Understanding the Basics of 401k and IRA Accounts

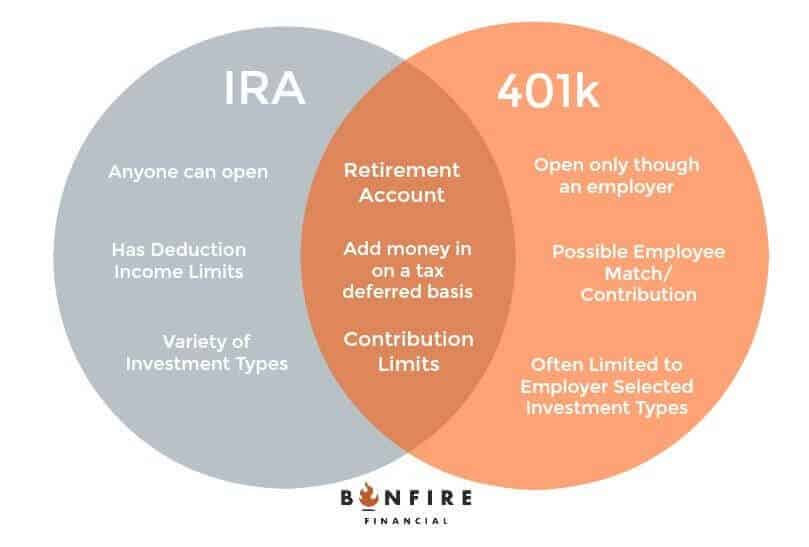

When it comes to retirement savings, two popular options are 401k and IRA accounts. While both are designed to help individuals save for their golden years, they have distinct differences in terms of their purpose, contribution limits, and investment options. In this section, we will delve into the fundamental differences between 401k and IRA accounts, providing a brief overview of how each account type works.

A 401k account is a type of employer-sponsored retirement plan that allows employees to contribute a portion of their salary to a tax-deferred investment account. The contributions are made before taxes, reducing an individual’s taxable income for the year. The funds are then invested in a variety of assets, such as stocks, bonds, or mutual funds, and grow tax-deferred until withdrawal. In contrast, an IRA (Individual Retirement Account) is a self-directed retirement savings plan that allows individuals to contribute a portion of their income to a tax-deferred investment account.

One of the primary differences between 401k and IRA accounts is the contribution limit. In 2022, the contribution limit for 401k accounts is $19,500, while the contribution limit for IRA accounts is $6,000. Additionally, 401k accounts often offer employer matching contributions, which can significantly boost an individual’s retirement savings. IRA accounts, on the other hand, do not offer employer matching contributions.

Another key difference between 401k and IRA accounts is the investment options. 401k accounts typically offer a range of investment options, including mutual funds, target-date funds, and company stock. IRA accounts, on the other hand, offer a broader range of investment options, including individual stocks, bonds, and real estate investment trusts (REITs).

So, is your 401k an IRA? The answer is no. While both accounts are designed for retirement savings, they have distinct differences in terms of their purpose, contribution limits, and investment options. Understanding these differences is crucial in determining which account type is best suited for your individual needs and goals.

How to Determine if Your 401k is an IRA: A Step-by-Step Guide

Determining whether your 401k is an IRA can be a straightforward process if you know where to look. In this section, we will provide a step-by-step guide on how to determine if your 401k is an IRA, including checking your account documents, contacting your HR department, and reviewing your investment options.

Step 1: Check Your Account Documents

Start by reviewing your account documents, including your plan summary, account statements, and any other relevant paperwork. Look for language that specifically states whether your account is a 401k or an IRA. If you’re still unsure, check for the following keywords: “401k,” “Individual Retirement Account,” or “IRA.”

Step 2: Contact Your HR Department

If you’re unable to find the information you need in your account documents, contact your HR department for assistance. They can provide you with information about your account type, including whether it’s a 401k or an IRA. Be prepared to provide your account information and any other relevant details.

Step 3: Review Your Investment Options

Another way to determine if your 401k is an IRA is to review your investment options. 401k accounts typically offer a range of investment options, including mutual funds, target-date funds, and company stock. IRA accounts, on the other hand, offer a broader range of investment options, including individual stocks, bonds, and real estate investment trusts (REITs). If you’re unsure about your investment options, contact your plan administrator or financial advisor for guidance.

So, is your 401k an IRA? By following these steps, you can determine whether your account is a 401k or an IRA. Remember to review your account documents, contact your HR department, and review your investment options to make an informed decision. Understanding the differences between 401k and IRA accounts can help you make the most of your retirement savings and achieve your long-term financial goals.

It’s worth noting that some employers offer IRA-based 401k plans, which can make it more difficult to determine whether your account is a 401k or an IRA. In these cases, it’s best to consult with your HR department or financial advisor to determine the specifics of your account.

Key Similarities and Differences Between 401k and IRA Accounts

While 401k and IRA accounts share some similarities, they also have distinct differences. Understanding these similarities and differences is crucial in determining which account type is best suited for your individual needs and goals.

