Navigating the Sunshine State’s Tax Landscape

Florida, known for its beautiful beaches and warm climate, is a popular destination for homeowners and investors. However, when it comes to property taxes, many people wonder: does Florida have property tax? The answer is yes, Florida does have property taxes, but the state’s tax system is designed to be more favorable to homeowners and investors compared to other states. In this article, we will delve into the world of Florida property taxes, exploring the factors that determine property taxes, exemptions, and implications for homeowners and investors.

One of the key benefits of Florida’s property tax system is the absence of a state income tax. This means that homeowners and investors can keep more of their hard-earned money, as they are not required to pay state income tax on their earnings. However, property taxes are still a significant consideration for anyone owning or investing in property in Florida. The state’s property tax system is based on the assessed value of the property, which is determined by the county property appraiser’s office.

The assessed value of a property is typically lower than its market value, and it is used to calculate the property taxes owed. The millage rate, which is set by the local government, is also used to calculate property taxes. The millage rate is the rate at which property taxes are levied, and it varies depending on the location and type of property. For example, properties located in areas with high demand and limited supply may have a higher millage rate, resulting in higher property taxes.

Despite the potential for higher property taxes, Florida’s tax system offers several exemptions and discounts that can help reduce the tax burden. For example, the homestead exemption provides a reduction in property taxes for eligible homeowners, while the senior exemption offers additional savings for seniors. Other exemptions, such as the disability exemption, are also available for eligible individuals.

In addition to exemptions, Florida’s property tax system also offers a number of discounts and credits. For example, the state offers a discount for early payment of property taxes, as well as a credit for property taxes paid on a primary residence. These discounts and credits can help reduce the overall cost of property taxes, making it more affordable for homeowners and investors to own property in Florida.

Overall, Florida’s property tax system is designed to be more favorable to homeowners and investors compared to other states. While property taxes are still a significant consideration, the state’s exemptions, discounts, and credits can help reduce the tax burden. By understanding the factors that determine property taxes and taking advantage of available exemptions and discounts, homeowners and investors can navigate Florida’s property tax system with confidence.

How to Calculate Your Florida Property Taxes

Calculating property taxes in Florida can seem like a daunting task, but it’s essential to understand the process to ensure you’re not overpaying. To calculate your Florida property taxes, you’ll need to know the assessed value of your property, the millage rate, and any exemptions or discounts that may apply. In this section, we’ll break down the step-by-step process of calculating your Florida property taxes.

Step 1: Determine the Assessed Value of Your Property

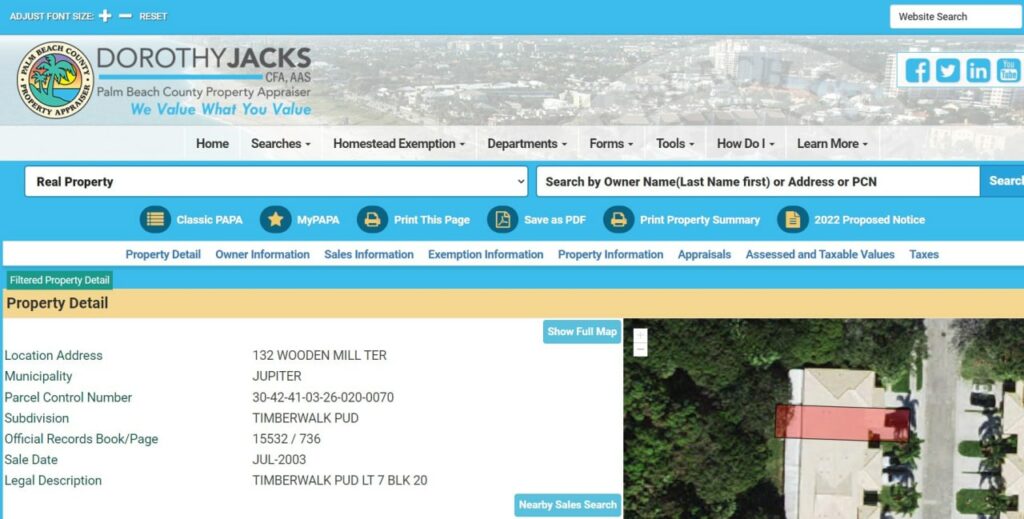

The assessed value of your property is the value assigned to it by the county property appraiser’s office. This value is typically lower than the market value of your property. You can find the assessed value of your property on your property tax bill or by contacting the county property appraiser’s office.

