Understanding the Basics of Stock Ownership

Investing in the stock market can be a lucrative way to grow your wealth over time, but it’s essential to understand the basics of stock ownership before getting started. When you buy shares of stock, you’re essentially becoming a part-owner of a company. This means you’ll have a claim on a portion of the company’s assets and profits. As a shareholder, you’ll be entitled to receive dividends, which are portions of the company’s profit distributed to its owners. You’ll also have the potential to earn capital gains, which occur when the value of your shares increases over time.

However, it’s crucial to remember that buying shares of stock also comes with risks. The value of your shares can fluctuate rapidly, and you may lose some or all of your investment if the company performs poorly. To mitigate these risks, it’s essential to do your research and choose companies with a strong track record of growth and stability. You should also diversify your portfolio by investing in a variety of different stocks and asset classes.

One of the most significant benefits of buying shares of stock is the potential for long-term growth. Historically, the stock market has provided higher returns over the long-term compared to other investment options, such as bonds or savings accounts. However, it’s essential to remember that past performance is not a guarantee of future results, and it’s crucial to have a well-thought-out investment strategy in place.

When it comes to buying shares of stock, there are several options to consider. You can invest in individual stocks, which allows you to choose specific companies you believe in. Alternatively, you can invest in mutual funds or exchange-traded funds (ETFs), which provide a diversified portfolio of stocks and can help reduce your risk. Regardless of which option you choose, it’s essential to have a solid understanding of the stock market and the companies you’re investing in.

By understanding the basics of stock ownership and doing your research, you can make informed investment decisions and potentially earn significant returns over time. Whether you’re a seasoned investor or just starting out, buying shares of stock can be a great way to grow your wealth and achieve your financial goals. To get started, you’ll need to open a brokerage account and fund it with money to invest. From there, you can begin researching and selecting stocks to add to your portfolio.

Remember, buying shares of stock is just the first step in building a successful investment portfolio. It’s essential to continue learning and adapting to changes in the market to ensure long-term success. By staying informed and making smart investment decisions, you can potentially earn significant returns and achieve your financial goals.

Choosing the Right Brokerage Account for Your Needs

When it comes to buying shares of stock, one of the most important decisions you’ll make is choosing the right brokerage account. With so many options available, it can be overwhelming to determine which one is best for your needs. In this section, we’ll discuss the different types of brokerage accounts available and provide tips on how to select the right one for you.

There are three main types of brokerage accounts: full-service, discount, and online brokerages. Full-service brokerages offer a wide range of services, including investment advice, retirement planning, and portfolio management. These brokerages typically charge higher fees and commissions, but they can provide valuable guidance and support for investors who need it.

Discount brokerages, on the other hand, offer lower fees and commissions, but they often provide limited services and support. These brokerages are best for investors who are comfortable managing their own portfolios and don’t need a lot of hand-holding.

Online brokerages are a type of discount brokerage that operates exclusively online. These brokerages often offer the lowest fees and commissions, but they may not provide as much support or guidance as full-service brokerages.

When selecting a brokerage account, there are several factors to consider. First, think about the types of investments you want to make. If you’re interested in buying shares of stock, you’ll want to choose a brokerage that offers a wide range of stock trading options. You should also consider the fees and commissions associated with each brokerage, as these can eat into your investment returns over time.

Another important factor to consider is the level of support and guidance you need. If you’re new to investing, you may want to choose a full-service brokerage that can provide valuable advice and guidance. On the other hand, if you’re an experienced investor, you may prefer a discount or online brokerage that offers lower fees and more flexibility.

Finally, think about the technology and tools you need to manage your investments. Some brokerages offer advanced trading platforms and mobile apps that can help you stay on top of your investments on the go. Others may offer more basic tools and technology.

By considering these factors and doing your research, you can choose a brokerage account that meets your needs and helps you achieve your investment goals. Remember to always read the fine print and understand the fees and commissions associated with each brokerage before making a decision.

