What to Look for in a No Balance Transfer Fee Credit Card

When selecting a no balance transfer fee credit card, there are several key features to consider. One of the most important factors is the interest rate. Look for cards with 0% introductory APR periods, which can last anywhere from 6 to 21 months. This can give you a significant amount of time to pay off your debt without incurring interest charges.

Another crucial aspect to consider is the credit limit. Ensure that the credit limit is sufficient to cover the amount you need to transfer. Some no balance transfer fee credit cards may have lower credit limits, so it’s essential to check this before applying.

Introductory APR periods are also a vital consideration. These periods can range from 6 to 21 months, and some cards may offer 0% APR for the entire introductory period. However, be aware that the APR may increase after the introductory period ends.

Additionally, consider the fees associated with the card. While no balance transfer fee credit cards do not charge a balance transfer fee, they may have other fees, such as annual fees or late payment fees. Look for cards with low or no annual fees to minimize your expenses.

Finally, consider the credit card issuer’s reputation and customer service. Look for issuers with a good reputation and a history of providing excellent customer service. This can give you peace of mind and ensure that you’re working with a reliable partner.

Some popular no balance transfer fee credit cards that offer these features include the Citi Simplicity Card and the Discover it Balance Transfer card. By considering these factors and choosing a card that meets your needs, you can make the most of a no balance transfer fee credit card and save money on interest charges.

Top No Balance Transfer Fee Credit Cards on the Market

When it comes to no balance transfer fee credit cards, there are several options available in the market. Two of the most popular options are the Citi Simplicity Card and the Discover it Balance Transfer card. Both cards offer 0% balance transfer fees, making them ideal for consolidating debt.

The Citi Simplicity Card offers a 0% introductory APR for 21 months on balance transfers, with a 3% balance transfer fee waived for the first 60 days. This card also has no annual fee, late fees, or penalty APRs. Additionally, it offers a credit limit of up to $25,000, making it a great option for those with larger debt balances.

The Discover it Balance Transfer card, on the other hand, offers a 0% introductory APR for 18 months on balance transfers, with a 3% balance transfer fee waived for the first 60 days. This card also has no annual fee and offers a credit limit of up to $25,000. Additionally, it offers a rewards program that allows cardholders to earn 1% cashback on all purchases.

Another popular option is the Bank of America Cash Rewards credit card, which offers a 0% introductory APR for 12 months on balance transfers, with a 3% balance transfer fee waived for the first 60 days. This card also has no annual fee and offers a credit limit of up to $25,000. Additionally, it offers a rewards program that allows cardholders to earn 1% cashback on all purchases.

When choosing a no balance transfer fee credit card, it’s essential to consider the features and benefits that matter most to you. Look for cards with 0% introductory APR periods, low or no annual fees, and flexible credit limits. Additionally, consider the rewards program and other benefits offered by the card.

By choosing the right no balance transfer fee credit card, you can save money on interest charges and fees, and make the most of your debt consolidation efforts. Remember to always read the terms and conditions carefully and make informed decisions based on your individual financial circumstances.

How to Make the Most of a No Balance Transfer Fee Credit Card

To get the most out of a no balance transfer fee credit card, it’s essential to use it strategically. Here are some tips to help you make the most of this type of credit card:

First, make sure to pay off your debt quickly. No balance transfer fee credit cards often come with 0% introductory APR periods, which can last anywhere from 6 to 21 months. During this time, focus on paying off as much of your debt as possible to avoid interest charges.

Second, avoid accumulating new debt. No balance transfer fee credit cards can be tempting to use for new purchases, but this can lead to a cycle of debt that’s difficult to break. Instead, focus on paying off your existing debt and avoid making new purchases until you’ve paid off your balance.

Third, take advantage of the 0% introductory APR period. This is a great opportunity to pay off your debt without incurring interest charges. Make sure to pay more than the minimum payment each month to take full advantage of this period.

Fourth, consider consolidating multiple debts onto one card. If you have multiple debts with high interest rates, consolidating them onto a no balance transfer fee credit card can save you money on interest charges and simplify your payments.

Fifth, make timely payments. Late payments can result in fees and interest charges, which can negate the benefits of a no balance transfer fee credit card. Set up automatic payments to ensure you never miss a payment.

By following these tips, you can make the most of a no balance transfer fee credit card and save money on interest charges and fees. Remember to always read the terms and conditions carefully and make informed decisions based on your individual financial circumstances.

Common Mistakes to Avoid When Using a No Balance Transfer Fee Credit Card

While no balance transfer fee credit cards can be a great tool for saving money on interest charges and fees, there are some common mistakes to avoid when using them. Here are some pitfalls to watch out for:

Missing payments is one of the most common mistakes people make when using a no balance transfer fee credit card. Late payments can result in fees and interest charges, which can negate the benefits of the card. To avoid this, set up automatic payments to ensure you never miss a payment.

