Why Travelers Need a Specialized Credit Card

Traveling can be a thrilling experience, but it also comes with its unique set of challenges. One of the most significant concerns for travelers is managing their finances while abroad. Foreign transaction fees, travel insurance, and rewards redemption can be a daunting task, especially for those who are not familiar with the intricacies of credit cards. This is where a specialized credit card for travelers comes into play. A credit card designed specifically for travel can help alleviate these concerns and provide a stress-free experience for travelers.

A good travel credit card can help travelers avoid foreign transaction fees, which can range from 1% to 3% of the transaction amount. This may not seem like a lot, but it can add up quickly, especially for frequent travelers. Additionally, a travel credit card can provide travel insurance, which can cover unexpected trip cancellations, interruptions, or delays. This can provide peace of mind for travelers and help them avoid financial losses.

Another significant benefit of a travel credit card is rewards redemption. Travelers can earn points or miles on their purchases, which can be redeemed for flights, hotel stays, or other travel-related expenses. This can help travelers save money on their trips and make the most of their credit card rewards. With the right credit card, travelers can enjoy a stress-free experience and make the most of their travels.

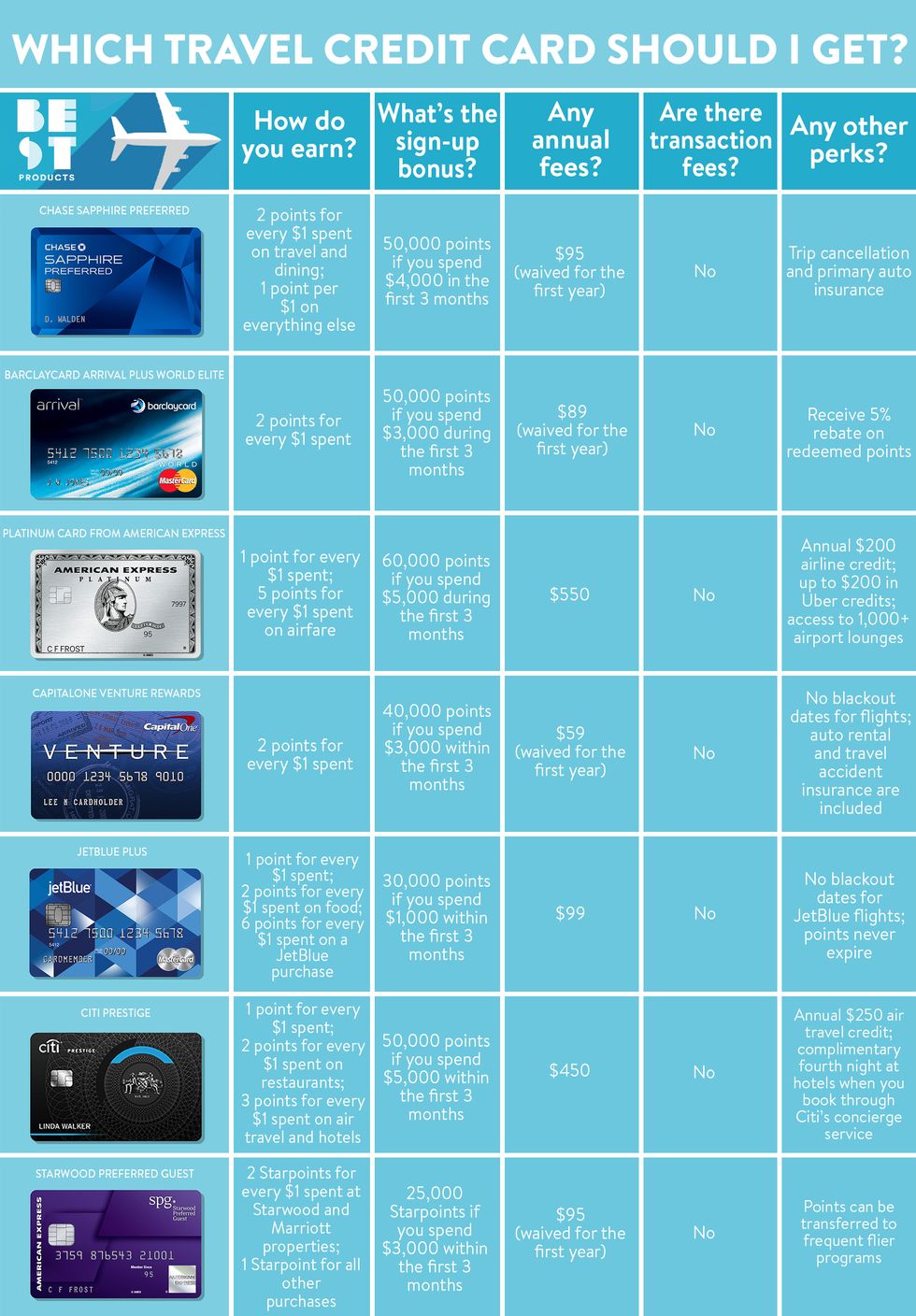

When it comes to choosing the best credit card for travelers, there are several options available. Some popular choices include the Chase Sapphire Preferred, Capital One Venture, and Barclays Arrival Plus. These cards offer a range of benefits, including no foreign transaction fees, travel insurance, and rewards redemption. However, the best credit card for travelers will depend on their individual needs and preferences.

For example, frequent flyers may prefer a credit card that offers airline-specific rewards, such as the Citi AAdvantage or the United Explorer. On the other hand, travelers who prefer to stay in hotels may prefer a credit card that offers hotel-specific rewards, such as the Hilton Honors or the Marriott Bonvoy. Ultimately, the best credit card for travelers will depend on their individual travel habits and preferences.

How to Choose the Best Travel Credit Card for Your Needs

With so many travel credit cards available, choosing the best one for your needs can be overwhelming. To make the process easier, consider the following factors:

Annual fees: While some travel credit cards come with no annual fee, others can charge upwards of $500 per year. Consider whether the benefits and rewards offered by the card outweigh the cost of the annual fee.

Rewards rates: Look for a card that offers a high rewards rate on purchases, especially in categories that align with your travel habits. For example, if you frequently fly with a particular airline, consider a card that offers bonus rewards on airline purchases.