Once you’ve selected a brokerage account, you can begin the process of buying shares of stock. This typically involves funding your account, selecting the stocks you want to buy, and placing trades. We’ll cover the specifics of how to buy shares of stock in the next section.

How to Research and Select Stocks for Your Portfolio

When it comes to buying shares of stock, one of the most important decisions you’ll make is selecting the right stocks for your portfolio. With thousands of stocks to choose from, it can be overwhelming to determine which ones are the best fit for your investment goals and risk tolerance. In this section, we’ll provide tips on how to research and select stocks, including evaluating company financials, industry trends, and competitive analysis.

One of the first steps in researching stocks is to evaluate the company’s financials. This includes reviewing the company’s income statement, balance sheet, and cash flow statement. You should also look at the company’s revenue growth, profit margins, and return on equity. These metrics can give you an idea of the company’s financial health and potential for future growth.

In addition to evaluating company financials, you should also research the industry trends and competitive landscape. This includes looking at the company’s position within its industry, as well as the overall health of the industry. You should also research the company’s competitors and how they compare to the company you’re considering.

Another important factor to consider when selecting stocks is diversification. This means spreading your investments across different asset classes, sectors, and geographic regions. By diversifying your portfolio, you can reduce your risk and increase your potential for long-term returns.

When it comes to creating a balanced portfolio, there are several strategies you can use. One approach is to allocate your investments across different asset classes, such as stocks, bonds, and real estate. You can also diversify your portfolio by investing in different sectors, such as technology, healthcare, and finance.

Once you’ve selected a stock, it’s essential to continue monitoring its performance and adjusting your portfolio as needed. This includes regularly reviewing the company’s financials, industry trends, and competitive landscape. You should also be prepared to sell your shares if the company’s performance declines or if you need to rebalance your portfolio.

By following these tips and doing your research, you can make informed investment decisions and potentially earn significant returns over time. Remember to always keep your investment goals and risk tolerance in mind when selecting stocks, and don’t be afraid to seek professional advice if you need it.

When buying shares of stock, it’s also essential to consider the fees and commissions associated with each trade. These costs can eat into your investment returns over time, so it’s crucial to choose a brokerage account that offers competitive pricing and low fees.

By taking the time to research and select the right stocks for your portfolio, you can increase your potential for long-term success and achieve your investment goals. Whether you’re a seasoned investor or just starting out, buying shares of stock can be a great way to grow your wealth and secure your financial future.

Understanding Stock Trading Orders and Execution

When buying shares of stock, it’s essential to understand the different types of stock trading orders and how to execute trades. In this section, we’ll explain the different types of stock trading orders, including market orders, limit orders, and stop-loss orders. We’ll also discuss how to execute trades and the importance of understanding trading fees and commissions.

A market order is an instruction to buy or sell a stock at the current market price. This type of order is executed immediately, and the price is determined by the current market conditions. Market orders are the most common type of stock trading order and are often used by investors who want to buy or sell a stock quickly.

A limit order, on the other hand, is an instruction to buy or sell a stock at a specific price. This type of order is executed only if the stock reaches the specified price. Limit orders are often used by investors who want to buy or sell a stock at a specific price and are willing to wait for the market to reach that price.

A stop-loss order is an instruction to sell a stock when it falls to a certain price. This type of order is designed to limit losses if the stock price falls. Stop-loss orders are often used by investors who want to protect their investments from significant losses.

When executing trades, it’s essential to understand the trading fees and commissions associated with each trade. These costs can eat into your investment returns over time, so it’s crucial to choose a brokerage account that offers competitive pricing and low fees.

In addition to understanding the different types of stock trading orders, it’s also essential to understand how to execute trades. This includes knowing how to use online trading platforms, mobile apps, and other tools to buy and sell stocks. It’s also important to understand the risks associated with trading, including the potential for losses and the importance of risk management.

By understanding the different types of stock trading orders and how to execute trades, you can make informed investment decisions and potentially earn significant returns over time. Remember to always keep your investment goals and risk tolerance in mind when buying shares of stock, and don’t be afraid to seek professional advice if you need it.