Step 2: Determine the Millage Rate

The millage rate is the rate at which property taxes are levied. It’s expressed as a decimal value, and it varies depending on the location and type of property. For example, properties located in areas with high demand and limited supply may have a higher millage rate, resulting in higher property taxes. You can find the millage rate for your property on your property tax bill or by contacting the county property appraiser’s office.

Step 3: Calculate the Taxable Value of Your Property

The taxable value of your property is the assessed value minus any exemptions or discounts that may apply. For example, if you’re eligible for the homestead exemption, you may be able to reduce the taxable value of your property by up to $50,000.

Step 4: Calculate the Property Taxes Owed

Once you have the taxable value of your property and the millage rate, you can calculate the property taxes owed. Multiply the taxable value of your property by the millage rate, and you’ll get the total property taxes owed.

Example:

Assessed Value: $200,000

Millage Rate

Florida Property Tax Rates: What You Need to Know

While Florida is known for having no state income tax, it does have property taxes that can impact homeowners and investors. Understanding the property tax rates in Florida is crucial for making informed decisions about buying, selling, or investing in real estate. The good news is that Florida’s property tax rates are generally lower compared to other states.

The average effective property tax rate in Florida is around 0.98%, which is lower than the national average. However, property tax rates can vary significantly depending on the location and type of property. For example, the highest property tax rate in Florida is in Monroe County, where the average effective tax rate is 1.23%. On the other hand, the lowest property tax rate is in Walton County, where the average effective tax rate is 0.63%.

It’s essential to note that property tax rates in Florida are determined by the local government, and they can change over time. The tax rate is calculated based on the assessed value of the property, which is typically lower than the market value. The assessed value is then multiplied by the millage rate, which is set by the local government. The resulting amount is the property tax owed.

For instance, if the assessed value of a property is $200,000 and the millage rate is 10 mills (1 mill = $1 per $1,000 of assessed value), the property tax owed would be $2,000. To give you a better idea, here are some examples of property tax rates in different counties in Florida:

- Miami-Dade County: 1.04%

- Broward County: 1.02%

- Hillsborough County: 0.95%

- Orange County: 0.92%

- Palm Beach County: 1.07%

As you can see, property tax rates in Florida can vary significantly depending on the location. It’s crucial to research the property tax rates in the area you’re interested in to get a better understanding of the costs involved. Additionally, it’s essential to consider other factors that can impact your property tax bill, such as exemptions and discounts.

Does Florida have property tax? Yes, it does, but the rates are generally lower compared to other states. By understanding the property tax rates in Florida, you can make informed decisions about your real estate investments and plan accordingly.

Property Tax Exemptions in Florida: Do You Qualify?

Florida offers several property tax exemptions that can help reduce the amount of property taxes owed. These exemptions can be a significant benefit for homeowners and investors, but it’s essential to understand the eligibility criteria and application procedures for each exemption.

One of the most common property tax exemptions in Florida is the homestead exemption. This exemption is available to homeowners who have lived in their primary residence for at least six months of the year. The homestead exemption can reduce the assessed value of the property by up to $50,000, resulting in significant property tax savings.

To qualify for the homestead exemption, homeowners must meet the following eligibility criteria:

- Be a permanent resident of Florida

- Own the property as their primary residence

- Have lived in the property for at least six months of the year

- Not be receiving a homestead exemption on any other property in Florida or another state

The application process for the homestead exemption typically involves submitting an application to the county property appraiser’s office by March 1st of each year. Homeowners can apply online or in person, and they will need to provide documentation to support their eligibility, such as a Florida driver’s license and a copy of their deed or title.

In addition to the homestead exemption, Florida also offers a senior exemption for homeowners who are 65 or older. This exemption can reduce the assessed value of the property by up to $25,000, resulting in additional property tax savings. To qualify for the senior exemption, homeowners must meet the following eligibility criteria:

- Be 65 or older

- Own the property as their primary residence

- Have lived in the property for at least six months of the year

Florida also offers a disability exemption for homeowners who have a permanent disability. This exemption can reduce the assessed value of the property by up to $25,000, resulting in additional property tax savings. To qualify for the disability exemption, homeowners must meet the following eligibility criteria:

- Have a permanent disability

- Own the property as their primary residence

- Have lived in the property for at least six months of the year

Other property tax exemptions available in Florida include the widow(er) exemption, the blind exemption, and the veterans’ exemption. Each of these exemptions has its own eligibility criteria and application procedures, so it’s essential to research and understand the specific requirements for each exemption.

