Understanding the Importance of Roth IRA Income Limits

When it comes to planning for retirement, understanding the rules and regulations surrounding Roth Individual Retirement Accounts (IRAs) is crucial. One of the most critical aspects of Roth IRAs is the income limits, which determine eligibility for contributions. In 2024, the Roth IRA salary limits will play a significant role in determining who can contribute to these accounts and how much they can contribute.

The benefits of Roth IRAs are well-documented, including tax-free growth and withdrawals, flexibility in retirement, and the potential for increased wealth. However, to take advantage of these benefits, individuals must first understand the income limits that govern Roth IRA contributions. The 2024 Roth IRA income limits will be a critical factor in determining eligibility, and it’s essential to understand how these limits work.

In general, Roth IRA income limits are based on Modified Adjusted Gross Income (MAGI), which includes income from various sources, such as wages, salaries, and investments. The MAGI calculation is used to determine eligibility for Roth IRA contributions, and it’s essential to understand how to calculate MAGI to ensure accurate eligibility determination.

For the 2024 tax year, the Roth IRA income limits will be adjusted for inflation, and it’s expected that the phase-out ranges for single and joint filers will be increased. Understanding these limits and how they impact eligibility is critical for individuals who want to contribute to a Roth IRA.

In addition to understanding the income limits, it’s also essential to consider the benefits of Roth IRAs, including tax-free growth and withdrawals. By contributing to a Roth IRA, individuals can create a tax-free source of income in retirement, which can be a valuable asset in retirement planning.

Overall, understanding the Roth IRA income limits for 2024 is critical for individuals who want to contribute to these accounts. By understanding the rules and regulations surrounding Roth IRAs, individuals can make informed decisions about their retirement planning and create a more secure financial future.

Roth IRA Income Limits for 2024: What You Need to Know

The Roth IRA income limits for 2024 are an essential consideration for individuals who want to contribute to these accounts. The income limits determine eligibility for contributions, and understanding how they work is crucial for maximizing retirement savings. In 2024, the Roth IRA salary limits will be adjusted for inflation, and the phase-out ranges for single and joint filers will be increased.

For single filers, the 2024 Roth IRA income limits will be as follows: individuals with a Modified Adjusted Gross Income (MAGI) below $129,000 will be eligible to contribute the full amount, while those with a MAGI between $129,000 and $153,999 will be eligible for a reduced contribution. Single filers with a MAGI above $153,999 will not be eligible to contribute to a Roth IRA.

For joint filers, the 2024 Roth IRA income limits will be as follows: couples with a MAGI below $204,000 will be eligible to contribute the full amount, while those with a MAGI between $204,000 and $213,999 will be eligible for a reduced contribution. Joint filers with a MAGI above $213,999 will not be eligible to contribute to a Roth IRA.

It’s essential to note that these income limits apply to the tax year 2024, and the limits may be adjusted for inflation in future years. Additionally, the income limits may vary depending on the individual’s filing status and the number of dependents they claim.

Understanding the Roth IRA income limits for 2024 is critical for individuals who want to contribute to these accounts. By knowing the phase-out ranges and the eligibility requirements, individuals can plan their retirement savings strategy and maximize their contributions. It’s also important to consider the long-term benefits of Roth IRA contributions, including tax-free growth and withdrawals, flexibility in retirement, and the potential for increased wealth.