Travel benefits: Consider the types of travel benefits that are important to you, such as airport lounge access, travel insurance, or concierge services. Look for a card that offers a comprehensive suite of benefits that align with your needs.

Foreign transaction fees: If you plan to travel internationally, look for a card that doesn’t charge foreign transaction fees. This can save you money on international purchases and help you avoid unnecessary fees.

Introductory offers: Many travel credit cards offer introductory bonuses or promotions that can provide a significant boost to your rewards earnings. Consider a card that offers a generous introductory offer, but be sure to read the terms and conditions carefully.

Travel credit cards can be broadly categorized into three types: airline credit cards, hotel credit cards, and general travel credit cards. Airline credit cards are ideal for frequent flyers, while hotel credit cards are best for those who prefer to stay in hotels. General travel credit cards offer a more flexible rewards program and are often a good choice for those who don’t have a specific airline or hotel loyalty.

When choosing the best credit card for travelers, consider your individual needs and preferences. Do you frequently fly with a particular airline? Look for a card that offers bonus rewards on airline purchases. Do you prefer to stay in hotels? Consider a card that offers hotel-specific rewards. By choosing a card that aligns with your travel habits, you can maximize your rewards earnings and enjoy a more stress-free travel experience.

Top Travel Credit Cards for Different Types of Travelers

With so many travel credit cards available, it can be difficult to choose the best one for your needs. Here are some top travel credit cards that cater to different types of travelers:

For frequent flyers, the Chase Sapphire Preferred is a top choice. This card offers 2X points on travel and dining purchases, plus a 60,000-point bonus after spending $4,000 in the first 3 months. The annual fee is $95, but the benefits and rewards make it well worth the cost.

For those who prefer to stay in hotels, the Capital One Venture is a great option. This card offers 2X miles on all purchases, plus miles can be redeemed for travel purchases with no blackout dates or restrictions. The annual fee is $0 for the first year, then $95.

For travelers who want a more flexible rewards program, the Barclays Arrival Plus is a top choice. This card offers 2X miles on all purchases, plus miles can be redeemed for travel purchases with no blackout dates or restrictions. The annual fee is $0 for the first year, then $89.

Other notable mentions include the Citi Premier, which offers 3X points on travel purchases, and the American Express Platinum, which offers 5X points on air travel purchases. These cards come with higher annual fees, but the benefits and rewards make them well worth the cost for frequent travelers.

