Why Small Businesses Need Specialized Accounting Tools

Small businesses face unique financial challenges that can make it difficult to manage their finances effectively. Limited resources, cash flow management, and regulatory compliance are just a few of the obstacles that small business owners must navigate on a daily basis. To overcome these challenges, small businesses need specialized accounting tools that can help them streamline their financial operations and make informed decisions.

One of the main reasons small businesses need specialized accounting software is to manage their cash flow effectively. Cash flow is the lifeblood of any business, and small businesses are no exception. However, managing cash flow can be a complex task, especially for businesses with limited resources. Specialized accounting software can help small businesses track their income and expenses, identify areas where they can cut costs, and make informed decisions about investments and funding.

Another reason small businesses need specialized accounting tools is to ensure regulatory compliance. Small businesses must comply with a range of regulations, including tax laws, employment laws, and financial reporting requirements. Specialized accounting software can help small businesses stay on top of these regulations, reducing the risk of fines, penalties, and reputational damage.

In addition to managing cash flow and ensuring regulatory compliance, specialized accounting software can also help small businesses make informed decisions about their financial operations. By providing real-time financial data and analytics, specialized accounting software can help small businesses identify areas where they can improve their financial performance, optimize their operations, and drive growth.

Small accounting software for small business is designed to meet the unique needs of small businesses. These solutions are typically cloud-based, scalable, and easy to use, making them accessible to businesses of all sizes. They also offer a range of features, including invoicing, expense tracking, financial reporting, and budgeting, that can help small businesses manage their finances effectively.

By using specialized accounting software, small businesses can overcome the financial challenges they face and achieve their goals. Whether it’s managing cash flow, ensuring regulatory compliance, or making informed decisions, specialized accounting software can help small businesses succeed in a competitive market.

Key Features to Look for in Small Business Accounting Software

Key Features to Look for in Small Business Accounting Software

When selecting accounting software for a small business, it’s essential to consider the features that will help streamline financial operations and drive growth. Small accounting software for small business should offer a range of features that cater to the unique needs of small businesses. Here are some key features to look for:

Invoicing and billing are critical components of any accounting software. Look for a solution that allows you to create professional-looking invoices, track payments, and send reminders to clients. This feature can help small businesses get paid faster and reduce the risk of late payments.

Expense tracking is another essential feature of accounting software. This feature allows small businesses to track expenses, categorize them, and generate reports. This can help small businesses identify areas where they can cut costs and optimize their financial operations.

Financial reporting is a critical feature of accounting software. Look for a solution that offers real-time financial reporting, including balance sheets, income statements, and cash flow statements. This feature can help small businesses make informed decisions about their financial operations and drive growth.

Scalability is also an essential feature of accounting software. As small businesses grow, their accounting needs change. Look for a solution that can scale with your business, offering additional features and functionality as needed.

Other key features to consider include payroll management, inventory management, and project management. These features can help small businesses streamline their operations, reduce costs, and drive growth.

When evaluating accounting software, consider the following questions: Does the software offer the features I

https://www.youtube.com/watch?v=X_UtrxhHqGw

How to Choose the Best Accounting Software for Your Small Business

Choosing the right accounting software for your small business can be a daunting task. With so many options available, it’s essential to take a step-by-step approach to ensure you select the best software for your business needs. Here’s a step-by-step guide to help you choose the right accounting software for your small business:

Step 1: Assess Your Business Needs

Before selecting accounting software, it’s essential to assess your business needs. Consider the size of your business, the number of employees, and the type of industry you’re in. This will help you determine the features and functionality you need in an accounting software.

