Why Knowing a Company’s Tax ID is Crucial

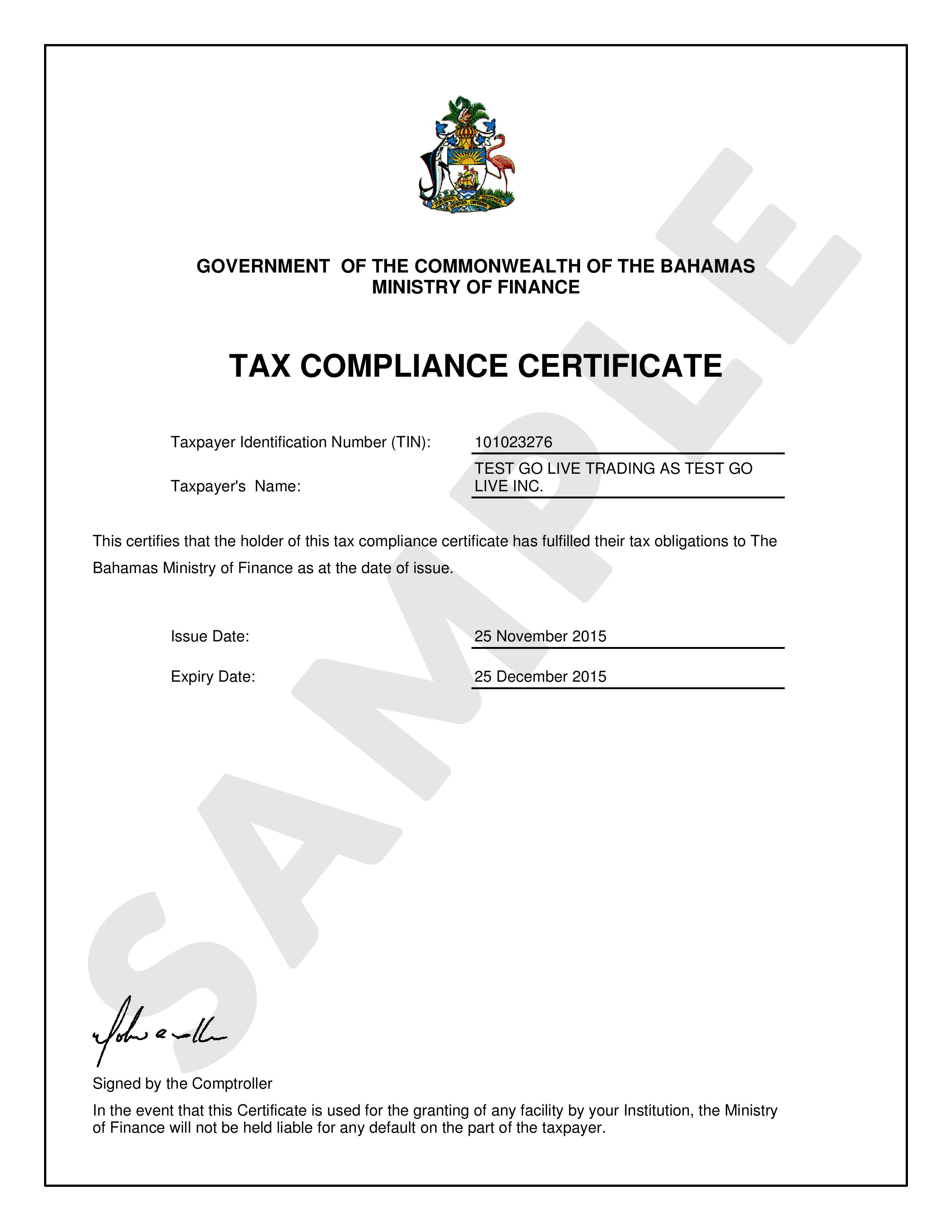

Verifying a company’s legitimacy and ensuring compliance with tax laws are essential for businesses, investors, and government agencies. One crucial step in this process is obtaining a company’s tax ID, also known as an Employer Identification Number (EIN) or Federal Tax Identification Number. This unique identifier is assigned to businesses by the Internal Revenue Service (IRS) and is used to track tax payments, report income, and conduct other financial transactions.

Knowing a company’s tax ID is vital for several reasons. Firstly, it helps to establish the company’s credibility and authenticity, which is essential for building trust with customers, partners, and investors. A legitimate tax ID is a sign of a company’s commitment to transparency and compliance with tax laws. Secondly, a tax ID is required for various business transactions, such as opening a business bank account, applying for credit, or filing tax returns.

In addition, a company’s tax ID is used to check its creditworthiness, which is critical for lenders, suppliers, and other stakeholders. A good credit history can help a company secure loans, negotiate better terms with suppliers, and attract investors. Furthermore, a tax ID is essential for ensuring compliance with tax laws and regulations, which can help companies avoid penalties, fines, and reputational damage.

