Breaking Down the Barriers to Renting a House

Renting a house can be a daunting task, especially for individuals or families with bad credit or no credit history. The traditional credit check process can be a major obstacle, leading to frustration and disappointment. However, there is a growing trend towards renting houses without credit checks, offering a beacon of hope for those who have been previously excluded from the rental market.

The credit check process has long been a staple of the rental industry, with landlords and property managers using it as a way to assess the creditworthiness of potential tenants. However, this approach can be limiting, as it fails to take into account other important factors such as rental history, employment verification, and income checks. As a result, many individuals and families are being unfairly excluded from the rental market, simply because of their credit score.

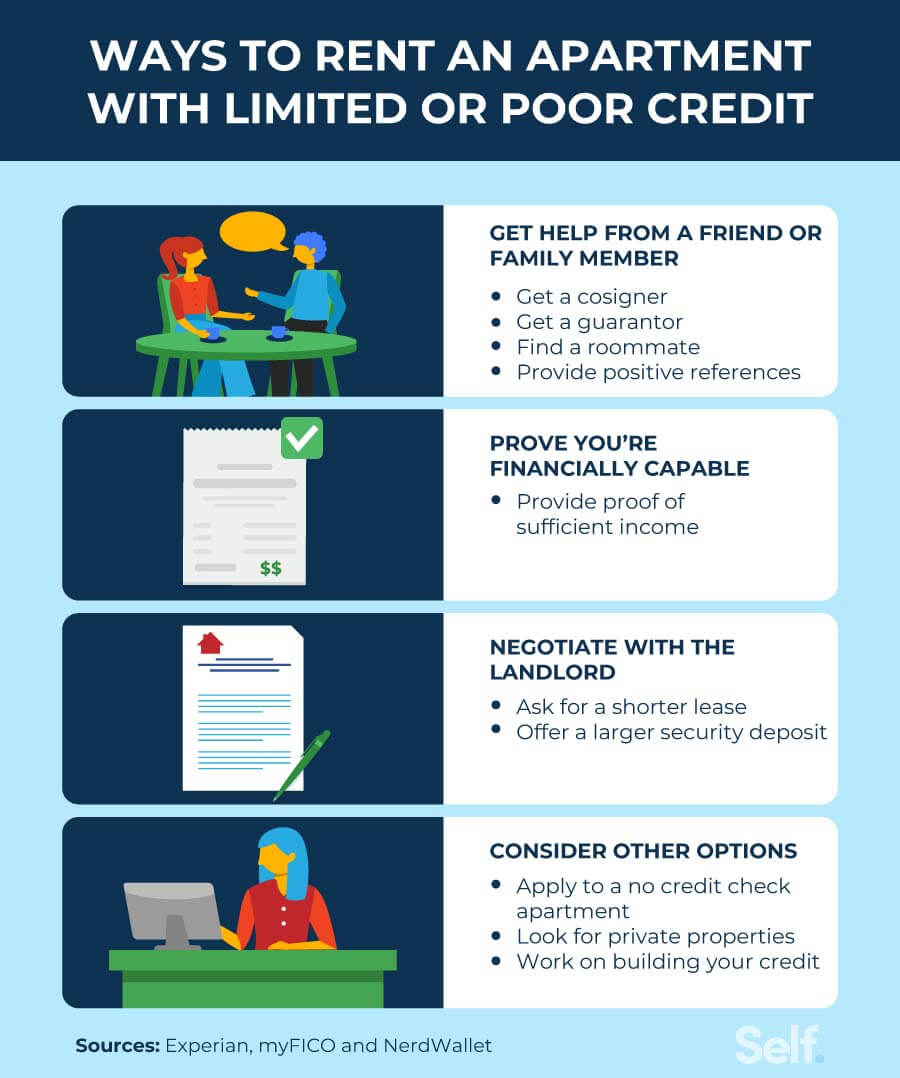

Fortunately, there are alternatives to traditional credit checks that can provide a more comprehensive picture of a potential tenant’s creditworthiness. For example, some landlords and property managers are now using rental history as a way to assess a tenant’s reliability and responsibility. This approach takes into account the tenant’s previous rental experience, including their payment history and any past disputes with landlords.