Similarities:

Both 401k and IRA accounts offer tax benefits, allowing individuals to save for retirement on a tax-deferred basis. Contributions to both account types are made with pre-tax dollars, reducing an individual’s taxable income for the year. Additionally, both account types offer a range of investment options, including stocks, bonds, and mutual funds.

Differences:

One of the primary differences between 401k and IRA accounts is their tax treatment. 401k accounts are typically offered through an employer and are subject to the employer’s plan rules. IRA accounts, on the other hand, are individual accounts that are not tied to an employer. As a result, IRA accounts offer more flexibility in terms of investment options and withdrawal rules.

Another key difference between 401k and IRA accounts is their contribution limits. 401k accounts have a higher contribution limit, with a maximum annual contribution of $19,500 in 2022. IRA accounts, on the other hand, have a lower contribution limit, with a maximum annual contribution of $6,000 in 2022.

Withdrawal rules also differ between 401k and IRA accounts. 401k accounts typically require individuals to be 59 1/2 years old to withdraw funds without penalty. IRA accounts, on the other hand, allow individuals to withdraw funds at any time, although they may be subject to a 10% penalty if withdrawn before age 59 1/2.

Understanding the similarities and differences between 401k and IRA accounts can help individuals make informed decisions about their retirement savings. By considering factors such as tax treatment, contribution limits, and withdrawal rules, individuals can choose the account type that best aligns with their goals and needs.

So, is your 401k an IRA? While both account types offer tax benefits and a range of investment options, they have distinct differences in terms of their tax treatment, contribution limits, and withdrawal rules. By understanding these differences, individuals can make informed decisions about their retirement savings and achieve their long-term financial goals.

Why Knowing the Difference Matters: Implications for Your Retirement Savings

Understanding the distinction between 401k and IRA accounts is crucial for optimizing retirement savings. The differences in tax treatment, withdrawal rules, and investment options can significantly impact an individual’s financial security in retirement. Knowing whether your 401k is an IRA or not can help you make informed decisions about your retirement strategy.

For instance, if you have a 401k account, you may be eligible for employer matching contributions, which can substantially boost your retirement savings. On the other hand, IRA accounts offer more flexibility in terms of investment options and portability. By recognizing the characteristics of each account type, you can tailor your retirement plan to suit your needs and goals.

Moreover, the tax implications of 401k and IRA accounts differ. 401k accounts are typically offered through employers and may have different tax treatment than IRA accounts. For example, 401k accounts may be subject to required minimum distributions (RMDs) starting at age 72, whereas IRA accounts have different RMD rules. Understanding these tax implications can help you minimize tax liabilities and maximize your retirement income.

In addition, knowing the difference between 401k and IRA accounts can inform your investment decisions. 401k accounts often have limited investment options, whereas IRA accounts offer a broader range of investment choices. By recognizing the investment options available in each account type, you can create a diversified investment portfolio that aligns with your risk tolerance and retirement goals.

Ultimately, understanding the differences between 401k and IRA accounts can help you take control of your retirement savings. By recognizing the unique characteristics of each account type, you can make informed decisions about your retirement strategy and optimize your financial security in retirement. So, is your 401k an IRA? Knowing the answer to this question can have a significant impact on your retirement savings and financial well-being.

Common Misconceptions About 401k and IRA Accounts

There are several common misconceptions about 401k and IRA accounts that can lead to confusion and poor decision-making. One of the most prevalent misconceptions is that 401k and IRA accounts are interchangeable. However, as discussed earlier, these accounts have distinct differences in terms of their purpose, contribution limits, and investment options.

Another misconception is that one account type is inherently better than the other. In reality, the choice between a 401k and an IRA depends on individual circumstances and goals. For example, a 401k may be a better option for those who want to take advantage of employer matching contributions, while an IRA may be more suitable for those who want more flexibility in their investment options.

Some individuals also believe that they can only have one type of account, either a 401k or an IRA. However, it is possible to have both types of accounts, and in some cases, it may be beneficial to do so. For instance, an individual may contribute to a 401k through their employer and also have an IRA account for additional retirement savings.

Additionally, some people think that 401k and IRA accounts are only for retirement savings. While these accounts are designed to help individuals save for retirement, they can also be used for other purposes, such as funding education expenses or buying a first home.

It’s also common for individuals to assume that they can withdraw money from their 401k or IRA accounts at any time without penalty. However, withdrawals from these accounts are subject to certain rules and regulations, and early withdrawals may be subject to penalties and taxes.

Finally, some individuals believe that they need to be an expert in finance to manage their 401k or IRA accounts. However, with a little knowledge and planning, anyone can effectively manage their retirement accounts and make informed decisions about their financial future.

By understanding the common misconceptions about 401k and IRA accounts, individuals can make more informed decisions about their retirement savings and avoid costly mistakes. So, is your 401k an IRA? Knowing the answer to this question can help you navigate the complexities of retirement savings and make the most of your accounts.