Accumulating new debt is another mistake to avoid. No balance transfer fee credit cards can be tempting to use for new purchases, but this can lead to a cycle of debt that’s difficult to break. Instead, focus on paying off your existing debt and avoid making new purchases until you’ve paid off your balance.

Not paying off the balance in full during the introductory APR period is another mistake to avoid. No balance transfer fee credit cards often come with 0% introductory APR periods, which can last anywhere from 6 to 21 months. If you don’t pay off the balance in full during this time, you’ll be charged interest on the remaining balance.

Not considering the regular APR is another mistake to avoid. While the introductory APR period may be 0%, the regular APR may be much higher. Make sure to consider the regular APR when choosing a no balance transfer fee credit card to ensure you’re not surprised by high interest charges later on.

Not reading the terms and conditions is another mistake to avoid. No balance transfer fee credit cards often come with terms and conditions that can affect your use of the card. Make sure to read the terms and conditions carefully to avoid any surprises.

By avoiding these common mistakes, you can make the most of a no balance transfer fee credit card and save money on interest charges and fees. Remember to always read the terms and conditions carefully and make informed decisions based on your individual financial circumstances.

No Balance Transfer Fee Credit Cards vs. Low-Interest Credit Cards

No balance transfer fee credit cards and low-interest credit cards are two popular options for individuals looking to manage their debt. While both types of cards can be beneficial, they have distinct differences that should be considered before making a decision.

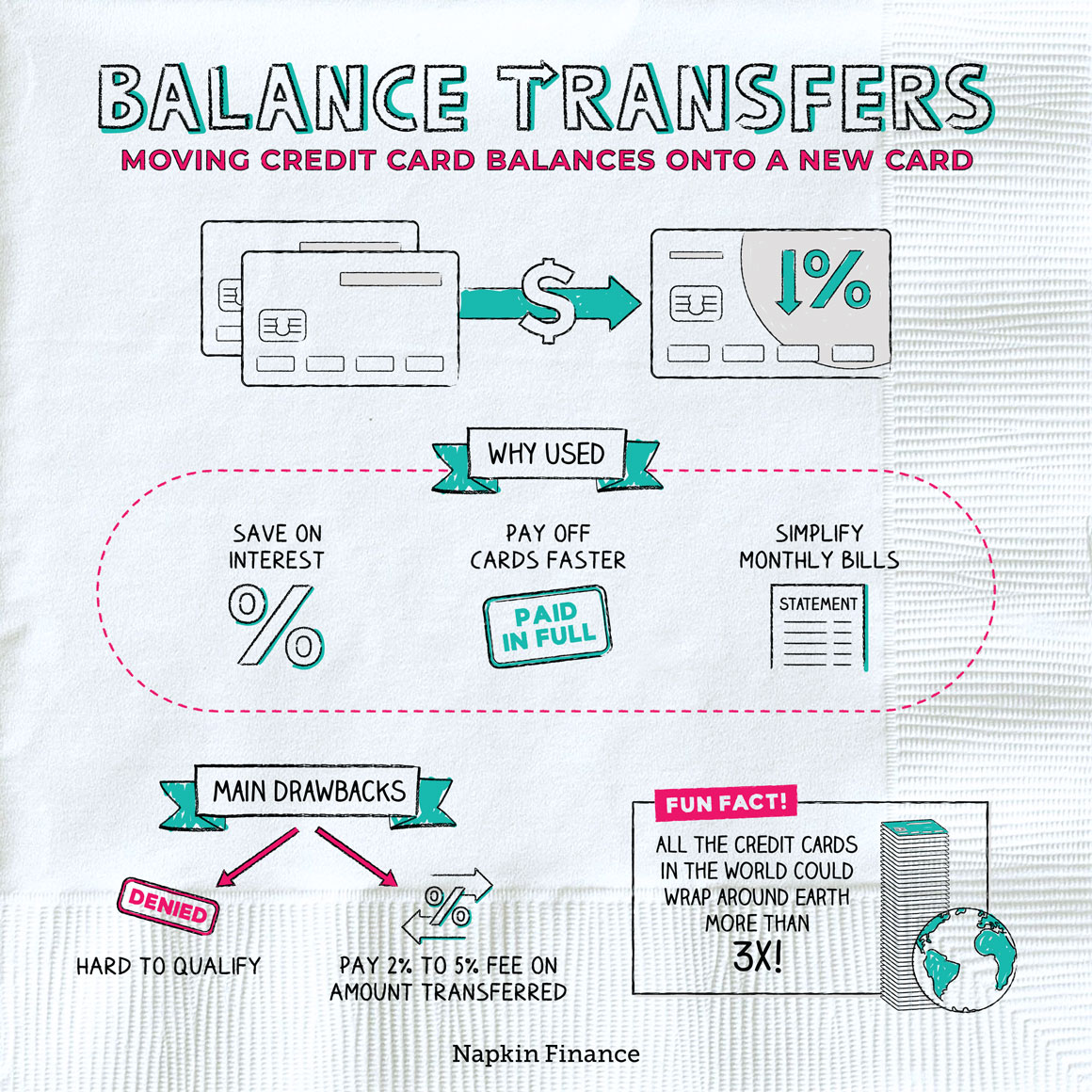

No balance transfer fee credit cards, as the name suggests, do not charge a fee for transferring balances from other credit cards. This can be a significant advantage for individuals who need to consolidate debt from multiple sources. Additionally, these cards often come with 0% introductory APR periods, which can last anywhere from 6 to 21 months.