Does Florida have property tax? Yes, it does, but the state offers several exemptions that can help reduce the amount of property taxes owed. By understanding the eligibility criteria and application procedures for each exemption, homeowners and investors can take advantage of these benefits and save on their property taxes.

How to Appeal Your Florida Property Tax Assessment

If you’re a homeowner or investor in Florida, you may be surprised to find that your property tax assessment is higher than expected. Fortunately, Florida law allows property owners to appeal their tax assessment if they believe it’s incorrect or unfair. In this article, we’ll explain the process of appealing a property tax assessment in Florida, including the deadlines and procedures for filing an appeal.

The first step in appealing a property tax assessment is to review your tax bill carefully and ensure that all the information is accurate. Check the assessed value of your property, the millage rate, and any exemptions or discounts that may apply. If you believe that your assessment is incorrect, you can file a petition with the county property appraiser’s office.

The deadline for filing a petition varies depending on the county, but it’s typically in mid-March. You can file a petition online or in person, and you’ll need to provide documentation to support your appeal, such as:

- A copy of your tax bill

- A copy of your deed or title

- Proof of income or financial statements

- Appraisals or other evidence of the property’s value

Once you’ve filed your petition, the county property appraiser’s office will review your case and make a determination. If your appeal is denied, you can further appeal to the Value Adjustment Board (VAB). The VAB is an independent board that reviews appeals and makes final determinations.

The grounds for appeal can vary, but common reasons include:

- Incorrect assessed value

- Incorrect millage rate

- Incorrect exemptions or discounts

- Unequal treatment compared to similar properties

The potential outcomes of an appeal can also vary, but common results include:

- A reduction in the assessed value of the property

- A reduction in the millage rate

- An increase in exemptions or discounts

- A refund of overpaid taxes

Does Florida have property tax? Yes, it does, and understanding the appeal process can help you navigate the system with confidence. By following the steps outlined above, you can ensure that your property tax assessment is fair and accurate.

It’s also important to note that the appeal process can be complex and time-consuming, so it’s recommended that you seek the advice of a qualified tax professional or attorney if you’re unsure about how to proceed.

Florida Property Tax Reform: Recent Changes and Updates

Florida’s property tax system has undergone several changes and updates in recent years, impacting homeowners and investors across the state. Understanding these changes is crucial for navigating the system with confidence and making informed decisions about your property investments.

One of the most significant changes to Florida’s property tax system is the implementation of Amendment 1, which was approved by voters in 2018. This amendment increased the homestead exemption from $50,000 to $75,000, providing additional tax relief to homeowners. The amendment also established a new exemption for low-income seniors, providing an additional $25,000 exemption for eligible homeowners.

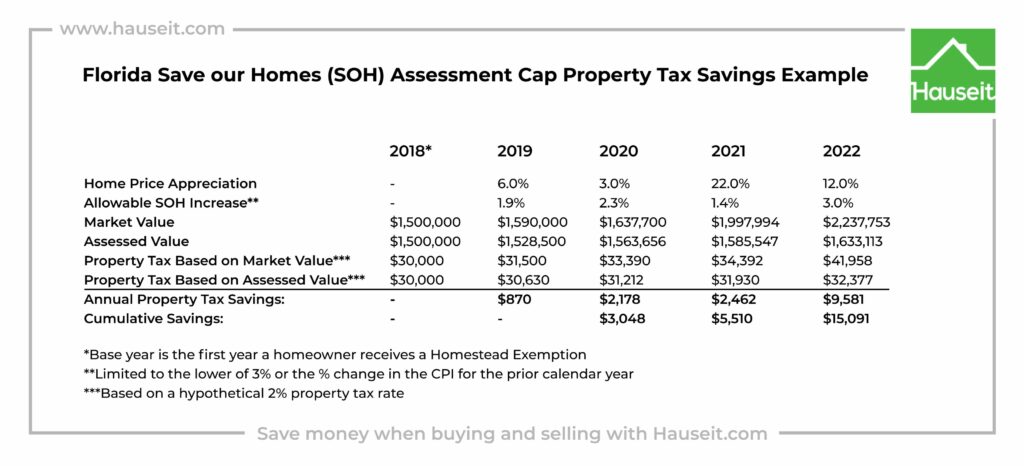

In addition to Amendment 1, the Florida Legislature has also made changes to the state’s property tax system. For example, in 2020, the Legislature passed a bill that allows homeowners to transfer their Save Our Homes (SOH) benefit to a new home, even if the new home is more expensive than the previous one. This change provides more flexibility for homeowners who are looking to move to a new home without losing their SOH benefit.