Another alternative to traditional credit checks is employment verification. This involves verifying a tenant’s employment status and income, to ensure that they have a stable source of income and can afford the rent. This approach can be particularly useful for individuals who are self-employed or have non-traditional income sources.

By considering these alternative approaches, landlords and property managers can gain a more nuanced understanding of a potential tenant’s creditworthiness, and make more informed decisions about who to rent to. This can help to break down the barriers to renting a house, and provide more opportunities for individuals and families who have been previously excluded from the rental market.

One of the most significant benefits of renting a house without a credit check is the increased flexibility it offers. Without the need for a traditional credit check, landlords and property managers can consider a wider range of applicants, including those with bad credit or no credit history. This can help to increase the pool of potential tenants, and provide more opportunities for individuals and families who are looking for a place to call home.

In addition to increased flexibility, renting a house without a credit check can also help to reduce stress and anxiety. For individuals and families who have been previously excluded from the rental market, the prospect of renting a house without a credit check can be a welcome relief. It can provide a sense of hope and opportunity, and help to alleviate the stress and anxiety that can come with trying to find a place to live.

Overall, renting a house without a credit check is a growing trend that offers a range of benefits for both landlords and tenants. By considering alternative approaches to traditional credit checks, landlords and property managers can gain a more nuanced understanding of a potential tenant’s creditworthiness, and make more informed decisions about who to rent to. This can help to break down the barriers to renting a house, and provide more opportunities for individuals and families who have been previously excluded from the rental market.

How to Rent a House with No Credit Check: A Step-by-Step Guide

Renting a house with no credit check can be a challenging task, but it’s not impossible. With the right approach and preparation, individuals and families can find a rental property that meets their needs without the hassle of a credit check. Here’s a step-by-step guide to help you get started:

Step 1: Research and Identify Landlords or Property Managers Who Don’t Require Credit Checks

Start by researching online for landlords or property managers in your desired area who don’t require credit checks. You can use online directories, social media, or local classifieds to find potential leads. Look for keywords like “no credit check rentals” or “rent a house no credit check” to find relevant listings.

Step 2: Prepare Your Rental Application

Once you’ve identified potential landlords or property managers, prepare your rental application. Make sure you have all the necessary documents, including proof of income, employment verification, and rental history. Be prepared to provide additional information, such as a co-signer or a larger security deposit, to offset the risk of not having a credit check.

Step 3: Find a Co-Signer or Guarantor

If you’re having trouble finding a landlord or property manager who doesn’t require a credit check, consider finding a co-signer or guarantor. This can be a friend, family member, or colleague who has good credit and is willing to sign the lease with you. Having a co-signer can provide an added layer of security for the landlord and increase your chances of getting approved.

Step 4: Be Prepared to Pay a Larger Security Deposit

Some landlords or property managers may require a larger security deposit to offset the risk of not having a credit check. Be prepared to pay a larger deposit, which can range from 1-3 months’ rent. This will provide the landlord with added security and increase your chances of getting approved.

Step 5: Negotiate the Terms of the Lease

Once you’ve found a landlord or property manager who is willing to rent to you without a credit check, negotiate the terms of the lease. Make sure you understand the length of the lease, the rent, and any additional fees or charges. Be prepared to negotiate and ask questions to ensure you’re getting a fair deal.

By following these steps, individuals and families can increase their chances of renting a house with no credit check. Remember to stay persistent, be prepared, and negotiate the terms of the lease to ensure you’re getting a fair deal.

Understanding the Alternatives to Traditional Credit Checks

When it comes to renting a house, traditional credit checks have long been the standard practice. However, with the rise of alternative credit scoring models and changing landlord attitudes, there are now several alternatives to traditional credit checks that can be used to evaluate potential tenants.

One of the most common alternatives to traditional credit checks is rental history. This involves verifying a tenant’s previous rental experience, including their payment history and any past disputes with landlords. Rental history can provide valuable insights into a tenant’s reliability and responsibility, and can be used to offset the risk of not having a credit check.

Another alternative to traditional credit checks is employment verification. This involves verifying a tenant’s employment status and income, to ensure that they have a stable source of income and can afford the rent. Employment verification can be particularly useful for individuals who are self-employed or have non-traditional income sources.

Income checks are also becoming increasingly popular as an alternative to traditional credit checks. This involves verifying a tenant’s income to ensure that they can afford the rent, and can be used in conjunction with other alternative credit scoring models.