Step 2: Evaluate Software Options

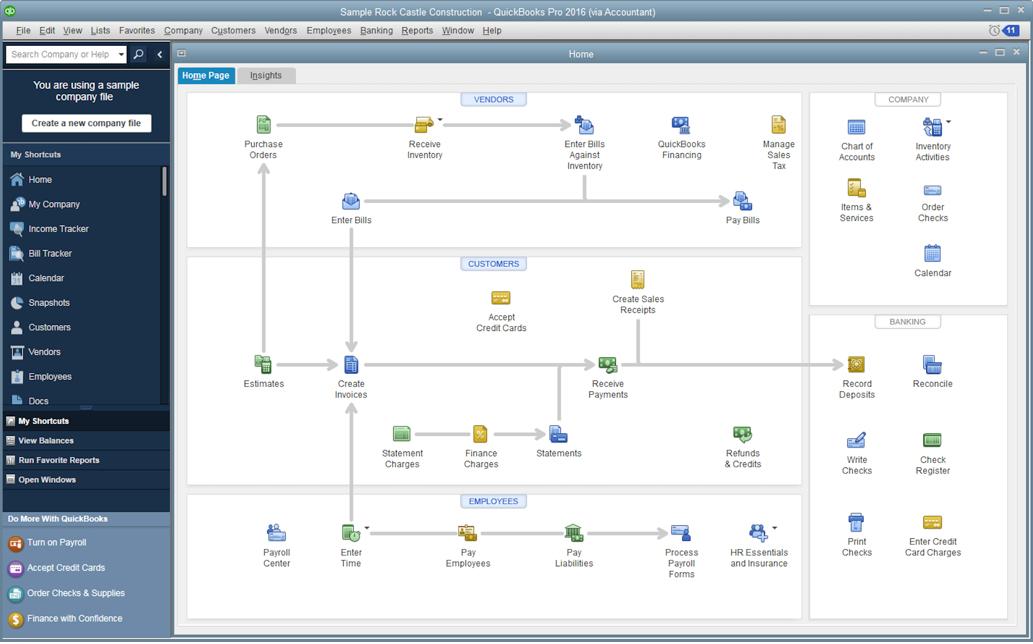

Once you’ve assessed your business needs, it’s time to evaluate software options. Research different accounting software solutions, such as QuickBooks, Xero, and Zoho Books. Compare their features, pricing, and user reviews to determine which software best meets your business needs.

Step 3: Read Reviews from Other Users

Reading reviews from other users can provide valuable insights into the pros and cons of different accounting software solutions. Look for reviews from businesses similar to yours to get a better understanding of how the software will meet your specific needs.

Step 4: Consider Scalability and Integration

As your business grows, your accounting software needs to grow with it. Consider scalability and integration when selecting accounting software. Look for software that can integrate with other business applications, such as payment gateways and e-commerce platforms.

Step 5: Evaluate Customer Support

Customer support is essential when selecting accounting software. Look for software providers that offer excellent customer support, including online resources, phone support, and email support.

By following these steps, you can ensure you select the best accounting software for your small business. Remember to consider your business needs, evaluate software options, read reviews from other users, consider scalability and integration, and evaluate customer support.

Cloud-Based Accounting Software: Is it Right for Your Small Business?

Cloud-based accounting software has become increasingly popular among small businesses in recent years. This type of software offers a range of benefits, including accessibility, security, and collaboration. But is cloud-based accounting software right for your small business?

Benefits of Cloud-Based Accounting Software

Cloud-based accounting software offers several benefits for small businesses. One of the main advantages is accessibility. With cloud-based software, you can access your financial data from anywhere, at any time, as long as you have an internet connection. This makes it easy to manage your finances on-the-go, and to collaborate with your accountant or bookkeeper.

Another benefit of cloud-based accounting software is security. Cloud-based software providers typically have robust security measures in place to protect your financial data, including encryption, firewalls, and backup systems. This can give you peace of mind, knowing that your financial data is safe and secure.

Collaboration is another key benefit of cloud-based accounting software. With cloud-based software, you can invite your accountant or bookkeeper to access your financial data, making it easy to collaborate and get advice on your financial management.

Drawbacks of Cloud-Based Accounting Software

While cloud-based accounting software offers several benefits, there are also some drawbacks to consider. One of the main disadvantages is the reliance on internet connectivity. If your internet connection is slow or unreliable, you may experience difficulties accessing your financial data or performing tasks.

Another drawback of cloud-based accounting software is the potential for data breaches. While cloud-based software providers typically have robust security measures in place, there is still a risk of data breaches or cyber attacks.

Examples of Cloud-Based Accounting Software

There are several examples of cloud-based accounting software that are popular among small businesses. Some of the most well-known options include QuickBooks Online, Xero, and Zoho Books. These software solutions offer a range of features, including invoicing, expense tracking, and financial reporting, and are designed to be user-friendly and accessible.

Is Cloud-Based Accounting Software Right for Your Small Business?

Whether or not cloud-based accounting software is right for your small business depends on your specific needs and requirements. If you need to access your financial data on-the-go, or collaborate with your accountant or bookkeeper, cloud-based software may be a good option. However, if you have concerns about security or internet connectivity, you may want to consider alternative options.

Ultimately, the decision to use cloud-based accounting software will depend on your individual circumstances and needs. By weighing the benefits and drawbacks, and considering your options carefully, you can make an informed decision that is right for your small business.

Mobile Accounting Apps: Managing Your Finances on-the-Go

Mobile accounting apps have revolutionized the way small businesses manage their finances. With the ability to access financial data and perform tasks on-the-go, mobile accounting apps have become an essential tool for small business owners. In this article, we will explore the features and benefits of mobile accounting apps for small businesses.

Features of Mobile Accounting Apps

Mobile accounting apps offer a range of features that allow small businesses to manage their finances on-the-go. Some of the most common features include:

Invoicing: Mobile accounting apps allow small businesses to create and send invoices to clients directly from their mobile device.

Expense tracking: Mobile accounting apps enable small businesses to track expenses and categorize them for easy reporting.

Financial reporting: Mobile accounting apps provide real-time financial reporting, allowing small businesses to make informed decisions about their financial operations.