When choosing a travel credit card, consider your individual needs and preferences. Do you frequently fly with a particular airline? Look for a card that offers airline-specific rewards. Do you prefer to stay in hotels? Consider a card that offers hotel-specific rewards. By choosing a card that aligns with your travel habits, you can maximize your rewards earnings and enjoy a more stress-free travel experience.

Ultimately, the best credit card for travelers is one that offers a combination of rewards, benefits, and flexibility. By considering your individual needs and preferences, you can choose a card that helps you make the most of your travels and enjoy a more stress-free experience.

Maximizing Rewards and Benefits on the Road

Travel credit cards offer a wide range of rewards and benefits that can enhance your travel experience. To get the most out of your credit card, it’s essential to understand how to maximize your rewards and benefits.

Redeeming points: One of the most significant benefits of travel credit cards is the ability to redeem points for travel purchases. Look for cards that offer flexible redemption options, such as transferring points to airline or hotel loyalty programs. Consider cards that offer a high redemption value, such as the Chase Sapphire Preferred, which offers a 25% bonus when redeeming points for travel purchases.

Using travel insurance: Travel credit cards often offer travel insurance, which can provide protection against trip cancellations, interruptions, or delays. Look for cards that offer comprehensive travel insurance, such as the Capital One Venture, which offers trip cancellation insurance up to $5,000.

Airport lounge access: Airport lounge access can be a valuable benefit for frequent travelers. Look for cards that offer lounge access, such as the American Express Platinum, which offers access to over 1,200 airport lounges worldwide.

Travel assistance: Travel credit cards often offer travel assistance, which can provide help with travel-related issues, such as flight delays or lost luggage. Look for cards that offer comprehensive travel assistance, such as the Barclays Arrival Plus, which offers 24/7 travel assistance.

Exclusive events: Some travel credit cards offer exclusive events, such as concerts or sporting events. Look for cards that offer these types of events, such as the Citi Premier, which offers exclusive access to events like the Grammy Awards.

By understanding how to maximize your rewards and benefits, you can get the most out of your travel credit card and enjoy a more stress-free travel experience. Remember to always read the terms and conditions of your card to understand the benefits and rewards offered.

Avoiding Common Pitfalls and Fees

While travel credit cards can offer numerous benefits and rewards, there are also common pitfalls and fees to be aware of. By understanding these potential drawbacks, you can avoid unnecessary costs and make the most of your credit card.

Foreign transaction fees: Many credit cards charge foreign transaction fees, which can range from 1% to 3% of the transaction amount. Look for cards that don’t charge these fees, such as the Chase Sapphire Preferred or the Capital One Venture.

Annual fees: While some travel credit cards come with no annual fee, others can charge upwards of $500 per year. Consider whether the benefits and rewards offered by the card outweigh the cost of the annual fee.

Interest charges: If you don’t pay your balance in full each month, you may be charged interest on your outstanding balance. Look for cards with low interest rates or consider paying your balance in full each month to avoid interest charges.

Other fees: Some credit cards may charge other fees, such as late payment fees or balance transfer fees. Be sure to read the terms and conditions of your card to understand any potential fees.

To avoid these common pitfalls and fees, it’s essential to read the terms and conditions of your credit card carefully. Understand the fees associated with your card and make sure you’re using it in a way that minimizes costs. By being aware of these potential drawbacks, you can make the most of your travel credit card and enjoy a more stress-free travel experience.

Additionally, consider the following tips to avoid common pitfalls and fees:

Pay your balance in full each month to avoid interest charges.

Choose a card with no foreign transaction fees to save money on international purchases.

Read the terms and conditions of your card carefully to understand any potential fees.

Consider the annual fee and whether the benefits and rewards offered by the card outweigh the cost.

Travel Credit Card Perks You Never Knew Existed

Travel credit cards often offer a range of benefits and perks that can enhance your travel experience. While many travelers are aware of the more obvious benefits, such as rewards points and travel insurance, there are several lesser-known perks that can provide significant value.

Travel assistance: Many travel credit cards offer travel assistance, which can provide help with travel-related issues, such as flight delays or lost luggage. This can be a valuable benefit for travelers who encounter unexpected problems on the road.

