Understanding the Importance of a Used Car Loan Calculator

Purchasing a used car can be a daunting task, especially when it comes to financing. With so many options available, it’s essential to make informed decisions to avoid financial pitfalls. A used car auto loan calculator is a valuable tool that can help buyers navigate the complex world of car financing. By using a reliable and accurate calculator, individuals can determine their monthly payments, total interest paid, and loan terms, empowering them to make smart decisions when purchasing a used vehicle.

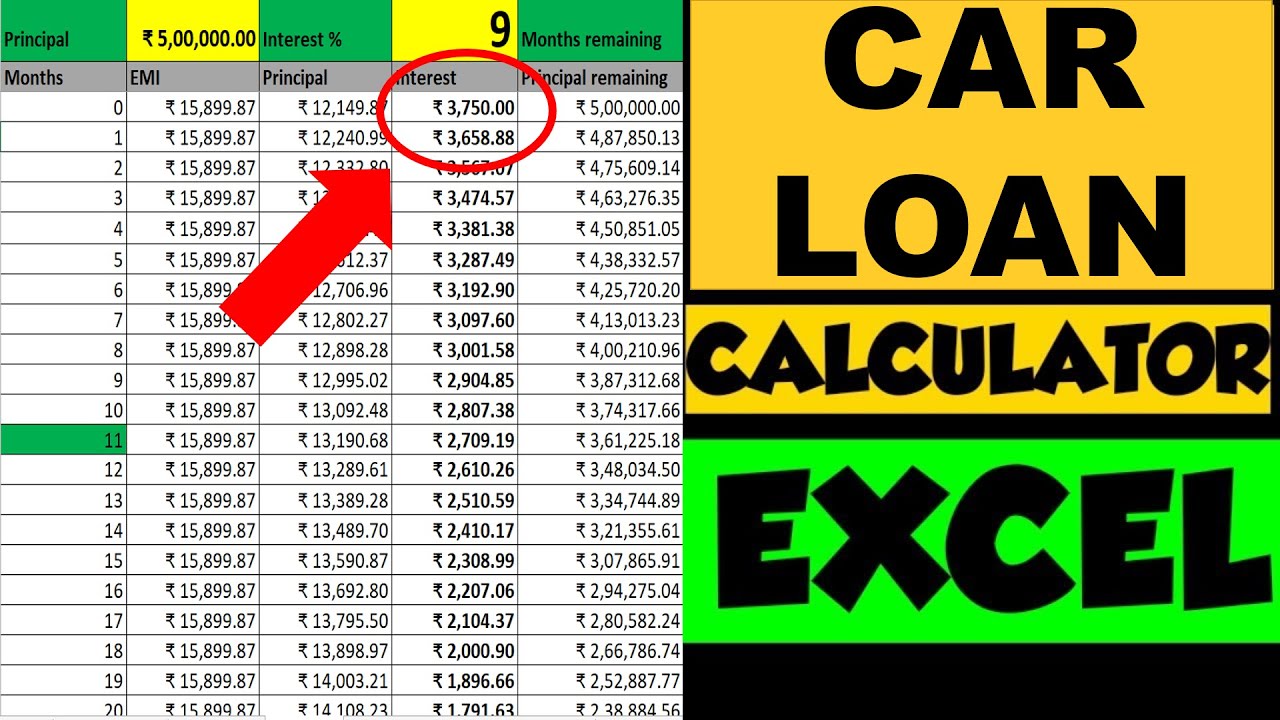

A used car loan calculator takes into account various factors, including the loan amount, interest rate, and repayment term, to provide a comprehensive picture of the loan’s costs. This information is crucial in helping buyers understand the true cost of owning a used car, beyond the initial purchase price. By considering all the costs associated with the loan, individuals can avoid surprises down the road and ensure they’re getting the best deal possible.

Moreover, a used car auto loan calculator can help buyers compare different loan offers from various lenders, including banks, credit unions, and online lenders. By inputting the loan details into the calculator, individuals can see how different interest rates, loan terms, and fees impact their monthly payments and total interest paid. This enables them to make informed decisions and choose the loan that best suits their financial situation.

In addition to providing a clear understanding of the loan’s costs, a used car loan calculator can also help buyers determine how much they can afford to spend on a used car. By inputting their desired monthly payment and other financial information, individuals can see how much they can borrow and what their total costs will be. This helps them set a realistic budget and avoid overspending on a used car.

Overall, a used car auto loan calculator is an indispensable tool for anyone purchasing a used car. By providing a clear and comprehensive picture of the loan’s costs, it empowers buyers to make informed decisions and avoid financial pitfalls. Whether you’re a first-time car buyer or a seasoned veteran, a used car loan calculator is an essential resource to have in your toolkit.

How to Choose the Right Used Car Loan Calculator for Your Needs

With numerous used car loan calculators available online, selecting the right one can be overwhelming. However, by considering a few key factors, you can find a reliable and accurate calculator that meets your needs. When choosing a used car auto loan calculator, look for one that allows you to input the loan amount, interest rate, and repayment term. This will provide you with a comprehensive picture of the loan’s costs and help you make informed decisions.

Another essential factor to consider is the calculator’s accuracy. Look for calculators that use up-to-date interest rates and take into account all the costs associated with the loan, including fees and taxes. Some popular online tools and websites that offer used car loan calculators include NADAguides, Kelley Blue Book, and Bankrate. These calculators are reliable, accurate, and easy to use, making them a great starting point for your car-buying journey.

Additionally, consider a calculator that allows you to compare different loan offers from various lenders. This will enable you to see how different interest rates, loan terms, and fees impact your monthly payments and total interest paid. Some calculators also provide features such as amortization schedules and loan payoff calculators, which can

Breaking Down the Costs: What to Consider When Calculating Your Used Car Loan

When purchasing a used car, it’s essential to consider all the costs associated with the vehicle, beyond the initial purchase price. A used car auto loan calculator can help you break down these costs and determine the overall affordability of the vehicle. The costs to consider include financing costs, insurance, fuel, maintenance, and repairs.

Financing costs, such as interest rates and fees, can significantly impact the overall cost of the vehicle. A used car loan calculator can help you determine the total interest paid over the life of the loan, as well as the monthly payments. Insurance costs, including liability, collision, and comprehensive coverage, should also be factored into the overall cost of the vehicle.

Fuel costs, including the cost of gasoline and maintenance, should also be considered. The fuel efficiency of the vehicle, as well as the cost of fuel in your area, can impact the overall cost of ownership. Maintenance and repair costs, including routine maintenance and unexpected repairs, should also be factored into the overall cost of the vehicle.

A used car loan calculator can help you determine the total cost of ownership, including all these costs, and provide a clear picture of the vehicle’s affordability. By considering all these costs, you can make an informed decision when purchasing a used car and avoid surprises down the road.

For example, let’s say you’re considering purchasing a used car with a purchase price of $15,000. Using a used car loan calculator, you determine that the total interest paid over the life of the loan will be $3,000, and the monthly payments will be $300. You also factor in insurance costs of $100 per month, fuel costs of $200 per month, and maintenance and repair costs of $100 per month. The total cost of ownership, including all these costs, would be $23,300 over the life of the loan.

By considering all these costs, you can determine whether the vehicle is affordable and make an informed decision when purchasing a used car. A used car loan calculator is an essential tool in this process, providing a clear picture of the vehicle’s affordability and helping you make a smart financial decision.

Using a Used Car Loan Calculator to Compare Loan Offers

When shopping for a used car loan, it’s essential to compare loan offers from different lenders to find the best deal. A used car auto loan calculator can help you do just that. By inputting the loan details from each lender, you can see how different interest rates, loan terms, and fees impact your monthly payments and total interest paid.

For example, let’s say you’re considering two loan offers from different lenders. Loan Offer A has an interest rate of 6% and a loan term of 60 months, while Loan Offer B has an interest rate of 5% and a loan term of 48 months. Using a used car loan calculator, you can see that Loan Offer A would result in monthly payments of $350 and total interest paid of $4,500, while Loan Offer B would result in monthly payments of $300 and total interest paid of $3,500.

As you can see, Loan Offer B is the better deal, with lower monthly payments and total interest paid. A used car loan calculator can help you make this comparison and determine which loan offer is best for your financial situation.

In addition to comparing loan offers, a used car loan calculator can also help you determine the impact of different loan terms and interest rates on your monthly payments and total interest paid. For example, you can use the calculator to see how a longer loan term would impact your monthly payments, or how a higher interest rate would impact your total interest paid.

By using a used car loan calculator to compare loan offers and determine the impact of different loan terms and interest rates, you can make an informed decision when purchasing a used car. This can help you save money on loan payments and interest, and ensure that you’re getting the best deal possible.

Some popular online tools and websites that offer used car loan calculators include NADAguides, Kelley Blue Book, and Bankrate. These calculators are easy to use and provide accurate results, making it easy to compare loan offers and determine the best deal.

Real-Life Examples: How a Used Car Loan Calculator Can Save You Money

Let’s consider a real-life example of how a used car loan calculator can help save money on loan payments and interest. Suppose you’re considering purchasing a used car with a purchase price of $20,000. You’ve found two loan offers from different lenders: Loan Offer A has an interest rate of 6% and a loan term of 60 months, while Loan Offer B has an interest rate of 5% and a loan term of 48 months.

Using a used car loan calculator, you can see that Loan Offer A would result in monthly payments of $375 and total interest paid of $5,500, while Loan Offer B would result in monthly payments of $325 and total interest paid of $4,000. By choosing Loan Offer B, you can save $50 per month on loan payments and $1,500 in total interest paid over the life of the loan.

Another example is a scenario where you’re considering purchasing a used car with a purchase price of $15,000. You’ve found a loan offer with an interest rate of 7% and a loan term of 72 months. Using a used car loan calculator, you can see that this loan offer would result in monthly payments of $250 and total interest paid of $4,500. However, by using the calculator to explore other loan options, you find a loan offer with an interest rate of 5% and a loan term of 48 months, which would result in monthly payments of $200 and total interest paid of $2,500. By choosing the second loan offer, you can save $50 per month on loan payments and $2,000 in total interest paid over the life of the loan.

These examples illustrate the potential savings that can be achieved by using a used car loan calculator to compare loan offers and determine the best loan option. By taking the time to use a calculator and explore different loan options, you can make an informed decision and save money on loan payments and interest.

In addition to saving money on loan payments and interest, a used car loan calculator can also help you avoid costly mistakes when purchasing a used car. By using a calculator to determine the total cost of ownership, including all costs associated with the vehicle, you can make a more informed decision and avoid surprises down the road.

Common Mistakes to Avoid When Using a Used Car Loan Calculator

When using a used car loan calculator, there are several common mistakes to avoid in order to get the most accurate results and make informed decisions. One of the most common mistakes is incorrect input, such as entering the wrong loan amount, interest rate, or repayment term. This can lead to inaccurate calculations and a misunderstanding of the loan’s costs.

Another mistake to avoid is neglecting to consider all costs associated with the loan, such as fees and insurance. A used car loan calculator can help you determine the total cost of ownership, including all these costs, but you must input the correct information to get an accurate result.

Not comparing loan offers is another mistake to avoid. A used car loan calculator can help you compare loan offers from different lenders, including banks, credit unions, and online lenders. By comparing loan offers, you can determine which one is the best option for your financial situation and save money on loan payments and interest.

To avoid these mistakes, it’s essential to carefully review the loan terms and conditions before using a used car loan calculator. Make sure you understand the interest rate, repayment term, and any fees associated with the loan. Additionally, consider all costs associated with the loan, including insurance and maintenance, to get an accurate picture of the total cost of ownership.

By avoiding these common mistakes, you can get the most out of a used car loan calculator and make informed decisions when purchasing a used car. Remember to always use a reliable and accurate calculator, and take the time to carefully review the loan terms and conditions before making a decision.

Some tips to keep in mind when using a used car loan calculator include:

- Always input accurate information, including the loan amount, interest rate, and repayment term.

- Consider all costs associated with the loan, including fees and insurance.

- Compare loan offers from different lenders to determine the best option for your financial situation.

- Carefully review the loan terms and conditions before making a decision.

By following these tips, you can use a used car loan calculator to make informed decisions and save money on loan payments and interest.

Maximizing Your Budget: Tips for Getting the Best Used Car Loan Deal

When purchasing a used car, it’s essential to maximize your budget to get the best deal possible. A used car auto loan calculator can help you determine how much you can afford to spend on a used car and what your monthly payments will be. Here are some tips for maximizing your budget and getting the best used car loan deal:

Negotiate the price: When purchasing a used car, it’s essential to negotiate the price to get the best deal possible. Use a used car loan calculator to determine how much you can afford to spend on a used car, and then negotiate the price based on that amount.

Consider certified pre-owned vehicles: Certified pre-owned vehicles are used cars that have been inspected and certified by the manufacturer or dealer. They often come with warranties and other perks, and can be a great option for those looking for a reliable used car. Use a used car loan calculator to determine how much you can afford to spend on a certified pre-owned vehicle.

Explore financing options: There are many financing options available for used cars, including loans from banks, credit unions, and online lenders. Use a used car loan calculator to compare loan offers and determine which one is the best option for your financial situation.

Use a used car loan calculator to determine your monthly payments: A used car loan calculator can help you determine your monthly payments based on the loan amount, interest rate, and repayment term. This can help you budget for your used car and ensure that you can afford the monthly payments.

Consider the total cost of ownership: When purchasing a used car, it’s essential to consider the total cost of ownership, including the purchase price, financing costs, insurance, fuel, maintenance, and repairs. Use a used car loan calculator to determine the total cost of ownership and ensure that you can afford the used car.

By following these tips and using a used car loan calculator, you can maximize your budget and get the best used car loan deal possible. Remember to always use a reliable and accurate calculator, and take the time to carefully review the loan terms and conditions before making a decision.

Conclusion: Take Control of Your Used Car Purchase with a Loan Calculator

Purchasing a used car can be a daunting task, but with the right tools, it can be a more manageable and informed process. A used car auto loan calculator is an essential resource for anyone looking to buy a pre-owned vehicle. By using a reliable and accurate calculator, individuals can determine their monthly payments, total interest paid, and loan terms, ultimately making informed decisions about their purchase.

Throughout this guide, we have emphasized the importance of considering all costs associated with purchasing a used car, including financing costs, insurance, fuel, maintenance, and repairs. A used car auto loan calculator takes these factors into account, providing a comprehensive picture of the overall affordability of the vehicle.

Moreover, a used car auto loan calculator enables individuals to compare loan offers from different lenders, ensuring they secure the best deal possible. By inputting different loan amounts, interest rates, and repayment terms, users can see how these variables impact their monthly payments and total interest paid.

Real-life examples have demonstrated how using a used car auto loan calculator can save individuals money on loan payments and interest. By avoiding common mistakes, such as incorrect input and neglecting to consider all costs, users can get the most out of a used car auto loan calculator.

Ultimately, a used car auto loan calculator empowers individuals to take control of their car-buying experience. By providing a clear understanding of the costs involved, users can make informed decisions and drive away with confidence. Whether negotiating the price, considering certified pre-owned vehicles, or exploring financing options, a used car auto loan calculator is an indispensable tool for anyone looking to purchase a pre-owned vehicle.

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)