Maximizing Your Retirement Savings: Strategies for 401k and IRA Accounts

To maximize your retirement savings, it’s essential to optimize your 401k and IRA contributions, investment options, and withdrawal strategies. Here are some strategies to consider:

For 401k accounts, consider contributing at least enough to take full advantage of any employer matching contributions. This is essentially free money that can help your retirement savings grow faster. Additionally, consider contributing to a Roth 401k if your employer offers it, as this can provide tax-free growth and withdrawals in retirement.

For IRA accounts, consider contributing to a traditional IRA if you’re eligible for a tax deduction, or a Roth IRA if you want tax-free growth and withdrawals. You can also consider converting a traditional IRA to a Roth IRA, which can provide tax-free growth and withdrawals in retirement.

In terms of investment options, consider diversifying your portfolio across different asset classes, such as stocks, bonds, and real estate. You can also consider working with a financial advisor to create a customized investment plan that aligns with your retirement goals and risk tolerance.

When it comes to withdrawal strategies, consider creating a sustainable income stream in retirement by withdrawing a fixed percentage of your account balance each year. You can also consider using the 4% rule, which suggests withdrawing 4% of your account balance each year to create a sustainable income stream.

Another strategy to consider is consolidating your retirement accounts, such as rolling over a 401k to an IRA or consolidating multiple IRA accounts into a single account. This can help simplify your retirement savings and reduce fees.

Finally, consider working with a financial advisor to create a comprehensive retirement plan that takes into account your 401k and IRA accounts, as well as other sources of income and expenses in retirement. This can help you create a sustainable income stream and achieve your retirement goals.

By implementing these strategies, you can maximize your retirement savings and create a sustainable income stream in retirement. So, is your 401k an IRA? Knowing the answer to this question can help you make informed decisions about your retirement savings and create a brighter financial future.

Real-Life Examples: How to Apply the Knowledge in Practice

Let’s consider a few real-life examples of how to apply the knowledge about 401k and IRA accounts in practice.

Example 1: Sarah is a 35-year-old marketing manager who has a 401k account through her employer. She contributes 10% of her salary to the account each month and receives a 5% employer match. Sarah is considering opening an IRA account to supplement her retirement savings. However, she’s not sure if she should prioritize her 401k or IRA contributions.

In this scenario, Sarah should consider contributing enough to her 401k account to take full advantage of the employer match, as this is essentially free money that can help her retirement savings grow faster. She can then consider contributing to an IRA account to supplement her retirement savings and take advantage of the tax benefits.

Example 2: John is a 50-year-old entrepreneur who has a SEP-IRA account for his business. He contributes 20% of his net earnings from self-employment to the account each year. John is considering rolling over his SEP-IRA account to a traditional IRA account to take advantage of the more flexible investment options.

In this scenario, John should consider the pros and cons of rolling over his SEP-IRA account to a traditional IRA account. He should also consider consulting with a financial advisor to determine the best course of action for his specific situation.

Example 3: Emily is a 28-year-old software engineer who has a Roth IRA account. She contributes $5,500 to the account each year and takes advantage of the tax-free growth and withdrawals. Emily is considering opening a 401k account through her employer to supplement her retirement savings.

In this scenario, Emily should consider contributing to her 401k account to take advantage of the employer match and the higher contribution limits. She can then consider contributing to her Roth IRA account to take advantage of the tax-free growth and withdrawals.

These examples illustrate how individuals can apply the knowledge about 401k and IRA accounts in practice to make informed decisions about their retirement savings. By understanding the differences between these account types, individuals can create a comprehensive retirement plan that meets their unique needs and goals.

So, is your 401k an IRA? Knowing the answer to this question can help you make informed decisions about your retirement savings and create a brighter financial future.

Conclusion: Taking Control of Your Retirement Savings

In conclusion, understanding the differences between 401k and IRA accounts is crucial for taking control of your retirement savings. By knowing whether your 401k is an IRA or not, you can make informed decisions about your retirement strategy and optimize your financial security in retirement.

Throughout this article, we have discussed the fundamental differences between 401k and IRA accounts, including their purpose, contribution limits, and investment options. We have also provided a step-by-step guide on how to determine if your 401k is an IRA and discussed the key similarities and differences between these account types.

Additionally, we have addressed common misconceptions about 401k and IRA accounts and provided strategies for maximizing your retirement savings, including tips on how to optimize your 401k and IRA contributions, investment options, and withdrawal strategies.

By applying the knowledge and strategies outlined in this article, you can take control of your retirement savings and create a brighter financial future. Remember, understanding the differences between 401k and IRA accounts is the first step towards making informed decisions about your retirement strategy.

So, is your 401k an IRA? Now that you have read this article, you should have a better understanding of the differences between these account types and be able to make informed decisions about your retirement savings. Take control of your financial future today and start building the retirement you deserve.