Another significant change to Florida’s property tax system is the implementation of the Tangible Personal Property Tax (TPPT) exemption. This exemption provides a $25,000 exemption for businesses that own tangible personal property, such as equipment and furniture. The exemption is designed to help small businesses and entrepreneurs by reducing their tax burden.

Recent court rulings have also impacted Florida’s property tax system. For example, in 2020, the Florida Supreme Court ruled that the state’s property tax system is constitutional, despite challenges from some taxpayers who argued that the system is unfair. The ruling provides clarity and stability to the system, allowing homeowners and investors to plan for the future with confidence.

Does Florida have property tax? Yes, it does, and understanding the recent changes and updates to the system is crucial for navigating it with confidence. By staying informed about these changes, homeowners and investors can make informed decisions about their property investments and take advantage of the tax relief available to them.

It’s also important to note that Florida’s property tax system is subject to change, and new legislation and court rulings can impact the system at any time. Staying informed and up-to-date on these changes is crucial for navigating the system with confidence and making informed decisions about your property investments.

Property Tax Implications for Florida Homebuyers and Investors

When it comes to buying or investing in real estate in Florida, property taxes can have a significant impact on cash flow and investment returns. Understanding the property tax implications is crucial for making informed decisions and maximizing returns on investment.

For homebuyers, property taxes can affect the affordability of a home. Higher property taxes can increase the cost of homeownership, making it more difficult for buyers to qualify for a mortgage. On the other hand, lower property taxes can make a home more affordable, increasing the buyer’s purchasing power.

For investors, property taxes can impact the cash flow and returns on investment. Higher property taxes can reduce the net operating income (NOI) of a rental property, making it less attractive to investors. On the other hand, lower property taxes can increase the NOI, making the property more attractive to investors.

When evaluating the property tax implications of a potential investment, it’s essential to consider the following factors:

- Property tax rates: Research the current property tax rates in the area and how they may impact the investment.

- Assessed value: Understand how the assessed value of the property is determined and how it may impact the property taxes.

- Exemptions and discounts: Research any available exemptions or discounts that may reduce the property taxes.

- Cash flow: Consider how the property taxes will impact the cash flow of the investment.

To factor property taxes into investment decisions, consider the following tips:

- Use a property tax calculator to estimate the property taxes and how they may impact the investment.

- Research the local market and understand the current property tax rates and trends.

- Consider working with a real estate agent or property manager who is familiar with the local market and can provide guidance on property taxes.

- Factor property taxes into the overall investment strategy and consider how they may impact the returns on investment.

Does Florida have property tax? Yes, it does, and understanding the property tax implications is crucial for making informed decisions and maximizing returns on investment. By considering the factors mentioned above and factoring property taxes into investment decisions, homebuyers and investors can make informed decisions and achieve their financial goals.

Conclusion: Navigating Florida’s Property Tax System with Confidence

Understanding Florida’s property tax system is crucial for homeowners and investors who want to make informed decisions about their property investments. While the state has no state income tax, it does have property taxes that can impact the bottom line. By understanding the factors that determine property taxes, including the assessed value of the property, the millage rate, and any exemptions or discounts that may apply, homeowners and investors can navigate the system with confidence.

It’s also important to stay up-to-date on recent changes and updates to Florida’s property tax system, including any legislative reforms or court rulings that may impact property taxes. By doing so, homeowners and investors can ensure that they are taking advantage of all the tax savings available to them.

In conclusion, navigating Florida’s property tax system requires a solid understanding of the system and its complexities. By following the tips and recommendations outlined in this article, homeowners and investors can make informed decisions and achieve their financial goals.

Some final tips for navigating Florida’s property tax system with confidence include:

- Stay informed about changes to the property tax system

- Understand the factors that determine property taxes

- Take advantage of available exemptions and discounts

- Consult with a tax professional or attorney if needed

By following these tips and staying informed, homeowners and investors can navigate Florida’s property tax system with confidence and achieve their financial goals.

Does Florida have property tax? Yes, it does, and understanding the system is crucial for making informed decisions. By staying informed and taking advantage of available tax savings, homeowners and investors can achieve their financial goals and succeed in the Sunshine State.