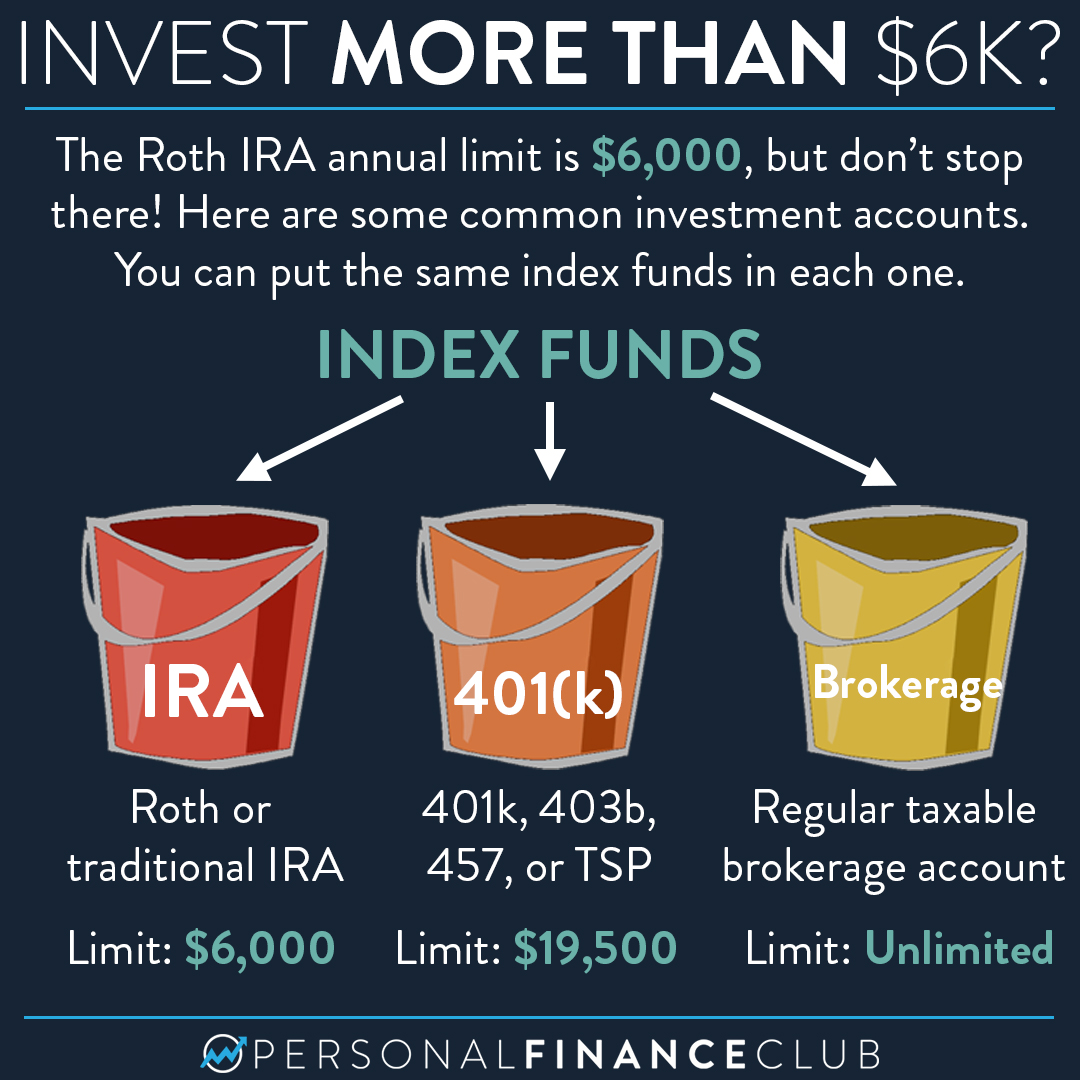

In addition to understanding the income limits, it’s also essential to consider the contribution limits for 2024. The annual contribution limit for Roth IRAs will be $6,500 in 2024, and individuals 50 and older will be eligible for an additional $1,000 catch-up contribution. By contributing the maximum amount allowed, individuals can maximize their retirement savings and achieve their long-term financial goals.