Benefits of Mobile Accounting Apps

Mobile accounting apps offer several benefits for small businesses, including:

Increased productivity: Mobile accounting apps allow small businesses to manage their finances on-the-go, increasing productivity and reducing the need for manual data entry.

Improved accuracy: Mobile accounting apps reduce the risk of human error, ensuring that financial data is accurate and up-to-date.

Enhanced collaboration: Mobile accounting apps enable small businesses to collaborate with their accountant or bookkeeper in real-time, improving communication and reducing the risk of errors.

Examples of Mobile Accounting Apps

There are several mobile accounting apps available for small businesses, including:

QuickBooks Mobile: QuickBooks Mobile is a popular mobile accounting app that allows small businesses to manage their finances on-the-go.

Xero Mobile: Xero Mobile is another popular mobile accounting app that offers a range of features, including invoicing, expense tracking, and financial reporting.

Zoho Books Mobile: Zoho Books Mobile is a cloud-based mobile accounting app that offers a range of features, including invoicing, expense tracking, and financial reporting.

Conclusion

Mobile accounting apps have become an essential tool for small businesses, offering a range of features and benefits that improve productivity, accuracy, and collaboration. By choosing the right mobile accounting app, small businesses can streamline their financial operations and make informed decisions about their financial operations.

Implementation and Integration: Getting the Most Out of Your Accounting Software

Once you’ve selected the right accounting software for your small business, it’s essential to implement and integrate it into your operations effectively. This will help you get the most out of your software and ensure that it meets your business needs. In this article, we’ll provide tips and best practices on how to implement and integrate accounting software into small business operations.

Data Migration

One of the first steps in implementing accounting software is to migrate your existing financial data into the new system. This can be a time-consuming process, but it’s essential to ensure that your data is accurate and up-to-date. Consider hiring a professional to help with data migration, especially if you have a large amount of data to transfer.

User Training

Once your data is migrated, it’s essential to train your staff on how to use the new accounting software. This will help ensure that they understand how to use the software effectively and can take advantage of its features. Consider providing ongoing training and support to ensure that your staff is comfortable using the software.

Customization

Most accounting software solutions offer customization options that allow you to tailor the software to your business needs. Consider customizing your software to meet your specific requirements, such as creating custom reports or workflows.

Integration with Other Systems

Many small businesses use multiple software systems to manage their operations. Consider integrating your accounting software with other systems, such as your customer relationship management (CRM) system or your e-commerce platform. This will help streamline your operations and ensure that your data is accurate and up-to-date.

Best Practices for Implementation and Integration

Here are some best practices to keep in mind when implementing and integrating accounting software into your small business operations:

Plan carefully: Before implementing accounting software, take the time to plan carefully and consider your business needs.

Test thoroughly: Test your accounting software thoroughly before going live to ensure that it meets your business needs.

Provide ongoing training and support: Provide ongoing training and support to your staff to ensure that they understand how to use the software effectively.

Monitor and evaluate: Monitor and evaluate your accounting software regularly to ensure that it’s meeting your business needs and identify areas for improvement.

By following these tips and best practices, you can ensure that your accounting software is implemented and integrated effectively into your small business operations. This will help you get the most out of your software and ensure that it meets your business needs.

Maximizing Your Return on Investment: Tips for Getting the Most Out of Your Accounting Software

Investing in accounting software can be a significant expense for small businesses. However, with the right strategies, you can maximize your return on investment and get the most out of your accounting software. In this article, we’ll provide tips and advice on how to maximize your return on investment in accounting software.

Automate Tasks

One of the best ways to maximize your return on investment in accounting software is to automate tasks. Automation can help reduce manual errors, increase efficiency, and free up staff to focus on more strategic tasks. Consider automating tasks such as invoicing, expense tracking, and financial reporting.

Streamline Processes

Streamlining processes is another way to maximize your return on investment in accounting software. Consider streamlining processes such as accounts payable, accounts receivable, and payroll. This can help reduce manual errors, increase efficiency, and improve cash flow.

Leverage Analytics and Insights

Leveraging analytics and insights is a key way to maximize your return on investment in accounting software. Consider using analytics and insights to identify trends, opportunities, and challenges in your business. This can help you make informed decisions, improve cash flow, and increase profitability.

Best Practices for Maximizing Return on Investment

Here are some best practices for maximizing return on investment in accounting software:

Implement a comprehensive training program: Ensure that all staff members are properly trained on the accounting software to maximize its potential.

Monitor and evaluate performance: Regularly monitor and evaluate the performance of your accounting software to identify areas for improvement.

Customize the software: Customize the accounting software to meet the specific needs of your business.

Integrate with other systems: Integrate the accounting software with other systems, such as CRM or ERP, to maximize its potential.

By following these tips and best practices, you can maximize your return on investment in accounting software and get the most out of your investment. Remember to automate tasks, streamline processes, and leverage analytics and insights to improve your business operations and increase profitability.