Given the importance of a company’s tax ID, it is essential to know how to find it. This can be a challenging task, especially for those who are new to the business world. However, with the right guidance and resources, it is possible to obtain a company’s tax ID and use it to verify its legitimacy, check its creditworthiness, and ensure compliance with tax laws.

Understanding the Different Types of Tax IDs

When it comes to finding a company’s tax ID, it’s essential to understand the different types of tax IDs that exist. The most common type of tax ID is the Employer Identification Number (EIN), which is assigned to businesses by the Internal Revenue Service (IRS). An EIN is a unique nine-digit number that is used to identify a business for tax purposes.

In addition to EINs, there are also Federal Tax Identification Numbers, which are used to identify businesses that are required to file federal tax returns. These numbers are typically used by businesses that have employees or are required to pay federal taxes.

Some states also have their own tax IDs, which are used to identify businesses that operate within that state. These tax IDs may be required for state tax purposes, such as filing state tax returns or obtaining a state business license.

It’s worth noting that some businesses may have multiple tax IDs, depending on the type of business they operate and the states in which they do business. For example, a business that operates in multiple states may have a separate tax ID for each state.

When searching for a company’s tax ID, it’s essential to understand the different types of tax IDs that may be used. This can help you to identify the correct tax ID and ensure that you are using the most up-to-date information.

By understanding the different types of tax IDs, you can also better navigate the process of finding a company’s tax ID. This can be a complex process, but with the right knowledge and resources, it can be made much easier.

In the next section, we will discuss public sources where company tax IDs can be found, including the Securities and Exchange Commission (SEC) database and state business registries.

Public Sources for Finding Company Tax IDs

There are several public sources where company tax IDs can be found. One of the most reliable sources is the Securities and Exchange Commission (SEC) database. The SEC database provides access to company tax IDs, as well as other financial information, for publicly traded companies.

Another public source for finding company tax IDs is state business registries. Each state has its own business registry, which provides information on companies that are registered to do business in that state. This information may include the company’s tax ID, as well as other business details such as the company’s name, address, and type of business.

Online directories such as LinkedIn or Crunchbase can also be used to find company tax IDs. These directories provide information on companies, including their tax IDs, as well as other business details such as the company’s products or services, revenue, and employee count.

In addition to these sources, company tax IDs can also be found through other public records and filings, such as tax liens or court documents. These records can provide valuable information on a company’s tax ID, as well as other business details.

When searching for a company’s tax ID through public sources, it’s essential to verify the accuracy of the information. This can be done by cross-checking the information with other sources, such as the company’s website or business registry.

By using public sources to find a company’s tax ID, businesses and individuals can gain valuable insights into a company’s financial health and legitimacy. This information can be used to make informed decisions about business partnerships, investments, and other financial transactions.

In the next section, we will discuss how to use company websites and contact information to find a company’s tax ID.

Using Company Websites and Contact Information

Another way to find a company’s tax ID is to check its website or contact the company directly. Many companies publish their tax ID on their website, usually in the “About Us” or “Investor Relations” section.

To find a company’s tax ID on its website, follow these steps:

1. Go to the company’s website and search for the “About Us” or “Investor Relations” section.

2. Look for a page that lists the company’s tax ID, such as a “Tax ID” or “EIN” page.

3. If you can’t find the tax ID on the website, try searching for the company’s name along with the keywords “tax ID” or “EIN” in a search engine.

If you’re unable to find the company’s tax ID on its website, you can try contacting the company directly to request its tax ID. Here are some tips for contacting the company:

1. Look for the company’s contact information on its website, such as a phone number or email address.

2. Reach out to the company’s customer service or investor relations department and ask for the tax ID.

3. Be prepared to provide your name, company name, and reason for requesting the tax ID.

When contacting the company, be sure to ask for the tax ID specifically, as it may not be readily available. Additionally, be respectful of the company’s time and resources, and only request the tax ID if it is necessary for your business or financial purposes.

By using company websites and contact information, you can often find a company’s tax ID quickly and easily. However, if you’re unable to find the tax ID through these methods, you may need to try other approaches, such as using business credit reporting agencies or searching public records and filings.

Utilizing Business Credit Reporting Agencies

Business credit reporting agencies, such as Dun & Bradstreet or Experian, can provide access to company tax IDs as part of their credit reporting services. These agencies collect and analyze financial data on businesses, including tax IDs, to provide credit scores and reports.

To obtain a company’s tax ID through a business credit reporting agency, you typically need to purchase a credit report or subscribe to their services. The report will include the company’s tax ID, as well as other financial information, such as credit scores, payment history, and public records.

The benefits of using business credit reporting agencies to find a company’s tax ID include:

1. Convenience: Business credit reporting agencies provide a convenient way to access company tax IDs, along with other financial information, in one place.

2. Accuracy: The tax IDs provided by business credit reporting agencies are typically accurate and up-to-date, as they are collected from reliable sources.