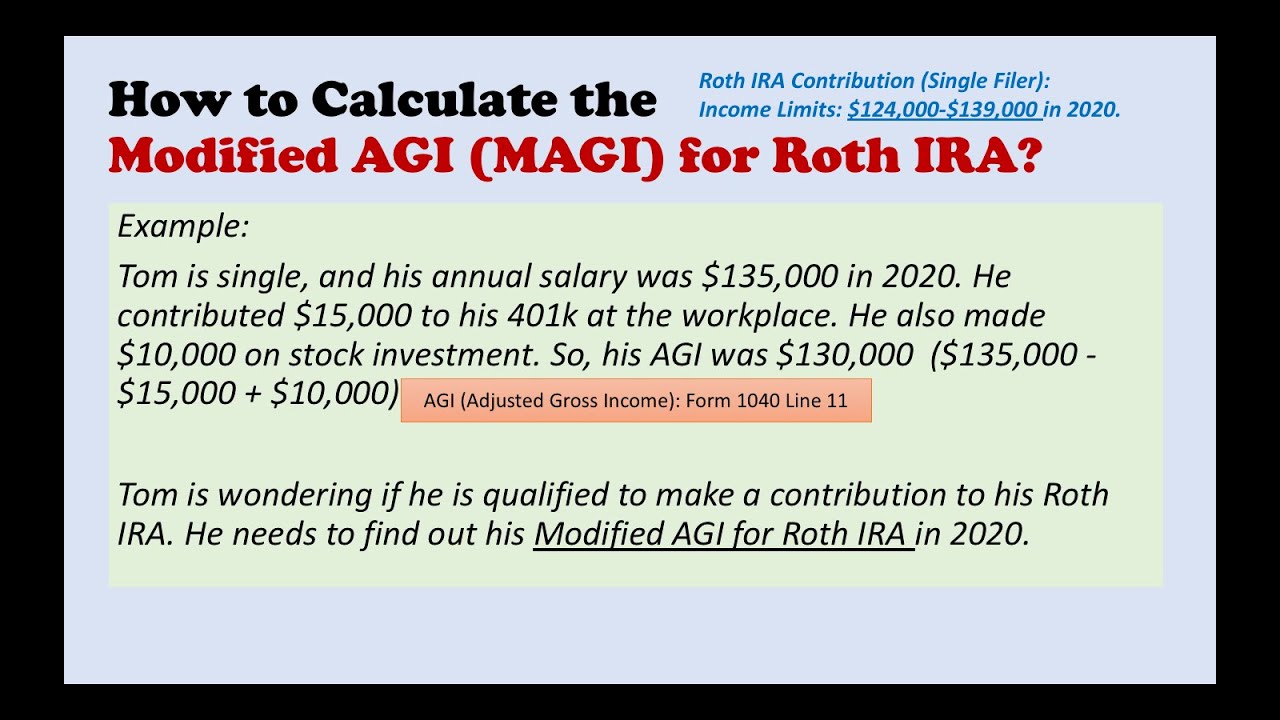

Calculating Your Modified Adjusted Gross Income (MAGI) for Roth IRA Eligibility

To determine your eligibility for Roth IRA contributions, you need to calculate your Modified Adjusted Gross Income (MAGI). MAGI is a critical component in determining your eligibility for Roth IRA contributions, and it’s essential to understand how to calculate it accurately.

MAGI is calculated by starting with your Adjusted Gross Income (AGI) and then adding back certain deductions and exclusions. The following types of income are included in MAGI:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Rental income and expenses

- Business income and expenses

- Alimony received

The following types of income are excluded from MAGI:

- Tax-free interest and dividends

- Capital gains from the sale of a primary residence

- Foreign earned income exclusions

To calculate your MAGI, follow these steps:

- Start with your AGI from your tax return

- Add back any deductions or exclusions that are not included in AGI, such as student loan interest or tuition and fees

- Subtract any income that is excluded from MAGI, such as tax-free interest and dividends

- Calculate your total MAGI by adding up all the included income and subtracting any excluded income

For example, let’s say your AGI is $100,000, and you have $10,000 in tax-free interest and dividends. You would subtract the $10,000 from your AGI to get a MAGI of $90,000.

Understanding how to calculate your MAGI is essential for determining your eligibility for Roth IRA contributions. By accurately calculating your MAGI, you can ensure that you are eligible to contribute to a Roth IRA and take advantage of the tax-free growth and withdrawals that these accounts offer.

In addition to calculating your MAGI, it’s also essential to understand the Roth IRA income limits for 2024. The income limits determine eligibility for contributions, and understanding how they work is crucial for maximizing your retirement savings.

Roth IRA Contribution Limits and Phase-Out Ranges for 2024

The Roth IRA contribution limits for 2024 are an essential consideration for individuals who want to maximize their retirement savings. The annual contribution limit for Roth IRAs in 2024 is $6,500, and individuals 50 and older are eligible for an additional $1,000 catch-up contribution.

In addition to the annual contribution limit, there are also phase-out ranges for single and joint filers. The phase-out ranges determine the amount that can be contributed to a Roth IRA based on the individual’s Modified Adjusted Gross Income (MAGI). For single filers, the phase-out range is $129,000 to $153,999, and for joint filers, the phase-out range is $204,000 to $213,999.

It’s essential to understand how the phase-out ranges work and how they impact the amount that can be contributed to a Roth IRA. For example, if a single filer has a MAGI of $140,000, they may be eligible to contribute a reduced amount to a Roth IRA. However, if their MAGI is above $153,999, they may not be eligible to contribute to a Roth IRA at all.