Concierge services: Some travel credit cards offer concierge services, which can provide personalized assistance with travel planning and booking. This can be a valuable benefit for travelers who want to make the most of their trip.

Exclusive events: Some travel credit cards offer exclusive events, such as concerts or sporting events, which can provide a unique and memorable experience for travelers.

Travel discounts: Many travel credit cards offer travel discounts, which can provide significant savings on flights, hotels, and other travel-related expenses.

Travel upgrades: Some travel credit cards offer travel upgrades, which can provide a more comfortable and enjoyable travel experience. This can include upgrades to first class or access to airport lounges.

By taking advantage of these lesser-known perks, travelers can get the most out of their credit card and enjoy a more stress-free and enjoyable travel experience.

For example, the American Express Platinum card offers a range of exclusive benefits, including travel assistance, concierge services, and access to exclusive events. The Chase Sapphire Preferred card offers travel discounts and upgrades, as well as a range of other benefits and perks.

By understanding the range of benefits and perks offered by travel credit cards, travelers can make informed decisions about which card is best for their needs and maximize their rewards and benefits.

Real-Life Examples of Travel Credit Card Success Stories

Travel credit cards can be a powerful tool for earning rewards, saving money, and enhancing your travel experiences. But don’t just take our word for it – here are some real-life examples of travelers who have successfully used their credit cards to achieve their travel goals.

Meet Sarah, a frequent traveler who uses her Chase Sapphire Preferred card to earn points on her travel purchases. She recently redeemed her points for a free flight to Europe, saving her over $1,000. “I was amazed at how easy it was to earn and redeem points with my Chase Sapphire Preferred card,” she said. “It’s been a game-changer for my travel habits.”

Meet John, a business traveler who uses his American Express Platinum card to earn points on his business expenses. He recently redeemed his points for a free stay at a luxury hotel, saving him over $500. “I was impressed by the quality of the hotel and the ease of redemption with my American Express Platinum card,” he said. “It’s been a valuable tool for my business travel needs.”

Meet Emily, a student who uses her Capital One Venture card to earn points on her everyday purchases. She recently redeemed her points for a free flight to visit her family, saving her over $200. “I was surprised by how easy it was to earn and redeem points with my Capital One Venture card,” she said. “It’s been a great way to save money on my travel expenses.”

These are just a few examples of how travel credit cards can be used to achieve real-life travel goals. By choosing the right credit card and using it strategically, you can earn rewards, save money, and enhance your travel experiences.

When choosing a travel credit card, consider your individual needs and preferences. Do you frequently fly with a particular airline? Look for a card that offers airline-specific rewards. Do you prefer to stay in hotels? Consider a card that offers hotel-specific rewards. By choosing a card that aligns with your travel habits, you can maximize your rewards earnings and enjoy a more stress-free travel experience.

Staying Ahead of the Game: Travel Credit Card Trends and Updates

The travel credit card industry is constantly evolving, with new card launches, changes to rewards programs, and emerging technologies. To stay ahead of the game, it’s essential to stay informed about the latest trends and updates.

New card launches: Several new travel credit cards have been launched in recent years, offering innovative features and benefits. For example, the Chase Sapphire Reserve card offers a $300 travel credit, while the American Express Platinum card offers a $200 airline fee credit.

Changes to rewards programs: Many travel credit cards have made changes to their rewards programs, offering more flexible redemption options and increased earning potential. For example, the Capital One Venture card now offers 2X miles on all purchases, while the Barclays Arrival Plus card offers 2X miles on all travel purchases.

Emerging technologies: The travel credit card industry is also seeing the emergence of new technologies, such as mobile payments and contactless transactions. These technologies offer increased convenience and security for travelers, and are expected to become more widespread in the coming years.

Increased focus on travel benefits: Many travel credit cards are now offering more comprehensive travel benefits, such as travel insurance, trip cancellation insurance, and travel assistance. These benefits can provide peace of mind for travelers and help them navigate unexpected travel-related issues.

More flexible redemption options: Many travel credit cards are now offering more flexible redemption options, such as the ability to redeem points for travel purchases or transfer points to airline or hotel loyalty programs. This increased flexibility can make it easier for travelers to get the most out of their rewards.

By staying informed about the latest trends and updates in the travel credit card industry, you can make informed decisions about which card is best for your needs and maximize your rewards and benefits.