When buying shares of stock, it’s also essential to consider the timing of your trades. This includes understanding the different market hours, including pre-market and after-hours trading. It’s also important to understand the impact of news and events on the stock market and how to adjust your trading strategy accordingly.

By following these tips and understanding the different types of stock trading orders, you can make informed investment decisions and potentially earn significant returns over time. Whether you’re a seasoned investor or just starting out, buying shares of stock can be a great way to grow your wealth and secure your financial future.

Managing Risk and Minimizing Losses in the Stock Market

Investing in the stock market involves risk, and it’s essential to manage that risk to minimize losses and maximize gains. In this section, we’ll discuss the importance of risk management in stock market investing, including strategies for minimizing losses and maximizing gains. We’ll also explain the concept of stop-loss orders and how to use them effectively.

Risk management is critical in stock market investing because it helps to protect your investments from significant losses. One way to manage risk is to diversify your portfolio by investing in different asset classes, sectors, and geographic regions. This can help to reduce your exposure to any one particular stock or market, and can increase your potential for long-term returns.

Another way to manage risk is to use stop-loss orders. A stop-loss order is an instruction to sell a stock when it falls to a certain price. This can help to limit your losses if the stock price falls, and can also help to lock in profits if the stock price rises. Stop-loss orders can be used in conjunction with other risk management strategies, such as diversification and position sizing.

Position sizing is another important risk management strategy. This involves determining the optimal amount of capital to allocate to each stock or investment, based on your investment goals and risk tolerance. By allocating the right amount of capital to each investment, you can help to minimize your losses and maximize your gains.

In addition to these strategies, it’s also essential to stay informed about market conditions and news that may affect your investments. This can help you to make informed investment decisions and to adjust your risk management strategy as needed.

By managing risk effectively, you can help to minimize losses and maximize gains in the stock market. Remember to always keep your investment goals and risk tolerance in mind when making investment decisions, and don’t be afraid to seek professional advice if you need it.

When buying shares of stock, it’s also essential to consider the potential for losses and the importance of risk management. By understanding the risks involved and taking steps to manage them, you can help to protect your investments and achieve your long-term financial goals.

In conclusion, risk management is a critical component of successful stock market investing. By diversifying your portfolio, using stop-loss orders, and staying informed about market conditions, you can help to minimize losses and maximize gains. Remember to always keep your investment goals and risk tolerance in mind when making investment decisions, and don’t be afraid to seek professional advice if you need it.

Monitoring and Adjusting Your Stock Portfolio Over Time

Once you’ve invested in the stock market, it’s essential to regularly monitor and adjust your portfolio to ensure it remains aligned with your investment goals and risk tolerance. In this section, we’ll explain the importance of monitoring and adjusting your stock portfolio over time, and provide tips on how to do so effectively.

Monitoring your stock portfolio involves regularly reviewing your investments to ensure they are performing as expected. This includes tracking the performance of individual stocks, as well as the overall performance of your portfolio. By monitoring your portfolio, you can identify areas where adjustments may be needed, and make changes to ensure your investments remain aligned with your goals.

Adjusting your stock portfolio involves making changes to your investments to ensure they remain aligned with your goals and risk tolerance. This may involve buying or selling stocks, or adjusting the allocation of your investments. By adjusting your portfolio, you can help to minimize losses and maximize gains, and ensure your investments remain on track to meet your long-term goals.

One way to monitor and adjust your stock portfolio is to use a portfolio rebalancing strategy. This involves regularly reviewing your portfolio to ensure it remains aligned with your target asset allocation, and making adjustments as needed. By rebalancing your portfolio, you can help to minimize risk and maximize returns, and ensure your investments remain on track to meet your long-term goals.