The following table outlines the Roth IRA contribution limits and phase-out ranges for 2024:

| Filing Status | Annual Contribution Limit | Phase-Out Range |

|---|---|---|

| Single | $6,500 | $129,000 – $153,999 |

| Joint | $6,500 | $204,000 – $213,999 |

| 50 and older | $7,500 | N/A |

Understanding the Roth IRA contribution limits and phase-out ranges for 2024 is crucial for maximizing retirement savings. By contributing the maximum amount allowed and taking advantage of catch-up contributions, individuals can create a tax-free source of income in retirement and achieve their long-term financial goals.

In addition to understanding the contribution limits and phase-out ranges, it’s also essential to consider the long-term benefits of Roth IRA contributions. Roth IRAs offer tax-free growth and withdrawals, flexibility in retirement, and the potential for increased wealth. By maximizing Roth IRA contributions, individuals can create a secure financial future and achieve their retirement goals.

Strategies for Maximizing Your Roth IRA Contributions

Maximizing your Roth IRA contributions requires a strategic approach. By contributing early in the year, taking advantage of catch-up contributions, and considering a Roth IRA conversion, you can make the most of your retirement savings.

Contributing early in the year is a great way to maximize your Roth IRA contributions. By contributing as soon as possible, you can take advantage of the entire year’s worth of compound interest. This can add up to a significant amount over time, especially if you start contributing early in your career.

Catch-up contributions are another way to maximize your Roth IRA contributions. If you are 50 or older, you can contribute an additional $1,000 to your Roth IRA each year. This can be a great way to boost your retirement savings, especially if you are nearing retirement age.

Considering a Roth IRA conversion is also a great way to maximize your Roth IRA contributions. If you have a traditional IRA or 401(k), you can convert it to a Roth IRA. This can provide tax-free growth and withdrawals in retirement, which can be a great way to maximize your retirement income.

Other strategies for maximizing your Roth IRA contributions include:

- Automating your contributions to make saving easier and less prone to being neglected

- Considering a Roth IRA contribution as part of your overall financial plan

- Reviewing and adjusting your contribution amount regularly to ensure you are maximizing your contributions

- Taking advantage of employer matching contributions, if available

By implementing these strategies, you can maximize your Roth IRA contributions and make the most of your retirement savings. Remember to always consider your individual financial situation and goals when making decisions about your Roth IRA contributions.

In addition to these strategies, it’s also important to understand the Roth IRA salary limits for 2024. The income limits determine eligibility for contributions, and understanding how they work is crucial for maximizing your retirement savings.

By combining these strategies with a solid understanding of the Roth IRA salary limits for 2024, you can create a comprehensive plan for maximizing your retirement savings and achieving your long-term financial goals.

Common Mistakes to Avoid When Contributing to a Roth IRA

When contributing to a Roth IRA, it’s essential to avoid common mistakes that can impact your retirement savings. By understanding these mistakes, you can ensure that you’re making the most of your Roth IRA contributions and achieving your long-term financial goals.

Exceeding the income limits is one of the most common mistakes to avoid when contributing to a Roth IRA. The Roth IRA salary limits for 2024 determine eligibility for contributions, and exceeding these limits can result in penalties and fines. It’s essential to understand the income limits and ensure that you’re eligible to contribute to a Roth IRA.

Contributing too much is another mistake to avoid. The annual contribution limit for Roth IRAs is $6,500 in 2024, and contributing more than this amount can result in penalties and fines. It’s essential to ensure that you’re not contributing too much to your Roth IRA and to adjust your contributions accordingly.

Failing to report contributions on tax returns is also a common mistake to avoid. When contributing to a Roth IRA, it’s essential to report your contributions on your tax return to ensure that you’re taking advantage of the tax-free growth and withdrawals. Failing to report contributions can result in penalties and fines, so it’s essential to ensure that you’re reporting your contributions accurately.

Other common mistakes to avoid when contributing to a Roth IRA include:

- Not considering the impact of Roth IRA contributions on your overall financial plan

- Not reviewing and adjusting your contribution amount regularly

- Not taking advantage of employer matching contributions, if available

- Not considering the fees associated with your Roth IRA investments

By avoiding these common mistakes, you can ensure that you’re making the most of your Roth IRA contributions and achieving your long-term financial goals. Remember to always consider your individual financial situation and goals when making decisions about your Roth IRA contributions.