3. Comprehensive information: Business credit reporting agencies provide a comprehensive view of a company’s financial health, including tax IDs, credit scores, and payment history.

However, there are also limitations to using business credit reporting agencies to find a company’s tax ID, including:

1. Cost: Purchasing a credit report or subscribing to a business credit reporting agency’s services can be expensive.

2. Limited access: Some business credit reporting agencies may not have access to tax IDs for all companies, particularly smaller or private businesses.

3. Data quality: While business credit reporting agencies strive to provide accurate data, there may be errors or inaccuracies in the tax IDs they provide.

Overall, business credit reporting agencies can be a useful resource for finding company tax IDs, but it’s essential to weigh the benefits and limitations before using their services.

Searching Public Records and Filings

Another way to find a company’s tax ID is to search public records and filings. This can include searching for tax liens, court documents, and other public records that may contain the company’s tax ID.

To search public records and filings, you can start by visiting the website of the county or state where the company is located. Many counties and states have online databases that allow you to search for public records, including tax liens and court documents.

Some common types of public records that may contain a company’s tax ID include:

1. Tax liens: A tax lien is a public record that is filed by the government when a company owes back taxes. The tax lien will typically include the company’s tax ID.

2. Court documents: Court documents, such as lawsuits and judgments, may also contain a company’s tax ID.

3. Business licenses: Business licenses and permits may also contain a company’s tax ID.

To search for these records, you can use online databases such as the county or state’s website, or you can visit the county or state’s office in person. You can also use third-party services that specialize in providing access to public records.

When searching public records and filings, it’s essential to be aware of the potential limitations and challenges. For example:

1. Limited access: Some public records may not be available online or may require a fee to access.

2. Inaccurate information: Public records may contain inaccurate or outdated information.

3. Time-consuming: Searching public records and filings can be a time-consuming process.

Despite these challenges, searching public records and filings can be a useful way to find a company’s tax ID. By using online databases and third-party services, you can quickly and easily search for public records that may contain the company’s tax ID.

Red Flags to Watch Out for When Searching for Company Tax IDs

When searching for a company’s tax ID, it’s essential to be aware of potential red flags that may indicate a fake or altered tax ID. Here are some common red flags to watch out for:

1. Inconsistent or missing information: If the tax ID is missing or inconsistent across different sources, it may be a sign of a fake or altered tax ID.

2. Unusual or suspicious activity: If the company’s tax ID is associated with unusual or suspicious activity, such as multiple tax liens or court documents, it may be a sign of a fake or altered tax ID.

3. Lack of transparency: If the company is not transparent about its tax ID or financial information, it may be a sign of a fake or altered tax ID.

4. Unverifiable information: If the tax ID is not verifiable through public records or other sources, it may be a sign of a fake or altered tax ID.

To verify the authenticity of a tax ID, you can use the following methods:

1. Check with the IRS: The IRS can verify the authenticity of a tax ID and provide information on the company’s tax status.

2. Use public records: Public records, such as tax liens and court documents, can provide information on the company’s tax ID and financial activity.

3. Contact the company: Contacting the company directly can provide information on the company’s tax ID and financial information.

4. Use third-party services: Third-party services, such as business credit reporting agencies, can provide information on the company’s tax ID and financial activity.

By being aware of these red flags and using these methods to verify the authenticity of a tax ID, you can ensure that you are working with a legitimate company and avoid potential risks.

Best Practices for Storing and Using Company Tax IDs

Once you have obtained a company’s tax ID, it’s essential to store and use it securely and responsibly. Here are some best practices to follow:

1. Store tax IDs securely: Store tax IDs in a secure location, such as a locked cabinet or a password-protected digital file.

2. Limit access: Limit access to tax IDs to authorized personnel only.

3. Use tax IDs responsibly: Use tax IDs only for legitimate business purposes, such as verifying a company’s identity or checking its creditworthiness.

4. Comply with regulations: Comply with relevant regulations, such as the Gramm-Leach-Bliley Act (GLBA) and the Fair Credit Reporting Act (FCRA), when storing and using tax IDs.

5. Protect data: Protect tax ID data from unauthorized access, theft, or destruction.

6. Dispose of tax IDs properly: Dispose of tax IDs properly, such as by shredding or deleting them, when they are no longer needed.

By following these best practices, you can ensure that you are storing and using company tax IDs securely and responsibly.

In addition to these best practices, it’s also essential to be aware of the potential risks associated with storing and using tax IDs. These risks include:

1. Identity theft: Tax IDs can be used to commit identity theft, so it’s essential to protect them from unauthorized access.

2. Data breaches: Tax ID data can be compromised in the event of a data breach, so it’s essential to have measures in place to protect against this risk.

3. Non-compliance: Failing to comply with relevant regulations when storing and using tax IDs can result in fines and penalties.

By being aware of these risks and following best practices, you can minimize the risks associated with storing and using company tax IDs.