Another way to monitor and adjust your stock portfolio is to use a tax-loss harvesting strategy. This involves selling stocks that have declined in value to realize losses, and using those losses to offset gains from other investments. By tax-loss harvesting, you can help to minimize tax liabilities and maximize after-tax returns, and ensure your investments remain on track to meet your long-term goals.

By regularly monitoring and adjusting your stock portfolio, you can help to ensure your investments remain aligned with your goals and risk tolerance, and maximize your potential for long-term returns. Remember to always keep your investment goals and risk tolerance in mind when making investment decisions, and don’t be afraid to seek professional advice if you need it.

When buying shares of stock, it’s also essential to consider the importance of monitoring and adjusting your portfolio over time. By doing so, you can help to minimize losses and maximize gains, and ensure your investments remain on track to meet your long-term goals.

In addition to monitoring and adjusting your portfolio, it’s also essential to stay informed about market conditions and news that may affect your investments. This can help you to make informed investment decisions and adjust your portfolio as needed.

By following these tips and regularly monitoring and adjusting your stock portfolio, you can help to ensure your investments remain aligned with your goals and risk tolerance, and maximize your potential for long-term returns.

Tax Implications of Buying and Selling Stocks

When buying and selling stocks, it’s essential to consider the tax implications of your investments. In this section, we’ll discuss the tax implications of buying and selling stocks, including capital gains tax and tax-loss harvesting. We’ll also explain how to minimize tax liabilities and maximize after-tax returns.

Capital gains tax is a tax on the profit made from selling a stock. The tax rate on capital gains depends on the length of time you’ve held the stock and your income tax bracket. If you’ve held the stock for less than a year, the capital gain is considered short-term and is taxed at your ordinary income tax rate. If you’ve held the stock for more than a year, the capital gain is considered long-term and is taxed at a lower rate.

Tax-loss harvesting is a strategy used to minimize tax liabilities by selling stocks that have declined in value. By selling these stocks, you can realize losses that can be used to offset gains from other investments. This can help to minimize your tax liability and maximize your after-tax returns.

Another way to minimize tax liabilities is to hold onto your stocks for the long-term. By holding onto your stocks for more than a year, you can qualify for the lower long-term capital gains tax rate. This can help to minimize your tax liability and maximize your after-tax returns.

It’s also essential to consider the tax implications of buying and selling stocks in a tax-deferred account, such as a 401(k) or IRA. In these accounts, the tax implications of buying and selling stocks are deferred until you withdraw the funds in retirement.

By understanding the tax implications of buying and selling stocks, you can make informed investment decisions and minimize your tax liability. Remember to always consult with a tax professional or financial advisor to ensure you’re making the most tax-efficient investment decisions.

When buying shares of stock, it’s also essential to consider the tax implications of your investments. By understanding the tax implications of buying and selling stocks, you can make informed investment decisions and minimize your tax liability.

In addition to considering the tax implications of buying and selling stocks, it’s also essential to consider the fees and commissions associated with buying and selling stocks. These fees and commissions can eat into your investment returns and minimize your after-tax returns.

By following these tips and considering the tax implications of buying and selling stocks, you can make informed investment decisions and minimize your tax liability. Remember to always consult with a tax professional or financial advisor to ensure you’re making the most tax-efficient investment decisions.