Some landlords and property managers are also using alternative credit scoring models, such as FICO XD or VantageScore, to evaluate potential tenants. These models take into account non-traditional credit data, such as rent payments and utility bills, to provide a more comprehensive picture of a tenant’s creditworthiness.

While these alternatives to traditional credit checks can provide valuable insights into a tenant’s creditworthiness, they also have their limitations. For example, rental history may not be available for all tenants, and employment verification may not be possible for individuals who are self-employed. Additionally, alternative credit scoring models may not be as widely accepted as traditional credit scores.

Despite these limitations, the use of alternatives to traditional credit checks is becoming increasingly popular among landlords and property managers. By considering these alternatives, landlords and property managers can gain a more nuanced understanding of a potential tenant’s creditworthiness, and make more informed decisions about who to rent to.

In the context of renting a house with no credit check, these alternatives can be particularly useful. By using rental history, employment verification, income checks, or alternative credit scoring models, landlords and property managers can evaluate potential tenants without the need for a traditional credit check.

The Benefits of Renting a House Without a Credit Check

Renting a house without a credit check can be a game-changer for individuals and families who have been struggling to find a place to call home. By bypassing the traditional credit check process, renters can enjoy a range of benefits that can make the rental experience more accessible, flexible, and stress-free.

One of the most significant benefits of renting a house without a credit check is increased flexibility. Without the need for a credit check, renters can explore a wider range of rental options, including properties that may not have been available to them otherwise. This can be especially beneficial for individuals who are self-employed, have non-traditional income sources, or have experienced credit difficulties in the past.

Another benefit of renting a house without a credit check is reduced stress. The traditional credit check process can be a source of anxiety and uncertainty, especially for individuals who are worried about their credit score. By eliminating the need for a credit check, renters can avoid the stress and uncertainty associated with the traditional rental application process.

Renting a house without a credit check can also provide more opportunities for individuals and families who have been previously excluded from the rental market. By considering alternative credit scoring models or rental history, landlords and property managers can evaluate potential tenants in a more holistic way, taking into account factors beyond just credit score.

In addition to these benefits, renting a house without a credit check can also provide a sense of freedom and empowerment. Without the burden of a credit check, renters can focus on finding a place that meets their needs and budget, rather than worrying about their credit score. This can be especially liberating for individuals who have been struggling to find a place to call home due to credit difficulties.

Overall, renting a house without a credit check can be a viable solution for individuals and families who are looking for a more flexible, stress-free, and accessible rental experience. By exploring alternative credit scoring models and rental history, renters can find a place that meets their needs and budget, without the hassle of a traditional credit check.

What to Expect from a No Credit Check Rental Application

When applying for a rental property without a credit check, it’s essential to understand what to expect from the application process. While the process may vary depending on the landlord or property manager, here are some general guidelines to help you prepare:

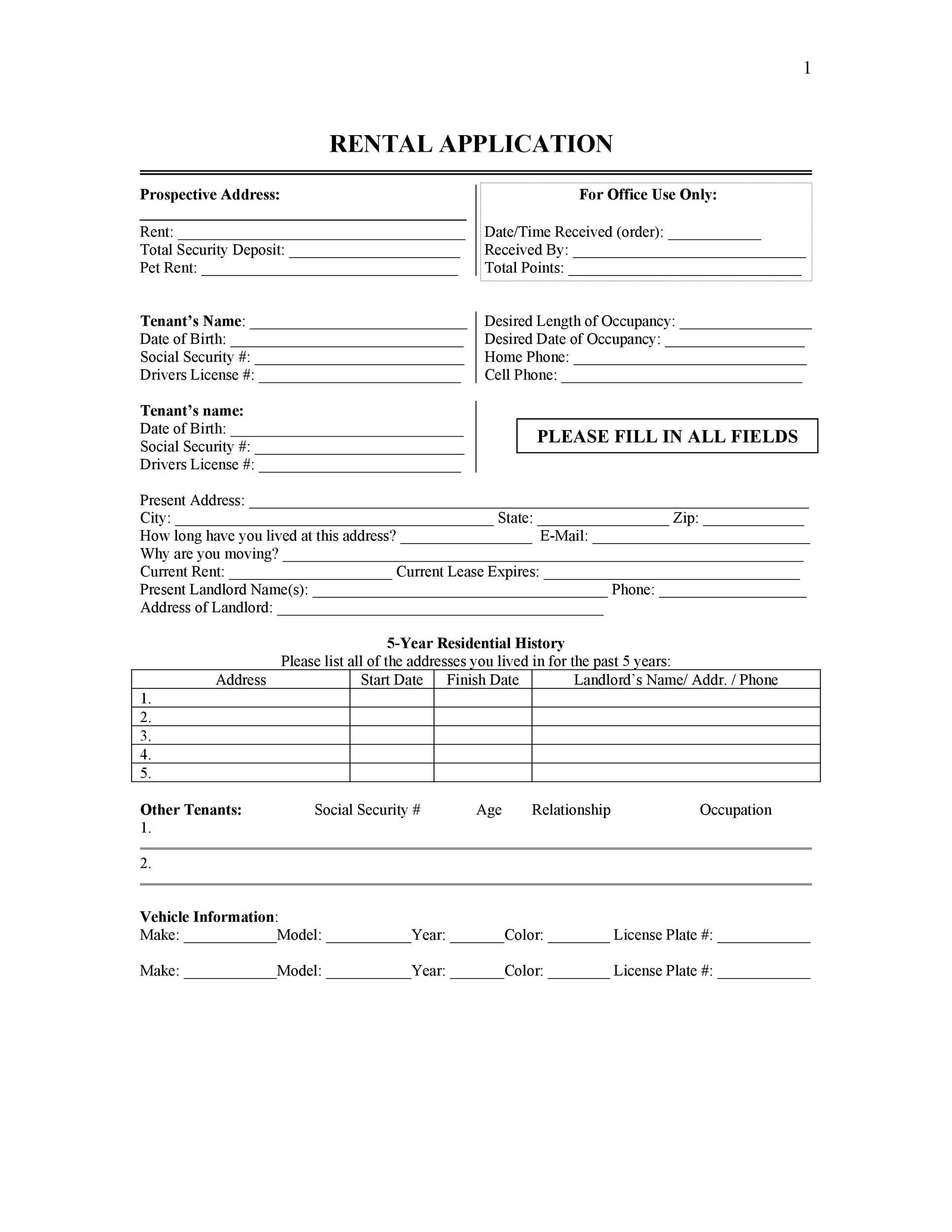

Required Documents:

Typically, you’ll need to provide identification, proof of income, and rental history. You may also be asked to provide additional documentation, such as bank statements or tax returns.

Application Process:

The application process for a no credit check rental typically involves filling out a rental application form, which may be online or in-person. You’ll need to provide the required documents and answer questions about your rental history, employment, and income.

Screening Process:

Instead of a credit check, the landlord or property manager may use alternative screening methods, such as rental history or employment verification. This process may take a few days to a week, depending on the complexity of the application.

Approval Process:

Once your application is approved, you’ll typically be required to sign a lease agreement and pay a security deposit. The lease agreement will outline the terms of the rental, including the rent, length of the lease, and any rules or regulations.

Tips for a Successful Application:

To increase your chances of a successful application, make sure to:

Provide accurate and complete documentation

Be prepared to answer questions about your rental history and employment

Be flexible with your move-in date and lease terms

Consider working with a reputable rental agent or property manager

By understanding what to expect from a no credit check rental application, you can better prepare yourself for the process and increase your chances of finding a rental property that meets your needs.

Top Cities for Renting a House with No Credit Check

While it’s possible to find rentals without credit checks in many cities, some areas are more accommodating than others. Here are some top cities and regions where it’s easier to find rentals without credit checks:

1. Austin, Texas: Known for its vibrant music scene and outdoor recreation opportunities, Austin is a popular destination for renters. Many landlords and property managers in the area offer no credit check rentals, making it easier for individuals with poor or no credit to find a place to call home.

2. Portland, Oregon: Portland is a hub for creatives and entrepreneurs, and its rental market reflects this. Many landlords and property managers in the area offer no credit check rentals, and some even specialize in working with renters who have poor or no credit.

3. Denver, Colorado: Denver is a popular destination for outdoor enthusiasts and young professionals, and its rental market is highly competitive. However, many landlords and property managers in the area offer no credit check rentals, making it easier for individuals with poor or no credit to find a place to call home.

