What is an Authorized User on a Credit Card?

An authorized user on a credit card is an individual who is granted permission to use the credit card account by the primary account holder. This person is not responsible for paying the credit card bill, but they can make purchases, pay bills, and manage the account on behalf of the primary account holder. Authorized users can be added to a credit card account to share financial responsibility, build credit, and access credit card rewards.

Authorized users differ from primary account holders in that they do not have the same level of financial responsibility. Primary account holders are responsible for paying the credit card bill, while authorized users are only responsible for making purchases and managing the account. This makes authorized user status an attractive option for individuals who want to build credit or access credit card rewards without taking on the full financial responsibility of a credit card account.

The benefits of adding an authorized user to a credit card account include shared financial responsibility, credit score benefits, and access to credit card rewards. Authorized users can help primary account holders manage their credit card accounts, make payments, and keep credit utilization low. In return, authorized users can benefit from the credit card rewards and build their credit scores by making responsible purchases and payments.

For example, a parent may add their child as an authorized user on their credit card account to help them build credit and learn how to manage a credit card responsibly. Alternatively, a business owner may add an employee as an authorized user on their business credit card account to grant them access to credit card rewards and simplify account management.

Overall, authorized user status on a credit card account can be a valuable tool for individuals who want to build credit, access credit card rewards, and share financial responsibility. By understanding the benefits and responsibilities of authorized user status, individuals can make informed decisions about how to manage their credit card accounts and achieve their financial goals.

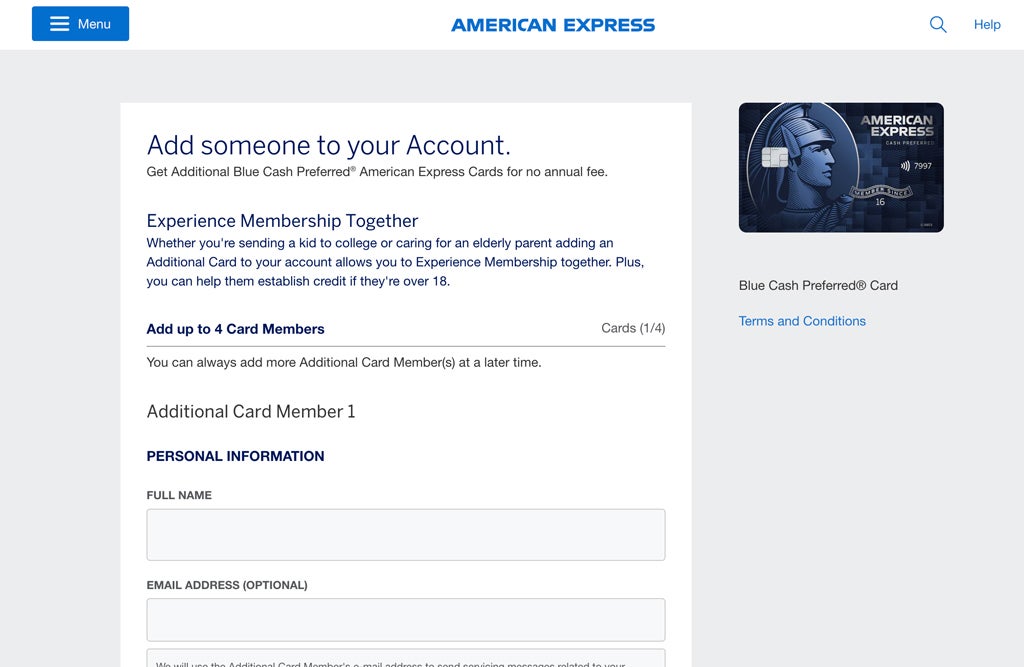

How to Add an Authorized User to Your Credit Card Account

To add an authorized user to your credit card account, you will need to provide the credit card issuer with the required information and documentation. This typically includes the authorized user’s name, address, date of birth, and Social Security number. You may also need to provide proof of the authorized user’s identity, such as a driver’s license or passport.

The process of adding an authorized user to your credit card account can vary depending on the credit card issuer and the type of account you have. Some credit card issuers may allow you to add an authorized user online or through their mobile app, while others may require you to call their customer service number or visit a branch in person.

Before adding an authorized user to your credit card account, it is essential to verify their identity and creditworthiness. This can help prevent identity theft and ensure that the authorized user is responsible with credit. You can check the authorized user’s credit report and score to get an idea of their credit history and creditworthiness.

Once you have added an authorized user to your credit card account, you will need to provide them with a credit card and explain the terms and conditions of the account. This includes the credit limit, interest rate, and any fees associated with the account. You should also discuss how to use the credit card responsibly and how to make payments.

Some credit card issuers may offer additional benefits and features for authorized users, such as credit card rewards or purchase protection. You should review the terms and conditions of the account to understand what benefits and features are available to authorized users.

Adding an authorized user to your credit card account can be a convenient way to share financial responsibility and build credit. However, it is essential to carefully consider the potential risks and consequences before adding an authorized user to your account.

Benefits of Being an Authorized User on a Credit Card

Being an authorized user on a credit card can have numerous benefits, particularly for individuals with limited or no credit history. As an authorized user, one can reap the rewards of shared financial responsibility and credit score benefits, ultimately paving the way for improved financial health.

One of the primary advantages of being an authorized user is the ability to build credit. When a primary account holder adds an authorized user to their credit card account, the authorized user’s credit profile is linked to the account. This means that the authorized user’s credit score can benefit from the primary account holder’s responsible credit behavior, such as on-time payments and low credit utilization. Over time, this can help the authorized user establish a positive credit history, making it easier to obtain credit in the future.

In addition to credit-building benefits, authorized users can also access credit card rewards and benefits. Many credit cards offer rewards programs, such as cashback, travel points, or purchase protection, which can be enjoyed by both the primary account holder and the authorized user. This can be especially beneficial for individuals who want to earn rewards without being responsible for the entire credit card account.

Shared financial responsibility is another significant benefit of being an authorized user. When an authorized user is added to a credit card account, they are not responsible for paying the credit card bill. However, they can still benefit from the primary account holder’s responsible payment habits, which can help to improve their credit score. This shared responsibility can be particularly helpful for individuals who are new to credit or have a limited credit history.

Furthermore, being an authorized user can provide an opportunity for individuals to learn about credit management and responsible financial habits. By being linked to a credit card account, authorized users can observe how the primary account holder manages their credit, including how they make payments, keep credit utilization low, and avoid negative credit habits. This can be a valuable learning experience, especially for individuals who are new to credit.

Overall, being an authorized user on a credit card can have numerous benefits, including credit-building opportunities, access to credit card rewards, and shared financial responsibility. By understanding the benefits and responsibilities of being an authorized user, individuals can make informed decisions about their financial health and take steps towards establishing a positive credit profile.

Responsibilities of an Authorized User on a Credit Card

As an authorized user on a credit card, it is essential to understand the responsibilities that come with this role. While authorized users are not responsible for paying the credit card bill, they still have a significant impact on the primary account holder’s credit score and financial well-being. Neglecting these responsibilities can have severe consequences, including damage to the primary account holder’s credit score and financial stability.

One of the primary responsibilities of an authorized user is to make payments on time. Although the authorized user is not responsible for paying the bill, they can still contribute to the payment process by making timely payments. This helps to maintain a positive payment history, which is essential for building and maintaining a good credit score.

Another critical responsibility of an authorized user is to keep credit utilization low. Credit utilization refers to the percentage of available credit being used. Keeping credit utilization low helps to maintain a healthy credit score and demonstrates responsible credit behavior. Authorized users should avoid making large purchases or accumulating high balances, as this can negatively impact the primary account holder’s credit score.

Avoiding negative credit habits is also crucial for authorized users. This includes avoiding late payments, high credit utilization, and applying for multiple credit cards in a short period. These negative credit habits can significantly damage the primary account holder’s credit score and financial stability.

In addition to these responsibilities, authorized users should also communicate effectively with the primary account holder. This includes informing the primary account holder of any changes in their financial situation, such as a change in income or employment status. This helps to ensure that the primary account holder is aware of any potential changes that may impact their credit score or financial

Responsibilities of an Authorized User on a Credit Card

As an authorized user on a credit card, it is essential to understand the responsibilities that come with this role. While authorized users are not responsible for paying the credit card bill, they still have a significant impact on the primary account holder’s credit score and financial well-being. Neglecting these responsibilities can have severe consequences, including damage to the primary account holder’s credit score and financial stability.

One of the primary responsibilities of an authorized user is to make payments on time. Although the authorized user is not responsible for paying the bill, they can still contribute to the payment process by making timely payments. This helps to maintain a positive payment history, which is essential for building and maintaining a good credit score.

Another critical responsibility of an authorized user is to keep credit utilization low. Credit utilization refers to the percentage of available credit being used. Keeping credit utilization low helps to maintain a healthy credit score and demonstrates responsible credit behavior. Authorized users should avoid making large purchases or accumulating high balances, as this can negatively impact the primary account holder’s credit score.

Avoiding negative credit habits is also crucial for authorized users. This includes avoiding late payments, high credit utilization, and applying for multiple credit cards in a short period. These negative credit habits can significantly damage the primary account holder’s credit score and financial stability.

In addition to these responsibilities, authorized users should also communicate effectively with the primary account holder. This includes informing the primary account holder of any changes in their financial situation, such as a change in income or employment status. This helps to ensure that the primary account holder is aware of any potential changes that may impact their credit score or financial

Responsibilities of an Authorized User on a Credit Card

As an authorized user on a credit card, it is essential to understand the responsibilities that come with this role. While authorized users are not responsible for paying the credit card bill, they still have a significant impact on the primary account holder’s credit score and financial well-being. Neglecting these responsibilities can have severe consequences, including damage to the primary account holder’s credit score and financial stability.

One of the primary responsibilities of an authorized user is to make payments on time. Although the authorized user is not responsible for paying the bill, they can still contribute to the payment process by making timely payments. This helps to maintain a positive payment history, which is essential for building and maintaining a good credit score.

Another critical responsibility of an authorized user is to keep credit utilization low. Credit utilization refers to the percentage of available credit being used. Keeping credit utilization low helps to maintain a healthy credit score and demonstrates responsible credit behavior. Authorized users should avoid making large purchases or accumulating high balances, as this can negatively impact the primary account holder’s credit score.

Avoiding negative credit habits is also crucial for authorized users. This includes avoiding late payments, high credit utilization, and applying for multiple credit cards in a short period. These negative credit habits can significantly damage the primary account holder’s credit score and financial stability.

In addition to these responsibilities, authorized users should also communicate effectively with the primary account holder. This includes informing the primary account holder of any changes in their financial situation, such as a change in income or employment status. This helps to ensure that the primary account holder is aware of any potential changes that may impact their credit score or financial

Responsibilities of an Authorized User on a Credit Card

As an authorized user on a credit card, it is essential to understand the responsibilities that come with this role. While authorized users are not responsible for paying the credit card bill, they still have a significant impact on the primary account holder’s credit score and financial well-being. Neglecting these responsibilities can have severe consequences, including damage to the primary account holder’s credit score and financial stability.

One of the primary responsibilities of an authorized user is to make payments on time. Although the authorized user is not responsible for paying the bill, they can still contribute to the payment process by making timely payments. This helps to maintain a positive payment history, which is essential for building and maintaining a good credit score.

Another critical responsibility of an authorized user is to keep credit utilization low. Credit utilization refers to the percentage of available credit being used. Keeping credit utilization low helps to maintain a healthy credit score and demonstrates responsible credit behavior. Authorized users should avoid making large purchases or accumulating high balances, as this can negatively impact the primary account holder’s credit score.

Avoiding negative credit habits is also crucial for authorized users. This includes avoiding late payments, high credit utilization, and applying for multiple credit cards in a short period. These negative credit habits can significantly damage the primary account holder’s credit score and financial stability.

In addition to these responsibilities, authorized users should also communicate effectively with the primary account holder. This includes informing the primary account holder of any changes in their financial situation, such as a change in income or employment status. This helps to ensure that the primary account holder is aware of any potential changes that may impact their credit score or financial

Responsibilities of an Authorized User on a Credit Card

As an authorized user on a credit card, it is essential to understand the responsibilities that come with this role. While authorized users are not responsible for paying the credit card bill, they still have a significant impact on the primary account holder’s credit score and financial well-being. Neglecting these responsibilities can have severe consequences, including damage to the primary account holder’s credit score and financial stability.

One of the primary responsibilities of an authorized user is to make payments on time. Although the authorized user is not responsible for paying the bill, they can still contribute to the payment process by making timely payments. This helps to maintain a positive payment history, which is essential for building and maintaining a good credit score.

Another critical responsibility of an authorized user is to keep credit utilization low. Credit utilization refers to the percentage of available credit being used. Keeping credit utilization low helps to maintain a healthy credit score and demonstrates responsible credit behavior. Authorized users should avoid making large purchases or accumulating high balances, as this can negatively impact the primary account holder’s credit score.

Avoiding negative credit habits is also crucial for authorized users. This includes avoiding late payments, high credit utilization, and applying for multiple credit cards in a short period. These negative credit habits can significantly damage the primary account holder’s credit score and financial stability.

In addition to these responsibilities, authorized users should also communicate effectively with the primary account holder. This includes informing the primary account holder of any changes in their financial situation, such as a change in income or employment status. This helps to ensure that the primary account holder is aware of any potential changes that may impact their credit score or financial