necessary. You can also consider setting up overdraft protection to transfer funds from another account or credit card.

Take Advantage of Account Features – No-fee business checking accounts often come with a range of features, including online banking, mobile banking, and bill pay. Take advantage of these features to manage your finances more efficiently and save time.

Monitor Your Account Activity – Regularly monitoring your account activity is essential to detect any suspicious transactions or errors. Use your online banking or mobile banking app to check your account activity regularly and report any issues to your bank.

Optimize Your Cash Flow – A no-fee business checking account can help you optimize your cash flow by providing you with real-time access to your account balances and transactions. Use this information to make informed decisions about your cash flow and optimize your finances.

By following these tips, you can manage your no-fee business checking account effectively and maximize its benefits. Remember to always review your account statements regularly and take advantage of account features to optimize your finances.

Common Mistakes to Avoid with No-Fee Business Checking Accounts

While no-fee business checking accounts can be a great way to save money and streamline your finances, there are some common mistakes to avoid. Here are some of the most common mistakes small businesses make when using no-fee business checking accounts:

Not Monitoring Account Activity – One of the most common mistakes small businesses make is not monitoring their account activity regularly. This can lead to overdrafts, unauthorized transactions, and other issues that can cost you money.

Not Keeping Track of Fees – While no-fee business checking accounts don’t have monthly maintenance fees, overdraft fees, or ATM fees, there may be other fees associated with the account. Make sure you understand all the fees associated with your account and keep track of them to avoid any surprises.

Not Taking Advantage of Account Features – No-fee business checking accounts often come with a range of features, including online banking, mobile banking, and bill pay. Make sure you take advantage of these features to manage your finances more efficiently and save time.

Not Reconciling Statements – Reconciling your statements regularly is essential to ensure that your account is accurate and up-to-date. This involves comparing your account statements with your internal records to identify any discrepancies or errors.

Not Setting Up Low-Balance Alerts – Low-balance alerts can help you avoid overdrafts and ensure that you have enough money in your account to cover your expenses. Make sure you set up low-balance alerts to notify you when your account balance falls below a certain threshold.

Not Reviewing Account Terms and Conditions – Before opening a no-fee business checking account, make sure you review the account terms and conditions carefully. This will help you understand all the fees associated with the account, as well as any other requirements or restrictions.

By avoiding these common mistakes, you can get the most out of your no-fee business checking account and manage your finances more effectively.

Scaling Your Business with a No-Fee Business Checking Account

A no-fee business checking account can be a valuable tool for small businesses looking to scale and grow. By providing a low-cost and efficient way to manage finances, these accounts can help businesses invest in new opportunities, expand their payroll, and increase their cash flow.

One of the key benefits of a no-fee business checking account is its ability to help businesses manage increased cash flow. As a business grows, it’s likely to experience an increase in cash flow, which can be challenging to manage. A no-fee business checking account can provide a low-cost and efficient way to manage this increased cash flow, allowing businesses to invest in new opportunities and expand their operations.

Another benefit of a no-fee business checking account is its ability to help businesses expand their payroll. As a business grows, it’s likely to need to hire more employees, which can be a significant expense. A no-fee business checking account can provide a low-cost and efficient way to manage payroll, allowing businesses to focus on growing their operations rather than worrying about banking fees.

In addition to managing increased cash flow and expanding payroll, a no-fee business checking account can also help businesses invest in new opportunities. By providing a low-cost and efficient way to manage finances, these accounts can help businesses invest in new equipment, technology, and marketing initiatives, which can help drive growth and expansion.

Overall, a no-fee business checking account can be a valuable tool for small businesses looking to scale and grow. By providing a low-cost and efficient way to manage finances, these accounts can help businesses invest in new opportunities, expand their payroll, and increase their cash flow, ultimately driving growth and expansion.

When choosing a no-fee business checking account, it’s essential to consider the needs of your business. Look for an account that provides a low-cost and efficient way to manage finances, as well as features such as online banking, mobile banking, and customer support. By choosing the right account, you can help your business scale and grow, while also saving money on banking fees.

Conclusion: Take Control of Your Business Finances with a No-Fee Checking Account

By switching to a no-fee small business checking account, entrepreneurs can break free from the burden of unnecessary banking fees and focus on growing their business. With the right account, small businesses can streamline their finances, reduce costs, and increase efficiency. By considering the key features outlined in this article, business owners can make an informed decision when selecting a no-fee business checking account that meets their unique needs.

A no-fee small business checking account can be a game-changer for small businesses, providing a cost-effective and convenient way to manage finances. By avoiding monthly maintenance fees, overdraft fees, and ATM fees, business owners can allocate more resources to drive growth and innovation. Additionally, features like online banking, mobile banking, and customer support can help businesses stay organized and focused on their goals.

As small businesses scale and grow, a no-fee business checking account can provide the flexibility and support needed to manage increased cash flow, expand payroll, and invest in new opportunities. By taking control of their finances with a no-fee checking account, entrepreneurs can make informed decisions, reduce financial stress, and achieve long-term success.

In conclusion, a no-fee small business checking account is an essential tool for any entrepreneur looking to optimize their finances and drive business growth. By understanding the benefits and features of these accounts, business owners can make a smart decision and take the first step towards financial freedom. With a no-fee business checking account, small businesses can thrive and reach their full potential.