Low-interest credit cards, on the other hand, offer a lower interest rate compared to standard credit cards. This can be beneficial for individuals who need to carry a balance on their credit card from month to month. However, these cards may not offer the same level of flexibility as no balance transfer fee credit cards, and may come with higher fees.

When deciding between a no balance transfer fee credit card and a low-interest credit card, it’s essential to consider your individual financial circumstances and goals. If you need to consolidate debt and want to avoid paying a balance transfer fee, a no balance transfer fee credit card may be the better option. However, if you need to carry a balance on your credit card from month to month and want to minimize your interest charges, a low-interest credit card may be the better choice.

Ultimately, the decision between a no balance transfer fee credit card and a low-interest credit card depends on your specific needs and financial situation. By carefully considering your options and choosing the card that best meets your needs, you can save money on interest charges and fees, and take control of your debt.

How to Choose the Best No Balance Transfer Fee Credit Card for Your Needs

Choosing the best no balance transfer fee credit card for your needs requires careful consideration of several factors. Here are some tips to help you make an informed decision:

First, consider your credit score. No balance transfer fee credit cards often require good credit, so if you have a poor credit score, you may not qualify for the best offers. However, there are some no balance transfer fee credit cards that are designed for people with poor credit, so don’t give up hope.

Next, think about your debt consolidation needs. How much debt do you need to consolidate, and what is the interest rate on your current debt? No balance transfer fee credit cards can be a great option for consolidating high-interest debt, but if you have a large amount of debt, you may need to consider a different option.

Another important factor to consider is the introductory APR period. No balance transfer fee credit cards often come with 0% introductory APR periods, which can last anywhere from 6 to 21 months. This can be a great opportunity to pay off your debt without incurring interest charges, but make sure you understand the terms and conditions of the card.

Finally, consider the fees associated with the card. While no balance transfer fee credit cards do not charge a balance transfer fee, they may charge other fees, such as annual fees or late payment fees. Make sure you understand all the fees associated with the card before applying.

By considering these factors and choosing a no balance transfer fee credit card that meets your needs, you can save money on interest charges and fees, and take control of your debt. Remember to always read the terms and conditions carefully and make informed decisions based on your individual financial circumstances.

Conclusion: Saving Money with No Balance Transfer Fee Credit Cards

No balance transfer fee credit cards can be a valuable tool for individuals looking to save money on interest charges and fees when consolidating debt. By choosing a no balance transfer fee credit card that meets your needs, you can avoid costly transfer fees and take control of your debt.

When selecting a no balance transfer fee credit card, it’s essential to consider your individual financial circumstances and goals. Look for cards with 0% introductory APR periods, low or no annual fees, and flexible credit limits. Additionally, consider the fees associated with the card, such as late payment fees or balance transfer fees.

By following the tips and guidelines outlined in this article, you can make the most of a no balance transfer fee credit card and save money on interest charges and fees. Remember to always read the terms and conditions carefully and make informed decisions based on your individual financial circumstances.

No balance transfer fee credit cards can be a great option for individuals who need to consolidate debt and want to avoid costly transfer fees. By choosing the right card and using it effectively, you can save money and take control of your debt.

In conclusion, no balance transfer fee credit cards can be a valuable tool for individuals looking to save money on interest charges and fees when consolidating debt. By choosing the right card and using it effectively, you can take control of your debt and achieve financial stability.

Conclusion: Saving Money with No Balance Transfer Fee Credit Cards

In conclusion, no balance transfer fee credit cards can be a valuable tool for individuals looking to save money on interest charges and fees when consolidating debt. By choosing the right card and using it effectively, individuals can take control of their debt and achieve financial stability.

When selecting a no balance transfer fee credit card, it’s essential to consider individual financial circumstances and goals. Look for cards with 0% introductory APR periods, low or no annual fees, and flexible credit limits. Additionally, consider the fees associated with the card, such as late payment fees or balance transfer fees.

By following the tips and guidelines outlined in this article, individuals can make the most of a no balance transfer fee credit card and save money on interest charges and fees. Remember to always read the terms and conditions carefully and make informed decisions based on individual financial circumstances.

No balance transfer fee credit cards can be a great option for individuals who need to consolidate debt and want to avoid costly transfer fees. By choosing the right card and using it effectively, individuals can save money and take control of their debt.

In summary, no balance transfer fee credit cards offer a range of benefits, including 0% introductory APR periods, low or no annual fees, and flexible credit limits. By selecting the right card and using it effectively, individuals can save money on interest charges and fees and achieve financial stability.