In addition to avoiding these mistakes, it’s also essential to understand the Roth IRA income limits for 2024 and how they impact your eligibility for contributions. By understanding these limits and avoiding common mistakes, you can create a comprehensive plan for maximizing your retirement savings and achieving your long-term financial goals.

Choosing the Right Investments for Your Roth IRA

When it comes to investing in a Roth IRA, it’s essential to choose the right investments to maximize your returns. With so many investment options available, it can be overwhelming to decide which ones to choose. In this article, we’ll provide guidance on how to choose the right investments for your Roth IRA, including considering risk tolerance, investment goals, and fees.

Risk tolerance is a critical factor to consider when choosing investments for your Roth IRA. If you’re conservative and risk-averse, you may want to consider investing in more stable assets such as bonds or money market funds. On the other hand, if you’re more aggressive and willing to take on more risk, you may want to consider investing in stocks or real estate.

Investment goals are also an essential factor to consider when choosing investments for your Roth IRA. Are you looking for long-term growth, or are you looking for income generation? Different investments are better suited for different goals, so it’s essential to consider what you’re trying to achieve with your Roth IRA.

Fees are another critical factor to consider when choosing investments for your Roth IRA. Some investments, such as mutual funds or exchange-traded funds (ETFs), come with fees that can eat into your returns. It’s essential to consider the fees associated with each investment and choose the ones with the lowest fees.

Popular investment options for Roth IRAs include:

- Index funds: These funds track a specific market index, such as the S&P 500, and provide broad diversification and low fees.

- ETFs: These funds are similar to index funds but trade on an exchange like stocks, providing flexibility and low fees.

- Dividend-paying stocks: These stocks provide a regular income stream and can be a good option for those looking for income generation.

- Real estate investment trusts (REITs): These investments provide exposure to real estate and can be a good option for those looking for diversification.

When choosing investments for your Roth IRA, it’s essential to consider your individual financial situation and goals. By considering risk tolerance, investment goals, and fees, you can choose the right investments to maximize your returns and achieve your long-term financial goals.

In addition to choosing the right investments, it’s also essential to understand the Roth IRA salary limits for 2024 and how they impact your eligibility for contributions. By understanding these limits and choosing the right investments, you can create a comprehensive plan for maximizing your retirement savings and achieving your long-term financial goals.

Long-Term Benefits of Roth IRA Contributions

Roth IRA contributions offer a range of long-term benefits that can help individuals achieve their retirement goals. One of the most significant benefits is tax-free growth and withdrawals. With a Roth IRA, contributions are made with after-tax dollars, and the funds grow tax-free over time. In retirement, withdrawals are tax-free, providing a source of income that is not subject to taxes.

Another benefit of Roth IRA contributions is flexibility in retirement. With a Roth IRA, individuals can withdraw contributions (not earnings) at any time tax-free and penalty-free. This provides flexibility in retirement, allowing individuals to use their Roth IRA funds as needed.

In addition to tax-free growth and withdrawals and flexibility in retirement, Roth IRA contributions also offer the potential for increased wealth. By contributing to a Roth IRA, individuals can take advantage of compound interest, which can help their retirement savings grow over time.

Other long-term benefits of Roth IRA contributions include:

- Protection from creditors: Roth IRA funds are generally protected from creditors, providing a safe source of retirement income.

- Legacy planning: Roth IRA funds can be passed to beneficiaries tax-free, providing a legacy for loved ones.

- Flexibility in investment options: Roth IRAs offer a range of investment options, allowing individuals to choose the investments that best align with their goals and risk tolerance.

By understanding the long-term benefits of Roth IRA contributions, individuals can make informed decisions about their retirement savings and create a comprehensive plan for achieving their goals.

In addition to understanding the long-term benefits of Roth IRA contributions, it’s also essential to understand the Roth IRA salary limits for 2024 and how they impact eligibility for contributions. By understanding these limits and the long-term benefits of Roth IRA contributions, individuals can create a comprehensive plan for maximizing their retirement savings and achieving their long-term financial goals.

By maximizing Roth IRA contributions and taking advantage of the long-term benefits, individuals can create a secure financial future and achieve their retirement goals.