4. Seattle, Washington: Seattle is a hub for tech companies and startups, and its rental market is highly competitive. However, many landlords and property managers in the area offer no credit check rentals, making it easier for individuals with poor or no credit to find a place to call home.

5. Tampa, Florida: Tampa is a popular destination for retirees and families, and its rental market is highly affordable. Many landlords and property managers in the area offer no credit check rentals, making it easier for individuals with poor or no credit to find a place to call home.

Tips for Finding No Credit Check Rentals in These Cities:

1. Work with a reputable rental agent or property manager who specializes in no credit check rentals.

2. Be prepared to provide additional documentation, such as proof of income or employment verification.

3. Be flexible with your move-in date and lease terms.

4. Consider looking for rentals outside of the city center, where prices may be lower and landlords may be more willing to work with renters who have poor or no credit.

By following these tips and knowing where to look, individuals with poor or no credit can find a rental property that meets their needs and budget.

Success Stories: Renting a House with No Credit Check

Renting a house with no credit check can be a challenging and intimidating process, but it’s not impossible. Many individuals and families have successfully rented a house without a credit check, and their stories can serve as inspiration and guidance for others.

Meet Sarah, a single mother who was struggling to find a rental property due to her poor credit history. She had been turned down by several landlords and property managers, and was starting to lose hope. But then she discovered a rental property that offered no credit check rentals. With the help of a reputable rental agent, Sarah was able to secure a beautiful three-bedroom house in a safe and desirable neighborhood.

Another success story is that of John, a young professional who had just moved to a new city for work. He didn’t have a credit history, and was worried that he wouldn’t be able to find a rental property. But then he discovered a property management company that offered no credit check rentals. John was able to secure a stylish one-bedroom apartment in a trendy neighborhood, and was thrilled with the convenience and flexibility of the rental process.

These success stories demonstrate that renting a house with no credit check is possible, and that there are many resources available to help individuals and families achieve their rental goals. By working with reputable rental agents and property managers, and by being prepared and flexible, anyone can find a rental property that meets their needs and budget.

Insights from these success stories include:

1. Be prepared to provide additional documentation, such as proof of income or employment verification.

2. Be flexible with your move-in date and lease terms.

3. Work with a reputable rental agent or property manager who specializes in no credit check rentals.

4. Don’t be discouraged by rejection – keep looking and stay positive.

By following these tips and learning from the experiences of others, individuals and families can successfully rent a house with no credit check and achieve their rental goals.

Conclusion: Finding Your Dream Home Without the Credit Check Hassle

Renting a house without a credit check can be a challenging and intimidating process, but it’s not impossible. By understanding the alternatives to traditional credit checks, the benefits of renting a house without a credit check, and the top cities for renting a house with no credit check, individuals and families can find a rental property that meets their needs and budget.

In this article, we’ve discussed the challenges of renting a house with bad credit or no credit history, and how it can be a major obstacle for many individuals and families. We’ve also provided a comprehensive guide on how to rent a house without a credit check, including tips on finding landlords or property managers who don’t require credit checks, and how to prepare for the application process.

We’ve also highlighted the benefits of renting a house without a credit check, including increased flexibility, reduced stress, and more opportunities for those with poor or no credit history. Additionally, we’ve identified top cities or regions where it’s easier to find rentals without credit checks, and provided tips on how to find these opportunities.

Finally, we’ve shared real-life success stories of individuals or families who have successfully rented a house without a credit check, and provided insights into their experiences. These success stories demonstrate that renting a house with no credit check is possible, and that there are many resources available to help individuals and families achieve their rental goals.

In conclusion, renting a house without a credit check is a viable solution for individuals and families who are struggling to find a rental property due to bad credit or no credit history. By understanding the alternatives to traditional credit checks, the benefits of renting a house without a credit check, and the top cities for renting a house with no credit check, individuals and families can find a rental property that meets their needs and budget.

We encourage readers to explore the possibilities of renting a house without a credit check, and to take advantage of the resources and tips provided in this article. With the right knowledge and preparation, anyone can find a rental property that meets their needs and budget, without the hassle of a credit check.

https://www.youtube.com/watch?v=_TyiMNaCcvc