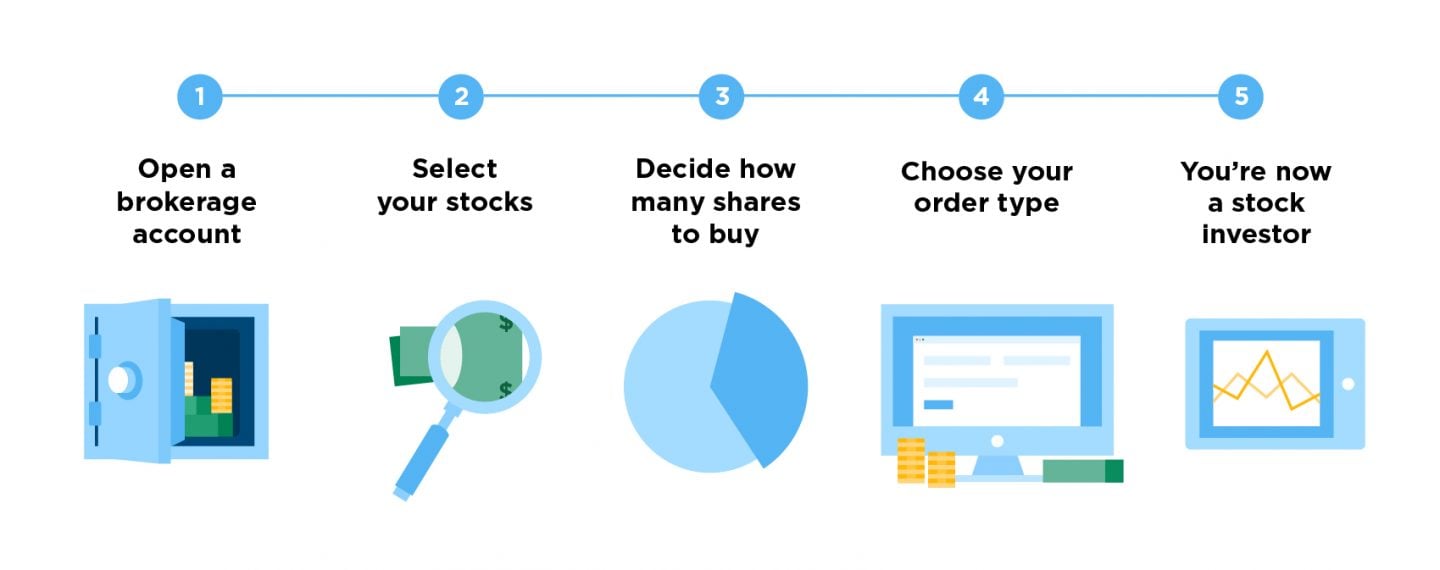

Getting Started with Buying Shares: A Step-by-Step Guide

Now that you’ve learned the basics of stock ownership and how to research and select stocks, it’s time to get started with buying shares. In this section, we’ll provide a step-by-step guide for beginners on how to get started with buying shares, including opening a brokerage account, funding the account, and placing trades.

Step 1: Open a Brokerage Account

The first step in buying shares is to open a brokerage account. This can be done online or in-person at a brokerage firm. When opening a brokerage account, you’ll need to provide personal and financial information, such as your name, address, and social security number.

Step 2: Fund Your Account

Once your brokerage account is open, you’ll need to fund it with money to buy shares. This can be done by depositing cash into your account or by transferring funds from another account.

Step 3: Choose Your Stocks

After your account is funded, you can start choosing the stocks you want to buy. This can be done by researching and selecting stocks that align with your investment goals and risk tolerance.

Step 4: Place Your Trades

Once you’ve chosen your stocks, you can place your trades. This can be done online or over the phone with your brokerage firm. When placing trades, you’ll need to specify the number of shares you want to buy and the price you’re willing to pay.

Step 5: Monitor Your Portfolio

After you’ve placed your trades, it’s essential to monitor your portfolio regularly. This includes tracking the performance of your stocks and making adjustments as needed.

By following these steps, you can get started with buying shares and begin building your investment portfolio. Remember to always do your research and consider your investment goals and risk tolerance before making any investment decisions.

When buying shares of stock, it’s also essential to consider the fees and commissions associated with buying and selling stocks. These fees and commissions can eat into your investment returns and minimize your after-tax returns.

By understanding the steps involved in buying shares and considering the fees and commissions associated with buying and selling stocks, you can make informed investment decisions and begin building your investment portfolio.

In conclusion, buying shares of stock can be a great way to build wealth and achieve your long-term financial goals. By following the steps outlined in this guide and considering the fees and commissions associated with buying and selling stocks, you can make informed investment decisions and begin building your investment portfolio.

:max_bytes(150000):strip_icc()/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg)