How to Choose the Right Mutual Fund for Your Investment Goals

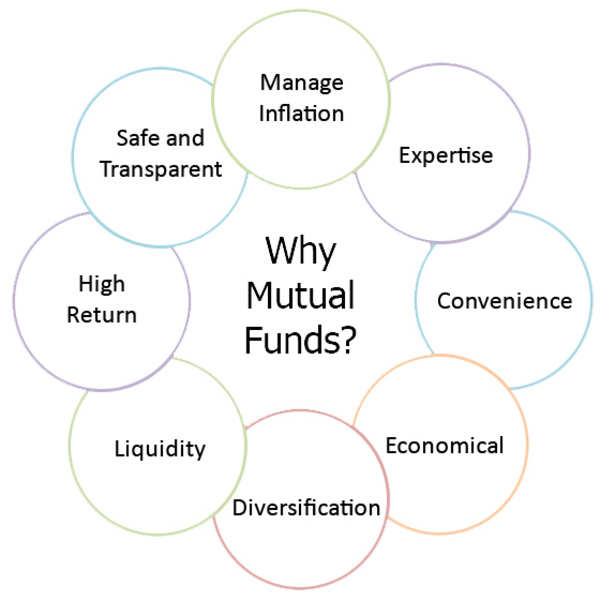

Mutual funds have become a popular investment option for individuals seeking to diversify their portfolios and achieve long-term financial goals. With numerous types of mutual funds available, selecting the right one can be a daunting task. In this article, we will explore the 4 kinds of mutual funds that can help you achieve your investment objectives. By understanding the characteristics and benefits of each type, you can make informed decisions and create a well-rounded investment portfolio.

When it comes to investing in mutual funds, it’s essential to consider your financial goals, risk tolerance, and time horizon. Different types of mutual funds cater to various investment objectives, such as capital appreciation, income generation, or capital preservation. By choosing the right type of mutual fund, you can increase your chances of achieving your financial goals and securing your financial future.

The 4 kinds of mutual funds that we will discuss in this article are equity mutual funds, fixed income mutual funds, hybrid mutual funds, and index mutual funds. Each type has its unique characteristics, benefits, and risk profile, making it crucial to understand the differences before making an investment decision. By the end of this article, you will have a comprehensive understanding of the 4 kinds of mutual funds and be able to make informed decisions about your investment portfolio.

Whether you’re a seasoned investor or just starting to build your investment portfolio, understanding the different types of mutual funds can help you achieve your financial goals. In the following sections, we will delve into the details of each type of mutual fund, exploring their characteristics, benefits, and risk profiles. By the end of this article, you will be equipped with the knowledge to make informed investment decisions and create a well-rounded investment portfolio that aligns with your financial objectives.

Understanding Equity Mutual Funds: A High-Risk, High-Reward Option

Equity mutual funds are a type of mutual fund that invests primarily in stocks, offering the potential for long-term capital appreciation. These funds are designed to provide investors with a high-risk, high-reward investment option, making them suitable for those with a higher risk tolerance and a long-term investment horizon.

Equity mutual funds typically invest in a diversified portfolio of stocks across various sectors and industries, aiming to provide broad market exposure and minimize risk. These funds can be further categorized into different sub-types, such as large-cap, mid-cap, and small-cap funds, each with its unique characteristics and risk profiles.

One of the key benefits of equity mutual funds is their potential for long-term growth. Historically, stocks have outperformed other asset classes over the long term, making equity mutual funds an attractive option for investors seeking capital appreciation. Additionally, equity mutual funds offer the benefits of diversification, professional management, and liquidity, making them a popular choice among investors.

Examples of popular equity mutual funds include Fidelity Contrafund and Vanguard 500 Index Fund. These funds have a proven track record of delivering strong returns over the long term, making them a popular choice among investors. However, it’s essential to remember that past performance is not a guarantee of future results, and investors should carefully evaluate their investment objectives and risk tolerance before investing in equity mutual funds.

When investing in equity mutual funds, it’s crucial to consider the fund’s investment strategy, risk profile, and fees. Investors should also evaluate the fund’s performance history, manager experience, and portfolio composition to ensure that it aligns with their investment objectives. By doing so, investors can make informed decisions and potentially achieve their long-term financial goals.

Fixed Income Mutual Funds: A Stable Source of Returns

Fixed income mutual funds are a type of mutual fund that invests in debt securities, such as bonds, to provide regular income to investors. These funds are designed to offer a stable source of returns, making them an attractive option for investors seeking predictable income and lower risk.

Fixed income mutual funds typically invest in a diversified portfolio of bonds, including government bonds, corporate bonds, and municipal bonds. These funds aim to provide a regular stream of income to investors, while also preserving capital. The income generated by fixed income mutual funds can be attractive to investors seeking regular returns, such as retirees or those seeking to supplement their income.

One of the key benefits of fixed income mutual funds is their relatively low risk profile. These funds typically invest in high-quality bonds with low credit risk, making them a more conservative investment option compared to equity mutual funds. Additionally, fixed income mutual funds offer the benefits of diversification, professional management, and liquidity, making them a popular choice among investors seeking stable returns.

Examples of popular fixed income mutual funds include iShares Core U.S. Aggregate Bond ETF and T. Rowe Price Short-Term Bond Fund. These funds have a proven track record of delivering stable returns and providing regular income to investors. However, it’s essential to remember that past performance is not a guarantee of future results, and investors should carefully evaluate their investment objectives and risk tolerance before investing in fixed income mutual funds.

When investing in fixed income mutual funds, it’s crucial to consider the fund’s investment strategy, credit quality, and interest rate risk. Investors should also evaluate the fund’s performance history, manager experience, and fees to ensure that it aligns with their investment objectives. By doing so, investors can make informed decisions and potentially achieve their long-term financial goals.

Hybrid Mutual Funds: A Balanced Approach to Investing

Hybrid mutual funds are a type of mutual fund that combines equity and fixed income investments, offering a balanced approach to investing. These funds are designed to provide investors with a diversified portfolio that can help reduce risk and increase potential returns.

Hybrid mutual funds typically invest in a mix of stocks, bonds, and other securities, with the goal of achieving a balance between growth and income. These funds can be further categorized into different sub-types, such as balanced funds, asset allocation funds, and target date funds, each with its unique characteristics and risk profiles.

One of the key benefits of hybrid mutual funds is their ability to provide diversification, which can help reduce risk and increase potential returns. By investing in a mix of asset classes, hybrid mutual funds can help spread risk and increase the potential for long-term growth. Additionally, hybrid mutual funds offer the benefits of professional management, liquidity, and convenience, making them a popular choice among investors.

Examples of popular hybrid mutual funds include Vanguard Balanced Index Fund and Fidelity Balanced Fund. These funds have a proven track record of delivering balanced returns and providing investors with a diversified portfolio. However, it’s essential to remember that past performance is not a guarantee of future results, and investors should carefully evaluate their investment objectives and risk tolerance before investing in hybrid mutual funds.

When investing in hybrid mutual funds, it’s crucial to consider the fund’s investment strategy, asset allocation, and fees. Investors should also evaluate the fund’s performance history, manager experience, and risk profile to ensure that it aligns with their investment objectives. By doing so, investors can make informed decisions and potentially achieve their long-term financial goals.

Hybrid mutual funds are one of the 4 kinds of mutual funds that can help investors achieve their financial goals. By understanding the benefits and characteristics of hybrid mutual funds, investors can make informed decisions and create a diversified portfolio that meets their needs.

Index Mutual Funds: A Low-Cost, Efficient Investment Option

Index mutual funds are a type of mutual fund that tracks a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds are designed to provide investors with broad diversification and low fees, making them an attractive option for those seeking a low-cost, efficient investment option.

Index mutual funds typically invest in a representative sample of the securities in the underlying index, with the goal of replicating the performance of the index. This approach allows investors to gain exposure to a broad range of securities, while minimizing the costs associated with active management.

One of the key benefits of index mutual funds is their low cost structure. Because these funds do not require a fund manager to actively select securities, they typically have lower fees than actively managed mutual funds. Additionally, index mutual funds offer the benefits of broad diversification, reduced risk, and increased potential for long-term growth.

Examples of popular index mutual funds include Vanguard 500 Index Fund and Schwab U.S. Broad Market ETF. These funds have a proven track record of delivering low-cost, efficient investment options to investors. However, it’s essential to remember that past performance is not a guarantee of future results, and investors should carefully evaluate their investment objectives and risk tolerance before investing in index mutual funds.

When investing in index mutual funds, it’s crucial to consider the fund’s underlying index, fees, and investment strategy. Investors should also evaluate the fund’s performance history, manager experience, and risk profile to ensure that it aligns with their investment objectives. By doing so, investors can make informed decisions and potentially achieve their long-term financial goals.

Index mutual funds are one of

Key Considerations When Selecting a Mutual Fund

When selecting a mutual fund, there are several key considerations to keep in mind. These factors can help you make an informed decision and choose a fund that aligns with your investment objectives and risk tolerance.

First and foremost, it’s essential to define your investment objectives. What are your financial goals? Are you seeking long-term growth, income, or capital preservation? Different types of mutual funds are designed to achieve different objectives, so it’s crucial to choose a fund that aligns with your goals.

Another critical factor to consider is risk tolerance. Mutual funds can be categorized into different risk profiles, ranging from conservative to aggressive. It’s essential to choose a fund that aligns with your risk tolerance to avoid taking on too much risk or not enough.

Fees are another important consideration when selecting a mutual fund. Different funds have varying fee structures, and some may charge higher fees than others. It’s essential to evaluate the fees associated with a fund and consider how they may impact your returns over time.

Performance history is also a crucial factor to consider when selecting a mutual fund. While past performance is not a guarantee of future results, it can provide valuable insights into a fund’s potential for growth and income. Look for funds with a strong track record of performance over the long term.

Finally, it’s essential to evaluate the fund’s investment strategy and portfolio composition. Different funds have varying investment approaches, and some may be more suitable for your investment objectives than others. Look for funds with a clear and transparent investment strategy that aligns with your goals.

By considering these key factors, you can make an informed decision and choose a mutual fund that aligns with your investment objectives and risk tolerance. Remember, there are 4 kinds of mutual funds to choose from, each with its unique characteristics and benefits. By understanding these differences, you can create a diversified portfolio that meets your needs and helps you achieve your financial goals.

Common Mistakes to Avoid When Investing in Mutual Funds

When investing in mutual funds, it’s essential to avoid common mistakes that can negatively impact your returns and overall investment success. By being aware of these pitfalls, you can make informed decisions and achieve your long-term financial goals.

One of the most common mistakes to avoid is putting all your eggs in one basket. This means investing too much in a single mutual fund or asset class, which can increase your risk exposure and potential losses. Instead, consider diversifying your portfolio across different asset classes and mutual funds to minimize risk and maximize returns.

Another mistake to avoid is not monitoring performance. It’s essential to regularly review your mutual fund’s performance and adjust your portfolio as needed. This can help you stay on track with your investment objectives and avoid potential losses.

Making emotional decisions is another common mistake to avoid. Investing in mutual funds should be based on a well-thought-out strategy and not on emotions. Avoid making impulsive decisions based on market volatility or short-term performance, and instead, focus on your long-term investment goals.

Not considering fees is another mistake to avoid. Mutual funds can have varying fee structures, and some may charge higher fees than others. It’s essential to evaluate the fees associated with a mutual fund and consider how they may impact your returns over time.

Finally, not seeking professional advice is another mistake to avoid. While it’s possible to invest in mutual funds on your own, seeking the advice of a financial advisor can be beneficial in creating a diversified portfolio and achieving your long-term investment goals.

By avoiding these common mistakes, you can increase your chances of success when investing in mutual funds. Remember, there are 4 kinds of mutual funds to choose from, each with its unique characteristics and benefits. By understanding these differences and avoiding common pitfalls, you can create a diversified portfolio that meets your needs and helps you achieve your financial goals.

Conclusion: Finding the Right Mutual Fund for Your Financial Future

In conclusion, mutual funds are a powerful investment tool that can help you achieve your financial goals. With 4 kinds of mutual funds to choose from, it’s essential to understand the characteristics and benefits of each type to make informed investment decisions.

Equity mutual funds offer high-risk, high-reward potential, while fixed income mutual funds provide a stable source of returns. Hybrid mutual funds offer a balanced approach to investing, and index mutual funds provide a low-cost, efficient investment option.

When selecting a mutual fund, it’s crucial to consider your investment objectives, risk tolerance, fees, and performance history. Avoid common mistakes such as putting all your eggs in one basket, not monitoring performance, and making emotional decisions.

By understanding the different types of mutual funds and avoiding common pitfalls, you can create a diversified portfolio that meets your needs and helps you achieve your financial goals. Remember to consult with a financial advisor or conduct your own research before making investment decisions.

With the right mutual fund, you can unlock the power of investing and achieve your financial future. Don’t wait – start exploring the world of mutual funds today and take the first step towards securing your financial future.